Base Station Antenna Market Report Scope & Overview:

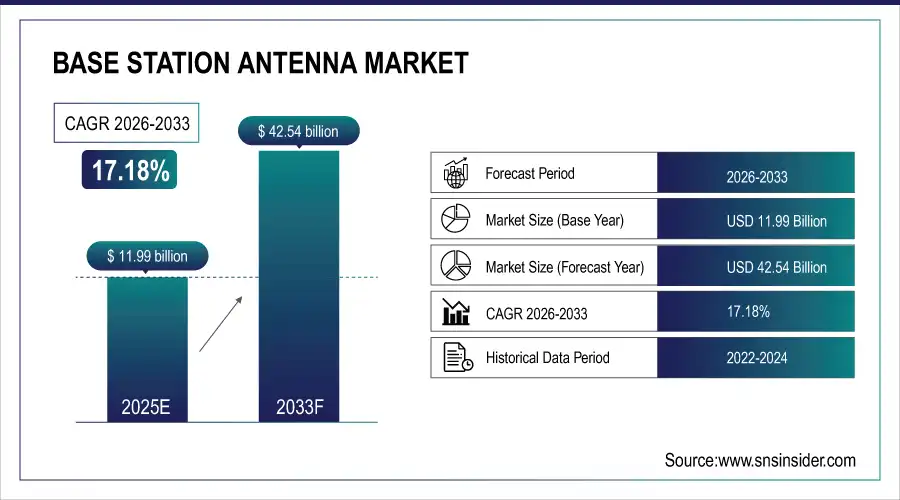

The Base Station Antenna Market Size is valued at USD 11.99 Billion in 2025E and is projected to reach USD 42.54 Billion by 2033, growing at a CAGR of 17.18% during the forecast period 2026–2033.

The Base Station Antenna Market analysis report delivers an in-depth insight into emerging market dynamics, emphasizing 5G deployment, advanced MIMO technologies, and high-capacity network demands. Rising mobile data traffic, IoT proliferation, and telecom infrastructure expansion are expected to drive substantial growth through 2033.

Base Station Antenna shipments reached 45 million units in 2025, driven by 5G rollout, rising data traffic, and expanding telecom infrastructure.

Base Station Antenna Market Size and Forecast:

-

Market Size in 2025: USD 11.99 Billion

-

Market Size by 2033: USD 42.54 Billion

-

CAGR: 17.18% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Base Station Antenna Market - Request Free Sample Report

Base Station Antenna Market Trends:

-

Telecom operators are accelerating 5G deployment, which is driving demand for advanced MIMO and high-capacity base station antennas.

-

Increasing mobile data traffic and IoT device adoption are expanding the application scope for antennas in urban and rural networks.

-

Growing awareness of network reliability and low-latency requirements is boosting investments in next-generation antenna technologies.

-

Market penetration is being enhanced by wider availability of compact, small-cell and tower-mounted antennas.

-

Rising adoption of smart cities and connected infrastructure is fueling demand for innovative antenna designs.

-

Eco-friendly and energy-efficient antenna solutions are trending, reflecting sustainability initiatives in the telecom sector.

U.S. Base Station Antenna Market Insights:

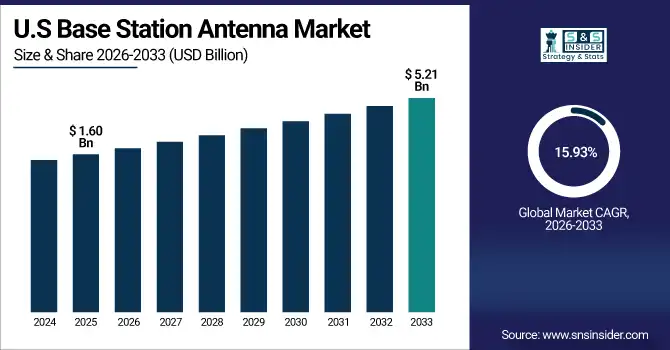

The U.S. Base Station Antenna Market is projected to grow from USD 1.60 Billion in 2025E to USD 5.21 Billion by 2033, at a CAGR of 15.93%. Market growth is driven by rapid 5G deployments, rising mobile data traffic, expanding IoT networks, and increasing investments in smart city and telecom infrastructure across the country.

Base Station Antenna Market Growth Drivers:

-

Rapid 5G rollout and surging mobile data traffic driving demand for advanced base station antennas.

Rapid 5G rollout and surging mobile data traffic are key drivers of Base Station Antenna Market growth. Telecom operators are deploying advanced MIMO, multibeam, and high-capacity antennas to meet increasing connectivity demands. Expansion of smart cities, IoT networks, and low-latency applications is boosting antenna adoption across urban and rural regions. This growing need for reliable, high-speed wireless communication is reshaping telecom infrastructure investments and accelerating market penetration of next-generation antenna solutions.

Base Station Antenna demand grew 14.5% in 2025, driven by rapid 5G deployments, rising mobile data traffic, and expanding smart city infrastructure.

Base Station Antenna Market Restraints:

-

High infrastructure costs, complex installation, and regulatory challenges are limiting widespread base station antenna deployment.

High infrastructure costs, complex installation, and regulatory challenges pose significant restraints for the Base Station Antenna Market. Deploying advanced antennas requires substantial capital investment and skilled labor, making scaling difficult and expensive. Strict government regulations, spectrum licensing, and safety compliance further slow rollout in several regions. These challenges increase deployment risk for operators, limit adoption in emerging markets, and create barriers for new entrants aiming to provide innovative, next-generation antenna solutions in a competitive telecom landscape.

Base Station Antenna Market Opportunities:

-

Growing 5G adoption and IoT expansion create significant opportunities for advanced, high-capacity base station antennas.

Growing 5G adoption and IoT expansion present a major opportunity for the Base Station Antenna Market. Increasing demand for high-speed connectivity, low-latency networks, and smart city infrastructure is driving development of advanced, high-capacity antennas. Telecom operators are investing in MIMO, multibeam, and small-cell solutions to enhance network performance. This shift toward next-generation wireless technologies enables innovation, strengthens operator competitiveness, and opens new deployment and revenue opportunities across urban and rural markets.

Advanced 5G-compatible antennas accounted for 28% of new base station deployments in 2025, driven by rising IoT adoption and smart city infrastructure expansion.

Base Station Antenna Market Segmentation Analysis:

-

By Antenna Type, Sector held the largest market share of 38.65% in 2025, while MIMO is expected to grow at the fastest CAGR of 21.47% during 2026–2033.

-

By Technology, 4G/LTE accounted for the highest market share of 42.13% in 2025, while 5G is projected to expand at the fastest CAGR of 24.18% during the forecast period.

-

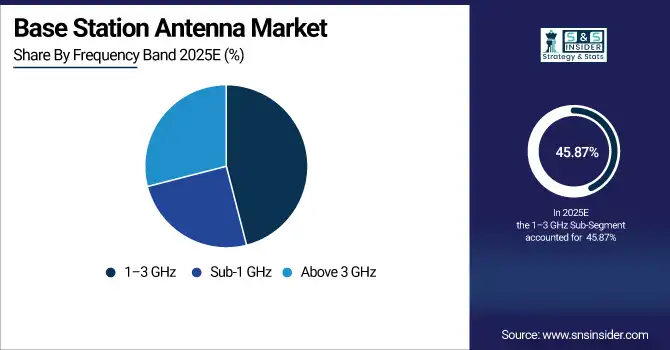

By Frequency Band, 1–3 GHz dominated with a 45.87% share in 2025, while Above 3 GHz is anticipated to record the fastest CAGR of 22.35% through 2026–2033.

-

By Installation Type, Tower-Mounted held the largest share of 40.24% in 2025, while Small Cell is expected to grow at the fastest CAGR of 23.42% during 2026–2033.

-

By End-User, Telecom Operators accounted for the largest share of 56.18% in 2025, while Enterprises are forecasted to register the fastest CAGR of 19.87% during 2026–2033.

By Antenna Type, Sector Dominates While MIMO Expands Rapidly:

Sector segment dominated the market due to its wide coverage, high reliability, and suitability for urban and rural macro-cell networks. Telecom operators prefer sector antennas for efficient network expansion and cost-effective deployment. In 2025, over 17 million units of sector antennas were installed.

MIMO are the fastest-growing segment, reflecting the surge in 5G adoption and demand for high-capacity, low-latency networks. Advanced MIMO deployments enable multiple simultaneous data streams, improving network efficiency. In 2025, MIMO installations reached 6.5 million units.

By Technology, 4G/LTE Dominates While 5G Expands Rapidly:

4G/LTE segment dominated the market, driven by widespread adoption and mature network infrastructure. Operators continued to rely on LTE for core connectivity, especially in emerging regions, supporting billions of mobile connections. In 2025, 19,200 base stations utilized 4G/LTE technology.

5G is the fastest-growing segment, fueled by ultra-high-speed connectivity, IoT expansion, and smart city initiatives. 5G adoption is driving advanced antenna designs such as massive MIMO and multibeam solutions. In 2025, 5G-compatible base station deployments reached 7,500 units, highlighting rapid growth.

By Frequency Band, 1–3 GHz Dominates While Above 3 GHz Expands Rapidly:

1–3 GHz segment dominated the market due to its optimal balance between coverage and capacity, making it ideal for macro-cell and rural networks. Telecom operators widely deployed antennas in this band for consistent connectivity. In 2025, over 20 million units operated within the 1–3 GHz frequency range.

Above 3 GHz is the fastest-growing segment, driven by 5G rollouts requiring high-frequency spectrum for ultra-fast, low-latency networks. mmWave and high-band antennas are increasingly deployed in urban hotspots. In 2025, deployments in this band reached 5.8 million units, reflecting rapid adoption.

By Installation Type, Tower-Mounted Dominates While Small Cell Expands Rapidly:

Tower-Mounted segment dominated the market due to their ability to cover large areas efficiently, supporting macro-cell networks in urban and rural regions. They are preferred for traditional deployments where high towers are available. In 2025, over 15 million tower-mounted antennas were operational.

Small Cell is the fastest-growing segment, responding to urban densification, 5G deployments, and demand for localized high-capacity coverage. Small cells enhance network performance in crowded areas. In 2025, small cell deployments reached 4.7 million units, marking rapid market growth.

By End-User, Telecom Operators Dominate While Enterprises Expand Rapidly:

Telecom Operators segment dominated the market, driving large-scale base station installations to meet growing mobile data demand and network expansion. They remain the primary buyers of antennas for urban and rural connectivity. In 2025, over 23 million units were installed for operator networks.

Enterprises are the fastest-growing segment, adopting private 5G networks, IoT applications, and campus connectivity solutions. Increasing demand for secure, high-speed internal networks is fueling antenna adoption. In 2025, enterprise antenna deployments reached 4.2 million units, reflecting accelerating growth opportunities.

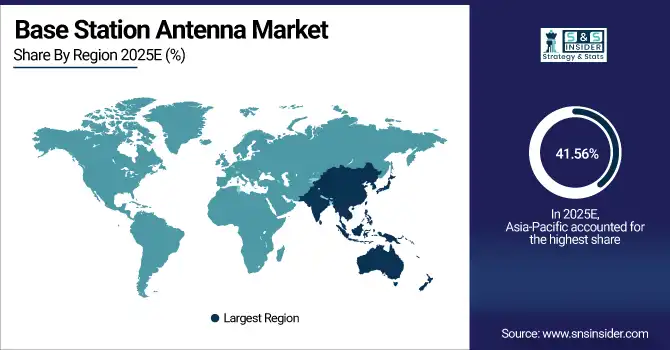

Base Station Antenna Market Regional Analysis:

Asia-Pacific Base Station Antenna Market Insights:

The Asia-Pacific Base Station Antenna Market dominated with a market share of 41.56% in 2025. Growth is driven by rapid 5G network deployments, increasing mobile data traffic, and rising IoT adoption across China, Japan, India, and South Korea. Expanding urban infrastructure, smart city initiatives, and telecom investments are further fueling demand. With strong government support, technological innovation, and increasing telecom operator expansion, the Asia-Pacific region remains the largest and most influential market for base station antennas.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Base Station Antenna Market Insights:

China’s Base Station Antenna Market is driven by rapid 5G deployment, growing mobile data traffic, and expanding IoT networks. Investments in smart cities, telecom infrastructure, and next-generation antenna technologies, along with supportive government policies, make China one of the dominant growth contributors in the Asia-Pacific base station antenna market.

North America Base Station Antenna Market Insights:

North America Base Station Antenna Market is driven by widespread 4G/LTE networks, ongoing 5G deployments, and increasing mobile data consumption. Growth in smart city initiatives, IoT applications, and telecom infrastructure expansion are key factors fostering the market. Strong demand from telecom operators for high-capacity, reliable antennas alongside investments in urban connectivity and network modernization positions North America as a leading region for advanced antenna deployments, technology innovation, and market development.

U.S. Base Station Antenna Market Insights:

The U.S. Base Station Antenna Market is driven by rapid 5G network rollouts, growing mobile data traffic, and expanding IoT and smart city initiatives. Rising demand for high-capacity, low-latency connectivity, adoption of advanced MIMO antennas, and telecom infrastructure upgrades are fueling the country’s leadership in the North American base station antenna market.

Europe Base Station Antenna Market Insights:

The Europe Base Station Antenna Market is growing due to widespread 4G/LTE networks, rapid 5G adoption, and rising mobile data consumption. Germany, the UK, France, and Italy are leading contributors, driven by urban infrastructure expansion, smart city initiatives, and increasing IoT deployments. Investments in network modernization, high-capacity antennas, and advanced telecom solutions also underpin Europe’s position as a key growth market, supporting both urban and rural connectivity across the region.

Germany Base Station Antenna Market Insights:

Germany is a key Base Station Antenna market due to rapid 5G deployment, growing mobile data traffic, and smart city initiatives. Expansion of urban telecom infrastructure, adoption of advanced MIMO and high-capacity antennas, and investments in network modernization further strengthen Germany’s position as a leading contributor to the European base station antenna market.

Middle East and Africa Base Station Antenna Market Insights:

The Middle East & Africa Base Station Antenna Market is expanding rapidly, projected at a CAGR of 20.72%. Growth is driven by increasing 5G deployments, rising mobile data traffic, and telecom infrastructure development. Countries such as Saudi Arabia, UAE, and South Africa are leading adoption, while smart city initiatives and high-capacity antenna installations contribute to the region’s accelerating market expansion.

Latin America Base Station Antenna Market Insights:

The Latin America Base Station Antenna Market is anticipated to grow with rising 4G/LTE and 5G deployments, increasing mobile data usage, and telecom infrastructure expansion in Brazil, Mexico, and Argentina. Adoption of high-capacity antennas, smart city initiatives, and enterprise connectivity solutions is expected to drive regional market growth.

Base Station Antenna Market Competitive Landscape:

Huawei Technologies Co., Ltd., headquartered in Shenzhen, China, is a dominant player in the base station antenna market. The company leads through deep vertical integration, offering end-to-end telecom solutions encompassing base stations, antennas, and core network equipment. Huawei’s strong focus on 5G, massive MIMO, and high-frequency antenna technologies has enabled large-scale deployments across Asia-Pacific, Europe, and emerging markets. Significant investments in R&D, cost-efficient manufacturing, and strategic partnerships with telecom operators have strengthened Huawei’s market leadership and accelerated adoption of next-generation antenna solutions.

-

In March 2025, Huawei launched its Alpha Series intelligent base station antennas, integrating massive MIMO and lightweight designs to improve energy efficiency, simplify installation, and support high-capacity 5G deployments across telecom networks.

Ericsson, based in Stockholm, Sweden, is a leader in telecom infrastructure with a strong presence in the base station antenna market. The company dominates through its advanced antenna systems, particularly in massive MIMO and energy-efficient radio solutions optimized for 5G networks. Ericsson’s strong relationships with Tier-1 telecom operators across North America and Europe, combined with continuous innovation and standards leadership, support widespread adoption. Its emphasis on network performance, reliability, and sustainability has positioned Ericsson as a preferred partner for large-scale network modernization projects.

-

In June 2025, Ericsson introduced next-generation 5G antenna systems optimized for dense urban and mission-critical networks, enhancing coverage, spectral efficiency, and energy performance while supporting large-scale network modernization initiatives.

CommScope Holding Company, Inc., headquartered in North Carolina, U.S., is a leading provider of base station antenna and connectivity solutions. The company dominates through a broad product portfolio including sector antennas, multiband antennas, and advanced MIMO systems tailored for dense urban and rural deployments. CommScope’s strong focus on innovation, network densification, and small-cell solutions supports 4G and 5G expansion. Extensive manufacturing capabilities, distribution networks, and long-standing partnerships with telecom operators reinforce its strong competitive position in the base station antenna market.

-

In August 2025, CommScope launched advanced multiband and MIMO base station antennas designed for 5G network densification, enabling improved coverage, faster deployment, and seamless integration across macro-cell and small-cell environments.

Base Station Antenna Market Key Players:

-

Huawei

-

CommScope

-

Nokia

-

ZTE

-

Amphenol Antenna Solutions

-

Rosenberger

-

Comba Telecom

-

ACE Technologies

-

PCTEL

-

Tongyu Communication

-

MOBI Antenna

-

Kathrein SE

-

Shenzhen Sunway Communication

-

Baylin Technologies

-

Procom

-

Alpha Wireless

-

Laird Connectivity

-

Panorama Antennas

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 11.99 Billion |

| Market Size by 2033 | USD 42.54 Billion |

| CAGR | CAGR of 17.18% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Antenna Type (Omni-Directional, Sector, Multibeam, MIMO, Others) • By Technology (2G, 3G, 4G/LTE, 5G) • By Frequency Band (Sub-1 GHz, 1–3 GHz, Above 3 GHz) • By Installation Type (Rooftop, Tower-Mounted, Small Cell) • By End-User (Telecom Operators, Enterprises, Government & Public Safety, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Huawei Technologies Co., Ltd., Ericsson AB, Nokia Corporation, CommScope Holding Company, Inc., ZTE Corporation, Samsung Electronics Co., Ltd., Amphenol Corporation, ACE Technologies Corporation, Rosenberger Hochfrequenztechnik GmbH & Co. KG, Comba Telecom Systems Holdings Ltd., Kathrein SE, Tongyu Communication Inc., MTI Wireless Edge Ltd., Alpha Wireless Ltd., Cobham Antenna Systems, Infinite Electronics (Pasternack), Laird Connectivity, RFS (Radio Frequency Systems), HUBER+SUHNER AG, Southwest Antennas Inc. |