Storage Area Network (SAN) Market Report Scope & Overview:

The Storage Area Network (SAN) Market Size was valued at USD 21.94 Billion in 2025E and is expected to reach USD 33.55 Billion by 2033 and grow at a CAGR of 5.48% over the forecast period 2026-2033.

The Storage Area Network (SAN) Market analysis driven by the data explosion in an enterprise due to cloud computing, big data analysis, and digital transformation. SAN solutions are being widely accepted by organizations looking for reliable high-speed scalable storage infrastructure to provide its user efficient storage management and tackle larger volumes of both structured and unstructured data. All flash storage arrays, NVMe over Fabrics (NVMe-oF), and software-defined storage are also taking SANs to the next level by making them faster, more efficient, and enabling better storage utilization, lower latency, and faster data access. Along with this, the increasing need for virtualization, server consolidation, and high-performance computing (HPC) in IT and telecom, BFSI, and healthcare sectors are driving the SAN growth in the world. According to study, Global enterprise data is expanding at an average rate of 40–50% annually, driving the need for high-capacity SAN infrastructure.

To Get More Information On Storage Area Network (SAN) Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 21.94 Billion

-

Market Size by 2033: USD 33.55 Billion

-

CAGR: 5.48% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Storage Area Network (SAN) Market Trends

-

Rapid enterprise data growth drives demand for high-speed, scalable SAN solutions.

-

Adoption of all-flash arrays and NVMe-oF improves storage efficiency significantly.

-

Increasing virtualization and server consolidation fuels SAN deployments across IT sectors.

-

Hybrid cloud integration enables flexible, scalable, and cost-effective storage solutions.

-

AI/ML-enabled SAN management optimizes performance, automates tasks, and predicts storage needs.

-

Expansion of high-performance computing (HPC) applications accelerates enterprise SAN adoption globally.

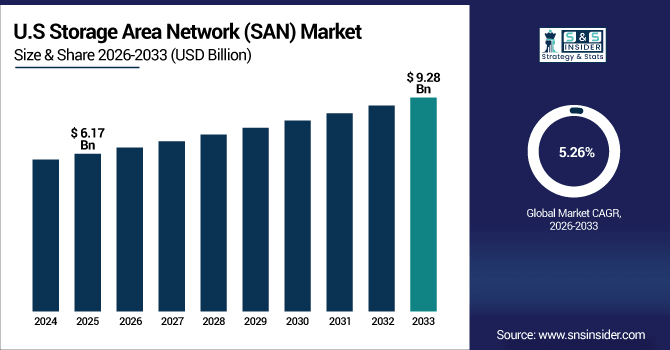

The U.S. Storage Area Network (SAN) Market size was USD 6.17 Billion in 2025E and is expected to reach USD 9.28 Billion by 2033, growing at a CAGR of 5.26% over the forecast period of 2026-2033, driven by high enterprise data growth, cloud adoption, and advanced storage technologies like NVMe-oF and all-flash arrays, driving demand for scalable, low-latency, and high-performance SAN solutions.

Storage Area Network (SAN) Market Growth Drivers:

-

Explosive Enterprise Data Growth Fuels Global Demand for Storage Area Network Solutions

The exponential growth of data across enterprises, as a result of the digital transformation journey, cloud computing, big data analytics, and IoT adoption, is the most significant factor contributing to Storage Area Network Market growth. Businesses need faster, consistent, and scalable storage technologies to efficiently process large amounts of structured and unstructured data. SANs offer dedicated storage networks that enable faster data access, lower latency and higher performance as compared to traditional direct-attached storage (DAS) systems. The growth of demand for all-flash arrays, NVMe over Fabrics (NVMe-oF) and software defined SANs also drives the rapid adoption growth since it improves storage efficiency, reduces bottlenecks and integrates seamlessly with virtualization, server consolidation, and high-performance computing (HPC) environments.

Storage Area Network implementation reduces average data access latency by 30–50% compared to traditional direct-attached storage (DAS).

Storage Area Network (SAN) Market Restraints:

-

High Implementation Costs Limit Storage Area Network Adoption Across Small Enterprises

Despite the advantages, the adoption for Storage Area Network Market is being restrained by its high capital and operational costs in terms of deployment and sustaining them. SAN hardware (fibre channel switches, host bus adapters (HBAs), controllers and storage arrays) can be extremely expensive, which makes it impossible for small and medium-sized enterprises (SMEs) to afford it. Furthermore, embedding SANs into the current IT framework requires a technical skill set, driving up labor costs and lagging implementation. Similar to the TCO restricting adoption, especially in cost-conscious industries, the TCO encompasses upgrades, maintenance, and power consumption.

Storage Area Network (SAN) Market Opportunities:

-

Hybrid Cloud Integration and AI Innovation Unlock Storage Area Network Market Potential

The Storage Area Network Market presents significant growth opportunities through hybrid cloud integration and AI/ML enabled storage optimization. Organizations today are shifting towards hybrid cloud environments, where part of the storage is on-premises SANs and then there is the cloud storage providing flexibility, scalability, and disaster recovery capabilities. AI and machine learning solutions can improve Storage Area Network management by forecasting storage requirements and locations, optimizing data placement or automating sticky storage maintenance tasks by maximizing performance efficiency. This simplification of operations needs organizations to optimize return on investment and sensor and storage capabilities create a unique opportunity for SAN vendors to offer next gen technology inclusion, intelligent storage continuous to track emerging enterprise technical requirements.

AI-driven Storage Area Network optimization can reduce storage management workload by 30–40%.

Storage Area Network (SAN) Market Segmentation Analysis:

-

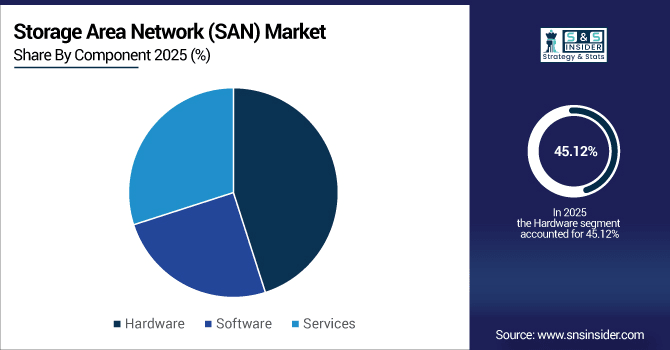

By Component: In 2025, Hardware led the market with a share of 45.12%, while Services is the fastest-growing segment with a CAGR of 7.10%.

-

By Technology: In 2025, Fibre Channel (FC) SAN led the market with a share of 40.30%, while NVMe over Fabrics (NVMe-oF) is the fastest-growing segment with a CAGR of 5.23%.

-

By Application: In 2025, Data Backup & Recovery led the market with a share of 38.10%, while Virtualization & Server Consolidation is the fastest-growing segment with a CAGR of 6.20%.

-

By End-Use Industry: In 2025, BFSI led the market with a share of 29.40%, while IT & Telecom is the fastest-growing segment with a CAGR of 6.80%.

By Component, Hardware Leads Market and Services Fastest Growth

The Hardware component in the Storage Area Network (SAN) Market is expected to wield the most influence, spurred on by the rising implementation of efficient storage arrays, host bus adapters (HBAs), Fibre Channel switches and controllers in enterprise data centers. Beyond the keyword level, hardware is important for organizations that want their storage infrastructure to be as reliable, scalable, and low-latency as possible for the hundreds of petabytes of structured and unstructured data that never stops coming. On the other hand, the Services segment is anticipated to grow at the highest pace due to increase in demand for consulting, installation, maintenance, and managed services related to Storage Area Network.

By Technology, Fibre Channel (FC) SAN Leads Market and NVMe over Fabrics (NVMe-oF) Fastest Growth

In the Storage Area Network (SAN) Market, Fibre Channel (FC) dominate the Market, due to its higher reliability, lower latency and high-performance which have been tried and tested for large volumes of mission-critical enterprise data. FC SAN remains the storage networks of choice for enterprises spanning IT, BFSI, healthcare, and the manufacturing sectors due to of its reliable connectivity, the high-speed transmission of data, and the provision of virtualization and high-performance computing (HPC) tactile environments, and the ability for virtually all systems to be linked together by one single device. On the other hand, NVMe over Fabrics (NVMe-oF) is expected to witness the highest growth in the forecast period also due to ultra-low latency, high throughput, and its smooth implementation with different all-flash storage arrays. The growing use of NVMe-oF is driven by the need for high-speed storage performance, scalability, and emerging hyper-optimized datacenter solutions of modern digital architectures.

By Application, Data Backup & Recovery Leads Market and Virtualization & Server Consolidation Fastest Growth

The Data Backup and Recovery is expected to hold the highest market share in the Storage Area Network (SAN) Market, growing demand for secure, reliable, and high-speed storage solutions to prevent critical enterprise data, from loss, corruption, and downtime. Diverse organizations across BFSI, IT, healthcare, and manufacturing segments are depending on SANs more than ever to continue their business unaffected, chaos-free disaster recovery, and of course, meet the stringent data compliance obligations. Simultaneously, Virtualization & Server Consolidation is scouted to witness the highest growth over the forecast period as enterprise adapt SAN solution in order to manage the IT infrastructure more efficiently, lower the operational costs and to get most out of underutilized hardware. That is contributing to this segment being adopted much faster, is the accelerating need for cloud integration, high-performance computing (HPC) and effective data management.

By End-Use Industry, BFSI Leads Market and IT & Telecom Fastest Growth

In the Storage Area Network (SAN) Market, the BFSI sector is expected to lead, due to the critical requirement for fast, risk free, and scalable storage solutions to manage sensitive financial data, ensure regulatory compliances and to facilitate disaster recovery operations. At the same time, IT & Telecom is estimated to exhibit the fastest market growth in the forecast period, due to the digital transformation, cloud adoption, and data center expansion. As such, increasing virtualization, server consolidation, high-performance computing, and hybrid cloud integration demand, also helps SAN adoption in this segment as it helps organizations optimize both storage efficiency and operational performance.

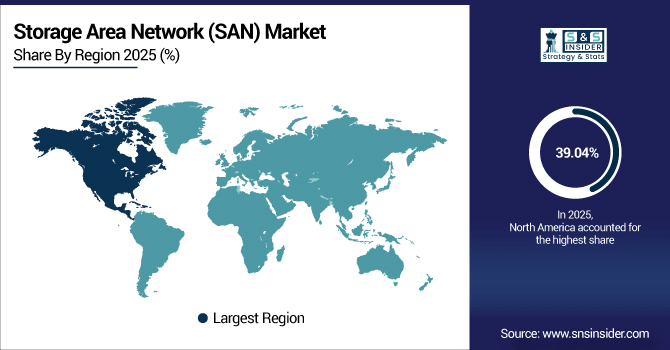

Storage Area Network (SAN) Market Regional Analysis:

North America Storage Area Network (SAN) Market Insights:

The Storage Area Network (SAN) Market in North America held the largest share 39.04% in 2025, owing to major technology vendors presence, advanced data center infrastructure and high adoption of cloud computing and virtualization technologies. However, with large amounts of structured & unstructured data generation, enterprise organizations mainly from BFSI, IT, healthcare and manufacturing sectors are increasingly deploying SAN solutions to reduce data loss, enhance business continuity and improve performance of computing applications. All-flash arrays, NVMe over Fabrics (NVMe-oF), and software-defined storage are increasing performance, lowering latency, and maximizing storage efficiency, fueling additional growth in the market. Increased IT budgets and perpetual digital transformation programs boost the market growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Storage Area Network (SAN) Market with Advanced Technological Adoption

The U.S. dominates the Storage Area Network (SAN) market, driven by advanced technological adoption, high cloud integration, all-flash storage deployment, and strong demand for virtualization, server consolidation, and high-performance computing solutions.

Asia Pacific Storage Area Network (SAN) Market Insights

In 2025, Asia Pacific is the fastest-growing region in the Storage Area Network (SAN) Market, projected to expand at a CAGR of 6.26%, owing rapid digital transformation initiatives, increasing cloud adoption, and enterprise data center expansion are driving the demand for SAN solutions in the region. Increasing need for high-speed, reliable, and scalable storage solutions across IT, BFSI, healthcare, and manufacturing industries is promoting SAN deployment. Moreover, the rising investments in cloud infrastructure, growing emphasis on data security, and the need for highly efficient disaster recovery solutions are also propelling the growth of Storage Area Network in the region.

China and India Propel Rapid Growth in Storage Area Network (SAN) Market

China and India propel rapid growth in the Storage Area Network (SAN) market, driven by increasing digital transformation, cloud adoption, advanced storage technologies, and rising demand for high-performance, scalable enterprise solutions.

Europe Storage Area Network (SAN) Market Insights

The Europe Storage Area Network (SAN) Market has witnessed steady growth owing to mounting enterprise requirement for a highly dependable, high-speed and scalable storage system. With the need to have the data available on demand due to various big data implementations and the increase in volume of structured and unstructured data due to the digitalisation across IT, BFSI, healthcare and manufacturing, organisations require SANs for efficient data management along with business continuity and disaster recovery. Furthermore, surge in investments towards data center, cloud framework, and cloud driven IT modernization initiatives, along with high degree of data security & compliance obligation are propelling the market growth in Europe.

Germany and U.K. Lead Storage Area Network (SAN) Market Expansion Across Europe

Germany and the U.K. lead Storage Area Network (SAN) market expansion across Europe, driven by increasing enterprise storage requirements, advanced data center infrastructure, cloud adoption, and deployment of high-performance SAN technologies.

Latin America (LATAM) and Middle East & Africa (MEA) Storage Area Network (SAN) Market Insights

The Storage Area Network (SAN) market in Latin America (LATAM) and the Middle East & Africa (MEA) is witnessing steady growth, driven by increasing digitalization and rising demand for high-performance, scalable storage solutions across industries. Enterprises in BFSI, IT, healthcare, and government sectors are adopting advanced SAN technologies, including NVMe and software-defined storage, to optimize data management, enhance business continuity, and support virtualization and cloud integration. Expansion of data centers, growing cloud adoption, and the need for efficient disaster recovery solutions are further fueling SAN market growth across both LATAM and MEA regions.

Storage Area Network (SAN) Market Competitive Landscape

IBM delivers SAN solutions that integrate AI-driven analytics, hybrid cloud capabilities, and predictive storage management. Its offerings ensure high availability, scalability, and performance for enterprise workloads. IBM’s SAN infrastructure supports virtualization, server consolidation, and high-performance computing, enabling businesses to optimize data storage efficiency and accelerate digital transformation initiatives.

-

In April 2025, IBM launched a specialized AI mainframe to support large language models and generative AI workloads, enhancing SAN capabilities.

Cisco provides SAN solutions through advanced networking, including Fibre Channel switches, storage networking software, and AI-integrated platforms. Its SAN offerings facilitate high-speed, low-latency data transfer, hybrid cloud integration, and secure enterprise storage, enabling organizations to manage growing data volumes and support critical applications across IT, BFSI, and healthcare sectors.

-

In September 2025, Cisco introduced software aimed at connecting quantum computing clouds, facilitating the integration of SANs with emerging quantum technologies.

Lenovo offers a comprehensive SAN portfolio, including ThinkSystem and ThinkAgile storage solutions, designed to support high-performance computing, virtualization, and hybrid cloud environments. The company focuses on AI-driven storage management, capacity forecasting, and automated data placement, helping enterprises optimize efficiency, reduce latency, and scale infrastructure reliably.

-

In April 2025, Lenovo unveiled its largest storage portfolio refresh, introducing new ThinkSystem and ThinkAgile SAN models equipped with machine learning algorithms for automated data placement and capacity forecasting.

Storage Area Network (SAN) Market Key Players:

Some of the Storage Area Network (SAN) Market Companies are:

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

NetApp Inc.

-

IBM Corporation

-

Cisco Systems Inc.

-

Pure Storage

-

Hitachi Vantara

-

Broadcom Inc. (Brocade)

-

Western Digital

-

Fujitsu Limited

-

Huawei Technologies Co., Ltd.

-

Lenovo Group Limited

-

DataCore Software Corporation

-

StarWind Software Inc.

-

Nutanix, Inc.

-

NEC Corporation

-

Arista Networks Inc.

-

ATTO Technology Inc.

-

Citrix Systems Inc.

-

Kaminario Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 21.94 Billion |

| Market Size by 2033 | USD 33.55 Billion |

| CAGR | CAGR of 5.48 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Technology (Fibre Channel (FC) SAN, iSCSI SAN, Fibre Channel over Ethernet (FCoE), NVMe over Fabrics (NVMe-oF), Others) • By Application (Data Backup & Recovery, Disaster Recovery & Business Continuity, Data Archiving, High-Performance Computing (HPC), Virtualization & Server Consolidation, Others) • By End-Use Industry (IT & Telecom, BFSI, Healthcare & Life Sciences, Government & Defense, Retail & E-Commerce, Manufacturing, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Dell Technologies, Hewlett Packard Enterprise (HPE), NetApp Inc., IBM Corporation, Cisco Systems Inc., Pure Storage, Hitachi Vantara, Broadcom Inc. (Brocade), Western Digital, Fujitsu Limited, Huawei Technologies Co., Ltd., Lenovo Group Limited, DataCore Software Corporation, StarWind Software Inc., Nutanix, Inc., NEC Corporation, Arista Networks Inc., ATTO Technology Inc., Citrix Systems Inc., Kaminario Inc., and Others. |