Security Service Edge Market Report Scope & Overview:

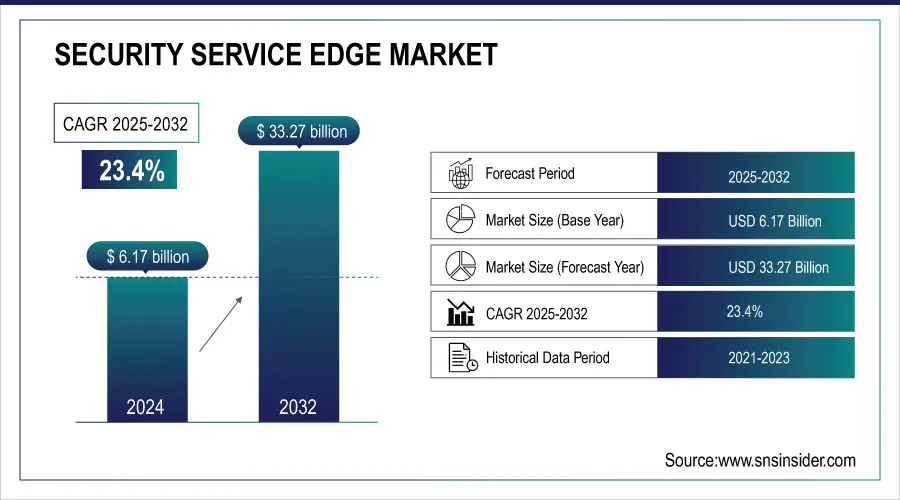

The Security Service Edge Market size was valued at USD 6.17 billion in 2024 and is projected to reach USD 33.27 billion by 2032, growing at a CAGR of 23.4% during 2025-2032.

The Security Service Edge (SSE) market is growing rapidly as enterprises adopt cloud-delivered security, integrating SWG, CASB, and ZTNA into unified platforms. Rising demand for remote workforce protection, real-time threat detection, and regulatory compliance fuels expansion. Vendors emphasize AI-driven tools, centralized management, and cloud-native frameworks. Over 70% of enterprises have embraced SSE, with more than 60% prioritizing zero-trust strategies, accelerating adoption of integrated solutions that deliver secure access, policy enforcement, and threat protection across increasingly distributed, cloud-first environments.

To Get more information on Security Service Edge Market - Request Free Sample Report

Key Security Service Edge Market Trends

-

Enterprises are adopting SSE platforms integrating SWG, CASB, and ZTNA for unified cloud-native security.

-

Remote and hybrid work models are driving demand for identity-based zero-trust network access.

-

AI-driven analytics, real-time threat detection, and automation are fueling SSE innovation.

-

High costs, legacy integration issues, and talent shortages hinder SSE adoption.

-

Regulatory mandates and data protection laws are accelerating SSE adoption for compliance.

-

Demand for centralized management, simplified operations, and scalability boosts cloud-delivered SSE investments.

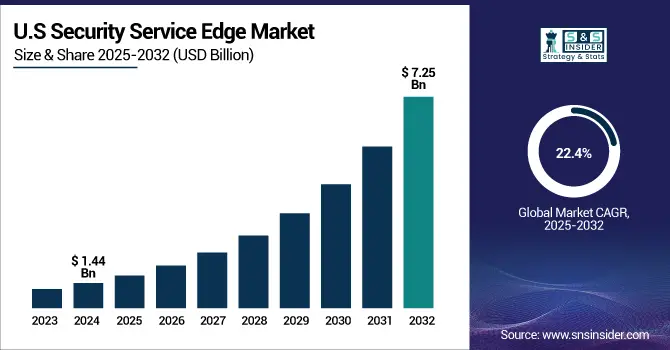

The U.S. Security Service Edge Market size was valued at USD 1.44 Billion in 2024 and is projected to reach USD 7.25 Billion by 2032, growing at a CAGR of 22.4% during 2025-2032. The U.S. market is expanding rapidly due to the rise in cloud service adoption and remote work, with over 68% of enterprises implementing integrated security frameworks.

The security service edge market trends include the growing adoption of cloud-native security platforms, the integration of SWG, CASB, and ZTNA into unified frameworks, and the acceleration of zero trust strategies to safeguard remote and hybrid workforces. AI-driven threat detection, behavioral analytics, and automated policy enforcement are enhancing real-time protection and operational efficiency. Rising regulatory compliance requirements, demand for centralized management, and scalability are fueling investments in cloud-delivered security.

Security Service Edge Market Growth Drivers:

-

Surge in Cloud-First Strategies and Remote Work Models Drives Strong Adoption of Security Service Edge Solutions Globally

The growing reliance on cloud-native applications and hybrid work environments has significantly boosted the adoption of Security Service Edge platforms. As organizations increasingly migrate workloads to the cloud and employees access corporate resources from diverse locations, traditional network security models have become insufficient. This shift has caused a spike in demand for integrated, cloud-delivered security frameworks like SSE, which combines SWG, CASB, and ZTNA capabilities.

In April 2024, a leading cybersecurity vendor launched an AI-enhanced SSE platform tailored for hybrid cloud environments, allowing real-time user behavior analysis and adaptive access control. This development demonstrates how the shift to remote and cloud-first models is prompting innovation in SSE technologies.

Security Service Edge Market Restraints:

-

Limited Awareness and Integration Complexities Among Small Enterprises Restrict Market Growth for Security Service Edge Solutions

Despite the increasing popularity of SSE among large corporations, small and medium-sized enterprises (SMEs) face challenges in adopting these advanced security solutions. The primary cause is the lack of awareness and in-house cybersecurity expertise, which leads to hesitancy in replacing traditional security setups with cloud-delivered alternatives. This results in slower adoption among smaller firms, ultimately restraining the overall market growth. Additionally, integrating SSE into existing IT ecosystems can be complex for organizations without dedicated security teams. Many SMEs find it difficult to navigate the configuration and policy enforcement processes involved in deploying SSE, especially when managing remote users across different environments. This limitation reduces the potential market scope and delays the full-scale transition to unified security frameworks in broader industry segments.

Security Service Edge Market Opportunities:

-

Expansion of AI-Driven Security Analytics in SSE Platforms Creates New Growth Opportunities for Advanced Cybersecurity Deployment

The evolution of artificial intelligence (AI) and machine learning (ML) in cybersecurity has opened significant opportunities for the Security Service Edge market. As threats grow more complex and dynamic, the demand for intelligent, automated security has increased sharply. SSE platforms embedded with AI/ML capabilities are now able to provide advanced threat detection, behavior analytics, and policy automation in real-time. This has led organizations to see SSE not just as a defensive layer but as a proactive tool for adaptive access control and risk management. The ability to continuously monitor user behavior, detect anomalies, and adjust policies accordingly is driving interest from industries with high regulatory and security demands.

In February 2024, a global cybersecurity provider introduced a new SSE suite integrated with AI-driven risk scoring and behavioral threat analytics. This launch highlighted the rising interest in intelligent SSE solutions that can provide deeper visibility and faster response times, aligning with the market’s growing focus on proactive security measures.

Key Security Service Edge Market Segment Analysis

-

By End Use, BFSI led with ~39% share in 2024; IT & Telecommunications fastest growing (CAGR 26.52%).

-

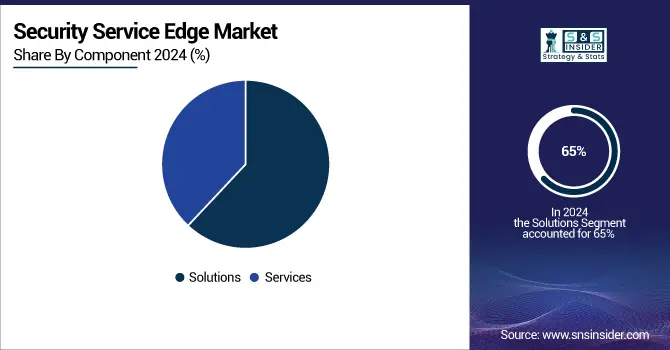

By Component, Solutions dominated with ~65% share in 2024; Services fastest growing (CAGR 24.56%).

-

By Deployment, Cloud-based held ~55% share in 2024; Hybrid fastest growing (CAGR 25.20%).

-

By Enterprise Size, Large Enterprises led with ~68% share in 2024; SMEs fastest growing (CAGR 26.14%).

By Component, Solutions Dominate While Services Expand Rapidly

In 2024, the Solutions segment held the market share, as organizations increasingly prefer unified, automated, and scalable platforms integrating SWG, CASB, and ZTNA into a single suite. AI-driven threat detection, centralized policy enforcement, and cloud-native integration have reinforced the dominance of solution-based offerings, enabling enterprises to achieve higher operational efficiency. The Services segment is expected to record the fastest CAGR growth from 2025–2032. Rising demand for expert-led integration, configuration, and managed services is driving adoption, particularly among organizations without in-house security teams. Providers now offer packaged services for policy enforcement, risk assessment, and real-time monitoring, accelerating the expansion of this segment.

By End Use, BFSI Leads Market While IT & Telecommunications Registers Fastest Growth

In 2024, the BFSI sector dominated the Security Service Edge market share, driven by its high exposure to financial fraud, data breaches, and strict regulatory requirements. The need for advanced, unified security solutions has led to the rapid adoption of SSE in financial institutions, with continuous product innovations such as encrypted data access, adaptive policies, and real-time monitoring making it indispensable for safeguarding transactions and ensuring compliance. The IT & Telecommunications segment is projected to grow at the fastest CAGR 2025–2032, fueled by rising data volumes, multi-cloud deployments, and decentralized user access. Recent advancements in API protection and zero trust integration are making SSE critical for securing telecom infrastructure, directly supporting the sector’s expanding digital footprint.

By Deployment, Cloud-Based Leads Market While Hybrid Shows Strong Growth

In 2024, the Cloud-based deployment model dominated market share, supported by the rising adoption of SaaS, remote work, and agile IT models. Cloud-delivered SSE platforms offer scalability, lower latency, and real-time updates, making them the preferred choice for distributed workforces. Innovations such as multi-tenant security, dynamic access controls, and cloud-native application integration are propelling this segment’s dominance. The Hybrid deployment model is forecasted to grow the fastest CAGR 2025–2032, as enterprises in regulated sectors and those undergoing phased cloud migration prioritize a mix of cloud and on-premise security. Features such as centralized dashboards, secure tunneling, and seamless integration with legacy systems make hybrid SSE a compelling choice for businesses seeking flexibility and control.

By Enterprise Size, Large Enterprises Lead While SMEs Grow Fastest

In 2024, Large Enterprises contributed service edge market share, driven by their complex IT environments, regulatory exposure, and geographically dispersed operations. With the need to secure multi-cloud access and sensitive data, large organizations are increasingly adopting SSE solutions featuring adaptive trust engines, deep traffic inspection, and AI-powered access policies. The SME segment is expected to expand at the fastest-growing CAGR over 2025–2032. Growing reliance on digital platforms, increasing cyber risks, and the demand for simplified, cost-effective security frameworks are encouraging SMEs to adopt SSE. Vendors are introducing lightweight, scalable solutions with intuitive dashboards and pay-as-you-go pricing, lowering adoption barriers and accelerating uptake among smaller businesses.

Security Service Edge Market Regional Outlook

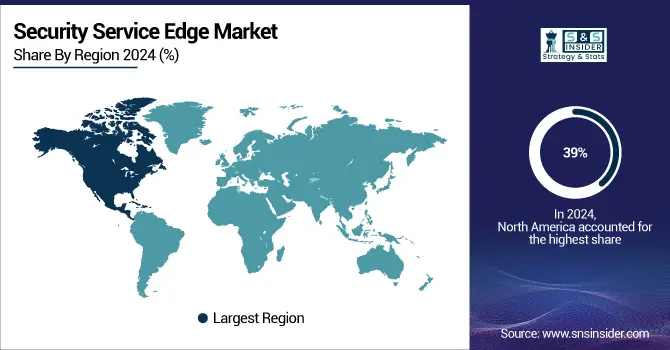

North America Security Service Edge Market Insights

In 2024, North America led the Security Service Edge market share with a 39% revenue, driven by advanced digital infrastructure, widespread cloud adoption, and strong regulatory frameworks around cybersecurity. The United States dominates the regional market owing to its vast IT ecosystem, rapid adoption of remote and hybrid work models, and significant cybersecurity investments across the BFSI, healthcare, and government sectors. The region’s emphasis on zero-trust frameworks and integrated security platforms continues to strengthen its leadership in the SSE landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Security Service Edge Market Insights

Asia Pacific is the fastest-growing region, projected to register a 25.3% CAGR over 2025–2032, supported by rapid digital transformation, expanding cloud infrastructure, and heightened exposure to cyber threats in emerging economies. Adoption is surging across manufacturing, telecom, and retail sectors, where secure remote access and compliance requirements are crucial.

China Leads Security Service Edge Market Growth Driven by Cloud Adoption and Cybersecurity Investments

China dominates the regional Security Service Edge market, fueled by rapid enterprise cloud migration, strong government-led cybersecurity initiatives, and increasing investments in advanced SSE platforms. These efforts aim to protect critical infrastructure, ensure regulatory compliance, and strengthen business continuity in an evolving digital and threat-driven environment.

Europe Security Service Edge Market Insights

In 2024, Europe witnessed steady growth in the SSE market, underpinned by stringent data privacy regulations, cross-border digital operations, and growing enterprise demand for unified cloud security frameworks. Regulatory pressure to enforce zero-trust access and secure multi-cloud environments is accelerating adoption across industries. Germany dominates the European market, backed by its strong industrial base, leadership in AI-driven cybersecurity adoption, and increasing investments in SSE platforms across automotive, manufacturing, and critical infrastructure sectors.

Latin America (LATAM) and Middle East & Africa (MEA) Security Service Edge Market Insights

The SSE market in LATAM and MEA is experiencing rising adoption, driven by digital modernization, increasing cyberattacks, and limited reliance on legacy systems. Enterprises in these regions are turning to SSE to secure cloud adoption and safeguard critical sectors. South Africa leads the MEA market with growing investment in enterprise cloud security and protection for industries like finance and energy. In LATAM, Brazil dominates due to its expanding digital ecosystem, rising enterprise awareness of scalable security, and increased adoption of SSE solutions across finance, telecom, and government services.

Competitive Landscape for the Security Service Edge Market:

Cisco Systems, Inc., headquartered in San Jose, California, is a global leader in networking, cloud, and cybersecurity solutions, serving enterprises, governments, and service providers worldwide. The company is renowned for its innovations in networking hardware, software, and services that power the internet and digital transformation. In the cybersecurity domain, Cisco plays a pivotal role in advancing Security Service Edge by integrating secure web gateway (SWG), cloud access security broker (CASB), and zero trust network access (ZTNA) capabilities. Its SSE offerings deliver unified, cloud-native security that enables secure remote access, real-time threat protection, and simplified policy enforcement across hybrid environments.

-

In July 2025, Cisco partnered with OneBill to integrate tenant billing and revenue management for Cisco BroadWorks service providers. This integration automates subscriber onboarding, service provisioning, and billing workflows, reducing manual overhead.

Zscaler, Inc., headquartered in San Jose, California, is a pioneer in cloud-delivered security solutions, enabling organizations to securely transform IT for the digital era. The company provides scalable, cloud-native platforms that replace traditional network security appliances with integrated zero trust frameworks. Zscaler plays a leading role in the Security Service Edge market by offering secure web gateway (SWG), cloud access security broker (CASB), and zero trust network access (ZTNA) in a unified solution. Its platforms deliver fast, secure, and seamless user access to applications, protecting enterprises from cyber threats while simplifying policy management and enhancing compliance.

-

Zscaler introduced a new Contract Management feature within its Business Insights platform in February 2025, enabling organizations to track SaaS application usage and manage vendor contracts based on actual consumption.

Broadcom Inc. is a global technology leader specializing in semiconductors, infrastructure software, and cybersecurity solutions. With its acquisition of Symantec’s enterprise security business, Broadcom significantly expanded into advanced network and cloud security offerings. In the Security Service Edge market, Broadcom plays a critical role by delivering cloud-native, AI-driven security solutions that integrate secure web gateway, zero trust network access, and cloud access security broker capabilities. Its SSE services enable enterprises to secure hybrid and remote workforces, ensure compliance, and maintain consistent policies across distributed environments. Broadcom leverages its scale, performance focus, and deep enterprise presence to strengthen SSE adoption.

-

May 2025: During the RSA Conference 2025, Google Cloud and Broadcom announced an AI-driven network security collaboration, enabling Broadcom to deploy Security Service Edge solutions at scale with high performance and consistent policy enforcement worldwide.

Palo Alto Networks is a global cybersecurity leader, recognized for its next-generation firewalls, AI-driven threat intelligence, and integrated cloud security platforms. The company has expanded aggressively into the Security Service Edge market through its Prisma Access platform, unifying secure web gateway, zero trust network access, and cloud access security broker features. By delivering SSE via the cloud, Palo Alto Networks enables enterprises to protect remote users, applications, and data with consistent, scalable, and policy-driven security. Its leadership in AI, automation, and unified security platforms positions it as one of the most influential vendors driving the global shift to SSE.

-

April 2025: Palo Alto Networks unveiled the Prisma Access Browser 2.0, described as the world’s only SASE-native secure browser. It extends Prisma SASE protection directly into the browser, adding real-time GenAI data-loss prevention and Precision AI-based defenses against cloaking and SaaS phishing, securing the most frequently used enterprise touchpoint.

Security Service Edge Market Key Players:

-

Zscaler

-

Cisco

-

Broadcom

-

Netskope

-

Fortinet

-

Cloudflare

-

Check Point (Perimeter 81)

-

Skyhigh Security

-

Citrix

-

HPE Aruba Networks

-

Versa Networks

-

TwinGate

-

Banyan Security

-

Akamai Technologies

-

Forcepoint

-

Lookout

-

iboss

-

Open Systems

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.17 Billion |

| Market Size by 2032 | USD 33.27 Billion |

| CAGR | CAGR of 23.4% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Type (Solutions [Secure Web Gateway (SWG), Cloud Access Security Broker (CASB), Zero Trust Network Access (ZTNA), Firewall-as-a-Service (FWaaS), Data Loss Prevention (DLP), Remote Browser Isolation (RBI)], Services [Professional Services, Managed Services]) • By Deployment Mode (On-Premises, Cloud-based, Hybrid) • By Enterprise Size (Large Size Enterprise, Small and Medium-Sized Enterprise (SMEs)) • By End-Use Industry (IT and Telecommunication, BFSI, Government & Public Sector, Healthcare, Retail and e-Commerce, Manufacturing, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Zscaler, Cisco, Broadcom, Palo Alto Networks, Netskope, Fortinet, Cloudflare, Check Point (Perimeter 81), Skyhigh Security, Citrix, HPE Aruba Networks, Menlo Security, Versa Networks, TwinGate, Banyan Security, Akamai Technologies, Forcepoint, Lookout, iboss, Open Systems, and Others. |