Business Process Management Market Report Scope & Overview:

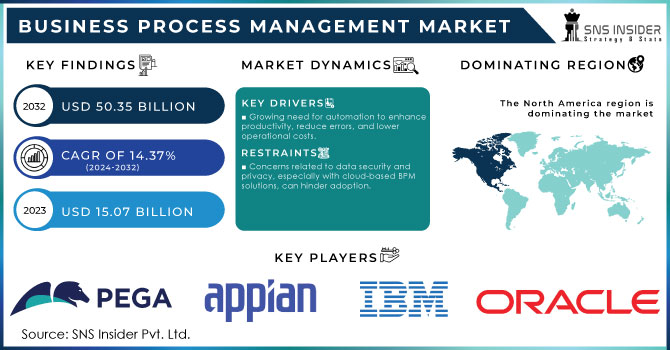

The Business Process Management Market was worth USD 15.07 billion in 2023 and is predicted to be worth USD 50.35 billion by 2032, growing at a CAGR of 14.37% between 2024 and 2032.

Get More Information on Business Process Management Market - Request Sample Report

Business Process Management (BPM) deployment brings about several advantages, such as better business agility, visibility across the board at all times and places, increase efficiency delivery of results faster so quicker ROI for BPM efforts improved compliance data security, continuous process improvement and seamless knowledge transfer. Major players providing BPM solutions on a global scale, including Accenture, Genpact and IBM are major contributors to market expansion. In 2024, a report mentioned that now around 75% of BPM platforms are capable and have started to integrate some AI whether it’s in the form of Machine Learning or Predictive Analytics being part it for better decision-making system plus efficient. By 2023, nearly 60% of worldwide organizations will have established formal BPM solutions and methodologies to optimize business processes especially in the financial services & healthcare sectors.

The AI deployment in BPM fuelled this market to grow further by providing an automation and process enhancement that includes repetitive tasks as well predictive analysis, cost saving technology improvement, and decision making. Infosys BPM unveiled an IBM-backed AI and automation center in Poland targeting enterprises looking to fast-track their hybrid cloud journey with new foundry offerings that deliver industry-specific solutions bolstered by the capabilities of artificial intelligence (AI) and data. This factor is anticipated to boost the demand for BPM during the forecast period. In another example, iGrafx, LLC & Zeitworks Technologies Inc. joined together in September 2022 to offer an AI-fueled intelligent process management platform which merged task and also process mining with predictive analysis & simulation capabilities. This is a widely recognized trend throughout the BPM market, which continues to grow rapidly. The next is, considering public & private clouds creasing over to be a super easy way for businesses to have such access to their cloud technology allowing them cost-effective BPM solutions. This has driven demand for automation to reduce costs of services and products, fuelling the growth of the BPM market particularly in service industries where process re-engineering is critical, BPM solutions enable better end-user connectivity improvement improve application quality, and Library technology. In 2023, a report from the American Productivity & Quality Center (APQC) stated that roughly 68% of U.S. businesses are using BPM solutions supporting automation as tool to improve operational efficacy in their organizations when it comes to making strategic technology choices. The U.S. market is clouded with over 60% implementations in the year 2023 from a study completed by International Data Corporation (IDC) emphasizing scalable and agile BPM also trialed to be able to consider based on demand modification US-oriented solutions Research in 2023 showed U.S. companies experienced a larger uptick with a 20% reduction of process cycle times for companies employing BPM solutions improve employee productivity and operational agility.

Drivers

-

Growing need for automation to enhance productivity, reduce errors, and lower operational costs.

-

Rapid adoption of digitalization across various industries to improve business agility and efficiency.

-

Increasing integration of artificial intelligence in BPM to streamline processes, provide predictive analysis and enhance decision-making.

The automation of Business Process Management (BPM) is one of the important drivers for this market, as businesses are focusing on automating their processes across industry verticals. This movement toward automation is being fuelled by the requirements of improved operational efficiency, error reduction and lower operational costs. With businesses becoming ever more focused on efficiency, the use of automation-capable business process management (BPM) tools is growing rapidly. BPM automation with bpm significantly eliminates manual and repetitive tasks, so human resources are kept free for crucial activities. It was very well understood in the ongoing Digital Transformation. A recent report estimated that for 60% of all occupations, at least 30% of activities could be automated which is a huge opportunity for automation driven directly from BPM. Even more, 73% of organizations are on the route of digitalizing their work with automation, and many will increase their capabilities within a few years.

The financial industry, in particular, has reaped significant benefits through BPM automation with enhanced customer service and faster processing times. According to the World Economic Forum, financial organizations that have automated processes (including BPM) are witnessing a 50-70 % faster processing time and cutting costs by up to 30%. Increasing use of automation is also being leveraged with AI and Machine learning to integrate deeper within the BPM systems leading to higher adoption. These technologies expanded the features of BPM tools allowing predictive analysis, smart decision making and optimizing resource management which has been instrumental in driving demand for BPM applications across industries as well.

Restraints

-

Integrating BPM solutions with existing IT infrastructure can be complex and time-consuming, Shortage of skilled personnel to manage and operate BPM systems effectively.

-

Concerns related to data security and privacy, especially with cloud-based BPM solutions, can hinder adoption.

-

Organizational resistance to adopting new processes and technologies can slow down the implementation of BPM solutions.

The major challenge in the Business Process Management (BPM) market is complex connectivity with existing IT infrastructure. While BPM tools can be fit into a legacy system, it is easier said than done and requires a major investment in terms of time. The differences in their system architectures, data formats, and operational workflows result in challenges for many organizations when it comes to integrating BPM platforms seamlessly with other applications. In some industries, very specific workflows such as healthcare and finance require highly specialized components which usually create barriers to the implementation of BPM.

Segment Analysis

By Solution

In 2023 more than 26% of total revenue is contributed by the process modeling section. This segment is expected to grow due to benefits such as collaboration, greater operational alignment with business strategies, increased efficiency of operations, and better control and consistency so that they can be more competitive. All of this translates to new solutions that enhance the identification and modeling of key business processes. For example, in June 2020 iGrafx LLC, a U.S.-based BPM solution provider launched an all-new solution to aid businesses with a business continuity boost. It is packed with specialized properties, custom services, online surveys as well as an auto accelerator for BIAs. With its increasing share in the market, these innovations are contributing prominently to the growth of the process modeling segment.

Automation is expected to grow at a significant CAGR from 2024 to 2032 due to various reasons few among which are a parallel shift in their benefits. These include higher efficiency, centralization of information, reduced mistakes and delays in processes; lower costs from operations payments to improved internal communication. Further, the companies are providing advanced solutions to boost these segments. For instance, in March 2021 Red Hat Inc. released an updated version of its open-source business automation platform, Red Hat Process Automation. This platform allows to have an end-to-end solution as its architecture has been designed in such a way that it cover functionalities like Case management, Business Process Management, Resource Planning and BPM rules.

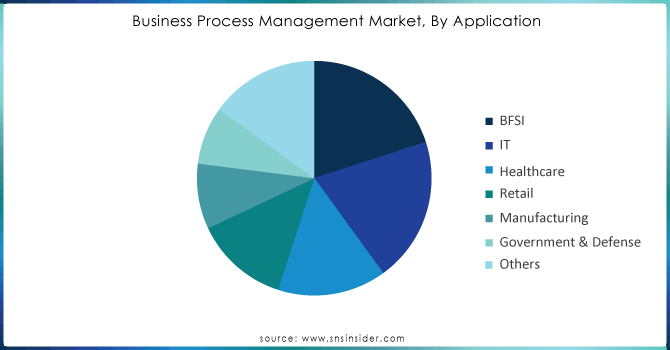

By Application

The BFSI segment held a significant share of more than 20% in 2023, benefiting from several advantages offered by BPM adoption in finance. Such benefits are improved customer service, a safer and more secure operational environment higher availability, or business agility/flexibility but what it really means is that clients are trying to be quicker than their competition and greater efficiency so you can leverage the savings into something else in your operation also further visibility. This growth has been further driven by various organizations including government bodies in introducing initiatives to help accelerate the sustainable transition of the banking sector. In March 2023, an Italian BPM solution provider BANCO BPM GRUPPO BANCARIO entered the United Nations-led Net-Zero Banking Alliance to help banks move towards a more sustainable future with sights set on achieving net-zero emissions by 2050.

The government and defence segment growing with significant CAGR 17% during forecast period. Government agencies have been particularly strong adopters of BPM and this trend is expected to grow in the future. In order to improve public services, automate their daily operations, control and audit critical processes, and adapt their business to the new legislative guidelines, government agencies are being demanded by BPM. The worldwide acceptance has also made the use of BPM solutions designed for government departments easily available. Major vendors such as BP Logix, Inc., SAP Signavio, and Comidor LTD among others are witnessing high demand for BPM solutions from government agencies hence fuelling the segment growth.

Need any customization research on Business Process Management Market - Enquiry Now

Regional analysis

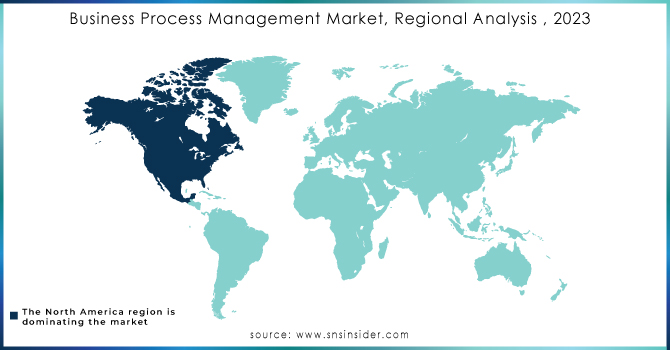

In 2023, North America has captured a major share of more than 33% of the global BPM market. The rapid adoption of next-generation technology and the development of new business models coupled with government-led digitization are propelling growth, being home to the world's largest economy and headquarters for major players such as Appian Corporation, Genpact International Business Machines. According to the latest information collected by U.S. Census Bureau, U.S. alone houses approximately 6.1 million employer firms.

APAC is expected to grow at the highest CAGR of over 19% from 2024 to 2032. This growth has majorly been due to the fast-expanding economies in the region especially India, which is undergoing a significant digital transformation. Moreover, the presence of some leading economies in this region such as China, Japan, and South Korea is accepting new technologies with increasing technological adoption; which would proliferate market growth. The BPM Market has grown substantially in the Asia Pacific region, driven by substantial adoption of BPM within their manufacturing sectors, providing significant growth opportunities for big players. This worldwide trend is expected to boost further the APAC market especially China and India where various global manufacturers have been moved.

KEY PLAYERS:

The major key players are IBM Corporation, Pegasystems, Appian, Oracle, Software AG, Nintex, OpenText, Newgen Software, Genpact, TIBCO & Other Players

| Report Attributes | Details |

| Market Size in 2023 | US$ 15.07 Bn |

| Market Size by 2032 | US$ 50.35 Bn |

| CAGR | CAGR of 14.37% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Process Modeling, Monitoring & Optimization, Automation, Content & Document Management, Integration, Others) • By Deployment (Cloud-based, On-premise) • By organization size (Large Enterprise, SMEs) • By Application (BFSI, IT, Healthcare, Retail, Manufacturing, Government & Defense, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | IBM Corporation, Pegasystems, Appian, Oracle, Software AG, Nintex, OpenText, Newgen Software, Genpact, TIBCO |

| Key Drivers | • Advanced technologies, machine learning, intelligence solutions, and artificial intelligence are all being adopted |

| Market Opportunities | • Increased use of on-premise BPM software • An increasing number of advantages are provided by cloud-based solutions |