Blockchain in Insurance Market Report Scope & Overview:

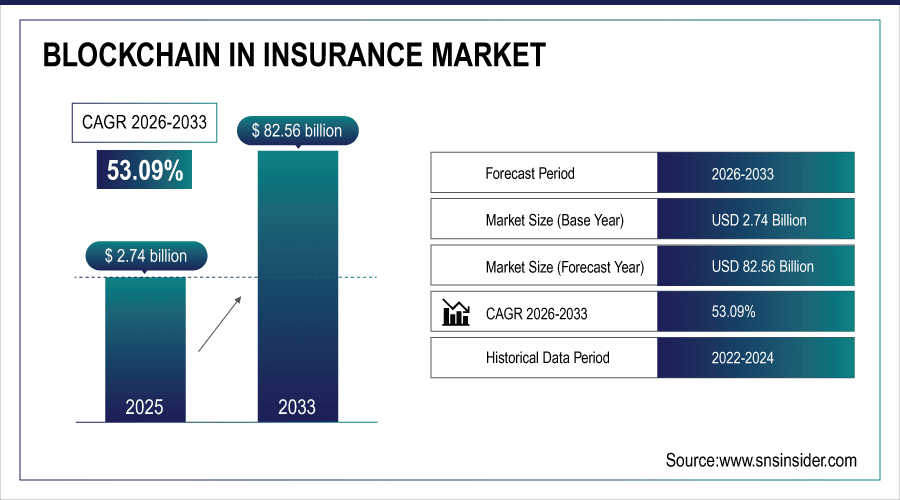

The Blockchain in Insurance Market was valued at USD 2.74 Billion in 2025E and is projected to reach USD 82.56 Billion by 2033, growing at a CAGR of 53.09% during the forecast period 2026–2033.

Blockchain in Insurance market explores public, private, consortium and hybrid types of blockchain platforms used in claims management, fraud detection, underwriting policy administration & customer identity management. Top vendors are blockchain solution providers and technology providers who cater to the large, medium-sized companies in insurance, reinsurance, brokers as well as insurtech. The market is anticipated to witness significant growth through 2033 on the back of increasing demand for secure, transparent and efficient insurance processes, fraud preventions and digital transformations.

Claims Management accounted for 30% of the Blockchain in Insurance market in 2025, driven by the increasing adoption of secure, transparent, and efficient insurance processes.

To Get More Information On Blockchain in Insurance Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 2.74 Billion

-

Market Size by 2033: USD 82.56 Billion

-

CAGR: 53.09% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Blockchain in Insurance Market Trends:

-

Public Blockchain held a market share of 35% in the year 2025 Use of public blockchain due to its decentralized transparency in cross-border insurance claims and settlements.

-

Private Blockchain accounted for 28%, with insurers favouring secure, permissioned networks to store sensitive policy and customer data.

-

Consortium Blockchain accounted for 20 % based on the involvement of insurers, reinsurers and technology players.

-

Large Organizations accounted for 12%, ahead in uptake on account of regulations and strong IT setup.

-

Cloud-Based Deployment accounted for 5% and was driven by cost-effectiveness, scalability and faster integration with insurance processes.

U.S. Blockchain in Insurance Market Insights:

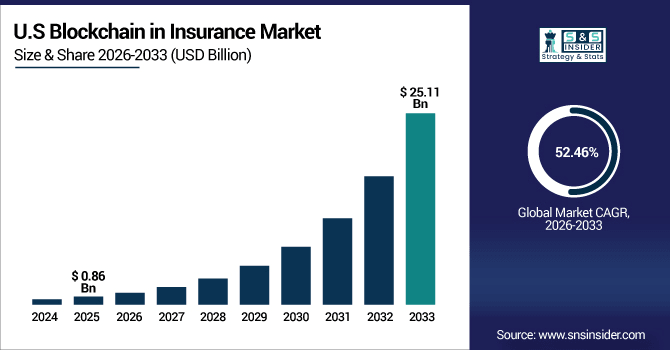

The U.S. Blockchain in Insurance Market reached USD 0.86 Billion in 2025E and is projected to reach USD 25.11 Billion by 2033, at a CAGR of 52.46%. Growth is being propelled by increasing deployment of blockchain in claims, fraud detection, and policy administration as well as favorable regulations and partnerships between insurers and technology vendors.

Blockchain in Insurance Market Growth Drivers:

-

Growing Need for Fraud Prevention, Transparent Claims, and Efficient Policy Management Drives Blockchain Adoption in Insurance.

Growth in the blockchain in insurance market is characterized by increasing demand for fraud detection and risk prevention, as well as faster transactions. Claims management holds the largest market size in 24%, and fraud detection & risk management, underwriting policy administration is 15%, and customer identity management by the same year are at 10%. 5% went to cloud deployments with both insurers and insurtechs looking for scalable, secure and easily integrated cloud-based blockchain solutions.

Rising demand for fraud prevention and transparent claims management drove 33% of blockchain adoption in insurance in 2025, reflecting growing focus on efficiency, data security, and streamlined policy operations.

Blockchain in Insurance Market Restraints:

-

High Regulatory Complexity and Data Privacy Concerns Limit Widespread Blockchain Adoption Across Global Insurance Operations.

Heavy regulation and privacy implications are limiting factors of blockchain in the insurance sector. They were 19 percent for insurtechs and challenged by regulations that was holding up more blockchain innovation in 2025, compared to 14 percent among large insurers which reported higher compliance and legal costs. These are some of the barriers to delivering new applications such as claim management, fraud detection, underwriting and policy administration. Consequently, the world market growth is temporarily held back in spite of reciprocally strong needs for secure, transparent and effective insurance operations.

Blockchain in Insurance Market Opportunities:

-

Integration of Blockchain with AI and IoT Enables Smarter Claims, Risk Assessment, and Personalized Insurance Solutions Globally.

Blockchain with AI and IoT is accelerating insurance transformation. By 2025, a quarter of insurtech startups leveraged blockchain-AI solutions compared to 18% of the leading insurers which had implemented IoT-driven blockchain initiatives. Cross industry projects accounted for 12% of total blockchain use cases, and some other possible applications were in claims management, fraud prevention and risk assessment. And there are many more such opportunities to come as the demand for smart, secure and automated insurance continues to grow around the globe in coming years.

Adoption of blockchain-AI and IoT solutions accounted for 13% of insurance blockchain projects in 2025, reflecting growing demand for secure, automated, and intelligent claims, risk, and policy management.

Blockchain in Insurance Market Segmentation Analysis:

-

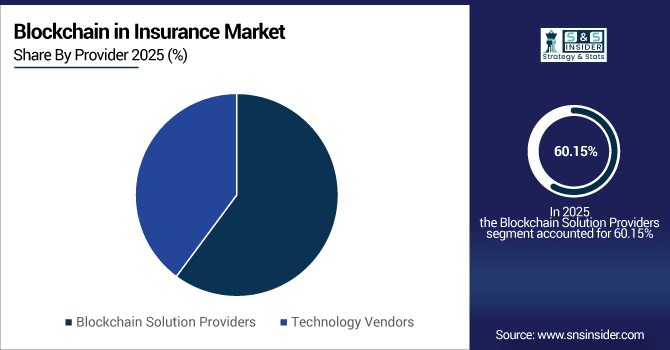

By Provider, Blockchain Solution Providers dominated with a 60.15% share in 2025, while Technology Vendors are projected to grow at the fastest CAGR of 55.45%.

-

By Technology, Private Blockchain held the largest market share of 28.50% in 2025, while Hybrid Blockchain is expected to grow at the fastest CAGR of 56.40%.

-

By Application, Claims Management contributed the highest share of 30.20% in 2025, while Fraud Detection & Risk Management is forecasted to expand at the fastest CAGR of 57.35%.

-

By Organization Size, Large Enterprises held the largest share of 58.30% in 2025, while SMEs are anticipated to grow at the fastest CAGR of 56.75%.

-

By End User, Insurance Companies accounted for the dominant share of 62.40% in 2025, while Insurtech Firms are expected to grow at the fastest CAGR of 58.25%.

-

By Deployment Mode, On-Premise solutions captured 55.25% of the market in 2025, while Cloud-Based deployments are projected to grow at the fastest CAGR of 57.10%.

By Provider, Blockchain Solution Providers Lead, Technology Vendors Expand:

In 2025, blockchain-based solution providers handled 1.8 million operations for insurers, such as claims services, policy administration and fraud prevention. Technology providers rolled out 1 million integration and platform development projects for enterprise and startup insurers. Vendors and solution providers engaged in 0.6 million joint initiatives across industries. Over 2 million blockchain deployments are expected to be made by technology vendors by 2033 on the strength of demand for scalable and innovative platforms in the insurance market.

By Technology, Private Blockchain Leads, Hybrid Gains Momentum

By 2025, private blockchain formed the foundation for insurance transactions with more than 1.5 million valid policy and claims procedures carried out in a secure fashion. Decentralised public blockchain facilitated 1.1 million transactions, mostly in cross-border and multi-party claim settlements. Consortium blockchains processed 0.8 million workflows between insurers and reinsurers. Hybrid- blockchain, with 0.5 million of processes and increase over 2.0 million projected upto 2033 driven by the more seamless demand on flexible solutions based on transparency, security and business control.

By Application, Claims Management Dominates, Fraud Detection Accelerates:

Claims management led the market in 2025, processing over 1.6 million insurance claims using blockchain-based verification. Fraud detection and risk management processed 1.2 million cases identifying anomalies in underwriting and claims settlements. Policy management automated 0.9 million transactions, enhancing operational productivity. In addition, secure identity verification in customer identity management: 0.7 million. More than 2.1 million individuals predicted to work in the field of fraud detection & risk management by 2033, as businesses increasingly shift their attention towards secure risk assessment that is automated.

By Organization Size, Large Enterprises Lead, SMEs Grow Fast:

In 2025, there were 1.9 million blockchain-based transactions for insurance giants which became possible thanks to strong info tech foundation and law obedience. Small and medium enterprises (SMEs) completed 0.8 million transactions, using blockchain technology for time-saving and cost-reduction. Joint venture operations between big and small insurers reached 500,000. By 2033, SMEs are expected to operate more than 1.8 million blockchain-related business processes making use of cloud-based affordable offerings and closer collaborations with tech players.

By End User, Insurance Companies Dominate, Insurtech Firms Expand:

More than 2.0 million insurance processes, such as claims processing, underwriting and policy management were conducted over committed blockchains in 2025. Reinsurers handled 1.2 million joint workflows. Brokers conducted 0.9 million customer trades. The number of insurtechs that exist today is estimated at 0.6 million operations and is expected to increase by a factor of four by 2033 with the increased diversity in implementation levels of AI-driven blockchain solutions, digital claims processing systems and chain risk models for insurance products.

By Deployment Mode, On-Premise Leads, Cloud-Based Grows Rapidly:

On-premise solutions supported 1.7 million insurance operations in 2025, favored by large insurers for data security and compliance. Cloud implementation processed 1 million transactions enabling cost effective scalability and rapid integration. Hybrid procedures contributed 0.5 million operations to the total. Key cloud adoption trends: SMEs and insurtech firms levering flexible, secure and readily implementable blockchain platforms across claims management, underwriting and policy administration. 2 million blockchain-based transactions predicted to be triggered by 2033.

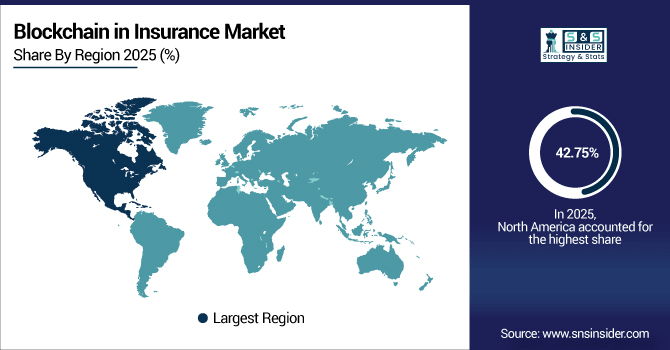

Blockchain in Insurance Market Regional Analysis:

North America Blockchain in Insurance Market Insights:

In 2025, North America accounted for 42.75% of the global blockchain in insurance market, recording nearly 1.6 billion blockchain-enabled operations. Claims management took care of 680 million operations, fraud detection covered 420 million and policy administration served 300 million. Self-managed installations accounted for 900 million operations and cloud installations handled 480 million. The market will see growth through 2033 driven by robust insurer adoption, regulatory backing and increased demand for secure, transparent and automated insurance services.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Blockchain in Insurance Market Insights:

The number of operations completed in the U.S. blockchain in insurance market was more than 620 million, with claims management (280 million), fraud detection (180 million) and policy administration (110 million). Cloud deployments processed 150 million operations, highlighting the extensive use of blockchain across the industry to provide secure and transparent insurance services.

Asia-Pacific Blockchain in Insurance Market Insights:

The Asia-Pacific blockchain in insurance market, the fastest-growing region, is projected to expand at a CAGR of 54.72% through 2033. Blockchain-empowered transactions reached in 2025 more than 780 million: China as the largest one 350 million, with India’s 190, and Japan’s 120. Cloud deployments executed 140 million operations, an indication of fast adoption. Strong regional growth will be the result of increasing digital insurance initiatives, insurtech innovation and supportive regulation, Global Data says.

China Blockchain in Insurance Market Insights:

In 2025, more than 350 million insurance transactions in China were processed using blockchain: This includes about 140 million claim management processes, 90 million fraud detection cases and nearly 60 million policy admin events. The cloud-based deployments processed 50 million, the on-premise systems 70 million, to serve a fast-growing market until 2033.

Europe Blockchain in Insurance Market Insights:

In 2025, the storytelling continent processed more than half a billion insurance transactions enabled by blockchain technology: in Germany 160 million; in the UK, 140 million; in France, 110 million. Claims management was 220 million, fraud detection was 150 million. Cloud operations numbers hit 130 million while on-premise did 180 million. The market will rise through 2033 as insurtech innovations, regulatory backing and the use of blockchain by insurers increases.

Germany Blockchain in Insurance Market Insights:

Germany meanwhile has implemented more than 160 million blockchain-driven insurance transactions in 2025, with over 70 million claims management procedures being conducted, over 50 million cases of fraud being detected and in excess of 25 million underwriting actions. Cloud deployments processed 35 million operations while on-premises systems processed 50 million and enough to sustain growth until 2033.

Latin America Blockchain in Insurance Market Insights:

In 2025, Latin America achieved more than 105 million blockchain use cases in insurance with the top countries being Brazil, Mexico and Argentina. Claims administration represented 50 million transactions, fraud detection 30 million and policy administration 15 million. Cloud-based deployments accounted for 20 million operations; market growth extrapolates through 2033 based on insurtech adoption, digital insurance initiatives, and friendly regulatory environments.

Middle East and Africa Blockchain in Insurance Market Insights:

By 2025, the Middle East & Africa have conducted more than 48 million blockchain insurance transactions including more than 22 million claims transactions, over 15 million fraud detection processes and nearly seven million policy administration events. The growth in the region is attributed to increasing insurtech adoption, rapid digitalization of insurance services, government’s push for blockchain and growing enterprise spend on blockchain solutions.

Blockchain in Insurance Market Competitive Landscape:

IBM is the dominant player in the blockchain in insurance space with Hyperledger Fabric being their enterprise solution. In 2025, the firm reported that their multiple blockchain platforms had processed more than 1.2 million insurance-related transactions to begin with half a million claims processing activities, and 400,000 fraud cases and another 300,000 policy administration transactions. Their products produce transparency, reduce fraud and lower administration costs for insurers worldwide. IBM’s enterprise blockchain focus means it dominates the market.

-

In March 2025, IBM integrated its blockchain insurance solutions with Salesforce, enhancing claims management and policy administration for global insurers. Its platform processed over 500,000 insurance operations, improving transparency, efficiency, and fraud prevention.

Azure Blockchain Service is a scalable and secure blockchain service for the insurance industry from Microsoft. In 2025 Microsoft’s blockchain platforms were processing more than 900,000 insurance transactions such as claims (350K), fraud checks (250K) and policy administration (200K). State-of-the-art mind behind the cloud structure being interlinked with Insurers Azure Cloud Infrastructure provides an insurerswith reliable blockchain solutions. Microsoft has cornered the market with the innovation, and more importantly, volume that they bring to the table.

-

In October 2025, Microsoft launched Azure Blockchain for Insurance templates and APIs, streamlining claims processing and underwriting. The platform supported 400,000 insurance operations, enabling scalable, secure, and automated workflows for insurers and reinsurers.

Amazon Web Services (AWS) offers blockchain products for the insurance industry to Amazon Managed Blockchain and Amazon QLDB. According to an analysis in 2025, blockchain solutions on AWS handled more than 800,000 insurance transactions, including the processing of claims management (300,000) and fraud detection cases (250,000) as well policy work tasks (200.000). The platform automatically scales the technology in the cloud and provides security for insurers at scale. Continuous innovation and robust cloud offerings help AWS take top spot in the blockchain insurance market.

-

In September 2025, Fnality expanded its blockchain payment network to support insurance settlements, processing over 300,000 transactions. The platform improved efficiency, transparency, and secure cross-institution insurance operations across multiple regions.

Blockchain in Insurance Market Key Players:

Some of the Blockchain in Insurance Market Companies are:

-

IBM Corporation

-

Microsoft Corporation

-

Amazon Web Services (AWS)

-

Oracle Corporation

-

SAP SE

-

Consensys

-

Deloitte

-

Chainlink

-

Lemonade

-

Nexus Mutual

-

B3i Services AG

-

Guardtime AS

-

EtherRisk Ltd.

-

Applied Blockchain

-

Cambridge Blockchain

-

Auxesis Group

-

BitPay

-

BlockCypher

-

Bitfury

-

Block Gemini

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.74 Billion |

| Market Size by 2033 | USD 82.56 Billion |

| CAGR | CAGR of 53.09% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Public, Private, Consortium, Hybrid) • By Application (Claims Management, Fraud Detection & Risk Management, Underwriting, Policy Administration, Customer Identity Management) • By Provider (Blockchain Solution Providers, Technology Vendors) • By Organization Size (Large Enterprises, SMEs) • By End User (Insurance Companies, Reinsurers, Brokers, Insurtech Firms) • By Deployment Mode (On-Premise, Cloud-Based) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM Corporation, Microsoft Corporation, Amazon Web Services (AWS), Oracle Corporation, SAP SE, Consensys, Deloitte, Chainlink, Lemonade, Nexus Mutual, B3i Services AG, Guardtime AS, EtherRisk Ltd., Applied Blockchain, Cambridge Blockchain, Auxesis Group, BitPay, BlockCypher, Bitfury, Block Gemini |