Beer Market Report Scope & Overview:

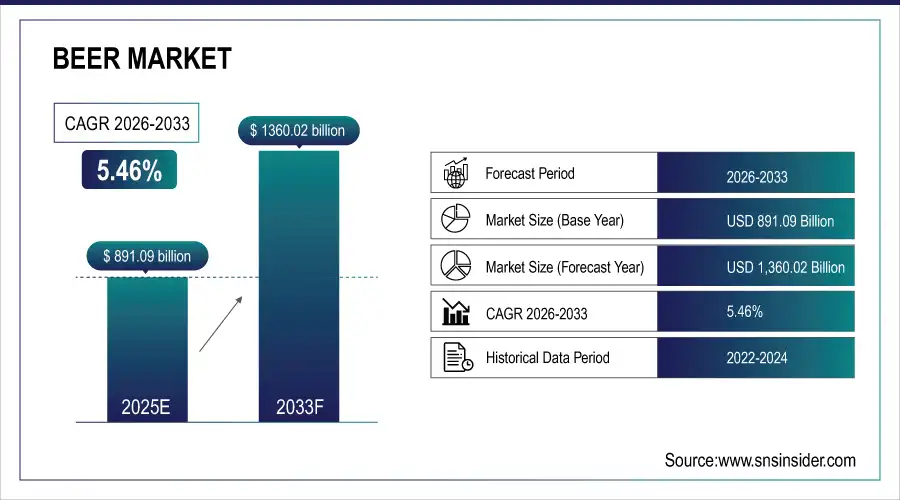

The Beer Market Size was valued at USD 891.09 Billion in 2025E and is projected to reach USD 1,360.02 Billion by 2033, growing at a CAGR of 5.46% during the forecast period 2026–2033.

The Beer Market analysis report for growth brings together a broad range statistics and information about the major factors influencing this market. Demand from bars, restaurants and retailers also helps growth as do consumer interest in flavored, specialty and local beers.

Beer production reached 195 million hectoliters in 2025, driven by rising craft and premium beer demand and growing consumption across bars, restaurants, and retail.

Market Size and Forecast:

-

Market Size in 2025: USD 891.09 Billion

-

Market Size by 2033: USD 1,360.02 Billion

-

CAGR: 5.46% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Beer Market - Request Free Sample Report

Beer Market Trends:

-

Growing demand for craft, flavored and specialty beers will help lift overall consumption, especially at bars, restaurants and stores.

-

The rise of beer culture, and along with-it craft breweries and home brewing trends are creating demand for a broad variety of beer styles and innovative brews.

-

Growth in e-commerce and modern retail outlets is improving availability, driving sales in urban and rural areas.

-

Consumers' demand for quality, aged and eco-friendly beer is driving investment in traditional brewing techniques.

-

Market dynamics are conducive to premiumization, brand differentiation and personalized beer experiences that cater to changing consumer preferences.

U.S. Beer Market Insights:

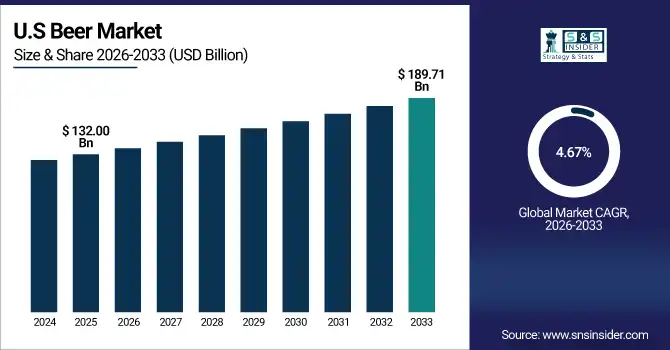

The U.S. Beer Market is projected to grow from USD 132.00 Billion in 2025E to USD 189.71 Billion by 2033, at a CAGR of 4.67%. The market growth is based on growing consumer inclination toward craft, premium, and flavored beers, expansion of on-trade and retail consumption, rise in adoption through e-commerce channels.

Beer Market Growth Drivers:

-

Growing consumer preference for craft and specialty beers, driven by bars, restaurants, and experiential drinking trends.

Growing consumer preference for craft, specialty, and flavored beers is the primary driver of Beer Market growth. An increase in consumption at bars, restaurants and retail outlets has been driven by burgeoning craft beer culture, home brewing trends and a growing array of drinking possibilities. Urban markets and emerging markets are well accessed through e-commerce and modern retail. Innovation and decent craftsmanship, sustainable production and product innovation create quality, variety and brand differentiation on the market in the long run.

Craft and specialty beer sales grew 7.5% in 2025, driven by rising consumer preference, bar, restaurant, and retail consumption.

Beer Market Restraints:

-

Stringent alcohol regulations, high excise taxes, and rising production costs are limiting large-scale growth of the Beer Market.

Stringent alcohol regulations, high excise taxes, and increasing production costs are key restraints for the Beer Market. Producers experience a myriad of compliance needs and licensing in various jurisdictions, which constrains operational flexibility. Pricing policies are held in check by heavy duties and taxes, with sales growth hampered, especially in the emerging markets. Furthermore, higher quality ingredients, craft brewing techniques and sustainability are on the rise which hinders massive scaling and secures a rather equal segmentation for upcoming and existing brands.

Beer Market Opportunities:

-

Growing demand for craft, flavored, and premium beers offers opportunities for innovation in brewing and branding.

Rising demand for craft, flavored, and premium beers presents a significant opportunity for market expansion. While consumers demand unique and authentic flavors and quality drinking experiences, producers turn to brewing techniques, local ingredients and sustainability efforts for inspiration. Sustainable packaging and ethically sourced materials are starting to become a must-have and dovetailing with environmental movements. This trend of premiumization and sustainability drives product uniqueness, adds value to the brand, thereby driving growth in the Beer Market.

Craft and specialty beer varieties accounted for 28% of total beer innovations in 2025, driven by rising demand for flavored, premium, and sustainably brewed products.

Beer Market Segmentation Analysis:

-

By Type, Lager held the largest market share of 41.82% in 2025, while Ale is expected to grow at the fastest CAGR of 6.28% during 2026–2033.

-

By Packaging, Bottle dominated with a 46.37% share in 2025, while Can packaging is projected to expand at the fastest CAGR of 5.83%.

-

By Production, Industrial accounted for the highest market share of 55.46% in 2025, and Craft production is expected to record the fastest CAGR of 6.42%.

-

By End-Use Industry, Bars & Restaurants held the largest share of 37.95% in 2025, while Retail is expected to grow at the fastest CAGR of 5.67% during the forecast period.

By Type, Lager Dominates While Ale Expands Rapidly:

Lager segment dominated the market owing to its easy taste preference, wider penetration and growth across both on-trade and off-trade channels. With its heritage, consumer loyalty and variety of snacking occasions remain part of our growth strategy. Ale is the fastest growing segment, driven by greater awareness of craft brewing, flavorful taste offerings and consumer demand for high-quality, hand-crafted beers. Creative brewing methods and local flavours also contribute to its appeal to younger and more premium consumers, boosting total market expansion.

By Packaging, Bottle Leads While Can Gains Momentum:

Bottle segment dominated the market since it is considered premium, fresh and of high quality along with strong presence on retail and hospitality segments. Its general usage and classic popularity bring more repeat customers and stable sales. Can is the fastest growing segment, led by portability, eco-conscience and outdoor and on-premise convenience. Increasing consumer awareness of environmentally responsible packaging and changing behavior has also provided momentum, as cans continue to penetrate urban and developing markets at a fast growth rate.

By Production, Industrial Dominates While Craft Brewing Surges Ahead:

Industrial segment dominated the market owing to continuous supply, quality assurance, wide distribution networks and brand equity. It guarantees the supply of bars, restaurants and retail channels all over the world and above all, market consistency. Craft is the fastest growing segment, due to consumer demand for real flavor and small-batch beers. Creative recipes, local ingredients and sustainability-minded brewing practices are drawing premium and younger enthusiasts, allowing for brisk growth in niche and urban markets.

By End-Use Industry, Bars & Restaurants Dominate While Retail Expands Rapidly:

Bars and restaurants segment dominated the market on account of high on-trade consumption, social drinking culture and rising demand for draft and premium beer products. These outlets offer exposure and the chance for experiential consumption that cultivates loyalty and repeat orders. Retail is the fastest growing segment which comes from at-home consumption, supermarkets and e-commerce. Altered consumer lifestyles, convenience and the rise of casual consumption are boosting off-trade sales, making it an interesting market for growth.

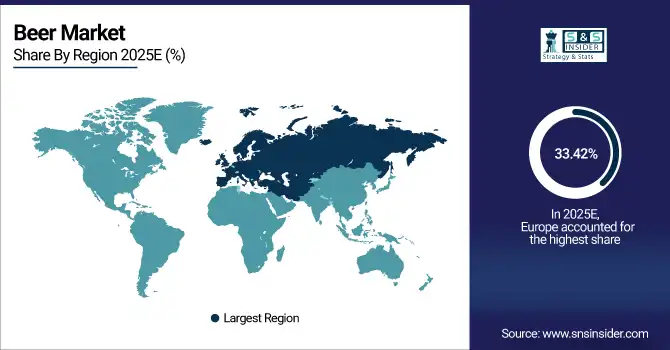

Beer Market Regional Analysis:

Europe Beer Market Insights:

Europe Beer Market dominated with a 33.42% share in 2025, is experiencing growth due to high per capita consumption of beer, increasing no own breweries and exceptional beer culture. Germany, the UK and France are key markets. Growth is driven by increasingly out-of-home dynamics, namely the growing demand for craft and premium beers, on-trade urban consumption and modern retail and e-commerce penetration. New flavors, environmental sustainability in brewing, and brand differentiation will bolster market presence and future growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Germany Beer Market Insights:

Germany is the major market for Beer with high consumption in bars, restaurants, and retail channels. The demand is supported by the interest in craft, premium, and flavored beers on the background of a rich beer culture. Innovation, sustainability in brewing, identity made by quality drink are the factors igniting further market development.

Asia-Pacific Beer Market Insights:

The Asia-Pacific Beer Market is the fastest-growing region, projected at a CAGR of 7.29% during 2026–2033. It features consumption-growing, craft and premium beers-expanding, and a surge in the on-trade and retail industry. The largest markets are China, India, Japan, and Australia. Urbanization boosts consumption, while higher disposable income and demand for flavored and specialty examples drive growth. Contemporary e-commerce, relevant to modern trade channels, underpins the accessibility and expansion of the regional market.

China Beer Market Insights:

China Beer Market is also driven by increasing disposable income, urbanization and on-trade outlets expansion along with off-trade growing sector. Consumer interest in craft, premium and flavoured beers is growing, and with the rise of modern retailing and e-commerce it is becoming more accessible. These are the factors which make China one of the biggest contributors to Asia-Pacific’s burgeoning beer market.

North America Beer Market Insights:

North America is witnessing strong growth in the Beer Market, with craft and premium beer consumption on the rise in both bars and restaurants and retail. Growing demand is being driven by rising appetites for flavored, speciality and small-batch beers and higher amount of disposable income. E-commerce proliferation, at-home consumption behaviors and a developing beer culture are anticipated to further propel penetration enhancing the region’s market presence which should be supportive for growth on the long-term.

U.S. Beer Market Insights:

The U.S. Beer Market is anticipated to be fuelled by increasing consumer preference for craft, premium, flavoured beers in on-premise (bars and restaurants) and off-premise (retail stores). Growth is also supported by increasing home consumption trends, rising disposable income, changing drinking culture, the growth in ecommerce and brand innovation helping to sustain market expansion.

Latin America Beer Market Insights:

The Latin America beer market is growing due to increasing consumption of craft, premium and flavored beers. The growth is buoyed by the expansion of bars, restaurants and retail outlets and growing disposable incomes. Innovations in brewing, sustainability and local production is paving the way for growth in important markets such as Brazil, Mexico and Argentina.

Middle East and Africa Beer Market Insights:

The Middle East & Africa Beer Market is expected to witness growth of consumption in bars, restaurants and retail channels. Growth is being driven by a rise in disposable income, a growing hospitality sector and demand for craft, premium or flavoured beer. Brand innovation, the rise of e-commerce and changing consumer habits are also helping to drive market growth throughout the region.

Beer Market Competitive Landscape:

Anheuser-Busch InBev, headquartered in Belgium, is the world’s largest beer producer, with a portfolio that includes Budweiser, Corona, and Stella Artois. Scale, broad distribution networks and a powerful brand are what enable it to dominate markets. The company exploits theoretical mergers and acquisitions, sophisticated brewing technologies, and no-holds-barred advertising in an effort to penetrate varied consumer groups. Juggling heritage brands and cutting-edge innovation, AB InBev stays ahead by offering affordability, quality assurance and unparalleled reach.

-

In January 2025, Anheuser-Busch InBev introduced Michelob Ultra Zero, a non-alcoholic beer with zero calories. This launch caters to growing demand for healthier, alcohol-free options and diversifies the company’s portfolio to appeal to health-conscious drinkers.

Heineken N.V., founded in 1864 in the Netherlands, is one of the most recognized beer brands globally. Its leadership is based on its premium positioning, high quality of brewing and a powerful international distribution footprint. It’s built around everything in marketing, sponsorship and our experiential campaigns to create loyalty to the brand. Due to its blend of innovation and tradition, the company's strong flavor profile, international footprint and myriad acquisitions in different markets continue to reinforce its position at the top amidst beer's competitive landscape.

-

In March 2025, Heineken unveiled a limited-edition commemorative can for the SAIL 2025 event in the Netherlands. The collector cans feature unique designs, available in the Americas and Europe, engaging consumers through special editions tied to cultural events.

China Resources Snow Breweries (CR Snow) is the largest beer producer in China, home to the top-selling Snow Beer brand. Its dominance is due to the local consumer knowledge, competitive price points and just sheer wide retail and open market distribution. The company employs strategic partners, high volume production and regional marketing campaigns to continue the market penetration. With the integration of large-scale efficiency and consistent product quality, CR Snow has become an undisputed market leader in the fiercely competitive beer market of China.

-

In May 2025, China Resources Snow Breweries (CR Snow) launched Snow Beer in Houston through Silver Eagle Distributors. The product, "Brave the World", is known for its lasting white foam and floral aroma. This move introduces one of China’s top-selling beers to the globally minded Houston market.

Beer Market Key Players:

Some of the Beer Market Companies are:

-

Anheuser-Busch InBev

-

Heineken N.V.

-

China Resources Snow Breweries

-

Carlsberg Group

-

Molson Coors Beverage Company

-

Asahi Group Holdings

-

Tsingtao Brewery Group

-

Kirin Holdings Company

-

Constellation Brands, Inc.

-

BGI/Groupe Castel

-

San Miguel Corporation

-

Efes Beverage Group

-

Beijing Yanjing Brewery

-

Thai Beverage Public Company Limited

-

Coopers Brewery Limited

-

Grupo Cuauhtémoc Moctezuma

-

Royal Unibrew

-

Oriental Brewery

-

Harbin Brewery Group

-

United Breweries Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 891.09 Billion |

| Market Size by 2033 | USD 1360.02 Billion |

| CAGR | CAGR of 5.46% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Lager, Ale, Stout, Pilsner, Wheat, Others) • By Packaging (Bottle, Can, Keg, Others) • By Production (Craft, Industrial, Regional, Others) • By End-Use Industry (Bars & Restaurants, Hospitality, Retail, Personal Consumption, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Anheuser-Busch InBev, Heineken N.V., China Resources Snow Breweries, Carlsberg Group, Molson Coors Beverage Company, Asahi Group Holdings, Tsingtao Brewery Group, Kirin Holdings Company, Constellation Brands, Inc., BGI/Groupe Castel, San Miguel Corporation, Efes Beverage Group, Beijing Yanjing Brewery, Thai Beverage Public Company Limited, Coopers Brewery Limited, Grupo Cuauhtémoc Moctezuma, Royal Unibrew, Oriental Brewery, Harbin Brewery Group, United Breweries Limited |