Waxy Maize Starch Market Report Scope And Overview:

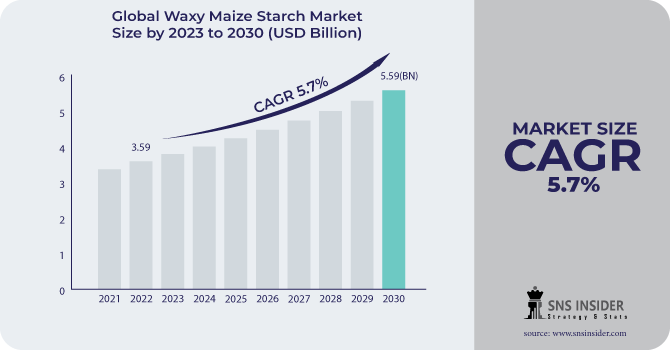

The Waxy Maize Starch Market size was USD 3.59 billion in 2022 and is expected to Reach USD 5.59 billion by 2030 and grow at a CAGR of 5.7% over the forecast period of 2023-2030.

Waxy maize starch, commonly known as waxy corn starch, is a starch that is fully composed of amylopectin. Amylopectin is a complex carbohydrate that is easier to digest than amylose, the other form of maize starch. Waxy maize starch is a white, odorless powder that is water-insoluble. It has a wide range of food and industrial applications.

Waxy maize starch is a versatile component with numerous food and industrial applications. It offers a lot of advantages, including easy digestion, neutral flavor and odor, water solubility, heat and moisture resistance, and inexpensive cost.

Based on nature, the conventional segment held a major value share of approximately 73.5% in 2022. The market is projected to grow at a CAGR of 5.8% in the forecast period. The food & beverage industry is evolving at a rapid pace, which is a direct consequence of the growing consumer demand for label-friendly finished products.

MARKET DYNAMICS

KEY DRIVERS

-

Rising demand in the food industry

Waxy maize starch is a multipurpose component found in a wide range of food applications. It is used in sauces and soups to thicken them, as a binding agent in baked goods, and as a texturizer in confectionary and processed foods. Demand for waxy maize starch is being driven by rising demand for various food products. Waxy maize starch is a gluten-free, low-calorie, and fat-free component. It is also high in complex carbs. Consumer demand for waxy maize starch is increasing as people become more aware of its health benefits.

RESTRAIN

-

Stringent government regulations

Stringent government regulations may result in higher production costs for waxy maize starch companies. This is due to the fact that producers must comply with these regulations, which may necessitate the purchase of new equipment and processes. The Food and Drug Administration (FDA) in the United States has rigorous restrictions regarding the use of food additives. Because waxy maize starch is classed as a food additive, it must be approved by the FDA. This may cause the introduction of new waxy maize starch products in the United States to be delayed. The European Union requires waxy maize starch to be labeled as a "modified starch." This may discourage consumers from purchasing items containing waxy maize starch.

OPPORTUNITY

-

The growing popularity of gluten-free diets

Waxy maize starch is a gluten-free component that can be used in various food products to substitute wheat starch. As a result, it is a helpful element for gluten-free diets. Waxy maize starch is being employed in a variety of novel and inventive culinary products, including gluten-free bread and pasta, low-carb sauces and dressings, and vegan meat replacements. Some people suffer from celiac disease, an autoimmune illness caused by gluten. Others suffer from gluten sensitivity, a disorder that causes bloating, gas, and diarrhea after consuming gluten. Others select gluten-free diets for a variety of reasons, including personal choice or the assumption that gluten-free diets are healthier. The increased popularity of gluten-free diets is driving up demand for waxy products.

CHALLENGES

-

Fluctuating prices of corn

Corn is the primary raw material utilized in the production of waxy maize starch. Corn price fluctuations can have an impact on the profitability of waxy maize starch manufacturers. For example, if corn prices skyrocket, waxy maize starch companies will have to pay more for their raw materials, perhaps resulting in decreased profits. Corn prices will have risen by more than 15% by 2021. This resulted in greater manufacturing costs for waxy maize starch companies, squeezing their earnings.

IMPACT OF RUSSIA UKRAINE WAR

Russia and Ukraine are important suppliers of waxy maize starch, and the war has hampered production and exports. Russia and Ukraine generated 15.5 and 19.5 million metric tons of maize, respectively, by 2022. Russia and Ukraine will export 14.66% and 10% of global waxy maize starch exports in 2022, respectively. The Food and Agriculture Organization of the United Nations (FAO) predicts that global waxy maize starch production will fall by 1% in 2022, owing mostly to the conflict in Ukraine. Waxy maize starch manufacturers face a number of issues, including less availability, higher prices, and greater production costs. Consumers are also confronting issues, such as rising living costs and less discretionary income.

IMPACT OF ONGOING RECESSION

Ukraine and Russia contribute to less than 5% of world maize production, while Ukraine accounts for the lion's share. Due to low domestic consumption, the majority of their output is exported; Ukraine is the third-highest supplier of maize to global markets. The disruption in the supply of maize led to an increase in price of maize. The Asia Pacific maize starch market fell precipitously in the third quarter of 2022 due to dropping feedstock corn prices and rising recessionary speculation. By the conclusion of the third quarter, the FOB Shanghai price of corn starch had fallen by 9.1% to USD 465/MT.

MARKET SEGMENTATION

By Type

-

Native

-

Modified

By Nature

-

Organic

-

Conventional

By End-use

-

Food Industry

-

Infant Nutrition

-

Soups, Sauces, and Dressings

-

Bakery & Confectionery

-

Dairy Products and Frozen Desserts

-

Other

-

-

Foodservice

-

Non-food Applications

.png)

REGIONAL ANALYSIS

Asia Pacific is the major regional market, accounting for 50% of worldwide revenue. The region is predicted to grow significantly due to increased product demand from key industries such as food and beverage, pharmaceuticals, detergents, and personal care. Over the forecast period, rising disposable income in emerging economies such as India and China is predicted to support the market growth.

North America region is expected to grow at a CAGR of 5.9% in 2022. The increased development of starches with distinct qualities is likely to increase market value in the region. Waxy maize starches are becoming more widely used in a variety of end-use industries, including food and beverage, cosmetics, and personal care products. Consumer awareness of the health benefits of waxy maize starches is also driving the demand.

Europe had an enormous market share in 2022. The rising demand for fresh meals that are ready to eat (RTE) is anticipated to drive market growth. The increasing health concerns of waxy maize starches in the food industry and industrial sector is anticipated to drive the demand. The Middle East & Africa market is anticipated to grow at a CAGR of 4.2% in the upcoming years.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Waxy Maize Starch Market are Cargill, Ingredion, Penford, Archer Daniels Midland (ADM), Tate & Lyle, Visco Starch, Roquette, Gulshan Polyols Ltd., Western Polymer Corporation, Grain Processing Corporation (GPC), AkzoNobel, Venus Starch Suppliers, Agrana Beteiligungs-AG, Spac Starch Products Ltd., and other key players.

Ingredion-Company Financial Analysis

RECENT DEVELOPMENTS

In 2022, Tate & Lyle announced the launch of a new customer innovation and collaboration center in Santiago, Chile for better consumer service and reach. Tate & Lyle is a leading global manufacturer of food & beverage ingredients and solutions.

In 2022, AGRANA built a huge solar system at its potato starch mill in Waldviertel, Gmund, under a contracting basis with RWA Solar Solutions. This installation is ready now and has 890 photovoltaic modules covering 1650 m2 that have been put on the potato starch factory’s roof and will produce 338,000 KWh annually.

| Report Attributes | Details |

| Market Size in 2022 | US$ 3.59 Billion |

| Market Size by 2030 | US$ 5.59 Billion |

| CAGR | CAGR of 5.7 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Native, Modified) • By Nature (Organic, Conventional) • By End-use (Food Industry, Foodservice, Non-food Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Cargill, Ingredion, Penford, Archer Daniels Midland (ADM), Tate & Lyle, Visco Starch, Roquette, Gulshan Polyols Ltd., Western Polymer Corporation, Grain Processing Corporation (GPC), AkzoNobel, Venus Starch Suppliers, Agrana Beteiligungs-AG, Spac Starch Products Ltd. |

| Key Drivers | • Rising demand in the food industry |

| Market Opportunity | • The growing popularity of gluten-free diets |