Brand Protection Tools Market Report Scope & Overview:

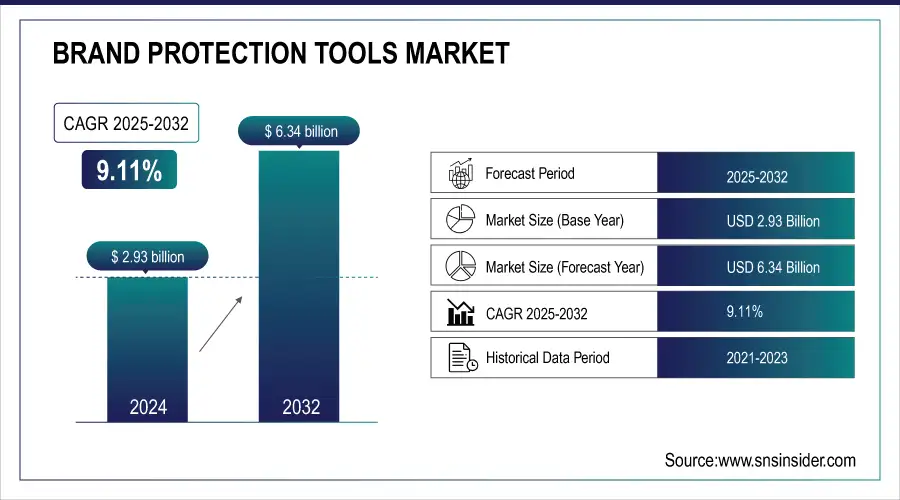

The Brand Protection Tools Market size was valued at USD 2.93 billion in 2024 and is expected to reach USD 6.34 billion by 2032, growing at a CAGR of 9.11% from 2025-2032.

The Brand Protection Tools Market growth is fuelled by escalating online counterfeiting, e-commerce growth, and the enhanced requirement to protect brand reputation. Moreover, innovations in AI and machine learning advance detection capabilities, prompting more firms to invest in end-to-end digital brand protection solutions worldwide.

For instance, in 2022, Amazon blocked more than 800,000 attempts to open new selling accounts, thereby preventing malicious players from posting counterfeit goods. In the same vein, Red Points handles and examines over 2.7 billion data points every month to identify and eliminate counterfeit listings, supporting more than 1,300 brands across the world.

To Get more information on Brand Protection Tools Market - Request Free Sample Report

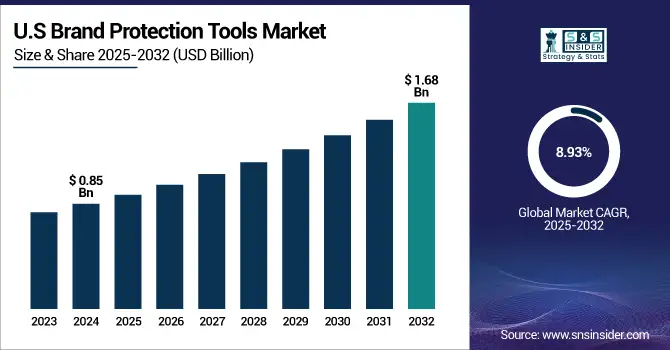

U.S. Brand Protection Tools Market size was valued at USD 0.85 billion in 2024 and is expected to reach USD 1.68 billion by 2032, growing at a CAGR of 8.93% from 2025-2032.

The U.S. Brand Protection Tools Market is growing due to the increase in instances of digital piracy, rising e-commerce fraud, and heightened concern among businesses to protect intellectual property as well as brand value through advanced AI-based monitoring and enforcement tools.

As per Mastercard's report, global e-commerce fraud losses totaled $41 billion in 2022, with more than 42% of the fraudulent transaction value coming from North America. This highlights the immediate necessity for strong digital brand protection strategies in the U.S. market.

Market Dynamics

Drivers

-

Growing online counterfeiting and digital brand misuse are forcing companies to take up automated brand protection solutions at scale.

The growth in e-commerce has posed exponentially more risks to counterfeit products, unauthorized resellers, and intellectual property theft, necessitating brand protection. Companies are adopting AI-based technology to monitor online platforms, identify infringements, and counter promptly. Offense prevention defends not just brand equity but consumer confidence and IP compliance worldwide too. With marketplaces expanding in cyberspace, protecting online brand assets via scalable technology is a boardroom imperative by geographies and industry.

Restraints

-

Absence of standardization and non-unified enforcement practices are barriers to effectiveness of brand protection measures across various jurisdictions.

Brand protection in international markets is plagued by uneven IP legislation, diverse enforcement capacity, and legal intricacies within countries. These variations hinder the ability of businesses to implement a single strategy or anticipate prompt recourse. Even where online tools exist, jurisdictional constraints can thwart takedown measures or diminish their effectiveness. Consequently, firms find it difficult to have uniform brand protection coverage across geographies, curtailing the overall impact of their tools and strategies, especially in weak enforcement economies of emerging markets.

Opportunities

-

Incorporation of machine learning and AI in brand protection technology is improving threat detection and opening doors to innovation.

Technological advancements have made possible smarter, faster, and more precise online brand abuse detection. Brand defense technologies enabled by artificial intelligence can now find fakes, impersonators, and unauthorized posting on thousands of online destinations in real time. Machine learning enhances the technologies by constantly refining detection based on changing threats and user behavior. This technology is not only turning brand protection into a business intelligence tool, but also into a legal defense. Technology vendors that incorporate these innovations are best positioned to offer predictive, customized solutions to more customers.

Deloitte's AI software "Dupe Killer" searches millions of web pages to identify design infringements, picking up unauthorized copies beyond trademark names. It reported 312 websites selling imitation products, suggesting legal action for 48% of instances.

Challenges

-

Insufficient awareness and concern for brand protection by businesses slows down investment and dilutes strategic reaction to threats.

Most organizations, particularly outside high-risk industries, still treat brand protection as an afterthought and not a strategic priority. This ignorance translates to reactive rather than proactive approaches with limited budget backing or executive attention. Without strong internal advocacy or cross-functional stewardship, even when tools are put in place, they are likely underleveraged. This organizational and cultural resistance is the biggest of all, particularly with online threats increasingly widespread and reputational harm instantly real in today's highly connected marketplace.

Segment Analysis

By Deployment

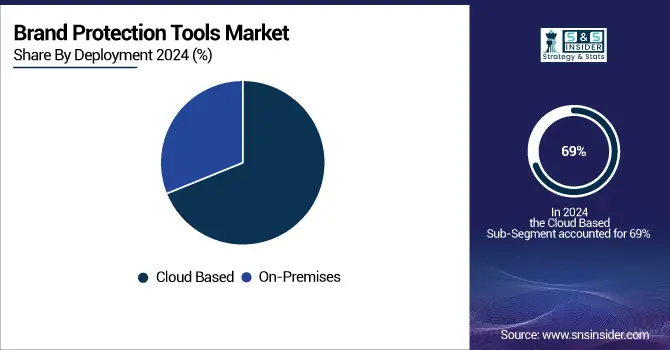

Cloud Based segment lead the Brand Protection Tools Market in terms of revenue share of roughly 69% in 2024 and is anticipated to progress at a fastest CAGR of roughly 9.72% during the forecast period from 2025–2032. The flexibility, cost effectiveness, and its capability to present real-time safety across global digital environments are major reasons behind it dominating the Market. Cloud-based solutions are favored due to their rapid deployment, scalability, and low infrastructure needs, making them suitable for small, medium-sized, and large organizations. Cloud-based solutions provide centralized threat identification, auto-takedown operations, and effortless updates, empowering businesses to remain at the forefront of emerging threats. As online commerce growth and cybersecurity threats increase, cloud adoption only gains momentum.

By Enterprise Size

Large enterprises led the Brand Protection Tools Market in 2024 with a 64% revenue share because of their widespread global reach, high brand value, and higher exposure to counterfeits across various digital channels. These players possess the financial resources and internal talent to spend on sophisticated brand protection technologies. Their proactive stance towards protecting brand value, compliance requirements, and customer confidence places them as the prime implementers of end-to-end protection solutions.

Small and medium-sized enterprises (SMEs) are anticipated to expand at the fastest CAGR of 10.25% during 2025-2032 due to rising digital adoption and enhanced awareness of IP threats. With SMEs growing online to reach wider markets, they are threatened by mounting risks of counterfeiting and brand impersonation. Economical and scalable cloud-based brand protection platforms are now available, allowing SMEs to actively track and protect their brand assets without the need for extensive in-house teams or significant capital investment.

By Application

The Consumer Goods and Retail industry accounted for the largest revenue percentage of 25% in 2024, primarily because the sector is most susceptible to counterfeiting products, unauthorized resellers, and copying packaging. Having powerful customer-facing brands and extensive online distribution channels, businesses in the industry are investing heavily in brand protection solutions to maintain brand integrity, trust from customers, and regulatory adherence. The industry's high number of SKUs and marketplace visibility make digital enforcement an ongoing and necessary process.

Pharmaceuticals and Healthcare are expected to record the highest growth at a CAGR of 12.31% over the forecast period of 2025-2032 due to mounting counterfeit drug threats and tightening worldwide regulations. With public health and safety at stake, the industry is facing increasing pressure to authenticate products and secure digital channels against fraud. Increasing use of e-pharmacies and cross-border medicine trade demand robust protection mechanisms to authenticate product origin, detect unauthorized listings, and authenticate compliance with health authority standards.

By Software Type

Digital Rights Management (DRM) Tools had the highest revenue share of 16% in 2024, with media, publishing, and software firms focusing on protecting copyrighted digital content from piracy and unauthorized distribution.Growing use of digital content and subscription services have made DRM a requirement for protecting intellectual property and maintaining revenue integrity. Businesses deploy these tools for access control, licensing, and encryption for various types of content and platforms.

Social Media Monitoring and Brand Reputation Management Tools are anticipated to grow at the highest CAGR of 11.92% from 2025-2032, as brand activity on social media increases and the risk of impersonation, fake reviews, and viral disinformation grows. With real-time consumer interaction on the rise, brands are giving importance to tools that provide real-time alerting, sentiment analysis, and automated removals. These provide protection to reputation, help preserve consumer trust, and act quickly towards reputational threats.

Regional Analysis

North America led the Brand Protection Tools Market in 2024 with a 38% revenue share, driven by effective regulatory landscapes, high penetration of digital commerce, and far-reaching intellectual property protection awareness. Companies in markets like technology, pharmaceuticals, and retail actively spend money on cutting-edge brand protection technology. The maturity of the digital ecosystem in the region and high-profile counterfeiting instances have pushed adoption of automated enforcement and monitoring technology in top U.S. and Canadian markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S. led the Brand Protection Tools Market with robust IP enforcement, strong digital adoption, and large investments from leading enterprises across industries.

Asia Pacific is expected to expand at the highest CAGR of 10.99% during 2025-2032 due to the rapid expansion of e-commerce, widening digital brand recall, and increasing IP infringements in countries like China, India, and Southeast Asia. With regional companies expanding across the world and increasingly confronting threats of counterfeiting, demand for cost-effective and scalable solutions for brand security is on the rise. Government programs towards IP expansion of laws and enforcement are also propelling quicker adoption in industries within the region.

China is leading the Asia Pacific Brand Protection Tools Market because of its huge e-commerce landscape, high rate of counterfeiting, and rising regulatory enforcement activities.

Europe is a significant region in the Brand Protection Tools Market fueled by strict intellectual property regulations, increasing e-commerce activity, and increasing awareness amongst businesses to protect brand value over digital channels.

Germany is leading the Brand Protection Tools Market across Europe based on its robust manufacturing sector, strong IP laws, and high digital security technology adoption.

The Latin America Brand Protection Tools and Middle East & Africa Brand Protection Tools markets are evolving rapidly due to increased digital uptake, wider counterfeit threats, and more government initiatives to strengthen intellectual property enforcement within these regions.

Key Players

Red Points, BrandShield, Corsearch, MarkMonitor, Counterfind, OpSec Security, NetNames, Sprockets, Incopro, Cimpress.

Recent Developments:

-

In 2024, MarkMonitor formed a strategic alliance with SecureWeb3 to provide comprehensive Web3 brand protection services to its clients

-

In 2024, Crane NXT acquired OpSec Security for $270 million, expanding its authentication solutions portfolio and creating a new Security and Authentication Technologies segment.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.17 Billion |

| Market Size by 2032 | USD 6.34 Billion |

| CAGR | CAGR of 9.11% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Software Type (Digital Rights Management Tools, Anti-Counterfeiting Solutions, Trademark Monitoring and Enforcement Tools, Domain Monitoring and Protection Tools, Social Media Monitoring and Brand Reputation Management Tools, Online Brand Enforcement Tools, Intellectual Property Protection Tools, Others) • By Deployment (Cloud Based, On-Premises) • By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)) • By Application (Consumer Goods and Retail, Pharmaceuticals and Healthcare, Electronics and Electrical, Automotive, Luxury Goods, Media and Entertainment, Software and Technology, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Red Points, BrandShield, Corsearch, MarkMonitor, Counterfind, OpSec Security, NetNames, Sprockets, Incopro, Cimpress |