Biometric POS Terminals Market Size Analysis:

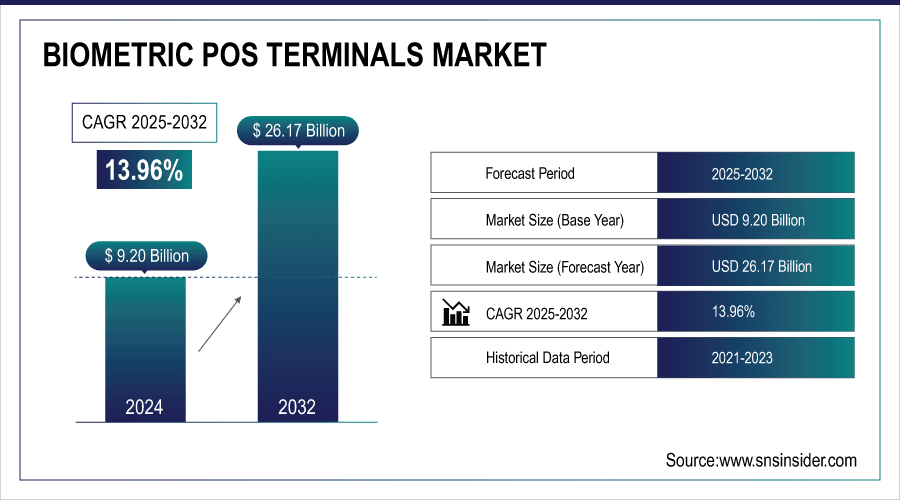

The Biometric POS Terminals Market size was valued at USD 9.20 Billion in 2024 and is projected to reach USD 26.17 Billion by 2032, growing at a CAGR of 13.96% during 2025-2032.

To Get More Information On Biometric POS Terminals Market - Request Free Sample Report

The biometric POS terminals market is experiencing significant growth driven by the rising need for secure, contactless payment methods. These solutions also feature state-of-the-art biometric technologies, such as facial identification and palm vein reader to improve the security of the transaction and improve authentication. Benefits including fraud prevention and enhanced customer convenience are driving their adoption in sectors including retail, finance and healthcare. While some are still worried about privacy of data, new technology, and better compliance processes, are helping to build trust with users. With consumers and businesses placing a premium on transaction efficiency and security, the biometric POS terminal industry is likely to witness unabated growth in the next few years, defining the future of deer digital payments both online and in person globally.

JPMorgan launched biometric-enabled POS terminals, JPMorgan Paypad and Pinpad, featuring facial recognition and infrared palm vein scanning in the U.S. to boost secure, touchless payments. This marks JPMorgan's first proprietary move into biometrics, aiming to mainstream the tech despite consumer privacy concerns.

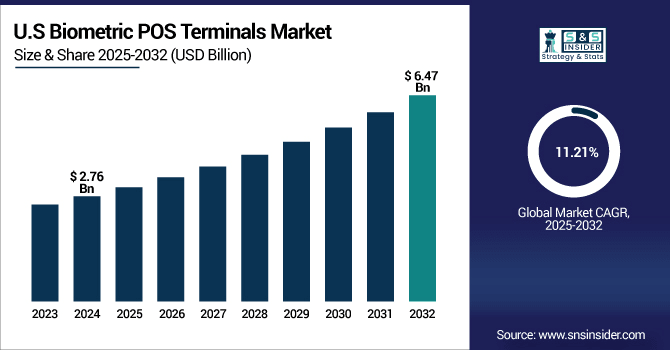

The U.S. Biometric POS Terminals Market was valued at 2.76 Billion in 2024 and is projected to reach USD 6.47 Billion by 2032, growing at a CAGR 11.21% during 2025-2032, owing to the demand for secure, contactless payment options, government encouragement towards digital ID programs and rising integration of AI-powered biometric authentication in retail, and banking.

Biometric POS Terminals Market Dynamics:

Drivers:

-

Rising Payment Security Concerns Drive Innovation and Adoption of Biometric POS Terminals Growth

Biometric and secure payment terminals market is also triggered by increased demand for secure and efficient payment systems with more convenience. Demand reflects the rise of digital and contactless payments and the pursuit of ways to defend from fraud and data breaches. The inclusion of biometric validation, for instance facial recognition, palm vein pattern, etc., in the payment terminal device is the best way to authenticate the EMV card user and stimulate customer confidence and adoption. In addition, with payment increasingly going global through multi-network and mobile connected devices, merchants have the ability to answer a wide range of payment demands. These trends in the focus on security, user experience, and connectivity as strong drivers for innovation and adoption continue to fuel innovation and adoption in the biometric payment terminal industry globally.

For instance, At Seamless Middle East Fintech 2025, a high-performance security chip business, in over 100 countries, count more than 25 billon each year of already shipping chip to the world's most high-performance securities chips, Tongxin suffered with the world. High-profile product highlights were a pioneering MIS integrated payment terminal platform and the world ́s first eSIM solution for Smart POS devices with global certification, such as EMVCo and PCI 7. x, reinforcing the leadership of Tongxin in secure, efficient and globally interconnected payment technologies.

Restraints:

-

Regulatory Challenges Cause Increased Costs and Slow Adoption of Biometric POS Terminals

Regulatory challenges related to data protection and compliance pose a significant restraint on the growth of biometric POS terminals. Retailers are increasingly using merged payment systems that are connecting face-to-face, online, and mobile payment transactions as one offering customer’s greater convenience and simplifying how they are paid. This integration decreases dependence on extra hardware, so that costs for company operations are reduced. In addition, PCI DSS, and EMV certifications guarantee the security of these products and instill confidence in users. Merchants are increasingly focused on fast and secure ways to conduct payments, which is aiding the growth and development of this market, and will be further demonstrated in the forecast. This development provides very expandable opportunities for POS terminal providers, which provide multi-functional, secure and user-friendly payment technologies.

Opportunities:

-

Increasing Consumer Demand for Seamless Payment Experiences Drive Innovation in Biometric POS Terminal Market

The growing demand for Omni channel payment solutions is a major opportunity for the POS terminal market. Merchants are increasingly adopting unified payment systems that seamlessly integrate in-person, online, and mobile transactions, providing enhanced convenience for customers and streamlining payment processes. This integration reduces the reliance on additional hardware, thereby lowering operational costs for businesses. Moreover, adherence to PCI DSS and EMV certifications ensures that these solutions maintain high security standards, building trust among users. As merchants continue to prioritize efficient and secure payment methods, the adoption of Omni channel POS solutions is expected to accelerate, driving innovation and expansion in the market. This Biometric POS Terminal Market trend opens significant growth avenues for POS terminal providers offering versatile, secure, and user-friendly payment technologies.

PXP develops new omnichannel POS P2PE Solution on Android-based terminals to deliver full card, contactless, and mobile wallet acceptance across POS devices without additional hardware. The PCI DSS-certified and EMV -approved solution enables omnichannel payment acceptance with a simple activation.

Challenges:

-

Technical Limitations in Biometric POS Systems Lead to Increased Costs and Reduced Accuracy

Biometric POS systems encounter key technical challenges that affect their performance and market adoption. Reliability may be compromised, and customer confidence and satisfaction weakened, if false positive or false negative conditions occur, such as legitimate users are denied access or unauthorized users are allowed. Environmental conditions such as bad light, dirt, moisture, and skin condition changes can lead to decreased sensor reliability. To solve these problems corresponding complex sensors and an advanced algorithm are required, and these increases of costs in production and maintenance. These technical limitations not only increase costs, but also more importantly, burden system integration and greatly reduce the user experience. It is challenging the biometric payment methods to be widely implanted in the retail or other areas because of such limitations.

Biometric POS Terminals Market Segmentation Analysis:

By Technology

The fingerprint scanner segment held a dominant Biometric POS Terminal Market share of around 39% in 2024. This leadership was driven by the technology’s very high trustworthiness, user-friendly aspects, and improved security. In addition, a preference for contactless and secure payment methods by the general population encourages adoption, and ‘Fingerprint Scanners’ contribute significantly to the market’s continued growth and future development innovation in biometric payment.

The facial recognition segment is expected to experience the fastest growth in the Biometric POS Terminal Market over 2025-2032 with CAGR 16.28%. The growth of facial recognition is attributed to the evolution of AI, demand for contactless payments and security, all of which have pushed for facial recognition as a good choice for both retailers and consumers when prioritizing speed and safety at the checkout.

By End-User

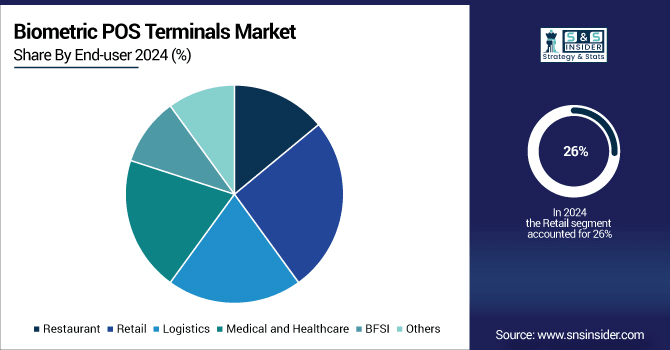

The retail segment held a dominant Biometric POS Terminal Market share of around 26% in 2024. This leadership is supported by a rise in retailers’ remodeling of customer experience, a rising penetration of secure and contactless payment methods, and the streamline operation requirement to satisfy increased consumer demand for smooth and fast checkout services.

The medical and healthcare segment is expected to experience the fastest growth in the Biometric POS Terminal Market over 2025-2032 with CAGR of 16.66%. This rise is driven by the growing requirement for safe patient identification, contactless payment method in medical facilities and the strict regulations promising the safety of confidential medical and financial information.

Biometric POS Terminals Market Regional Outlook:

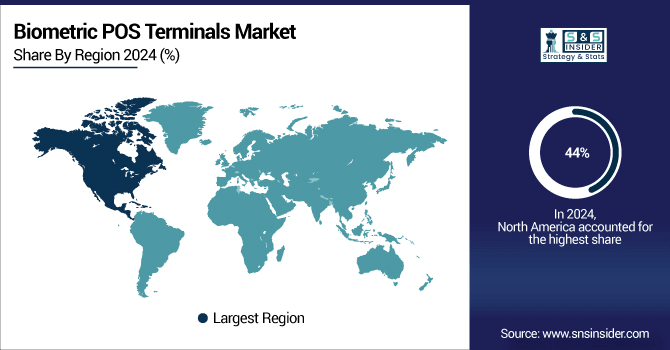

In 2024, the North America dominated the Biometric POS Terminal Market and accounted for 44% of revenue share. This leadership is enabled by sophisticated technical infrastructure, strong consumer uptake of biometric payment methods, and regulations requiring it. Furthermore, major financial institutions and payment solution providers have made significant investment to expand the implementation of biometric-based POS terminals in the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

The U.S. leads the Biometric POS Terminal Market, driven by innovations like Verifone’s partnership with PopID. This collaboration integrates face and palm biometric authentication into payment terminals, enhancing security and speeding transactions. Supporting over 45 million devices globally, Verifone aims to boost biometric payment adoption in the U.S., improving efficiency and customer experience across various sectors.

Asia Pacific is projected to register the fastest CAGR of 15.74% during 2025-2032 on account of growing use of digital payments, increase in smartphone penetration and expansion of the retail and hospitality industries.

China dominates the Asia Pacific Biometric POS Terminal Market, driven by rapid digital payment adoption and strong government fintech support. XH Smart Tech (China) Co., Ltd. is expanding its global presence by offering advanced end-to-end digital security, IoT solutions, and innovative POS terminals, reinforcing its leadership in secure payment technology globally.

In 2024, Europe emerged as a promising region in the Biometric POS Terminal Market, with the growing adoption of biometric authentication to ensure security along with government support for digital payments. Growing consumer demand for quicker and contactless payments also boost market growth, promoting the investment in innovative biometric payment solutions in the region.

LATAM and MEA are experiencing steady growth in the Biometric POS Terminal Market, owing to the growing digital payment infrastructure and high adoption of smartphones. Rising demand for secure and contactless payment options and government initiatives to promote the adoption of Fintech, is piquing interest in business to adopt next-generation biometric POS installations for enhanced transaction security and effectiveness.

Biometric POS Terminals Companies are:

The Biometric POS Terminal market companies IDEMIA, Ingenico (Worldline), NEC Corporation, Fujitsu Ltd., Suprema Inc., Verifone, PAX Technology, JPMorgan Chase & Co., Zwipe, Toshiba and Others.

Recent Developments:

-

In Nov 2024, NEC unveiled a multimodal biometric solution combining face and iris recognition from a single low-resolution image, enabling fast, secure authentication for POS, ATMs, and access control. The compact technology aims for commercial rollout by 2026 across financial, retail, and entertainment sectors.

-

In October 2024 , Suprema launched the BioEntry W3, a facial authentication scanner using Template on Mobile (ToM) to enhance privacy by storing biometrics on users' devices. Designed for high-security environments, it offers local authentication, AI-driven accuracy in 0.2 seconds, and complies with global cybersecurity and privacy standards like GDPR and NIS2.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.20 Billion |

| Market Size by 2032 | USD 26.17 Billion |

| CAGR | CAGR of 13.96% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology(Fingerprint Scanner, Palm Vein Scanner, Iris-Retina Scanner, Voice Recognition, Facial Recognition and Others) • By End-user (Restaurant, Retail, Logistics, Medical and Healthcare, BFSI and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Biometric POS Terminal market companies IDEMIA, Ingenico (Worldline), NEC Corporation, Fujitsu Ltd., Suprema Inc., Verifone, PAX Technology, JPMorgan Chase & Co., Zwipe, Toshiba and Others. |