Biological Safety Testing Products and Services Market Report Scope & Overview:

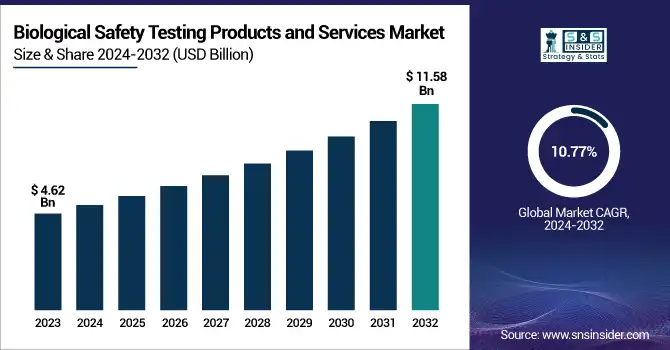

The Biological Safety Testing Products and Services Market was valued at USD 4.62 billion in 2023 and is expected to reach USD 11.58 billion by 2032, growing at a CAGR of 10.77% over the forecast period of 2024-2032. This report profiles the adoption and market penetration of biological safety testing by region, driven by strict regulatory environments and increasing demand for biopharmaceuticals. The research analyzes the trend shift from outsourced to in-house testing, with a trend towards contract research organizations (CROs) gaining popularity driven by economic efficiency and regulatory knowledge. Furthermore, it considers changing compliance trends, which are key drivers for shaping testing strategies and market growth. The study explores the influence of biopharmaceutical industry expansion on testing demand, with growing drug development pipelines demanding rigorous safety testing. New technologies in biological safety testing, including automated detection systems and AI-based analytics, are improving testing accuracy and efficiency. Emerging contaminants and the growing demand for advanced testing solutions are also pushing innovation in the market, ensuring product safety across biologics, vaccines, and gene therapies. In addition, R&D and healthcare expenditures on biological safety testing are region-specific, with government, commercial, and private investments defining market trends.

Get More Information on Biological Safety Testing Products and Services Market - Request Sample Report

The U.S. Biological Safety Testing Products and Services Market was valued at USD 1.36 billion in 2023 and is expected to reach USD 3.09 billion by 2032, growing at a CAGR of 9.54% over the forecast period of 2024-2032. In the United States, the market is growing as a result of increasing FDA regulations, higher investment in biotech R&D, and a rise in government-sponsored programs for biopharmaceutical innovation and quality control.

Market Dynamics

Drivers

-

The expanding biopharmaceutical industry and the increasing regulatory requirements for product safety.

The increasing incidence of chronic diseases and infectious outbreaks has driven up demand for biologics, vaccines, and gene therapies, all of which need stringent safety testing. As an example, mRNA-based vaccine and monoclonal antibody drug development has spawned increased levels of endotoxin, sterility, and mycoplasma testing. Regulatory bodies, such as the FDA, EMA, and WHO, have enforced strict regulations requiring thorough biological safety testing to guarantee product efficacy and patient safety. Non-compliance with these regulations leads to product recalls and delays, compelling manufacturers to invest in sophisticated biosafety testing solutions. Also, the growing use of cell and gene therapies has further propelled the demand for advanced testing, including adventitious agent screening and viral clearance testing. The trend of pharmaceutical companies outsourcing more activities to contract research organizations (CROs) for biosafety testing services is also propelling market growth. Advances in technology in swift microbiological test techniques, e.g., real-time PCR and next-generation sequencing (NGS), are streamlining efficiency, minimizing turnaround time, and raising contamination detection specificity, making biologic safety testing a necessity for the entire biopharmaceutical sector.

Restraints

-

High Cost and Complex Regulatory Approvals Impacting Market Expansion

One of the key restraints on the biological safety testing market is the expensive nature of testing and compliance. The adoption of sophisticated biosafety testing protocols entails substantial investment in sophisticated equipment, reagents, and trained personnel, raising operational costs for biopharmaceutical firms. The cost of endotoxin and sterility testing per batch may average anywhere from USD 5,000 to USD 15,000, rendering periodic testing costly, particularly for small and medium-sized biotech companies. In addition, lengthy and intricate regulatory approval procedures are the biggest challenge to manufacturers. Novel biologics, such as vaccines and gene therapies, need to be subject to numerous safety tests, typically resulting in lengthy approval times. The rigorous regulatory specifications imposed by regulatory bodies like the FDA, EMA, and ICH impose massive documentation and validation, raising costs and timelines for market release.

Opportunities

-

The increasing adoption of rapid microbiological methods (RMMs) and the rising demand for outsourced biosafety testing services.

Traditional biological safety testing methods tend to be time-consuming, with sterility tests taking as long as 14 days to yield results. But new rapid testing technologies like real-time PCR, flow cytometry, and biosensors are making it possible to detect contamination more quickly and accurately, compressing turnaround times from days to hours. The increasing application of artificial intelligence (AI) and automation in biosafety testing is also increasing efficiency and accuracy. Further, the growth of contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) is developing new business opportunities. More than 60% of the biotech and pharma firms are outsourcing biological safety testing to expert third-party service providers to cut operating expenses and regulatory burdens. In addition, the growing interest in the development of biosimilar and cell therapy is increasing the need for customized safety testing solutions. Firms that are investing in new in vitro test models, LAL assay synthetic alternatives, and high-throughput screening platforms are best positioned to benefit from this increasing market. Increased development of biologics production plants and new regulatory routes for advanced therapies are further creating promising opportunities in the market.

Challenges

-

The frequent changes in regulatory requirements and the increasing risk of microbial and viral contamination in biopharmaceutical manufacturing.

Regulatory bodies such as the FDA, EMA, and WHO are constantly refining biosafety standards, prompting manufacturers to change with increasing standards and introduce more testing methods. This uncertainty makes compliance planning more difficult and raises the expense of retaining regulatory clearance. Furthermore, increased cases of contamination in biopharmaceutical manufacturing represent a substantial challenge. For example, over the past few years, various vaccine makers experienced mycoplasma and endotoxin contamination, which resulted in expensive recalls and delays. The increasing sophistication of gene and cell therapy production processes also raises the risk of contamination, as these treatments are sensitive to handling, need strict sterility, and undergo rigorous viral clearance testing. The limited shelf life of biologics and personalized drugs creates another level of challenge in maintaining quality control within limited time windows. In addition, the lack of experienced personnel with knowledge in biological safety testing and regulatory compliance is slowing down the adoption of novel safety evaluation technologies. Overcoming these challenges needs ongoing investment in workforce development, enhanced contamination control strategies, and flexible regulatory compliance solutions to assure smooth biologic and vaccine production.

Segmentation Analysis

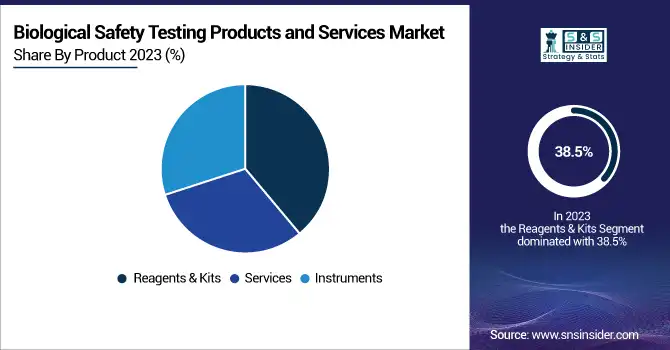

By Product

In 2023, the reagents & kits segment maintained a dominant revenue share of more than 38.5% and was the largest category in the biological safety testing market. The reason for their dominance lies in the common utilization of consumables in day-to-day testing methods like endotoxin, sterility, and mycoplasma testing. The continuous need for reagents and kits among pharmaceuticals, biotechnology companies, and contract research organizations has helped increase their market share by a considerable amount.

Conversely, the instruments segment is likely to register the most rapid growth till 2032, spurred by the growing utilization of sophisticated technology for automated biological safety testing. The surging demand for RMMs, real-time PCR systems, and NGS to detect contamination is fueling the growth of the segment. Progress in high-throughput testing solutions is also becoming more cost-efficient, thereby expanding their adoption further.

By Application

The vaccines & therapeutics segment held the largest revenue share in 2023, controlling the market through the influx in vaccine manufacturing, such as for infectious diseases and oncology. With growing worldwide demand for biologics, high regulatory standards on the safety of vaccines, and increased use of monoclonal antibody therapies, the segment is still leading the market. The widespread use of biological safety testing in the assurance of the sterility and purity of vaccines and therapeutic biologics has further cemented its supremacy.

The gene therapy segment is anticipated to expand at the highest growth rate during 2032, led by the fast growth of cell and gene therapy research, FDA approvals of gene-based therapies, and increasing clinical trials. The accelerating demand for rigorous biological safety testing of viral vectors during manufacturing and the avoidance of adventitious agent contamination is further accelerating this segment's growth. Gene therapy, as it continues to redefine the biopharmaceuticals industry, will further accelerate the demand for highly specialized safety testing services.

By Test Type

In 2023, the endotoxin tests segment held the largest market share in terms of revenue, as these tests are indispensable for the detection of bacterial endotoxins in biopharmaceuticals, medical devices, and injectable pharmaceuticals. Endotoxin testing is required by regulatory bodies for all injectable and implantable medical devices to guarantee patient safety and compliance. The frequent testing and extensive use of limulus amebocyte lysate (LAL)-based assays have established this segment as the market leader.

The bioburden tests segment is expected to show the highest growth until 2032 due to a growing emphasis on contamination control in biopharmaceutical production. With regulatory authorities imposing tighter limits on microbial contamination, demand for bioburden testing is growing, especially in the fields of cell therapy, gene therapy, and vaccine development. The increasing trend toward faster and automated bioburden testing technologies is also propelling the segment toward rapid growth.

Regional Analysis

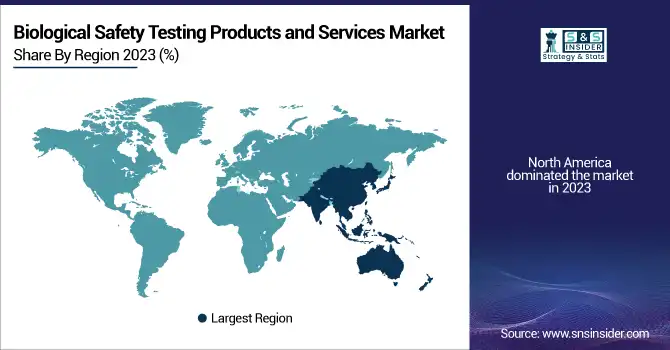

North America led the biological safety testing products and services market in 2023 with high usage of biopharmaceuticals, sophisticated healthcare infrastructure, and stringent regulatory norms established by the FDA and USP. The United States is the largest contributor, with a strong sector for manufacturing biologics, higher gene therapy investments, and extensive outsourcing to contract research organizations (CROs). Moreover, the availability of dominant market players and robust government support for R&D has further strengthened North America's dominance in biological safety testing. Europe is a close second, with stringent regulatory guidelines enforced by the EMA and increasing emphasis on biosimilar manufacturing.

Asia-Pacific is expected to be the fastest-growing region up to 2032, driven by growing biopharmaceutical manufacturing centers in China, India, South Korea, and Japan, as well as increasing government efforts to enhance regulatory compliance. China and India are seeing more investment in contract testing services and vaccine manufacturing, which is driving demand for biological safety testing considerably. In addition, affordable manufacturing and increasing partnerships between international pharma companies and APAC-based CDMOs are driving regional market growth. Increasing use of accelerated microbiological tests and automated test solutions also further establish the Asia-Pacific region as a principal growth driver for the industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their Products in Biological Safety Testing

-

Charles River Laboratories – Endosafe nexgen-PTS, Accugenix Microbial Identification System

-

BSL Bioservice – Mycoplasma Detection Assays, Adventitious Agent Testing Services

-

Merck KGaA (MilliporeSigma) – Steritest NEO System, PyroMAT System

-

Samsung Biologics – Viral Clearance Testing Service, Endotoxin & Bioburden Testing

-

Sartorius AG – Microsart Filtration System, Sartoclear Dynamics Lab Filtration

-

Eurofins Scientific – GMP Sterility Testing, Residual Host Cell Protein Analysis

-

SGS Société Générale de Surveillance SA – Mycoplasma Testing Service, Bioburden & Endotoxin Testing

-

Thermo Fisher Scientific Inc. – Applied Biosystems qPCR Kits, EndoPrep Endotoxin Testing

-

BIOMÉRIEUX – BACT/ALERT 3D, Endozyme Endotoxin Detection Assays

-

Lonza – PyroGene Recombinant Factor C Assay, MycoAlert Mycoplasma Detection Kits

Recent Developments

In Oct 2024, Merck launched a €290 million biosafety testing facility in Rockville, Maryland, USA, to address the rising global demand for advanced biological safety testing solutions. This expansion strengthens its capacity to support biopharmaceutical manufacturers with stringent regulatory compliance and quality assurance.

| Report Attributes | Details |

| Market Size in 2023 | USD 4.62 billion |

| Market Size by 2032 | USD 11.58 billion |

| CAGR | CAGR of 10.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Reagents & Kits, Services, Instruments] • By Application [Vaccines & Therapeutics (Vaccines, Monoclonal Antibodies, Recombinant Protein), Blood & Blood-based Products, Gene Therapy, Tissue & Tissue-based Products, Stem Cell] • By Test Type [Endotoxin Tests, Sterility Tests, Cell Line Authentication & Characterization Tests, Bioburden Tests, Adventitious Agent Detection Tests, Residual Host Contamination Detection Tests, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Charles River Laboratories, BSL Bioservice, Merck KGaA (MilliporeSigma), Samsung Biologics, Sartorius AG, Eurofins Scientific, SGS Société Générale de Surveillance SA, Thermo Fisher Scientific Inc., BIOMÉRIEUX, Lonza. |