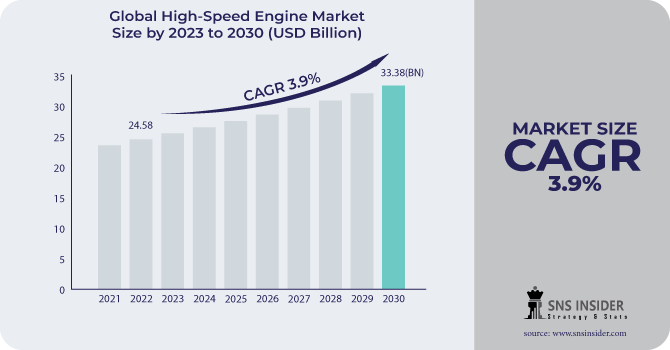

High-Speed Engine Market Size Analysis:

The High-Speed Engine Market size was valued at USD 24.58 billion in 2022 and is expected to grow to USD 33.38 billion by 2030 and grow at a CAGR of 3.9% over the forecast period of 2023-2030.

"High-Speed Engine" is a term used to describe an engine that is designed to operate at high speeds. These engines are typically used in applications where speed and power are critical, such as in racing cars, airplanes, and boats. The design of a high-speed engine is focused on maximizing power output while minimizing weight and size. This is achieved through the use of lightweight materials, such as aluminum and titanium, and advanced engineering techniques, such as turbocharging and direct injection. One of the key advantages of a high-speed engine is its ability to deliver power quickly and efficiently. This makes it ideal for applications where rapid acceleration and high speeds are required. Additionally, high-speed engines are often more fuel-efficient than their slower counterparts, which can result in significant cost savings over time.

To Get More Information on High-Speed Engine Market - Request Sample Report

High-Speed Engine Market is characterized by the production and sale of engines that are designed to operate at high speeds, typically above 1,000 revolutions per minute (RPM). These engines are commonly used in a variety of applications, including power generation, marine propulsion, and locomotives. The demand for high-speed engines is being driven by several factors, including the need for increased efficiency and reduced emissions. As governments around the world continue to implement stricter regulations on emissions, manufacturers are turning to high-speed engines as a way to meet these requirements while still delivering the power and performance that customers demand. In addition to their environmental benefits, high-speed engines also offer a number of other advantages over traditional engines. For example, they are typically smaller and lighter, making them easier to install and transport. They also tend to be more reliable and require less maintenance, which can result in significant cost savings over the life of the engine.

Market Dynamics

Drivers

-

Growing adoption of energy-efficient and environmentally friendly engines

-

Growing industrialization and urbanization in emerging countries

-

Increasing demand for high-speed engines in various industries

The high-speed engines market is being propelled by a growing demand for engines that can operate at high speeds across a range of industries. This demand is driven by the need for increased efficiency and productivity in various applications, including power generation, marine transportation, and construction.

Restraints

-

Complexity of high-speed engines

-

High cost associated with maintenance and repair services of high-speed engines

The complexity of high-speed engines poses a significant challenge for the high-speed engines market. This complexity is attributed to the need for advanced materials and technologies to withstand the high temperatures and pressures generated by these engines. Additionally, the design and manufacturing processes for high-speed engines require a high degree of precision and expertise, which can increase costs and lead times. Furthermore, the maintenance and repair of high-speed engines can be particularly challenging, as any issues or malfunctions can have serious consequences for the engine's performance and safety.

Opportunities

-

Rising demand for electric vehicles

Increasing demand for electric vehicles is presenting lucrative opportunities for the high-speed engines market. As the world shifts towards more sustainable modes of transportation, the demand for electric and hybrid vehicles is on the rise. These vehicles require high-speed engines to power their electric motors, creating a significant opportunity for the high-speed engines market. Furthermore, the increasing adoption of electric and hybrid vehicles by governments and businesses worldwide is driving the demand for high-speed engines even further. This trend is expected to continue in the coming years, making the high-speed engine market a promising investment opportunity.

Challenges

-

Strict regulations imposed by the government on the use of high-speed engines

-

Rising issues of noise pollution

Impact of Russia-Ukraine War:

The war has caused disruptions in the supply chain, leading to a shortage of critical components and materials needed for the production of high-speed engines. This has resulted in increased costs and delays in delivery times, affecting the profitability of businesses in the industry. Furthermore, the political instability and economic sanctions imposed on Russia have also affected the market. Russia is a significant player in the high-speed engine market, and the sanctions have limited its ability to export its products and access critical technologies. The energy and power sector has also been hit hard, with a decrease in demand for energy due to high prices. This has led to a decrease in the demand for high-speed engines which further impacted the market for high-speed engines.

Impact of Recession:

The economic recession has caused a significant change in consumer behavior, as many individuals are now seeking more cost-effective alternatives to high-speed engines. As a result, manufacturers have been forced to innovate and develop new products that are both affordable and efficient, while still maintaining the high quality and performance standards that customers expect. The recession is expected to have a significant impact on the Eurozone and the United States, particularly in the high-speed engine industry. As a result of the economic downturn, there will likely be a decrease in demand for these engines.

Key Market Segmentation

By Speed

-

1000-1500 rpm

-

1500-1800 rpm

-

Above 1800 rpm

By Power Output

-

0.5-0.55

-

0.56-1 MW

-

1-2 MW

-

2-4 MW

-

Above 4 MW

By End-user

-

Marine

-

Power Generation

-

Railway

-

Mining and Oil Gas

-

Others

.png)

Do You Need any Customization Research on High-Speed Engine Market - Enquire Now

Regional Analysis

Asia Pacific is the leading region in the high-speed engine market and is expected to be the fastest-growing region during the forecast period of 2023-2030. This region's dominance is attributed to the increasing demand for high-speed engines in various industries such as automotive, aerospace, and marine. Additionally, the region's robust economic growth and rising disposable income have led to an increase in demand for high-speed engines, particularly in emerging economies such as China and India. For instance, according to the International Monetary Fund, the economy of Asia Pacific is expected to contribute about 70% of global growth in 2023, which is a significantly larger share than we have seen during the past few years. Furthermore, the Asia Pacific region is home to several leading manufacturers of high-speed engines, which has contributed to the region's dominance in the market. These manufacturers have invested heavily in research and development to produce high-quality engines that meet the growing demand for high-speed engines in the region.

North America is the second largest market for the high-speed engine market and is expected to grow significantly during the forecast period owing to the region's robust industrial sector, increasing demand for power generation, and the growing popularity of high-speed engines in the transportation industry.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Cummins Inc., Caterpillar, Doosan Infracore Co., Ltd., Volvo Penta, Rolls-Royce Holdings plc, Yanmar Co., Ltd., MAN Energy Solutions SE, Wärtsilä Corporation, Weichai Power Co., Ltd., Mitsubishi Heavy Industries, Ltd., and other players.

Rolls-Royce Holdings plc-Company Financial Analysis

Recent Developments:

-

In April 2023, Caterpillar made an announcement regarding the development of their latest innovation, the Cat® C13D. This new 13-liter diesel engine platform is specifically designed for heavy-duty off-highway applications and is set to revolutionize the industry.

-

In March 2023, Under the collaboration of Rolls-Royce, Woodward L’Orange, and WTZ methanol engines started developing for marine applications.

-

In February 2023, Cummins Inc. revealed their plans to launch the next engine in their fuel-agnostic series, the X10, in North America in 2026.

| Report Attributes | Details |

| Market Size in 2022 | US$ 24.58 Bn |

| Market Size by 2030 | US$ 33.38 Bn |

| CAGR | CAGR of 3.9% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Speed (1000-1500 rpm, 1500-1800 rpm, and Above 1800 rpm) • By Power Output (0.5-0.55, 0.56-1 MW, 1-2 MW, 2-4 MW, and Above 4 MW) • By End-user (Marine, Power Generation, Railway, Mining and Oil Gas, and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cummins Inc., Caterpillar, Doosan Infracore Co., Ltd., Volvo Penta, Rolls-Royce Holdings plc, Yanmar Co., Ltd., MAN Energy Solutions SE, Wärtsilä Corporation, Weichai Power Co., Ltd., Mitsubishi Heavy Industries, Ltd. |

| Key Drivers | • Growing adoption of energy-efficient and environmentally friendly engines • Growing industrialization and urbanization in emerging countries |

| Market Opportunities | • Rising demand for electric vehicles |