Customer Data Platform Market Report Scope & Overview:

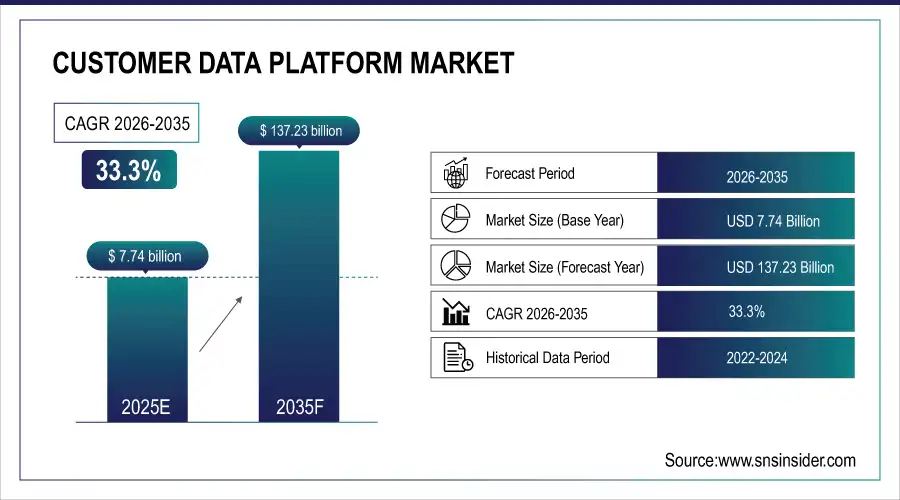

The Global Customer Data Platform Market size was USD 7.74 billion in 2025 and is projected to grow to USD 137.23 billion by 2035 at a CAGR of 33.3% from 2026-2035. The high-growth trajectory is driven by increased adoption of the combined customer profiles, real-time data insights, and hyper-personalized engagements across retail, BFSI, healthcare, and telecom industries. CDPs are becoming vital as businesses turn to first-party data strategies under tighter privacy controls. AI and machine learning integration allows for predictive analytics, journey mapping automation, and one-to-one marketing. Cloud deployment, growing SME use, and innovations from top players such as Salesforce, Adobe, and Oracle are further fueling this market's global expansion and evolution.

Market Size and Forecast: 2025

-

Market Size in 2025 USD 7.74 Billion

-

Market Size by 2035 USD 137.23 Billion

-

CAGR of 33.3% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

To Get more information On Customer Data Platform Market - Request Free Sample Report

Customer Data Platform Market Trends:

• Rapid adoption of real-time customer data unification to enable hyper-personalized marketing and consistent omnichannel engagement

• Increasing integration of AI and machine learning within CDPs for predictive analytics, dynamic segmentation, and next-best-action recommendations

• Growing shift from siloed data management toward centralized customer intelligence platforms across retail, BFSI, telecom, and media sectors

• Rising demand for automated customer journey orchestration and trigger-based, cross-channel messaging capabilities

• Strong focus on data governance, privacy compliance, and consent management as customer data volumes and regulatory scrutiny increase

U.S. Customer Data Platform Market was USD 1.89 billion in 2025 and is anticipated to reach USD 27.43 billion by 2035 at a CAGR of 30.64% during the period of 2026–2035. This growth is largely due to the high digital maturity of the country, high adoption of cloud, and strong base of major players such as Salesforce, Adobe, and Oracle. U.S. businesses in retail, BFSI, healthcare, and telecom are using CDPs to consolidate customer data, personalize more effectively, and meet changing data privacy regulations. The need for AI-powered analytics, real-time segmentation, and effortless marketing integration is growing. Strategic investments in customer experience technology are also accelerating CDP adoption across the U.S. market.

Customer Data Platform Market Growth Drivers:

-

Growing Need for Real-Time Unified Customer Profiles for Personalization and Engagement Across Industries

The increasing need for real-time, unified customer data profiles is playing a major role in fueling the growth of the Customer Data Platform market. With companies relying more and more on hyper personalized marketing and engagement tactics, conventional data silos and disparate analytics systems are unable to deliver timely and unified customer insights. CDPs provide unified platforms which gather, combine, and standardize customer data from various touchpoints including websites, mobile applications, social media, CRM and offline channels. This unified view of the customer allows companies to personalize marketing campaigns, forecast customer action, and improve user experience successfully. As an example, real-time CDP users indicate strong improvement in campaign performance and customer satisfaction. The need is especially high in industries such as retail, telecommunication and BFSI, where personalization has a direct linkage to top line growth.

In addition, with AI integration, CDPs now offer predictive segmentation and dynamic audience building, driving strategic choices and customer-centric marketing efforts.

Customer Data Platform Market Restraints:

-

Concerns Over Data Privacy and Regulatory Compliance Create Hurdles for Customer Data Platform Adoption Across Industries

Although Customer Data Platforms hold tremendous promise, issues regarding data privacy and stringent compliance remain significant obstacles. With data protection regulations like the GDPR, CCPA, and other local data protection legislations gaining strength, businesses face heightened scrutiny to responsibly handle personal data. CDPs that centralize and process enormous quantities of sensitive customer data need to maintain strong security and regulatory compliance. Yet, not every CDP provider has advanced compliance capabilities or consent management features, which complicates adoption by companies—particularly those in highly regulated industries such as healthcare and finance. Any data breach or abuse caused by insufficient security measures can lead to drastic legal and reputational damage. Additionally, differing global standards for data treatment further complicate deployment, causing delayed and conservative adoption in certain markets. Therefore, regulatory uncertainty remains a prime impediment to extensive CDP adoption.

Customer Data Platform Market Opportunities:

-

Growing Use of Artificial Intelligence and Machine Learning to Provide Predictive Analysis and Automated Customer Journey Mapping

The inclusion of machine learning and AI into Customer Data Platforms is a significant market growth opportunity. With the incorporation of predictive analytics and automated decision-making features, CDPs are transforming from tools for data consolidation into smart platforms that analyse historical behaviour but also predict future actions. With these features, companies can predict customer needs, recommend best-in-class engagement tactics, and automate cross-channel interactions, enhancing efficiency and conversion rates.

For instance, vendors such as Segment and Tealium are already providing AI-powered CDPs that allow real-time behavioural tracking and trigger-based messaging. CDPs, with increasingly advanced AI models, can create dynamic customer segments, identify churn, and offer next best actions with better precision. This combination seriously enhances ROI and equips companies to shift towards entirely personalized customer journeys. As the need for data-driven approaches continues to grow, AI-powered CDPs will be a game changer in customer experience management and marketing automation.

Customer Data Platform Market Segment Analysis:

By Component

The solution segment held the highest revenue share of 62.74% in 2025 driven by the increasing need for combined platforms that bring customer data together, allow real-time analytics, and support personalized marketing. Companies are increasingly embracing CDP solutions to shatter data silos and increase cross-channel customer interactions. Major vendors like Salesforce and Oracle have extended their CDP solutions with enhanced AI and automation features. The services segment will grow at a fastest CAGR of 32.6% during the forecast period, influenced by growing needs for consulting, integration and support services to facilitate smooth implementation of CDPs. Enterprises do not normally possess in-house skills to design and operate these platforms effectively, thus fueling the need for professional services. Managed service providers are also allowing SMEs to deploy CDPs with low overhead.

By Enterprise Size

In 2025, the Large Enterprises segment contributed the largest share of revenue at 43.16%, primarily due to large businesses having specialized marketing and IT staff that use CDPs directly through vendor deals. These firms desire direct agreements to be tailored, integrated with current infrastructure, and have better Service-Level Agreements. Sizeable organizations like Adobe, SAP, and Oracle remain focused on straightforward enterprise selling in association with grouped data governance and analytics offerings. The Small and Medium Enterprises segment is projected to expand at the fastest CAGR of 35.46% because the role of third-party service providers, channel partners, and resellers in offering CDPs is growing, especially among mid-sized companies and SMEs. Indirect models provide cost-effective and scalable solutions, enabling organizations to leverage CDP capabilities without having to manage complex deployment internally. CDP providers such as Segment and Blue Conic have grown their channel partner ecosystems to reach new markets effectively.

By Deployment

On-premises segment held a largest market share of 64.78% in 2025 based on increased demand for data security, control, and customization, particularly across sectors such as BFSI and healthcare. These industries emphasize storage within the company to adhere to strict regulatory regulations like GDPR and HIPAA. Existing IT infrastructure-based organizations prefer on-premises solutions for better integration and more effective data governance. SAS and Oracle provide mature on-premise CDPs specifically for high security environments. In 2025, Oracle enhanced its on-premise CDP to incorporate hybrid cloud capabilities at the expense of compliance standards. Enterprises tend to deploy it to minimize third-party vendors' reliance and achieve complete control of data flow and processing, and thus it remains the deployment model of choice in spite of increasing popularity of cloud services. Cloud-based segment is expected to grow at the fastest CAGR of 34.2% due to scalability, reduced initial cost and remote access. With increasing digital transformation, particularly among D2C brands and SMEs, cloud CDPs are opted for due to ease of implementation, fast integration, and real-time analysis. Players such as ActionIQ, Salesforce, and Segment are constantly evolving cloud-native platforms.

By Type

Analytics dominated the CDP segment in 2025 with a revenue share of 67.32%, which underscores the imperative role customer insights play in powering personalization and engagement tactics. CDPs are being integrated with more sophisticated analytics, which allow companies to monitor user paths, behaviour patterns, and anticipate future behaviours. Vendors such as Treasure Data and Adobe provide analytics-driven CDPs that enable marketers to build dynamic customer segments and optimize campaigns in real time. The increased demand for actionable insights to inform ROI, campaign optimization, and churn prevention solidifies analytics as the most prevalent form within the CDP landscape. The access segment is expected to grow at the fastest CAGR of 34.5%, driven by growing demand for real-time availability of data and frictionless omnichannel connections. This category is aimed at allowing customer data flow between platforms and applications, facilitating personalized content targeting and marketing automation. As real-time responsiveness expectations grow, companies are spending in CDPs that deliver instant access to singular customer profiles.

By End Use

The retail segment dominated the largest revenue share of 19.25% during 2025 due to its high emphasis on personalization, customer retention, and omnichannel interactions. CDPs allow retailers to consolidate customer touchpoints digital, mobile, and in-person into one cohesive profile, which supports the delivery of context-specific experiences as well as informed marketing campaigns. Retailers like Walmart and Nike leverage CDPs to steer loyalty schemes, personalized promotions, and real-time pricing. Travel segment is anticipated to grow fastest with CAGR of 31.54% through the highest CAGR, being boosted by an increased need for personalized itineraries, in-time notifications, and frictionless booking experiences. Travel organizations use CDPs to bring data together from sites, apps, loyalty schemes, and social networks to better engage with travellers.

Customer Data Platform Market Regional Analysis:

North America Customer Data Platform Market Insights

North America dominated the Customer Data Platform market in 2025 with a market share of approximately 38%, fueled by high digital maturity, extensive cloud penetration, and presence of key players like Salesforce, Oracle, and Adobe. The U.S. market, specifically, has witnessed robust enterprise-level adoption across retail, BFSI, and healthcare industries. For instance, Adobe Real-Time CDP experienced substantial growth throughout North America, facilitated by AI-driven features and close marketing suite integrations. Early regulatory frameworks and robust technology infrastructure further cement the region's position as a CDP leader.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Customer Data Platform Market Insights

Asia-Pacific is expected to grow at the fastest CAGR of around 34.47% over the forecast period, driven by rising digital transformation, growth in e-commerce, and an upsurge in demand for customer centric solutions in India, China, and Southeast Asia. With rising smartphone penetration and growth in online consumer interactions, local brands are actively investing in CDPs in order to establish competitive edge. In 2025, firms such as Capillary Technologies and MoEngage furthered their CDP capabilities in APAC markets. The trend towards cloud-based marketing software and the imperative to consolidate fragmented consumer data are key growth drivers, making APAC the most dynamic and fast-changing CDP market in the world

Europe Customer Data Platform Market Insights

The Europe Customer Data Platform market is driven by rising demand for unified customer views, strict GDPR compliance, and rapid digital transformation across retail, BFSI, and telecom sectors. Enterprises are increasingly adopting AI-enabled CDPs to enhance personalization, consent management, and omnichannel engagement, while cloud-based deployments support scalability and cross-border data integration.

Latin America (LATAM) and Middle East & Africa (MEA) Customer Data Platform Market Insights

The LATAM and MEA Customer Data Platform market is growing steadily, supported by expanding digital ecosystems, rising e-commerce adoption, and increasing mobile penetration. Organizations are leveraging CDPs to improve customer engagement and marketing efficiency. Growing cloud adoption, improving data infrastructure, and rising awareness of data-driven strategies are accelerating CDP uptake across emerging economies.

Customer Data Platform Market Key Players:

-

Salesforce – (Salesforce Data Cloud, Customer 360 Audiences)

-

Oracle – (Oracle Unity Customer Data Platform, Oracle CX Marketing)

-

Adobe – (Adobe Experience Platform, Real-Time CDP)

-

SAP – (SAP Customer Data Platform, SAP Emarsys Customer Engagement)

-

Microsoft – (Dynamics 365 Customer Insights, Microsoft Intelligent Data Platform)

-

Twilio – (Segment, Twilio Engage)

-

Tealium – (Tealium AudienceStream CDP, Tealium iQ Tag Management)

-

Treasure Data – (Treasure Data CDP, Treasure Insights)

-

BlueConic – (BlueConic CDP)

-

Amperity – (Amperity CDP, Amperity Profile Accelerator)

-

Optimove – (Optimove CDP)

-

ActionIQ – (ActionIQ CDP, ActionIQ CX Hub)

-

Acquia – (Acquia CDP, Acquia Marketing Cloud)

-

Lytics – (Lytics CDP, Lytics Decision Engine)

-

Klaviyo – (Klaviyo Customer Profile, Klaviyo CDP)

-

Emarsys – (Emarsys CDP, SAP Emarsys Customer Engagement)

-

Blueshift – (Blueshift SmartHub CDP, Blueshift Recommendation Engine)

-

Leadspace – (Leadspace CDP, Leadspace for Ads)

-

Dun & Bradstreet – (D&B Rev.Up ABX CDP, D&B Audience Targeting)

-

SAS Institute – (SAS Viya, SAS Customer Intelligence 360)

Competitive Landscape for Customer Data Platform Market:

Adobe is a leading player in the Customer Data Platform market through Adobe Experience Platform, enabling real-time customer data unification, advanced analytics, and AI-driven personalization. The company supports enterprises with scalable, cloud-based CDP solutions that integrate marketing, commerce, and analytics to deliver personalized, data-driven customer experiences across channels.

-

In March 2025, Adobe unveiled significant enhancements to its Experience Platform, introducing the Agent Orchestrator with ten new AI-driven agents designed to streamline marketing processes. These advancements aim to deliver personalization at scale, with companies like Marriott reporting a 70% reduction in campaign content generation time after adopting Adobe's suite.

Redpoint is a prominent Customer Data Platform provider offering unified customer profiles, real-time data integration, and advanced segmentation capabilities. Its CDP solutions help enterprises personalize marketing, orchestrate omnichannel customer journeys, and improve engagement by combining transactional, behavioral, and demographic data within a single, scalable platform.

-

In April 2025, Redpoint Global was awarded the 2025 Customer Data Platform of the Year by the Data Breakthrough Awards, recognizing its outstanding innovation, leadership, and performance in customer data technology and data readiness capabilities across industries.

Oracle is a major player in the Customer Data Platform market, delivering enterprise-grade CDP solutions through Oracle Customer Experience platforms. The company enables real-time customer data unification, AI-driven analytics, and personalized engagement across channels, supporting scalable, secure, and compliant customer data management for large organizations worldwide.

-

In September 2024, Oracle announced new AI-powered features for Oracle Unity CDP at Oracle Cloud World, enabling businesses to drive revenue growth through precise customer insights and faster onboarding using industry-specific accelerators.

|

Report Attributes |

Details |

|---|---|

| Market Size in 2025 | USD 7.74 Billion |

| Market Size by 2035 | USD 137.23 Billion |

| CAGR | CAGR of 33.3% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Component (Solution, Services, Integration & Deployment, Support & Maintenance, Training & Consulting) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

(Salesforce, Oracle, Adobe, SAP, Microsoft, Twilio, Tealium, Treasure Data, BlueConic, Amperity, Optimove, ActionIQ, Acquia, Lytics, Klaviyo, Emarsys, Blueshift, Leadspace, Dun & Bradstreet, SAS Institute) |