Data Observability Market Report Scope & Overview:

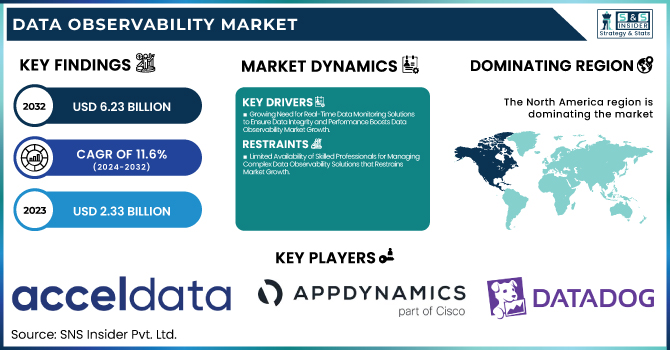

The Data Observability Market Size was valued at USD 2.33 Billion in 2023 and is expected to reach USD 6.23 Billion by 2032 and grow at a CAGR of 11.6% over the forecast period 2024-2032.

To Get more information on Data Observability Market - Request Free Sample Report

The market is a rapidly evolving segment within the broader data management and analytics industry, driven by the increasing reliance on data for decision-making across various sectors. It enables businesses to monitor, track, and ensure the health of their data systems, providing insights into data quality, availability, and performance. As the volume, variety, and velocity of data continue to surge, the need for robust monitoring tools that can handle complex data environments becomes crucial. The market’s expansion is further fueled by the rising demand for automated solutions that improve operational efficiency and reduce manual efforts.

The U.S. Data Observability Market size was USD 0.71 billion in 2023 and is expected to reach USD 1.71 billion by 2032, growing at a CAGR of 10.43% over the forecast period of 2024-2032.

The U.S. Data Observability Market is experiencing significant growth as organizations increasingly prioritize data monitoring and quality management. With the rising complexity of data systems and the need for real-time insights, businesses across various industries are adopting advanced observability solutions. These tools help ensure data integrity, improve performance, and enhance decision-making capabilities. As data-driven strategies continue to evolve, the demand for comprehensive data observability solutions in the U.S. is expected to grow, supporting the market's expansion in the coming years.

Data Observability Market Dynamics

Key Drivers:

-

Growing Need for Real-Time Data Monitoring Solutions to Ensure Data Integrity and Performance Boosts Data Observability Market Growth

The growing need for real-time data monitoring is a key driver of the data observability market’s growth. As organizations increasingly rely on data for decision-making, they require real-time insights into the health, availability, and performance of their data systems. Real-time monitoring enables businesses to detect and resolve issues promptly, minimizing downtime and ensuring smooth operations. This need is particularly important in sectors such as finance, healthcare, and e-commerce, where even a minor data failure can have significant consequences.

Moreover, with the rising complexities of data environments, organizations are looking for solutions that provide automated, end-to-end monitoring capabilities. As the volume and diversity of data continue to increase, the demand for effective and efficient real-time data monitoring solutions is expected to rise, fueling market expansion. With advancements in AI and machine learning technologies, these observability tools are becoming more predictive, further boosting the growth of the market.

Restrain:

-

Limited Availability of Skilled Professionals for Managing Complex Data Observability Solutions that Restrains Market Growth

Data observability solutions are often complex, requiring specialized expertise to implement, maintain, and optimize. Organizations face challenges in finding talent with the right skill set to manage these tools effectively. This talent shortage hampers the widespread adoption of observability solutions, particularly among small and medium-sized enterprises (SMEs) that may not have the resources to hire and retain highly skilled professionals. The demand for expertise in areas such as machine learning, AI, and cloud computing, which are critical components of modern data observability tools, only exacerbates the issue.

The complexity of integrating these solutions into existing IT infrastructures also adds to the challenge, further delaying deployment and adoption. While the industry is actively working on simplifying these tools, the skills gap remains a significant barrier. Without sufficient expertise to optimize these solutions, organizations risk not fully capitalizing on the potential benefits of data observability, leading to slower market adoption in certain regions and industries.

Opportunity:

-

Integration of AI and Machine Learning Technologies Presents Significant Opportunity for Advancing Data Observability Capabilities

The integration of AI and machine learning technologies into data observability tools presents a tremendous opportunity for the market. As organizations continue to generate vast amounts of data, it becomes increasingly difficult to monitor, manage, and ensure the quality of this data without advanced technologies. AI and machine learning can automate anomaly detection, identify patterns, and predict potential data issues before they occur, significantly improving the efficiency of observability solutions.

Moreover, AI-driven observability tools can continuously learn from data patterns, improving their accuracy and adaptability over time. As industries such as finance, healthcare, and retail adopt these advanced technologies, the demand for AI-powered data observability solutions is expected to rise, presenting substantial growth opportunities for vendors. Furthermore, these tools can help organizations enhance data security, optimize performance, and improve compliance with regulatory standards, making them an invaluable asset in today’s data-driven world.

Challenges:

-

Data Privacy and Security Concerns Present Significant Challenges in Adopting Data Observability Solutions

As organizations implement observability tools to monitor and analyze their data, they expose sensitive and proprietary information to potential risks. Given that observability tools often need access to vast amounts of data across multiple platforms, ensuring that this data is protected from breaches, unauthorized access, and cyberattacks is a major challenge. Many businesses are concerned about how observability solutions can maintain the confidentiality and security of their data, especially when using third-party vendors or cloud-based platforms.

Additionally, the regulatory landscape surrounding data privacy is becoming more stringent, with frameworks like GDPR and CCPA requiring organizations to meet specific compliance standards. Ensuring that observability tools are compliant with these regulations while providing real-time insights can be a delicate balancing act. As organizations increasingly prioritize data security, the challenge lies in finding observability solutions that can offer effective monitoring without compromising data privacy. Addressing these concerns will be critical for the continued growth and adoption of data observability solutions across industries.

Data Observability Market Segment Analysis

By Component

In 2023, the Solution segment of the data observability market accounted for the largest revenue share, standing at 62%. This is primarily due to the increased demand for end-to-end monitoring solutions that ensure the health and reliability of data systems. Several companies have introduced innovative product developments in this area. For instance, companies like Datadog and Splunk have launched new observability tools focused on improving data monitoring capabilities across cloud environments. Their solutions use machine learning to automatically detect and resolve data issues, driving the demand for such tools. The growth of digital transformation initiatives across various sectors has fueled the widespread adoption of these solutions.

The Services segment within the data observability market is anticipated to grow at the highest CAGR of 12.5% during the forecast period. The demand for implementation, consulting, and managed services is rising as businesses seek expert guidance to adopt data observability tools. Leading firms like IBM and Accenture are launching tailored services to help organizations transition to observability-driven data management systems.

Additionally, managed services are gaining traction due to the increasing complexity of data environments. Outsourcing data observability to experts allows organizations to focus on core business operations while experts handle the data monitoring, troubleshooting, and analytics. As the market for data observability services grows, these offerings will become essential for businesses that need to maintain high data quality standards.

By Deployment

The Public Cloud deployment segment is the dominant force in the data observability market in 2023, commanding the largest revenue share. Public cloud services like AWS, Microsoft Azure, and Google Cloud provide the scalability and flexibility needed for data observability solutions. Their adoption enables businesses to scale their data monitoring capabilities according to demand without the need for extensive on-premise infrastructure. These cloud platforms also offer integrated AI and machine learning tools to enhance observability functionalities. With growing digitalization, organizations are increasingly adopting public cloud solutions for their data analytics and management needs, driving the demand for cloud-based observability tools.

The Private Cloud segment is expected to grow at the highest CAGR during the forecast period in the data observability market. Organizations concerned about data privacy and control are shifting toward private cloud solutions for their observability needs. This segment allows businesses to maintain the dedicated infrastructure that is secure and compliant with data governance regulations. Companies such as Oracle and IBM have introduced private cloud solutions that offer enhanced data observability features tailored to the needs of enterprises in regulated industries like finance and healthcare. As businesses increasingly prioritize security and regulatory compliance, the private cloud segment is set to gain substantial traction, providing growth opportunities for both software vendors and service providers in the market.

By End-Use

The BFSI sector holds the largest share of the data observability market, representing 32% of total revenue in 2023. This sector has increasingly adopted data observability solutions to improve data quality, reduce fraud, and enhance regulatory compliance. Financial institutions like JPMorgan and Bank of America are leveraging advanced data observability tools to ensure the health of their vast data ecosystems, which include sensitive customer information. With the growing complexity of financial transactions and regulatory requirements, data observability plays a critical role in maintaining high levels of data integrity. As more organizations in the BFSI sector prioritize data-driven decision-making, the demand for observability solutions is expected to rise, further solidifying this sector's dominant position in the market.

The IT & Telecom segment is anticipated to grow at the highest CAGR of 12.6% within the forecast period in the data observability market. With the rise of digital transformation and increased data traffic, the IT & telecom sectors are heavily investing in observability tools to ensure optimal data performance. Leading companies like Cisco and Ericsson are enhancing their data observability offerings to improve the performance of networks and infrastructure. These tools help manage the high volumes of data generated by telecommunications networks, ensuring uptime and service continuity. As the demand for faster and more reliable data services grows, the IT & telecom segment will continue to lead in terms of growth rate, creating significant opportunities for service providers in the data observability space.

Regional Analysis

North America was the dominant region in the data observability market in 2023, with an estimated market share of over 43%. The region's dominance is driven by the high adoption of advanced technologies and the presence of key players like Splunk, Datadog, and New Relic. These companies have introduced cutting-edge solutions that help businesses improve data monitoring and troubleshooting. Additionally, the strong regulatory framework in the U.S. and Canada, particularly around data privacy and security, has accelerated the adoption of observability solutions. The increasing focus on cloud-based data solutions and AI-driven technologies further strengthens North America's position as the leading region in the market.

Asia Pacific is the fastest-growing region in the data observability market, with a projected CAGR of 12.9% during the forecast period. The rapid digitalization in countries like China, India, and Japan is a significant driver of this growth. As businesses in these regions undergo digital transformation, the need for data observability solutions to ensure data quality, availability, and performance becomes critical. The rise of e-commerce, fintech, and cloud computing in the region has led to a surge in demand for observability tools that can manage complex data systems. With increasing investments in AI and machine learning technologies, the Asia Pacific market is poised for exponential growth, creating ample opportunities for vendors to expand their presence.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Acceldata (Acceldata Platform, Acceldata Data Observability)

-

AppDynamics (AppDynamics Performance Monitoring, AppDynamics Business iQ)

-

Datadog (Datadog Log Management, Datadog Cloud Security Platform)

-

Dynatrace LLC (Dynatrace Smart Cloud Monitoring, Dynatrace AI-Powered Observability)

-

Hound Technology, Inc. (Hound Platform, Hound Data Solutions)

-

International Business Machines Corporation (IBM) (IBM Watson Studio, IBM Observability Platform)

-

Microsoft (Microsoft Azure Monitor, Microsoft Power BI)

-

Monte Carlo (Monte Carlo Data Observability, Monte Carlo Data Quality Management)

-

New Relic, Inc. (New Relic One, New Relic Infrastructure Monitoring)

-

Splunk Inc. (Splunk Enterprise, Splunk Observability Cloud)

Recent Trend

-

In March 2024, AppDynamics enhanced its platform's observability capabilities by integrating advanced AI-driven insights, allowing organizations to proactively identify issues across their entire tech stack. This integration enables quicker resolution of data issues, ensuring better business continuity

-

In 2024, Dynatrace launched a next-gen version of its observability platform, incorporating deeper AI and machine learning features for better root cause analysis. This upgrade is set to optimize data flows, allowing enterprises to predict and fix issues before they impact business operations

-

In October 2023, Acceldata reported significant growth, achieving 150% year-over-year revenue growth and expanding its customer base with major Fortune 500 clients. The company also raised an additional USD 10 million in Series C funding, bringing the total to over USD 100 million. This momentum is supporting its product innovation and market expansion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.33 Billion |

| Market Size by 2032 | US$ 6.23 Billion |

| CAGR | CAGR of 11.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Deployment (Public Cloud, Private Cloud) • By End Use (BFSI, IT & Telecom, Government & Public Sector, Energy & Utility, Manufacturing, Healthcare & Life Sciences, Retail & Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acceldata, AppDynamics, Datadog, Dynatrace LLC, Hound Technology, Inc., International Business Machines Corporation (IBM), Microsoft, Monte Carlo, New Relic, Inc., Splunk Inc. |