Blockchain in Fintech Market Report Scope & Overview:

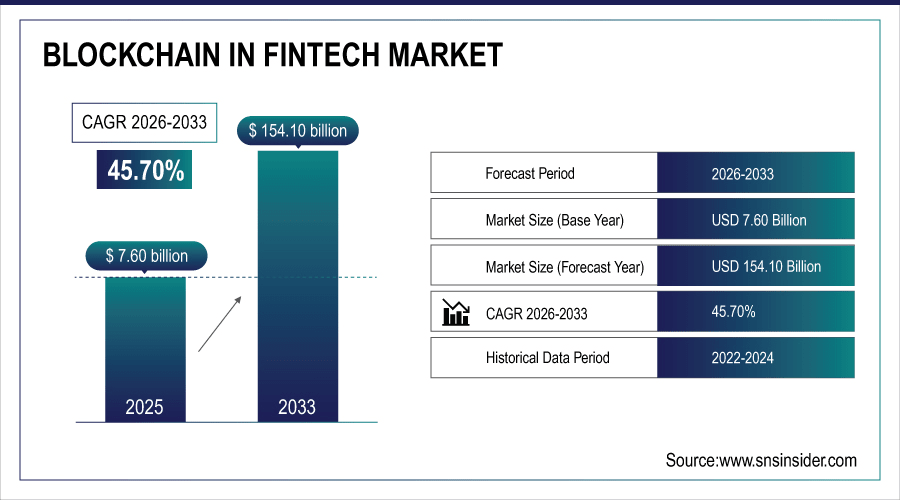

The Blockchain in Fintech Market was valued at USD 7.60 Billion in 2025E and is projected to reach USD 154.10 Billion by 2033, growing at a CAGR of 45.70% during the forecast period 2026–2033.

The Blockchain in Fintech market analyses public, private, consortium, and hybrid blockchain technologies applied in payments, smart contracts, digital identity, lending, and fraud detection. Key providers are solution vendors and technology firms, serving large enterprises and SMEs across banks, fintech companies, insurance, and investment firms. The market is expected to expand rapidly through 2033, driven by increasing adoption of secure digital transactions, regulatory support, and the growing need for transparency, efficiency, and fraud prevention in financial services.

Payments & Money Transfer accounted for 32% of the Blockchain in Fintech market in 2025, driven by the growing adoption of secure, fast, and cost-efficient digital transactions.

To Get More Information On Blockchain in Fintech Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 7.60 Billion

-

Market Size by 2033: USD 154.10 Billion

-

CAGR: 45.70% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Blockchain in Fintech Market Trends:

-

Public Blockchain accounted for around 38% of the market in 2025, driven by its decentralized transparency and growing adoption in cross-border payments.

-

Private Blockchain made up 27%, reflecting enterprises’ preference for secure, permissioned networks.

-

Consortium Blockchain held 18%, supported by collaborations between banks and fintech firms.

-

Large Enterprises represented 11%, leading adoption due to regulatory compliance and infrastructure capabilities.

-

Cloud-Based Deployment contributed 6%, fueled by cost efficiency, scalability, and ease of integration.

U.S. Blockchain in Fintech Market Insights:

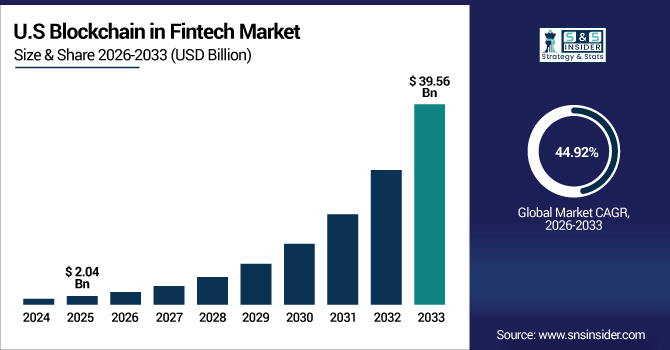

The U.S lockchain in Fintech Market reached USD 2.04 Billion in 2025E, projected to reach USD 39.56 Billion by 2033, at a CAGR of 44.92%. Growth is driven by digital payment adoption, blockchain-based lending, strong institutional investments, supportive regulations, and collaborations between fintech firms and tech giants.

Blockchain in Fintech Market Growth Drivers:

-

Rising Demand for Secure, Transparent, and Efficient Financial Transactions Fuels Blockchain Adoption in Fintech Globally.

The Blockchain in Fintech market is driven by growing demand for secure, transparent, and efficient financial transactions. By 2025, payments & money transfer accounted for 32% of overall market share, smart contracts 24%, and digital identity 18%. Lending & credit contributed 12%, while fraud detection & risk management made up 14%. Cloud-based deployments represented 6%, reflecting increasing adoption of scalable, easily integrated blockchain solutions across financial services.

Rising demand for secure digital transactions drove 34% of blockchain adoption in fintech in 2025, reflecting growing focus on transparency, efficiency, and fraud prevention.

Blockchain in Fintech Market Restraints:

-

Regulatory Uncertainty and Complex Compliance Requirements Hinder Widespread Blockchain Adoption in the Fintech Industry Globally.

Regulatory uncertainty and complex compliance requirements restrict blockchain adoption in the fintech market. In 2025, 21% of fintech startups reported delays in blockchain integration due to unclear regulations, while 16% of large enterprises faced increased legal and compliance costs. These challenges slow implementation of innovative solutions such as smart contracts, digital identity, and fraud detection platforms. Consequently, despite rising demand for secure, transparent, and efficient financial transactions, overall market growth experiences temporary constraints globally.

Blockchain in Fintech Market Opportunities:

-

Increasing Integration of Blockchain with AI and IoT Offers Innovative Growth Opportunities in Fintech Services Globally.

Increasing integration of blockchain with AI and IoT is driving fintech innovation. In 2025, 28% of fintech startups adopted blockchain-AI solutions, while 19% of large enterprises implemented IoT-enabled blockchain platforms. Cross-industry collaborations contributed 15% of total blockchain projects, highlighting emerging applications in payments, fraud detection, and digital identity. These opportunities are expected to accelerate as demand for intelligent, secure, and automated financial services grows globally through 2033.

Adoption of blockchain-AI and IoT solutions accounted for 14% of fintech projects in 2025, reflecting growing demand for secure, automated, and intelligent financial services.

Blockchain in Fintech Market Segmentation Analysis:

-

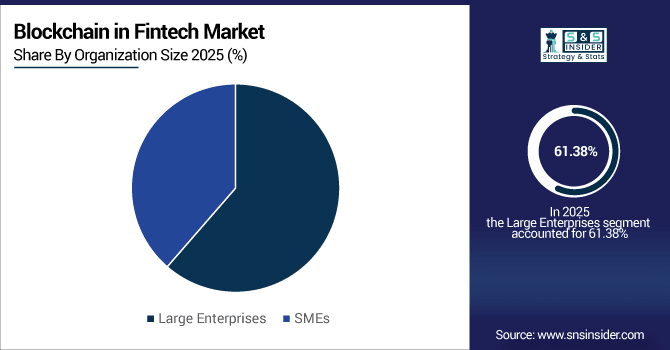

By Organization Size, Large Enterprises held the largest share of 61.38% in 2025, while SMEs are anticipated to grow at the fastest CAGR of 52.16%.

-

By Technology, Public Blockchain held the largest market share of 38.45% in 2025, while Hybrid Blockchain is expected to grow at the fastest CAGR of 53.28%.

-

By Application, Payments & Money Transfer contributed the highest share of 32.78% in 2025, while Smart Contracts are forecasted to expand at the fastest CAGR of 50.87%.

-

By Provider, Blockchain Solution Providers dominated with a 54.62% share in 2025, while Technology Vendors are projected to grow at the fastest CAGR of 51.44%.

-

By End User, Banks accounted for the dominant share of 43.87% in 2025, while Fintech Companies are expected to grow at the fastest CAGR of 49.77%.

-

By Deployment Mode, On-Premise solutions captured 47.21% of the market in 2025, while Cloud-Based deployments are projected to grow at the fastest CAGR of 54.12%.

By Organization Size, Large Enterprises Lead, SMEs Rapidly Scale:

Large enterprises dominated the Blockchain in Fintech market in 2025 with 4.1 billion blockchain-enabled financial operations, leveraging advanced infrastructure for risk management, compliance, and global payments. SMEs accounted for 1.6 billion operations, adopting blockchain primarily for lending, fraud detection, and credit scoring. By 2033, SMEs are expected to surpass 5.3 billion operations, driven by affordable cloud deployments and access to decentralized finance tools that enable secure, low-cost services at scale.

By Technology, Public Blockchain Leads, Hybrid Gains Momentum

The Blockchain in Fintech market in 2025 was dominated by public blockchain, powering over 1.8 million daily transactions in payments and remittances. Private blockchain supported 1.2 million secure operations, favored by banks and insurers. Consortium models enabled 0.9 million shared processes, strengthening collaborations among financial institutions. Hybrid blockchain, though smaller at 0.6 million transactions, is projected to surpass 2.1 million by 2033, driven by rising demand for flexible architectures that blend transparency with control.

By Application, Payments Dominate, Smart Contracts Accelerate

Within the Blockchain in Fintech market, payments and money transfer led in 2025 with 3.2 billion recorded transactions, underscoring blockchain’s efficiency in cross-border settlements. Smart contracts automated 1.9 billion agreements, cutting legal and processing costs. Digital identity verified 1.3 billion authentications, addressing rising fraud concerns. By 2033, smart contracts are forecasted to exceed 5.7 billion deployments, positioning them as the fastest-growing application, fueled by decentralized finance (DeFi), lending innovation, and regulatory acceptance.

By Provider, Solution Vendors Dominate, Tech Vendors Rise:

The Blockchain in Fintech market in 2025 was driven by solution providers, enabling over 2.4 billion deployments across banks and fintech platforms. Technology vendors accounted for 1.1 billion implementations, largely focused on integrating blockchain with AI and IoT. Consulting firms managed 0.7 billion advisory projects, helping financial institutions navigate compliance. By 2033, technology vendors are set to surpass 3.8 billion deployments, reflecting surging demand for scalable, modular, and cloud-ready blockchain platforms in financial services.

By End User, Banks Dominate, Fintech Firms Expand Fast:

Banks led the Blockchain in Fintech market in 2025 with 3.6 billion blockchain-backed processes, mainly in remittances, settlements, and fraud detection. Fintech companies followed with 2.3 billion processes, focusing on decentralized lending and digital identity solutions. Insurance firms validated 1.2 billion claims through blockchain, boosting transparency. By 2033, fintech companies are projected to exceed 6.1 billion blockchain operations, fueled by consumer adoption of app-based services and the expansion of DeFi ecosystems globally.

By Deployment Mode, On-Premise Strong, Cloud Surges Ahead:

The Blockchain in Fintech market in 2025 saw 2.8 billion on-premise processes, favored by banks for compliance and data control. Cloud-based deployments handled 1.7 billion processes, enabling scalability and cost savings for SMEs and fintech startups. Hybrid solutions supported 0.9 billion processes, balancing flexibility with security. By 2033, cloud deployments are expected to surpass 6.4 billion processes, fueled by SaaS adoption, rising fintech innovation, and demand for faster, cost-efficient cross-border financial transactions.

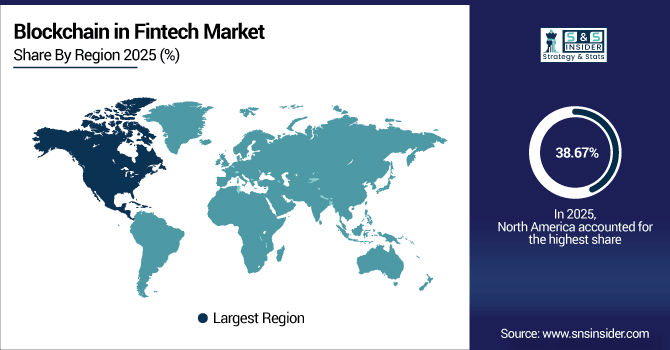

Blockchain in Fintech Market Regional Analysis:

North America Blockchain in Fintech Market Insights:

In 2025, North America accounted for 38.67% of the global blockchain in fintech market, recording nearly 1.9 billion blockchain-enabled financial operations. Payments and money transfers contributed 820 million operations, smart contracts supported 470 million, while digital identity secured 320 million authentications. On-premise deployments handled 1.1 billion operations, with cloud-based systems covering 540 million. Growth through 2033 will be fueled by strong fintech adoption, regulatory clarity, and rising demand for secure, transparent financial services.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Blockchain in Fintech Market Insights:

In 2025, the U.S. blockchain in fintech market executed over 1.15 billion operations, including 480 million payments, 310 million smart contracts, and 210 million digital identity verifications. Cloud-based deployments handled 260 million operations, reflecting rapid adoption by fintech firms, banks, and enterprises leveraging blockchain for secure, efficient financial services.

Asia-Pacific Blockchain in Fintech Market Insights:

The Asia-Pacific blockchain in fintech market, the fastest-growing region, is projected to expand at a CAGR of 47.38% through 2033. In 2025, over 950 million blockchain-enabled operations were executed: China led with 420 million, India with 230 million, and Japan with 150 million. Cloud-based deployments handled 180 million operations, reflecting rapid adoption. Rising digital payment adoption, fintech innovations, and supportive government initiatives are expected to drive strong regional growth.

China Blockchain in Fintech Market Insights:

In 2025, China executed over 420 million blockchain-enabled fintech operations, including 180 million payments and transfers, 120 million smart contracts, and 70 million digital identity verifications. Cloud-based deployments handled 50 million operations, while on-premise systems managed 60 million, supporting rapid market expansion through 2033, driven by fintech innovation, digital payment adoption, and government-backed blockchain initiatives.

Europe Blockchain in Fintech Market Insights:

In 2025, Europe executed over 650 million blockchain-enabled fintech operations, with Germany accounting for 180 million, the UK 150 million, and France 120 million. Payments and money transfers totaled 280 million operations, smart contracts 180 million, and digital identity verifications 120 million. Cloud-based deployments processed 150 million operations, while on-premise systems handled 200 million. Market growth through 2033 will be driven by fintech innovation, regulatory support, and increasing enterprise blockchain adoption.

Germany Blockchain in Fintech Market Insights:

In 2025, Germany executed over 180 million blockchain-enabled fintech operations, including 80 million payments and transfers, 50 million smart contracts, and 30 million digital identity verifications. Cloud-based deployments processed 40 million operations, while on-premise systems handled 50 million, supporting growth through 2033 driven by fintech innovation, enterprise adoption, and regulatory support.

Latin America Blockchain in Fintech Market Insights:

In 2025, Latin America executed over 120 million blockchain-enabled fintech operations, led by Brazil, Mexico, and Argentina. Payments and money transfers accounted for 55 million operations, smart contracts 35 million, and digital identity verifications 20 million. Cloud-based deployments handled 25 million operations, supporting market growth through 2033 driven by fintech adoption, digital payment expansion, and supportive regulatory initiatives.

Middle East and Africa Blockchain in Fintech Market Insights:

As of 2025, the Middle East & Africa executed over 45 million blockchain-enabled fintech operations, including 20 million payments and transfers, 12 million smart contracts, and 8 million digital identity verifications. Regional growth is driven by rising digital payment adoption, fintech innovation, government blockchain initiatives, and expanding enterprise blockchain deployments.

Blockchain in Fintech Market Competitive Landscape:

Fnality dominates the blockchain fintech market by offering a regulated, DLT-based wholesale payment network connecting major financial institutions. In 2025, Fnality processed over 1.36 million real-time transactions, enabling instant settlement across multiple currencies. Its infrastructure reduces operational risk and liquidity costs for banks in Europe and North America. By providing 24/7 settlement and interoperability between institutions, Fnality strengthens global financial networks and remains a market leader.

-

In December 2023, Fnality launched the Sterling Fnality Payment System, enabling real-time, DLT-based wholesale settlements for banks in the UK. It supports tokenized securities and repo transactions, bridging traditional finance with blockchain innovation.

BitGo is a market leader in blockchain fintech due to its secure crypto custody solutions for institutional clients. In 2025, it safeguarded over 90 million digital assets and supported more than 4.1 million transactions. Known for high security, regulatory compliance, and insurance coverage, BitGo attracts banks, hedge funds, and asset managers. Its expanding client base and technology-driven services reinforce its dominant position globally.

-

In September 2025, BitGo filed for a U.S. IPO under BTGO, showcasing growth and investor confidence. It also unveiled an enhanced trading interface with advanced charts and streamlined order books for institutional clients.

AVAX One leads the market by focusing on tokenized assets on the Avalanche blockchain. In 2025, it managed over 700,000 tokenized asset transactions and expanded its platform for institutional and retail investors. Its innovative approach combines asset tokenization, blockchain treasury management, and digital trading. By simplifying access to blockchain-based financial products and driving adoption across multiple sectors, AVAX One has established itself as a rapidly growing market leader.

-

In September 2025, AgriFORCE rebranded to AVAX One, focusing on AVAX token acquisition and asset tokenization on the Avalanche blockchain. Leadership appointments of Anthony Scaramucci and Matt Zhang drive strategic blockchain expansion and market adoption.

Blockchain in Fintech Market Key Players:

Some of the Blockchain in Fintech Market Companies are:

-

Fnality

-

BitGo

-

AVAX One

-

Coinbase

-

Ripple

-

Circle

-

Paxos

-

ConsenSys

-

Block (formerly Square)

-

Stripe

-

PayPal

-

Visa

-

Mastercard

-

Ant Group

-

Nubank

-

Revolut

-

Robinhood

-

Zodia Markets

-

UBS

-

Prolifics

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 7.60 Billion |

| Market Size by 2033 | USD 154.10 Billion |

| CAGR | CAGR of 45.70% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Public, Private, Consortium, Hybrid) • By Application (Payments & Money Transfer, Smart Contracts, Digital Identity, Lending & Credit, Fraud Detection & Risk Management) • By Provider (Blockchain Solution Providers, Technology Vendors) • By Organization Size (Large Enterprises, SMEs) • By End User (Banks, Fintech Companies, Insurance, Investment Firms) • By Deployment Mode (On-Premise, Cloud-Based) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Fnality, BitGo, AVAX One, Coinbase, Ripple, Circle, Paxos, ConsenSys, Block (formerly Square), Stripe, PayPal, Visa, Mastercard, Ant Group, Nubank, Revolut, Robinhood, Zodia Markets, UBS, Prolific |