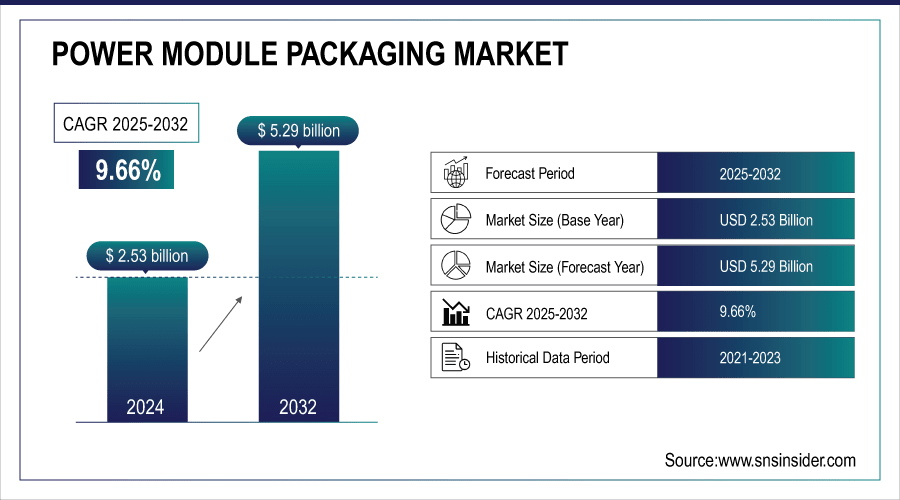

Power Module Packaging Market Size & Growth:

The Power Module Packaging Market size was valued at USD 2.53 Billion in 2024 and is projected to reach USD 5.29 Billion by 2032, growing at a CAGR of 9.66% during 2025-2032.

The Power Module Packaging Market is set for strong growth, driven by rising demand for efficient solutions in electric vehicles, renewable energy, and high-performance computing. Adoption of SiC and GaN materials enhances power density, thermal management, and efficiency, while advanced packaging and investments in electrification and smart manufacturing accelerate market expansion.

Infineon introduced a new roadmap for high-efficiency PSUs (8 kW and world’s first 12 kW) to meet the rising energy demands of AI data centers by integrating Si, SiC, and GaN technologies, achieving 97.5% efficiency and reducing CO₂ emissions.

To Get More Information On Power Module Packaging Market - Request Free Sample Report

Key Power Module Packaging Market Trends

-

Increasing adoption of electric vehicles and renewable energy systems is driving demand for highly efficient, compact power modules with optimized thermal management.

-

Manufacturers are investing in advanced packaging solutions and wide-bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) to enhance performance, reliability, and system efficiency.

-

Market growth is restrained by high costs and technical complexities of advanced materials and packaging technologies, which can limit adoption among small and mid-sized manufacturers.

-

Thermal management challenges in high-power applications remain critical, as poor solutions can affect module reliability and operational performance.

-

Rising demand for compact, high-density power solutions creates opportunities for innovative packaging technologies, magnetic component integration, and wide-bandgap materials to improve efficiency and reduce size.

-

Texas Instruments’ MagPack technology demonstrates these trends, achieving up to 23% smaller size, nearly 1A per mm² power density, improved thermal performance, and reduced EMI for high-density applications like data centers.

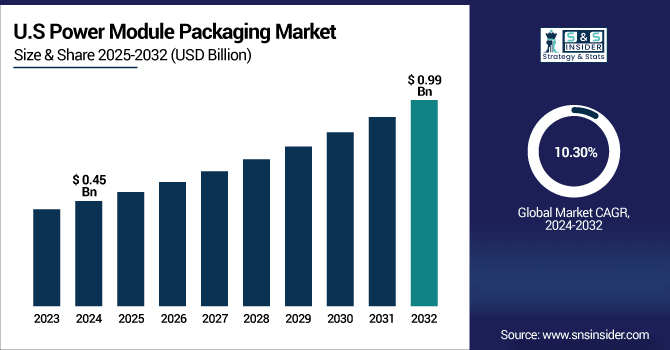

The U.S. Power Module Packaging market size was valued at USD 0.45 Billion in 2024 and is projected to reach USD 0.99 Billion by 2032, growing at a CAGR of 10.30% during 2025-2032. This Power Module Packaging growth is fueled by the rising demand for high-efficiency power electronics, integration of wide-bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN), and advancements in thermal management solutions. Growing investments in smart manufacturing and energy-efficient infrastructure further support market development across diverse applications.

The Power Module Packaging market trends include the growing shift toward wide-bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) to enhance power density and efficiency, increasing adoption across electric vehicles and renewable energy systems, and advancements in thermal management solutions like liquid cooling and advanced interface materials. Miniaturization, improved reliability, and integration of smart monitoring technologies are further shaping the market, while rising investments in next-generation power electronics are driving innovation and accelerating widespread deployment.

Power Module Packaging Market Growth Drivers:

-

Increasing Power Requirements Fuel Demand for Advanced Power Module Packaging

The increasing adoption of electric vehicles and renewable energy systems is creating a strong demand for power modules that are both highly efficient and compact, as rising power requirements necessitate optimized thermal management and reduced size. As a result, manufacturers are focusing on advanced packaging solutions and incorporating wide-bandgap materials such as silicon carbide and gallium nitride to improve performance and reliability. This cause and effect dynamic, where growing energy and power needs drive innovation in packaging technology, promotes miniaturization, enhanced heat dissipation, and greater system efficiency, supporting market growth across automotive, industrial, and high-performance computing sectors.

ROHM launched 4-in-1 and 6-in-1 SiC molded power modules in HSDIP20 package for EV onboard chargers, delivering over 3× higher power density, 38°C better heat dissipation, and 52% reduced mounting area, enabling compact, high-efficiency power conversion.

Power Module Packaging Market Restraints:

-

High Costs and Technical Complexities Limit Growth in the Power Module Packaging Market

The Power Module Packaging market faces significant restraints due to the high cost of advanced materials and complex packaging technologies, which can limit adoption by small and mid-sized manufacturers. Integrating wide-bandgap materials such as silicon carbide and gallium nitride introduces design and production challenges, leading to longer development cycles and increased manufacturing expenses. Furthermore, managing thermal performance in high-power applications remains critical, as inadequate solutions can compromise reliability. This cause and effect dynamic, where elevated costs and technical complexities hinder adoption and create operational challenges, can slow market growth and restrict widespread deployment across automotive, industrial, and high-performance computing applications.

Power Module Packaging Market Opportunities:

-

Rising Demand for Compact and Efficient Electronics Drives Opportunities in the Power Module Packaging Market

The Power Module Packaging market presents significant opportunities as demand for compact, high-efficiency, and high-density power solutions grows across automotive, data center, and industrial applications. Increasing energy consumption and space constraints in electronic systems are driving the need for innovative packaging technologies that reduce size, improve thermal management, and enhance overall performance. Integration of magnetic components and wide-bandgap materials like SiC and GaN enables higher power density and reliability, allowing manufacturers to optimize system efficiency and reduce operational costs. These factors create opportunities for expansion, innovation, and adoption of next-generation power modules globally.

17 July 2024, Texas Instruments introduced six new power modules with MagPack integrated magnetic packaging technology, shrinking size by up to 23% and achieving nearly 1A per mm² power density.These modules enhance efficiency, reduce EMI, minimize board space, and improve thermal performance for high-density applications like data centers.

Power Module Packaging Market Segment Highlights

-

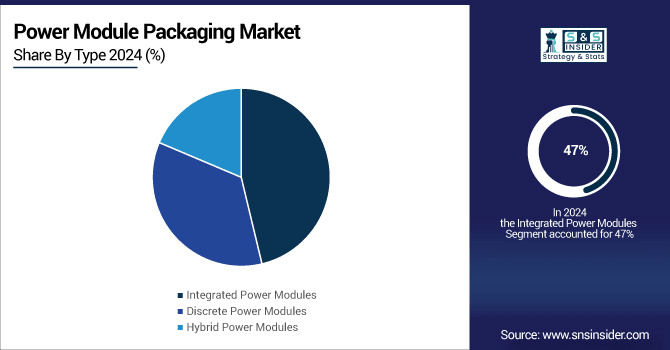

By Type – Dominating: Integrated Power Modules (47%), Fastest: Hybrid Power Modules (12.17% CAGR)

-

By Material – Dominating: Silicon (67%), Fastest: Gallium Nitride (12.24% CAGR)

-

By Power Rating – Dominating: Medium Power (39%), Fastest: High Power (11.38% CAGR)

-

By Application – Dominating: Consumer Electronics (29%), Fastest: Renewable Energy Systems (12.47% CAGR)

By Type, Integrated Power Modules Leads Market While Hybrid Power Modules Fastest Growth

Integrated Power Modules lead the Power Module Packaging market, reflecting their widespread adoption across automotive, industrial, and high-performance applications. Meanwhile, Hybrid Power Modules are experiencing the fastest growth, driven by rising demand for compact, high-efficiency solutions and increasing integration of advanced materials and innovative packaging technologies.

By Deployment, Silicon Dominate While Gallium Nitride Shows Rapid Growth

Silicon dominates the Power Module Packaging market, reflecting its widespread use across automotive, industrial, and consumer electronics applications. Meanwhile, gallium nitride is experiencing the fastest growth, driven by rising demand for high-efficiency, high-density, and compact power modules and increasing adoption of advanced wide-bandgap materials and innovative packaging technologies.

By Power Rating, Medium Power Lead While High Power Registers Fastest Growth

Medium power modules lead the Power Module Packaging market, reflecting their extensive use across automotive, industrial, and consumer electronics applications. Meanwhile, high power modules are registering the fastest growth, driven by increasing demand for higher output, efficient thermal management, and compact designs in electric vehicles, renewable energy systems, and high-performance computing. The trend toward advanced packaging technologies and wide-bandgap materials further accelerates adoption of high power solutions globally.

By Application, Consumer Electronics Lead While Renewable Energy Systems Grow Fastest

Consumer electronics lead the Power Module Packaging market, reflecting their widespread use in compact, high-performance devices. Meanwhile, renewable energy systems are growing the fastest, driven by increasing demand for efficient, high-density power modules in solar, wind, and other clean energy applications. The adoption of advanced materials and innovative packaging technologies supports higher efficiency, improved thermal management, and greater system reliability, accelerating market growth in the renewable energy sector.

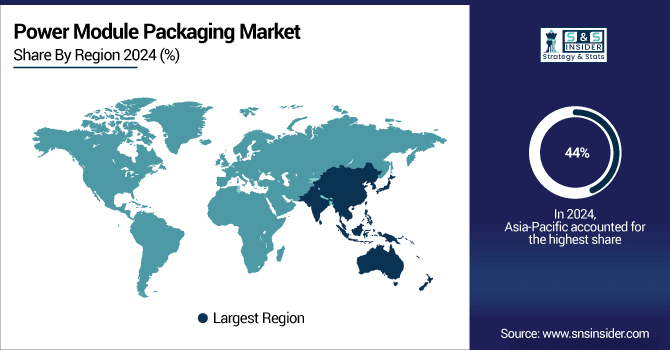

Asia-Pacific Power Module Packaging Market Insights

In 2024 Asia-Pacific dominated the Power Module Packaging Market and accounted for 44% of revenue share, driven by rapid industrialization, growing adoption of electric vehicles, and expanding renewable energy infrastructure. The region’s focus on advanced manufacturing, increasing investments in high-efficiency power electronics, and rising demand across automotive, consumer electronics, and industrial sectors contribute to its leading position. These factors support continued growth and innovation in the Asia-Pacific market.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Power Module Packaging Market Insights

North America is expected to witness the fastest growth in the Power Module Packaging Market over 2025-2032, with a projected CAGR of 11.37%, This growth is driven by increasing adoption of electric vehicles, expansion of renewable energy projects, and rising demand for high-efficiency power modules in industrial and high-performance computing applications. Investments in advanced manufacturing technologies and innovative packaging solutions are further accelerating market development in the region.

Europe Power Module Packaging Market Insights

In 2024, Europe emerged as a promising region in the Power Module Packaging Market, driven by increasing adoption of electric vehicles, growth in renewable energy installations, and rising demand for energy-efficient industrial and consumer electronics applications. Supportive government policies, investments in advanced manufacturing, and a focus on sustainability and decarbonization are further fueling market growth, making Europe a key contributor to innovation and expansion in the global power module packaging sector.

Latin America (LATAM) and Middle East & Africa (MEA) Power Module Packaging Market Insights

The Power Module Packaging Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, driven by increasing industrialization, gradual adoption of electric vehicles, and expansion of renewable energy projects. Rising investments in energy-efficient power electronics and infrastructure development are supporting steady market growth, while demand from automotive, industrial, and consumer electronics sectors continues to create opportunities for market expansion in these regions.

Competitive Landscape for Power Module Packaging Market:

STMicroelectronics, founded in 1987, is a global semiconductor leader specializing in power module packaging, offering advanced solutions for automotive, industrial, and cloud infrastructure applications. The company focuses on high-efficiency silicon carbide (SiC) devices, integrating wafer fabrication, device production, and module packaging to deliver reliable, high-performance, and compact power solutions worldwide.

-

In June 2024, STMicroelectronics announced a new high-volume 200mm silicon carbide manufacturing campus in Catania, Italy, integrating wafer fabrication, device production, and module packaging to support automotive, industrial, and cloud infrastructure applications and expand global SiC capacity.

Mitsubishi Electric, established in 1921, is a global leader in power module packaging, providing high-efficiency SiC and Si solutions for electric and hybrid vehicles. The company focuses on compact, reliable modules that enhance inverter performance, reduce power loss, and support the downsizing of batteries and power conversion systems worldwide.

-

In January 2024, Mitsubishi Electric announced six new J3-Series SiC and Si power modules for xEV inverters, featuring compact, high-efficiency designs that reduce power loss, support inverter downsizing, and enhance reliability for electric and plug-in hybrid vehicles, with samples available from March 25 and global exhibition showcases planned.

Power Module Packaging Companies are:

-

Analog Devices

-

Infineon Technologies

-

Broadcom

-

Vishay Intertechnology

-

Samsung Electronics

-

Mitsubishi Electric

-

Microchip Technology

-

STMicroelectronics

-

Hitachi

-

Texas Instruments

-

Fuji Electric

-

Renesas Electronics

-

Toshiba

-

Amkor Technology

-

Kyocera

-

Semikron

-

ROHM Semiconductor

-

Maxim Integrated

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.53 Billion |

| Market Size by 2032 | USD 5.29 Billion |

| CAGR | CAGR of 9.66% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Integrated Power Modules, Discrete Power Modules and Hybrid Power Modules) • By Material(Silicon, Silicon Carbide and Gallium Nitride) • By Power Rating(Low Power, Medium Power and High Power) • By Application(Renewable Energy Systems, Electric Vehicles, Consumer Electronics and Industrial Automation) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Key players in the Power Module Packaging market include Analog Devices, Nexperia, Infineon Technologies, Broadcom, Vishay Intertechnology, ON Semiconductor, Samsung Electronics, Mitsubishi Electric, Microchip Technology, STMicroelectronics, Hitachi, Texas Instruments, Fuji Electric, Renesas Electronics, Toshiba, Amkor Technology, Kyocera, Semikron, ROHM Semiconductor, and Maxim Integrated. |