Breathalyzers Market Report Scope & Overview:

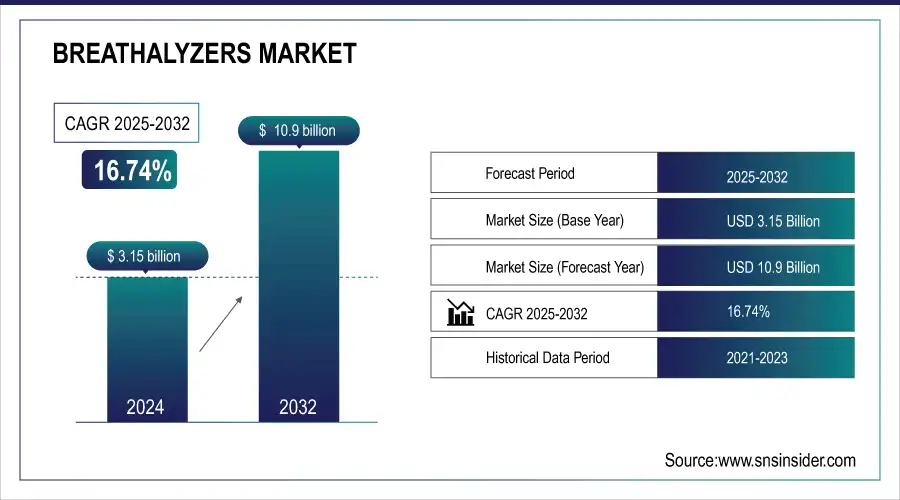

Breathalyzers Market was valued at USD 3.15 billion in 2024 and is expected to reach USD 10.9 billion by 2032, growing at a CAGR of 16.74% from 2025-2032.

The breathalyzers market is expected to grow with urgency on road safety improvement. Every year, about 1.19 million people die in traffic accidents worldwide. Road injuries have become the leading cause of death in young adults aged 5–29. In lower- and middle-income countries, which account for 92% of fatalities despite housing almost 60% of the world's vehicles, law enforcement is increasingly using breathalyzers. Some 37 lose their lives daily in alcohol-related crashes in the U.S., suggesting further solutions to make testing easily available.

Get more information on Breathalyzers Market - Request Sample Report

Breathalyzers Market Size and Forecast:

-

Market Size in 2024: USD 3.15 Billion

-

Market Size by 2032: USD 10.9 Billion

-

CAGR: 16.74% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Trends in the Breathalyzers Market:

-

Rising adoption of portable and personal breathalyzer devices for law enforcement and individual use.

-

Integration of smartphone connectivity and mobile apps for real-time BAC (blood alcohol content) monitoring.

-

Increasing demand for advanced fuel cell and semiconductor-based breathalyzers for accurate and rapid detection.

-

Growing use in workplaces, bars, and ride-sharing services to promote safety and prevent DUI incidents.

-

Expansion of roadside sobriety testing programs by governments globally to curb drunk driving.

-

Development of wearable alcohol monitoring devices for continuous and discreet tracking.

-

Rising awareness of alcohol-related health risks boosting personal use of breathalyzer devices.

-

Collaborations between manufacturers and automotive companies for in-vehicle alcohol detection systems.

Workplace and healthcare applications fuel expansion in the breathalyzer market. Alcohol use causes 11% of all workplace accidents, costing companies an estimated USD 2 billion annually in lost productivity and time off. High-risk industry employers are using alcohol testing to minimize accidents and improve safety in the workplace. Health care providers also use breath analyzers for monitoring the level of alcohol in their patients, particularly in treating addiction. Applications in occupational and medical sectors are thus driving growth in the market.

New market opportunities are therefore emerging from innovations in the technology of the breathalyzer especially with regard to cannabis use. Cannabis use is indeed on the rise, mainly in the U.S. where 52.5 million users reported usage. A growing demand for marijuana-specific breathalyzers is building up. Such devices are useful for reliable on the spot testing in meeting regulation needs as cannabis legalization goes on. Digital and smartphone-compatible breathalyzers have also boosted user accessibility as they are very useful both in law enforcement, in workplaces, and in personal use. As these technologies develop, the breathalyzer market shall achieve a multi-sector development across various fields.

Breathalyzers Market Drivers:

-

Demand for Portable Breathalyzers Surges as Stricter Regulations Address Escalating Alcohol-Impaired Driving Fatalities

As the deaths due to alcohol-driving totaled 18% of road fatalities in UK during the year 2022, it is now raising more control over the killing safety threat from authorities. With this alcohol-related binge on driving violation, there's an always-growing demand for a portable and accurate breathalyser that the police so badly want to use for accurate roadside tests. In light of both regulator and community pressures to drive safer roads, innovative technology in breathalyzer technology for accuracy, portability, and ease of use, advanced devices now become that critical solution that will ensure impaired driving can be halted in real-time and losses on the road will stop.

- Innovative Breathalyzer Technologies Expand Market Reach with Enhanced Accuracy, Usability, and Industry Applications

New innovations for breathalyzer technology, including smartphone connectivity, fuel cell sensors, and IR spectroscopy, bring the bar up even more in terms of accuracy, usability, and industry application. Recently, in September 2022, fuel cell breathalyzer sensors have demonstrated accuracy in providing BAC between 0.00% and 0.400%, a range which provides coverage of what is desired for most uses. This precision has made fuel cell breathalyzers a necessity in law enforcement, healthcare, and workplace safety as most countries have established a legal intoxication level at 0.08% BAC. Smart phone connectivity enables the transfer of real-time data and IR spectroscopy to enhance performance in legal and forensic environments, which makes this device relevant to many industries.

Breathalyzers Market Restraints:

-

Temperature Sensitivity Challenges Breathalyzer Accuracy and Reliability in Diverse Environments and Extreme Conditions

The breathalyzers are convenient for BAC measurement, although their measurements are seriously affected by external conditions, particularly by temperature. Extremes of cold or heat may cause sensor readings to become less reliable. This leads to inaccurate results. For instance, a fuel cell is highly accurate under standard conditions but is compromised if it is extremely high or low in temperatures as the performance influences its diverse environment. This sensitivity to temperature is a limitation, especially when climatic conditions change more frequently, and it needs readjustment or recalibration from time to time, thus adding to the cost of maintenance and reducing its reliability.

Breathalyzers Market Segmentation Analysis:

By Technology, Fuel Cell Leads Market While Infrared Spectroscopy Registers Fastest Growth

In 2024, fuel cell technology leads the market with about 34% in terms of revenue due to its high accuracy and reliability in providing precise BAC readings, even in diluted alcohol concentrations. Such a technology has become the preference in law enforcement and workplace testing applications where accurate results play a crucial role in maintaining public safety. On the other hand, infrared spectroscopy is expected to grow significantly in the near future and is anticipated to hold a CAGR of 18.52% during the period 2025-2032. This growth is attributed to the rising demand for sophisticated testing capabilities in forensic and clinical settings and thus the higher sensitivity and IR technology's ability to detect the existence of several substances. This classifies IR technology as the significant area for future application to be used in fields demanding high accuracy and variability.

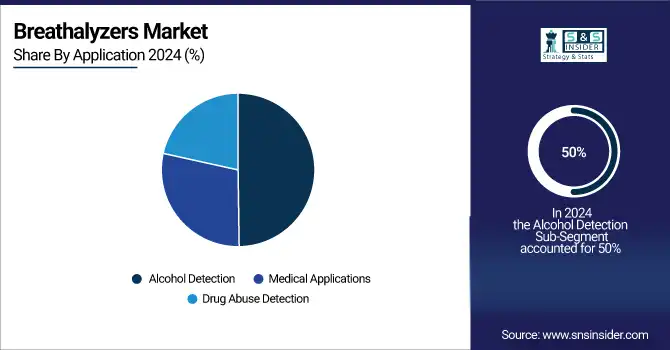

By Application, Alcohol Detection Dominates While Drug Detection Shows Rapid Growth

In 2024, alcohol detection holds about 50% revenue of the breathalyzer market mainly because of heavy regulatory requirements concerning alcohol screening across law enforcement, workplace, and transportation sectors. The breathalyzer systems are highly established and known for their reliability, hence remain the devices preferred for the establishment of prompt results and potential legality. Meanwhile, growth in the segment of detecting drug abuse is projected to be significant during the foreseen forecast period; the segment is expected to attain a CAGR of 17.9% from 2025 to 2032. The factor that has primarily driven growth through a rapid rate is seen mainly in rising demand for multi-substance testing, as well as increased focus in curbing drug-impaired driving and a growing scale of drug-testing protocols becoming implemented across industries. Consequently, drug-detective breath analyzers are now an integral part of public-safety programs, thus expanding applications for breath analyzers.

Breathalyzers Market Regional Insights:

North America Dominates Breathalyzers Market in 2024

North America dominates the breathalyzers market in 2024 with an estimated 42% share, primarily driven by strict DUI regulations and robust enforcement initiatives. High government and law enforcement spending ensures widespread deployment of alcohol-detection devices across police, transportation, and workplace settings. Additionally, workplace safety mandates and corporate compliance programs further fuel adoption in industrial and commercial sectors. Rising public awareness about drunk-driving risks and emphasis on road and occupational safety encourage investments in advanced breathalyzer technologies, including fuel cell and infrared devices, reinforcing the region’s leadership in the global market.

Need any customization research on Breathalyzers Market - Enquiry Now

-

United States Leads North America’s Breathalyzers Market

The U.S. dominates due to strict regulatory enforcement of blood-alcohol limits, extensive law enforcement infrastructure, and workplace safety mandates. High public awareness regarding drunk driving, coupled with government initiatives promoting alcohol testing and compliance programs, drives consistent demand. Additionally, advanced technology adoption in healthcare, law enforcement, and transportation sectors ensures preference for high-accuracy devices such as fuel cell and infrared breathalyzers. Major U.S.-based manufacturers and distributors strengthen supply chains, while rising emphasis on road safety and corporate compliance maintains the U.S. as the leading market in North America.

Asia Pacific is the Fastest-Growing Region in Breathalyzers Market in 2024

Asia Pacific’s breathalyzers market is projected to grow at a CAGR of 20.8% from 2025 to 2032, fueled by rapid urbanization, stricter traffic regulations, and rising public awareness of road safety. Governments across the region are enforcing alcohol-testing laws and workplace safety standards, driving demand for high-accuracy devices. Expanding industrialization and smart-city initiatives are further accelerating adoption of breathalyzers in law enforcement, corporate, and healthcare sectors. Combined with increasing local manufacturing and technology penetration, these factors are propelling robust market growth in Asia Pacific.

-

China Leads Asia Pacific’s Breathalyzers Market

China dominates due to strict implementation of traffic safety laws, rapid industrialization, and rising awareness of workplace alcohol policies. Government initiatives to reduce road accidents and strengthen public safety have increased the deployment of breathalyzers across law enforcement and corporate sectors. Additionally, China’s expanding healthcare infrastructure and growing domestic manufacturing of advanced alcohol-testing devices contribute to market growth. The presence of both local and international players ensures accessibility and innovation, positioning China as the key driver for the Asia Pacific breathalyzers market.

Europe Breathalyzers Market Insights, 2024

Europe shows steady growth in 2024, supported by stringent drunk-driving regulations, workplace safety mandates, and adoption of advanced detection technologies. Germany’s strict road safety regulations and widespread alcohol testing programs drive higher adoption of advanced breathalyzers, enhancing market penetration.

-

Germany Leads Europe’s Breathalyzers Market

Germany dominates due to its robust automotive sector, strong law enforcement protocols, and adoption of high-accuracy breathalyzer technologies. Road safety regulations, corporate alcohol policies, and government-backed public safety initiatives drive consistent demand for fuel cell and infrared breathalyzers. The presence of advanced R&D and leading European manufacturers ensures continued innovation and distribution. German regulatory compliance and technological adoption make it the primary contributor to Europe’s breathalyzers market in 2024.

Middle East & Africa and Latin America Breathalyzers Market Insights, 2024

The breathalyzers market in the Middle East & Africa and Latin America is experiencing steady growth in 2024. Growth is driven by rising awareness of road safety, stricter traffic enforcement, and adoption of alcohol testing in workplaces. In the Middle East, countries such as the UAE and Saudi Arabia are investing in law enforcement and smart city projects that utilize breathalyzers for public safety. In Latin America, Brazil and Mexico lead adoption due to government campaigns on drunk-driving prevention and growing corporate safety compliance programs.

Competitive Landscape for the Breathalyzers Market:

Drägerwerk AG & Co. KGaA

Drägerwerk AG & Co. KGaA is a Germany-based leader in breathalyzer and safety technology solutions. The company specializes in high-precision alcohol detection devices, including fuel-cell and infrared breath analyzers, used across law enforcement, workplace safety, and personal monitoring applications. With decades of expertise in measurement technology and medical devices, Drägerwerk provides comprehensive solutions combining hardware, software, and calibration services. Its role in the breathalyzers market is pivotal, delivering reliable, accurate, and certified devices for public safety and corporate compliance.

-

In 2024, Drägerwerk previewed its latest fuel-cell breathalyzer series, featuring enhanced sensitivity, rapid response times, and robust calibration capabilities for professional use.

Lifeloc Technologies, Inc.

Lifeloc Technologies is a U.S.-based provider of portable and desktop breathalyzers, offering solutions for law enforcement, occupational safety, and personal use. Known for fuel-cell technology and industry-compliant accuracy, Lifeloc devices ensure reliable BAC readings and data integrity. The company focuses on user-friendly interfaces, durability, and advanced data logging to meet professional and regulatory standards. Its role in the breathalyzers market is central, supporting safety enforcement and corporate compliance with scalable testing solutions.

-

In 2024, Lifeloc Technologies launched a new line of handheld breathalyzers with smartphone connectivity, enabling real-time reporting and secure data management.

BACtrack (by KHN Solutions, Inc.)

BACtrack, headquartered in the U.S., is a leading consumer and professional breathalyzer manufacturer. The company develops fuel-cell and portable breath-testing devices for personal, corporate, and law enforcement applications. BACtrack emphasizes accuracy, user-friendly operation, and mobile integration through app connectivity. Its role in the breathalyzers market is significant, providing reliable solutions that combine technology innovation with ease of use.

-

In 2024, BACtrack introduced the BACtrack Mobile Pro, featuring smartphone synchronization, cloud-based BAC tracking, and enhanced calibration for professional monitoring.

AlcoPro, Inc.

AlcoPro, Inc. is a U.S.-based manufacturer of advanced breath alcohol testing equipment for law enforcement, workplace, and clinical settings. Specializing in fuel-cell and infrared analyzers, the company delivers high-precision, rugged devices with comprehensive calibration and certification services. AlcoPro’s role in the breathalyzers market is crucial, providing accurate, reliable, and regulatory-compliant solutions that support public safety and occupational health initiatives.

-

In 2024, AlcoPro rolled out its latest AlcoScan series, offering improved measurement accuracy, portable design, and streamlined reporting capabilities for professional users.

Crowdfunding Market Key Players:

-

Drägerwerk AG & Co. KGaA

-

Lifeloc Technologies, Inc.

-

BACtrack (by KHN Solutions, Inc.)

-

AlcoPro, Inc.

-

Intoximeters, Inc.

-

Lion Laboratories Ltd.

-

Guth Laboratories, Inc.

-

National Patent Analytical Systems, Inc.

-

Sensorcon, Inc.

-

Sentech Instruments Co., Ltd.

-

Autoliv, Inc.

-

ALCOSENSE TECHNOLOGIES Ltd.

-

BreathTech Corporation

-

ACE Instruments

-

Alcohawk (by BACtrack/KHN Solutions)

-

Lifeloc Technologies (Law Enforcement Division)

-

Scitec Instruments

-

Andatech AG

-

AlcoMate (AlcoPro)

-

Guardian Safety & Security

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.15 Billion |

| Market Size by 2032 | USD 10.9 Billion |

| CAGR | CAGR of 16.74% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Fuel Cell Technology, Semiconductor Sensor, Infrared (IR) Spectroscopy, Others) • By Application (Drug Abuse Detection, Alcohol Detection, Medical Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lifeloc Technologies, Inc., Quest Products, Inc., Intoximeters, Alcohol Countermeasure Systems Corp., AK GlobalTech Corp., Bedfont Scientific Ltd., Tanita, Lion Laboratories, Shenzhen Ztsense Hi-Tech Co., Ltd., Drägerwerk AG & Co. KGaA, AlcoPro, Brezel GmbH, Sentech, Narkomed, AlcoDigital, Bactrack, AEB. |