Biochar Market Report Scope & Overview:

Get More Information on Biochar Market - Request Sample Report

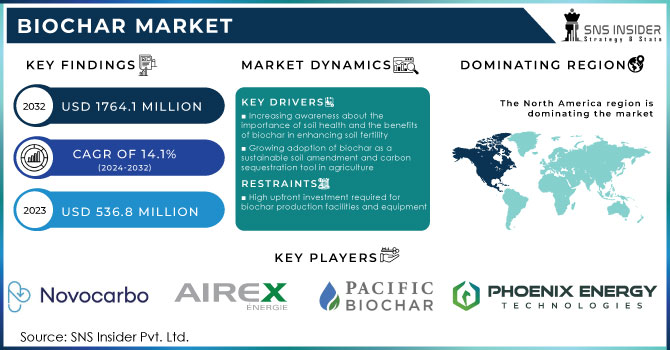

The Biochar Market Size was valued at USD 536.8 million in 2023. It is projected to reach USD 1764.1 million by 2032 and grow at a CAGR of 14.1% over the forecast period 2024-2032.

The biochar market is witnessing robust growth driven by increasing concerns over soil degradation and the need for sustainable agricultural practices. Rising adoption of biochar for improving soil fertility, enhancing crop yields, and mitigating greenhouse gas emissions is fueling market expansion. Government policies promoting biochar usage as a climate change mitigation strategy further accelerate market growth. Technological advancements in biochar production methods and increasing investments in research and development contribute to market development. Additionally, growing awareness among farmers and environmentalists about the benefits of biochar in carbon sequestration and soil health drives market demand.

For instance, Carbo Culture raised USD 6.2 million to increase its biochar production technology, focusing on carbon-negative biochar solutions for agricultural and environmental purposes. The company's advanced production techniques aim to increase carbon sequestration capacity while improving soil health and water retention

Another growth factor for the biochar market is the increasing demand for organic food products, which drives the need for sustainable farming practices like biochar application. Additionally, the rising interest in circular economy models, where organic waste is converted into valuable resources like biochar, supports market expansion. Among other uses, it is widely applied as a soil amendment to lessen contaminants and dangerous compounds, soil leaching, and fertilizer runoff. Furthermore, the biochar market is propelled by the growing trend of urban farming and rooftop gardening, which relies on soil enrichment methods such as biochar incorporation for optimal plant growth and productivity.

According to USDA data, biochar adoption in U.S. farming has grown by over 15% since 2020, driven by incentives under the Conservation Stewardship Program (CSP) and carbon credits for reducing emissions. Moreover, Indian government included biochar in its National Action Plan on Climate Change, incentivizing the use of biochar to improve soil fertility and sequester carbon. This initiative is expected to lead to a 20% increase in biochar use in agricultural lands by 2025.

Furthermore, A stable form of carbon produced from organic waste by pyrolysis, biochar has come to the attention of many people due to its capacity to store carbon for a long time. In fact, it can preserve of up to hundreds and even thousands of years and that is why it is invaluable in the fight against climate change as the tool assisting in the capture and storage of the free atoms. In 2023, for example, a new biochar facility in California was put into service by the U.S.-based Bioforcetech Corporation. The construction and operation of the facility were triggered by governmental regulations placed in the state to minimise atmospheric emissions produced during the management of waste.

Market Dynamics:

Drivers

- Growing adoption of biochar as a sustainable soil amendment and carbon sequestration tool in agriculture drive the market growth.

The key driver of market growth is the ever-increasing adoption of biochar as a sustainable soil amendment and carbon sequestration method in agriculture. As a soil enhancer, biochar improves soil structure, water retention, and nutrient availability, ultimately contributing to higher crop yields. Moreover, the ability to sequester carbon for up to several centuries’ positions biochar as an effective measure against climate change, in line with the global push for sustainability. The governments undertook substantial efforts to support the agricultural use of biochar, equally driving its growth. For example, the U.S. Department of Agriculture has been offering subsidies and carbon credits for farmers, encouraging biochar applicators to farms. As a result, biochar usage has grown by 15% annually.

Similarly, the European Union has been providing financial incentives for farmers under the Common Agricultural Policy, also reflecting in significant market growth. The recent innovations by major market players suggest a large-scale adoption of biochar in soil health and climate action by farmers. PYREG GmbH also expanded its biochar plant in 2022, fostering market growth by boosting the availability of biochar systems across Europe, which is essential for carbon sequestration in agricultural soil.

Restrain

- High upfront investment required for biochar production facilities and equipment.

The biochar market is relatively new and, as such, has several challenges to face. The first is the fact that high initial costs and complete absence of profitable products keep many potential producers out of the market. High costs are a result of the amount of new equipment that must be purchased as production on such scale was not available before. Special biochar-producing devices must be custom-built, which costs money and presents a significant barrier to entry. The operational and maintenance costs present yet another financial hurdle the long-term benefits of using biochar due to stimulation of nutritional processes, soil fertility preservation, and facilitation of nutrient recycling seem viable but keep potential benefactors at bay. As such, both global and Russian producers rely on governmental grants, support, and foreign investments.

Market Segmentation

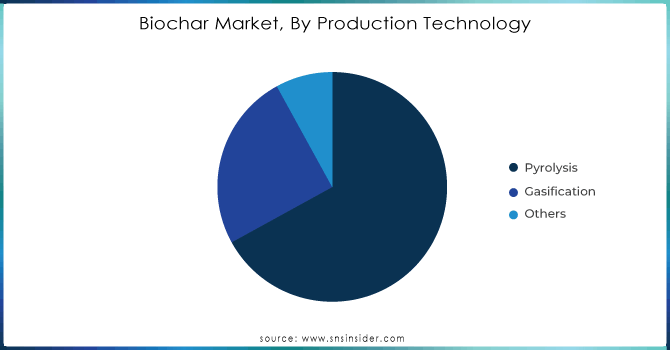

By Production Technology

Pyrolysis dominated the production technology of the biochar market in 2023 with the highest revenue share of more than 63% owing to its efficiency in converting biomass into biochar through controlled heating in the absence of oxygen. This method offers high biochar yields and allows for the utilization of various feedstocks, contributing to its widespread adoption. Additionally, pyrolysis technology aligns well with sustainability goals, as it facilitates the conversion of organic waste materials into valuable biochar products, further driving its market dominance.

By Application

By Application, Agriculture held the highest revenue share of about 75% in 2023 owing to its versatile benefits in enhancing soil fertility, water retention, and nutrient absorption. The agricultural sector heavily relies on biochar to promote sustainable farming practices, improve crop yields, and mitigate the effects of climate change on agricultural productivity. Furthermore, increasing awareness among farmers about the long-term benefits of biochar application further drove its significant adoption in agricultural activities.

Get Customized Report as per your Business Requirement - Request For Customized Report

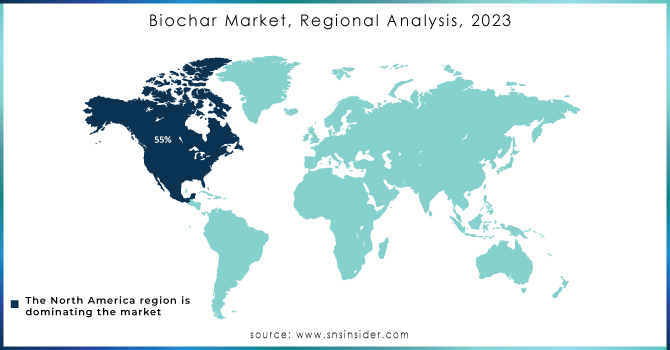

Regional Analysis

North America dominated the Biochar Market with the highest revenue share of more than 55% in 2023 due to rising demand for organic food and high meat consumption, fostering a need for sustainable farming practices. Increasing awareness, particularly among farmers, further propels regional growth, supported by favorable feed costs for livestock. The U.S. leads global revenue generation due to heightened product awareness, despite some companies exiting due to capital constraints. Overall, despite challenges, the industry shows highly positive growth prospects for the future.

Asia Pacific is expected to grow at the highest CAGR in the Biochar Market during the forecast period owing to escalating concerns about soil degradation, coupled with efforts to enhance agricultural sustainability. Rapid industrialization and urbanization in the region have heightened awareness of environmental issues, driving demand for biochar as a soil amendment and carbon sequestration tool. Additionally, supportive government initiatives and increasing investments in agricultural technologies further bolster the growth of the biochar market in Asia Pacific.

Key Players:

The major key players are Pacific Biochar Corporation (US), Novocarbo (India), Airex Energy Inc., Phoenix Energy (US), KARR Group Co. (KGC) (US), ArSta Eco Pvt Ltd. (India), Biochar Supreme (US), Coaltec Energy USA (US), Farm2Energy Pvt. Ltd. (India), Diacarbon Energy (Canada), Frontline BioEnergy LLC (US), ProActive Agriculture (US), and other players.

Recent Development:

-

In December 2023, Carbon Crusher announced a groundbreaking collaboration with Phoenix Energy, focusing on the utilization of biochar to create an advanced, carbon-negative road at the Blue Mountain Company Electric (BMEC) site. This innovative partnership combines Phoenix Energy's biochar with Carbon Crusher's bio-binder, presenting a unique and forward-thinking approach to road technology.

-

In July 2023, Airex Energy, Groupe Rémabec, and SUEZ joined forces to establish Canada's inaugural industrial biochar production plant in Port-Cartier, Québec. This collaboration marks a significant milestone in the advancement of sustainable and eco-friendly practices within the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 536.8 Million |

| Market Size by 2032 | US$ 1764.1 Million |

| CAGR | CAGR of 14.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Production Technology (Pyrolysis, Gasification, and Others) • By Application (Animal Farming, Agriculture, Industrial, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pacific Biochar Corporation (US), Novocarbo (India), Airex Energy Inc., Phoenix Energy (US), KARR Group Co. (KGC) (US), ArSta Eco Pvt Ltd. (India), Biochar Supreme (US), Coaltec Energy USA (US), Farm2Energy Pvt. Ltd. (India), Diacarbon Energy (Canada), Frontline BioEnergy LLC (US), ProActive Agriculture (US), and other players. |

| DRIVERS | • Increasing awareness about the importance of soil health and the benefits of biochar in enhancing soil fertility • Growing adoption of biochar as a sustainable soil amendment and carbon sequestration tool in agriculture |

| Restraints | • High upfront investment required for biochar production facilities and equipment |