Dielectric Resonator Antenna Market Size Analysis:

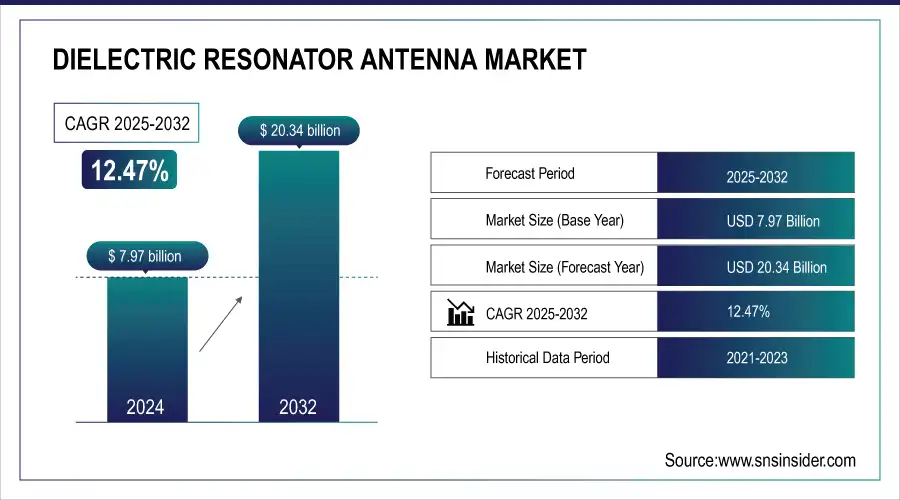

The Dielectric Resonator Antenna Market Size was valued at USD 7.97 Billion in 2024 and is expected to reach USD 20.34 Billion by 2032, growing at a CAGR of 12.47% over the forecast period 2025-2032. The dielectric resonator antenna (DRA) market has witnessed substantial growth in recent years, driven by the increasing demand for advanced antenna technology across various industries. The rise in demand for compact, high-frequency antenna systems especially in telecommunications has played a pivotal role. The rapid growth of the global 5G network, with over 230 commercial networks now operational, has further intensified the need for high-speed data and enhanced connectivity. In 2023, the average person consumed 15 GB of data per month, largely driven by mobile apps such as video streaming, which is forecasted to account for 80% of mobile data traffic. This surge in mobile data, coupled with the increasing number of connected devices, is fueling the demand for advanced antenna technologies such as Dielectric Resonator Antennas (DRAs).

Get More Information on Dielectric Resonator Antenna Market - Request Sample Report

DRAs are becoming increasingly popular in 5G networks due to their ability to support high-frequency bands, offer high efficiency, and manage large volumes of data traffic, making them essential for next-generation mobile communication systems. The growing reliance on the Internet of Things (IoT) is also driving demand for small, power-efficient antennas that can be integrated into various environments for seamless wireless communication. Additionally, in the defense sector, Dielectric Resonator Antennas (DRAs) are being used in advanced radar and communication systems.

Key Dielectric Resonator Antenna Market Trends:

-

Rising adoption of DRAs in 5G infrastructure due to their high radiation efficiency and millimeter-wave performance.

-

Increasing demand for compact and space-efficient antennas in consumer electronics like smartphones, tablets, and wearables.

-

Growing deployment of small-cell base stations in urban areas to support ultra-fast 5G networks.

-

Expanding use of DRAs in multifunctional devices requiring seamless connectivity across Wi-Fi, Bluetooth, LTE, and 5G.

-

Manufacturers prioritizing broadband and low-power-loss antenna solutions to enhance device efficiency and network performance.

Dielectric Resonator Antenna Market Growth Drivers:

-

The rapid adoption of 5G technology has significantly driven the demand for advanced antennas capable of handling higher frequencies, faster speeds, and lower latency.

Dielectric Resonator Antennas (DRAs) are ideal for 5G technologies because of their excellent radiation efficiency, small form factor, and capability to operate effectively at millimeter-wave frequencies. In contrast to conventional antennas, DRAs exhibit low power loss, rendering them suitable for the high-frequency requirements of 5G infrastructure. With the worldwide transition to ultra-fast internet and extensive 5G networks, the need for DRAs has surged, especially in densely populated urban areas where numerous small-cell base stations are necessary to facilitate rapid communication. The ability of DRAs to manage different frequency bands and polarization needs makes them very attractive to telecommunications firms investing in 5G networks. With the ongoing global deployment of 5G, the need for sophisticated antenna solutions such as DRAs is projected to increase, establishing them as an essential element in the upcoming generation of telecommunications networks.

Dielectric Resonator Antenna Market Restraints:

-

Compatibility with current communication and electronic systems may pose a considerable limitation for the DRA market.

In scenarios where conventional antenna technologies are commonly employed, incorporating DRAs might necessitate alterations to the current infrastructure, potentially leading to significant expenses and delays. Moreover, not every system is built to accommodate the distinct features of DRAs, including their particular frequency needs and radiation patterns. These compatibility issues can impede adoption, especially in sectors that depend significantly on legacy systems. The requirement for personalized integration solutions could increase the complexity and expenses of deploying DRAs, discouraging certain potential users from transitioning to this technology. Tackling these compatibility issues will be essential for growing the DRA market, especially in areas where current systems are well-established.

Dielectric Resonator Antenna Market Opportunities

-

The miniaturization of electronics and the increasing demand for smaller, more efficient antennas in Military are driving the adoption of dielectric resonator antennas.

Modern Military, including smartphones, tablets, wearables, and smart home gadgets, need compact, high-performance antennas capable of operating across various frequency bands without occupying considerable space. DRAs are naturally concise and can be tailored to occupy the restricted space found in consumer devices, rendering them an appealing option for producers aiming to improve device efficiency without sacrificing size. As Military evolve to include advanced communication and connectivity capabilities, DRAs are increasingly preferred for their flexibility and effectiveness. Their broadband features enable them to work with various communication protocols like Wi-Fi, Bluetooth, and LTE, making them ideal for devices needing smooth connectivity across different networks.

Dielectric Resonator Antenna Market Segment Analysis

By Type

Rectangular DRAs dominated with a market share of over 56% in 2024 because of their effectiveness and adaptability in high-frequency applications. These antennas offer a superior quality factor and high radiation efficiency, making them suitable for military and aerospace use where signal precision and low interference are essential. Firms such as Cobham and Kymeta utilize rectangular DRAs for satellite communication systems, taking advantage of their efficient radiation pattern and suitability for compact designs, which is essential for contemporary, space-limited devices.

The cylindrical DRA segment is projected to become the fastest-growing segment during 2025-2032 because of its strong performance in multi-band and omnidirectional applications, attracting interest from industries like telecommunications and 5G networks. The cylindrical design of DRAs enables a uniform radiation pattern, essential for cellular base stations and IoT devices that need reliable coverage.

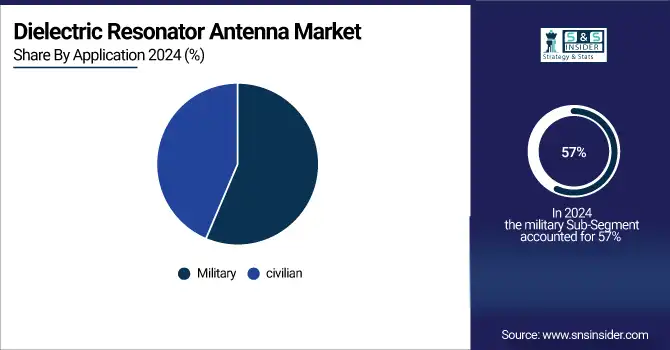

By Application

The military segment led with more than 57% of the market share in 2024. Military uses depend on DRAs for secure, high-frequency communication, radar, and surveillance technologies. These antennas are preferred for their high efficiency, slim design, and resistance to environmental conditions, crucial for military activities. Moreover, their ability to adjust to harsh environments and low energy losses renders DRAs perfect for cutting-edge communication systems and satellite communications.

The civilian segment is projected to become the fastest-growing segment during 2025-2032. Civilian uses of DRAs encompass cellular networks, automotive radar, and satellite broadcasting. These antennas are appreciated for their small size and excellent performance at microwave and millimeter-wave frequencies. Technology firms such as Qualcomm and car manufacturers are employing DRAs in 5G infrastructure and vehicle radar systems, demonstrating the rising need for civilian uses, which is anticipated to keep expanding quickly as 5G and IoT applications grow.

Dielectric Resonator Antenna Market Report Analysis:

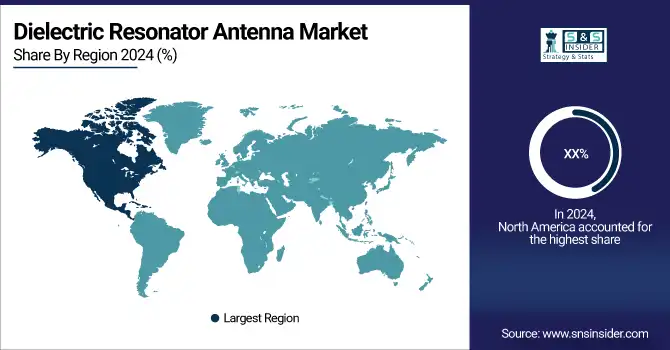

North America Dielectric Resonator Antenna Market Insights

North America dominated in 2024 with a major market share because of its strong telecommunications infrastructure, significant investments in 5G technology, and prominent advanced military applications. Leading telecom firms and technology giants in the U.S. and Canada use DRA technology to enhance signal strength and coverage in heavily populated urban areas. Furthermore, defense companies such as Lockheed Martin and Raytheon utilize DRA solutions to improve military communications and radar systems, as dielectric resonator antennas offer dependable, compact, and high-performance options.

Need any customization research on Dielectric Resonator Antenna Market - Enquiry Now

Asia Pacific Dielectric Resonator Antenna Market Insights

Asia-Pacific region is expected to experience the fastest growth rate during 2025-2032 in the DRA market, mainly fueled by swift developments in the telecommunications and Military industries. Nations such as China, Japan, and South Korea are significantly investing in 5G infrastructure, generating considerable demand for DRA technology within wireless communication networks.

Europe Dielectric Resonator Antenna Market Insights

The Europe Dielectric Resonator Antenna (DRA) market is growing due to increasing demand for high-performance, compact antennas in 5G, IoT, and satellite communication applications. DRAs offer low power loss, wide bandwidth, and high radiation efficiency, making them ideal for advanced wireless systems. Rising adoption in telecom, defense, and aerospace sectors, along with technological advancements and government support for next-generation connectivity, is driving market expansion across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Dielectric Resonator Antenna Market Insights

The LATAM and MEA Dielectric Resonator Antenna (DRA) markets are expanding due to increasing deployment of 5G networks, satellite communications, and defense applications. Growing demand for compact, high-efficiency, and low-power antennas drives adoption across telecom, aerospace, and military sectors. Government initiatives to modernize communication infrastructure, coupled with investments in advanced wireless technologies, support market growth. Additionally, rising IoT and M2M connectivity in urban and remote areas are further propelling the DRA market in these regions.

Key Dielectric Resonator Antenna Companies are:

-

CommScope

-

TE Connectivity

-

Laird Connectivity

-

Molex

-

Taoglas

-

Amphenol Antenna Solutions

-

Cobham Antenna Systems

-

KYOCERA AVX Corporation

-

Huawei Technologies

-

Radiall

-

Eaton

-

Alcatel-Lucent

-

RFS (Radio Frequency Systems)

-

Belden Inc.

-

Filtronic plc

-

Comba Telecom Systems

-

Yageo Corporation

-

Qorvo, Inc.

Competitive Landscape for Dielectric Resonator Antenna Industry

Sony Electronics leverages its expertise in consumer electronics and advanced communication technologies to integrate dielectric resonator antennas into next-generation devices. The company focuses on compact, high-performance antenna solutions to enhance connectivity, efficiency, and reliability in smartphones, wearables, and smart home applications.

-

In November 2024, Sony Electronics has introduced new closed-back monitor headphones engineered for professional-grade sound isolation. These headphones combine enhanced noise isolation, ergonomic comfort, and high-quality audio performance, ideal for both studio and on-the-go use.

Amphenol RF is a leading provider of RF interconnect solutions, offering advanced dielectric resonator antenna technologies for 5G, IoT, and wireless applications. The company emphasizes high-performance, miniaturized designs that support seamless connectivity, low-loss transmission, and reliability across diverse communication systems.

-

In August 2023, Amphenol RF announced embedded antennas. The chip antennas are surface mountable and offer great electrical performance, covering the full frequency range up to 8.5 GHz.

PCTEL, Inc. specializes in developing high-performance antenna and wireless solutions, including dielectric resonator antennas for 5G, industrial IoT, and mission-critical communications. The company focuses on reliable, compact, and efficient designs that enhance connectivity, optimize network performance, and support advanced wireless applications.

-

In September 2022, PCTEL, Inc. announced its new Multi Fin programmable antenna for use in fleet management, public safety, and intelligent transportation applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.97 Billion |

| Market Size by 2032 | USD 20.34 Billion |

| CAGR | CAGR of 12.47% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cylindrical DRA, Rectangular DRA) • By Application (Civilian, Military) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Antenna Company, CommScope, TE Connectivity, Laird Connectivity, Molex, Taoglas, Amphenol Antenna Solutions, Rogers Corporation, Cobham Antenna Systems, KYOCERA AVX Corporation, Huawei Technologies, Radiall, Eaton, Alcatel-Lucent, RFS (Radio Frequency Systems), Belden Inc., Filtronic plc, Comba Telecom Systems, Yageo Corporation, Qorvo, Inc. |