Game Server Hosting Platform Market Report Scope & Overview:

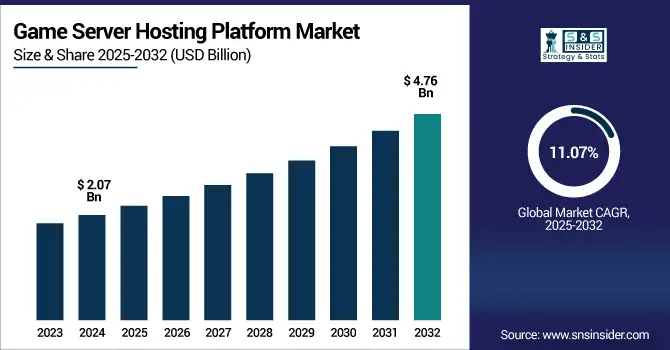

Game Server Hosting Platform Market was valued at USD 2.07 billion in 2024 and is expected to reach USD 4.76 billion by 2032, growing at a CAGR of 11.07% from 2025-2032.

To Get more information on Game Server Hosting Platform Market - Request Free Sample Report

The growth of the Game Server Hosting Platform Market is driven by the rising popularity of multiplayer and cloud-based gaming, the increasing demand for low-latency and high-performance gaming experiences, and the rapid expansion of the esports industry. Game developers and studios are shifting toward scalable, flexible hosting solutions to support global user bases and dynamic game loads. Additionally, the surge in mobile and cross-platform gaming is boosting the need for reliable server infrastructure. Advancements in cloud technology and edge computing are also enhancing server capabilities, driving further market expansion.

-

AWS powers games like Fortnite, Roblox, and League of Legends, serving 750 million gamers monthly on its platform.

-

Azure PlayFab powers over 1,200 live games with 80 million monthly active players, offering virtual servers and container orchestration for scaling from hundreds to millions of players.

-

PlayFab servers can run 200-player sessions on modest VMs, simplifying reliability and performance versus peer-to-peer setups.

U.S. Game Server Hosting Platform Market was valued at USD 0.55 billion in 2024 and is expected to reach USD 1.25 billion by 2032, growing at a CAGR of 10.75% from 2025-2032.

The U.S. Game Server Hosting Platform Market is growing due to the rising demand for immersive multiplayer experiences, increasing adoption of cloud gaming, strong esports presence, and the need for scalable, low-latency infrastructure to support expanding online and mobile gaming communities.

Market Dynamics

Drivers

-

Rising Demand For Multiplayer Online Games Is Accelerating The Need For Scalable, Low-Latency Game Server Hosting Solutions Globally.

With the rise of multiplayer and online competitive games, developers are being pushed in the direction of more powerful server hosting platforms. Scalable infrastructure with low-latency performance found in these platforms, enable real-time interaction, seamless gameplay, and scalability for widespread user engagement. Cloud and Dedicated servers are a perfect fit for these requirements, minimizing latency and improving the user experience. This is particularly crucial in esports and battle royale titles, where seamless play is integral to retention and monetization. This only serves to increase the pace of the market as the online gaming user base expands incessantly.

-

Epic’s Fortnite, built on AWS, supports 125 million players and processes 2 petabytes of data per month, running across 24 AWS availability zones to ensure low-latency and global scalability.

-

Meanwhile, indie developers using PlayFab for Unreal Engine 5-based MMORPGs have achieved scalable infrastructure supporting 300+ in-game objects per server, with containerized deployment costs as low as ₹0.02–0.07 per connection per month.

Restraints

-

Security Vulnerabilities And Ddos Threats Pose Serious Risks To Uninterrupted Gameplay And Trust In Hosted Server Platforms.

Game servers are a major target of cyber attacks, and in particular, Distributed Denial of Service (DDoS) attacks that disrupt gameplay and knock the server offline. They ruin player experience, damage trust, and cost money in refunds or negative reviews. Ongoing security holes can even compromise end user data and harm brand reputation. Hosting platforms take protective measures, but as new threats emerge, they must adapt and have updated cybersecurity protocols in place. For developers, this creates complications during deployment which further leads to greater dependence on dedicated security solutions, which otherwise adds to the complexity of server hosting.

-

In H1 2024, the gaming sector was the primary target for DDoS attacks, accounting for 49% of all attempts up 46% compared to H1 2023 totaling 830,000 incidents. UDP floods accounted for 61%, often overwhelming game servers.

-

Cloudflare mitigated a record-breaking 37.4 TB attack in 45 seconds (~7.3 Tbps), showcasing the escalating scale of modern DDoS threats.

Opportunities

-

Increasing Popularity Of Esports And Game Streaming Is Driving Demand For Reliable And High-Performance Server Hosting Infrastructure.

Esports and real-time game streaming around the world is increasing the global demand of large-scale, low-latency interactions and therefore, demand more robust infrastructures of servers. Gamers and streamers have a need for speed, so hosting providers must respond with customizable servers, regional redundancy and high data throughput. Supporting brands are the driving force of premium infrastructure investment. Further, previous new streams from businesses beyond gaming, such as entertainment and media, are fueling convergence to present different types of partnership opportunities for server providers and driving expansion into hybrid entertainment-gaming delivery models and their growing impact on the server hosting market scope.

-

In 2024 alone, fans watched 3.26 billion hours of esports content, setting a new annual record. Peak viewership for the League of Legends World Championship in 2024 hit approximately 6.9 million concurrent viewers, the highest in esports history.

-

The BLAST.tv Counter‑Strike Major in Austin (June 2025) is expected to draw 220 million online viewers alongside 40,000+ in-person audiences.

Challenges

-

Ensuring Consistent Low-Latency Performance Across Geographically Dispersed Player Bases Remains Technically Complex And Resource-Intensive.

With games going global, it is very difficult to keep latency low in remote or developing regions. The quality of the internet might be poor, the routing delays too long, and the data center access might be restricted to make it a less-than-optimal experience. By contrast, hosting providers will have to invest in edge servers, and dynamic load balance, complicating and expanding costs. For latency-sensitive game genres such as FPS games and MMORPGs, real-time synchronization is desired and infrastructure optimization is necessary. Variability is counter-productive in driving player churn and bad reviews that are deal-breakers for developers who want to branch out to wider geographical territories.

Segment Analysis

By End-User

Game developers held the largest revenue share of 36% in 2024 due to their direct involvement in building and deploying multiplayer games requiring reliable server infrastructure. As developers increasingly prioritize user experience, latency reduction, and seamless online interactions, they invest heavily in scalable hosting solutions. Customizable server settings and integration with major engines like Unity and Unreal further drive adoption, positioning developers as the primary clients in the game server hosting ecosystem.

Esports organizations are projected to grow at the fastest CAGR of 12.37% from 2025 to 2032, driven by the rising number of tournaments and global viewership. These organizations demand ultra-low latency, high concurrency, and regionally distributed server infrastructure to ensure fair, real-time gameplay. Their emphasis on professional standards, sponsor expectations, and audience engagement compels significant investment in high-performance hosting. As esports monetization grows, hosting services become essential operational assets, accelerating market expansion.

By Type

Cloud hosting led the market with a 39% revenue share in 2024 due to its flexibility, scalability, and ability to support dynamic traffic loads. Developers and publishers prefer cloud solutions for their pay-as-you-go models and geographic reach, ensuring low-latency experiences across global user bases. Integration with DevOps workflows and managed services also reduces infrastructure management burdens, making cloud hosting the default choice for most multiplayer and online-first games.

VPS hosting is expected to grow at the fastest CAGR of 13.61% from 2025 to 2032, fueled by rising demand among indie developers and small studios. VPS offers a cost-effective balance between performance and customization, appealing to developers with limited budgets. It allows isolated environments and greater control compared to shared hosting, while avoiding the higher costs of dedicated servers. As more mid-tier studios seek control without high capital expenditure, VPS adoption continues to rise rapidly.

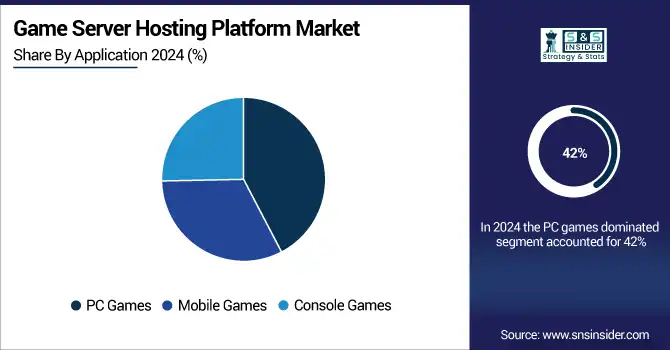

By Application

PC games dominated the market in 2024 with a 42% revenue share, owing to their complex architectures and demand for high-performance, customizable server environments. PC titles, especially in the MMO, FPS, and strategy genres, rely heavily on robust multiplayer infrastructure. Game developers prioritize PC-first releases with dedicated server support to meet performance expectations. Additionally, the modding community and esports players contribute to higher server usage and greater hosting requirements.

Mobile games are set to grow at the fastest CAGR of 12.66% from 2025 to 2032, driven by massive user adoption in emerging markets and increasing multiplayer capabilities. With mobile-first development becoming widespread, developers are integrating real-time online features like PvP, team play, and leaderboards. Hosting providers are responding with lightweight, scalable backend solutions tailored for mobile environments. Growing investment in 5G and mobile cloud gaming further fuels this segment’s rapid expansion.

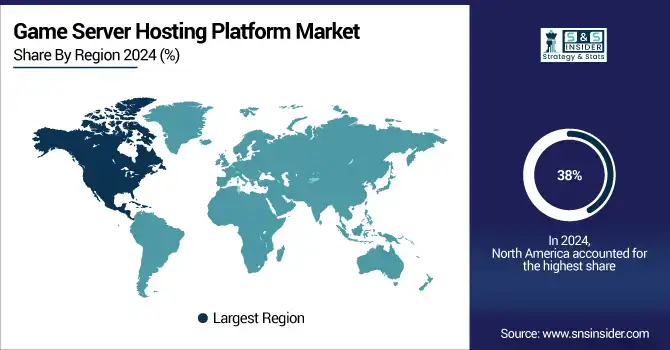

Regional Analysis

North America

North America accounted for the largest revenue share of 38% in 2024 due to its mature gaming ecosystem, high internet penetration, and strong presence of leading game developers and publishers. The region also hosts numerous esports leagues, game studios, and tech infrastructure providers that rely on high-performance server hosting. Continuous innovation in gaming technologies and widespread adoption of multiplayer and cloud-based games further cement North America’s dominance in the game server hosting market.

-

Over 80% of U.S. data center capacity is clustered in 15 states, notably Virginia and Texas, which are major game server hosting hubs.

-

Amazon GameLift (part of AWS) enables game developers to spin up to 9,000 game servers per minute, with autoscaling that supports up to 100 million concurrent players, effectively matching demand in real time.

The U.S. is dominating the Game Server Hosting Platform Market due to its advanced gaming infrastructure, major developer presence, and high online multiplayer engagement.

Asia Pacific

Asia Pacific is projected to grow at the fastest CAGR of 12.97% from 2025 to 2032, driven by a massive gaming population, rising smartphone usage, and increasing investment in digital infrastructure. Countries like China, India, and Southeast Asian nations are witnessing explosive growth in mobile and online gaming. Government support for esports, rapid urbanization, and the expansion of 5G networks are enhancing connectivity, enabling developers to deliver scalable, low-latency gaming experiences across the region.

-

As of July 2023, China had nearly 1.97 million 5G base stations, covering all prefecture-level cities and 96% of towns.

-

As of May 2025, India now has over 591 million gamers, with the number of esports athletes quadrupling in recent years.

China is dominating the Game Server Hosting Platform Market in Asia Pacific due to its massive gaming population, strong esports industry, and advanced data infrastructure.

Europe

Europe holds a strong position in the Game Server Hosting Platform Market, supported by advanced digital infrastructure, rising esports engagement, and growing demand for multiplayer gaming experiences. The region’s expanding cloud adoption and developer activity continue to drive market growth.

The United Kingdom is dominating the Game Server Hosting Platform Market in Europe, supported by its strong gaming industry, esports ecosystem, and cloud infrastructure.

Middle East & Africa and Latin America

Middle East & Africa and Latin America are emerging markets in the Game Server Hosting Platform space, driven by increasing internet access, mobile gaming growth, and rising youth engagement. Infrastructure development and regional investments are gradually accelerating hosting demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Amazon Web Services (AWS), Google Cloud Platform (GCP), Microsoft Azure, IBM Cloud, Alibaba Cloud, OVHcloud, Rackspace Technology, NVIDIA, Liquid Web, GameServers.com, Multiplay (Unity), Nitrado, HostHorde, Blue Fang Solutions, Akliz.

Recent Developments:

-

2025: AWS open‑sourced the GameLift Server SDKs (C++, C#, Go) on GitHub, simplifying integration with Unreal, Unity, ARM servers, and community contributions.

-

2025: Google Cloud Platform showcased Agones + Open Match + Gemini AI integration for scalable “living” multiplayer servers on GKE, enabling dynamic NPCs and narratives.

-

2023: Microsoft Azure PlayFab launched Economy v2, now generally available, offering powerful tools for managing in-game economies with multiple currencies and marketplace support.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.07 Billion |

| Market Size by 2032 | USD 4.76 Billion |

| CAGR | CAGR of 11.07% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Shared Hosting, Dedicated Hosting, Cloud Hosting, VPS Hosting) • By Application (PC Games, Mobile Games, Console Games) • By End-User (Individual Gamers, Professional Gamers, Game Developers, Esports Organizations) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amazon Web Services (AWS), Google Cloud Platform (GCP), Microsoft Azure, IBM Cloud, Alibaba Cloud, OVHcloud, Rackspace Technology, NVIDIA, Liquid Web, GameServers.com, Multiplay (Unity), Nitrado, HostHorde, Blue Fang Solutions, Akliz |