Business Process Outsourcing (BPO) Market Report Scope & Overview:

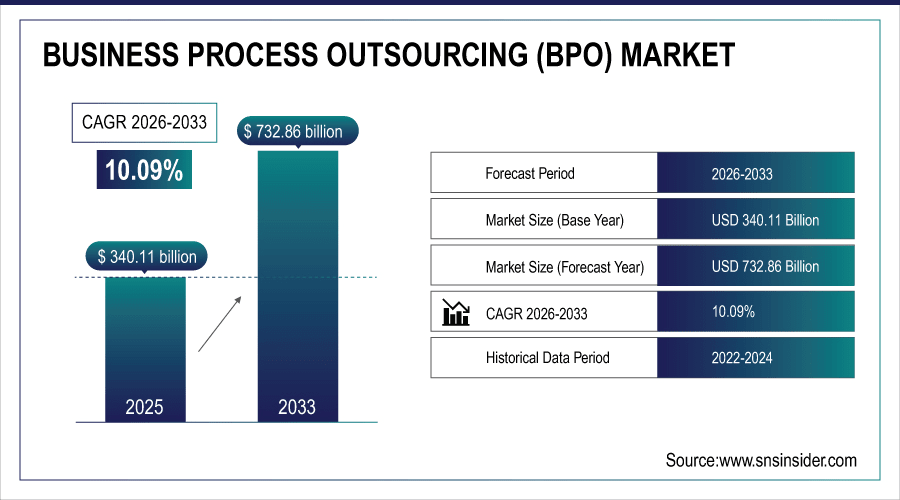

The Business Process Outsourcing (BPO) market was valued at USD 340.11 billion in 2025E and is projected to reach USD 732.86 billion by 2033, growing at a CAGR of 10.09% during the forecast period 2026–2033.

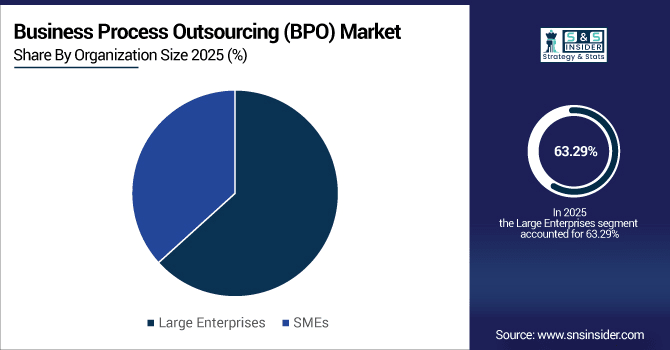

The demand is highest for services: The BPO market examines service types such as Customer Support, IT & Software Services, Finance & Accounting, HR Outsourcing, and Knowledge Process Outsourcing across multiple industries. In 2025, IT & Software Services accounted for 28% of the market, Customer Support 24%, and Finance & Accounting 18%. Large enterprises represented 63% of clients. Rising adoption of digital processes, automation, and outsourcing is driving strong market expansion through 2033.

Knowledge Process Outsourcing (KPO) contributed 8%, driven by analytical and research-based services.

To Get More Information On Business Process Outsourcing (BPO) market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 340.11 Billion

-

Market Size by 2033: USD 732.86 Billion

-

CAGR: 10.09% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Business Process Outsourcing (BPO) Market Trends:

-

In 2025, more than 12,500 customer support outsourcing projects were executed globally, reflecting growing demand for client interaction services.

-

Over 9,300 IT & software services outsourcing initiatives were launched in 2025, indicating accelerated digital transformation adoption.

-

22% of BPO activities focused on finance & accounting outsourcing, showing increased interest in back-office efficiency.

-

HR outsourcing projects totalled 5,400, highlighting a rising emphasis on workforce management and optimization.

-

15% of BPO engagements involved multi-vendor or collaborative setups, reflecting stronger partnerships between enterprises and service providers.

U.S. Business Process Outsourcing (BPO) Insights:

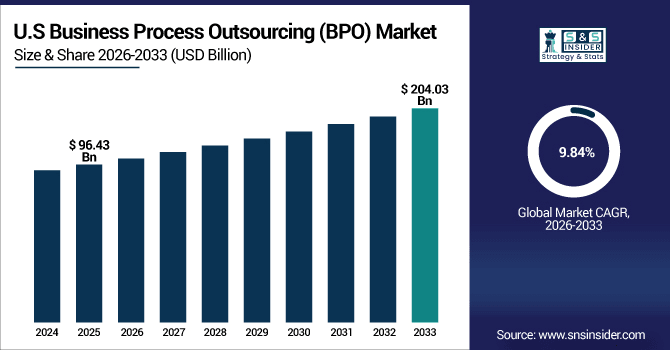

The U.S. Business Process Outsourcing (BPO) market was valued at USD 96.43 billion in 2025E, projected to reach USD 204.03 billion by 2033 at a CAGR of 9.84%. Strong demand for IT, finance, HR, and customer support outsourcing, coupled with automation and cloud adoption, is driving market growth, led by large enterprises.

Business Process Outsourcing (BPO) Market Growth Drivers:

-

Increasing Demand for Outsourced IT, Finance, and Customer Support Services Fuels BPO Market Expansion.

The BPO market growth is driven by rising demand for IT, finance, and customer support outsourcing. In 2025, over 12,500 projects focused on client support, while 9,300 initiatives targeted IT and software services. Finance & accounting outsourcing accounted for 22% of total activities, and HR outsourcing represented 12%. 15% of engagements involved multi-vendor collaborations, with 63% of clients being large enterprises, reflecting their strong influence on market expansion.

Knowledge process outsourcing (KPO) made up 8% of engagements, driven by analytical and research-based services.

Business Process Outsourcing (BPO) Market Restraints:

-

Data Security Concerns and Compliance Challenges Limit Adoption of Business Process Outsourcing Among Risk-Averse Enterprises.

Data security concerns and compliance challenges remain major barriers to BPO market growth. In 2025, nearly 21% of outsourcing projects were delayed or canceled due to regulatory or data protection issues, predominantly affecting SMEs. Around 17% of IT and finance outsourcing initiatives faced setbacks because of insufficient in-house expertise on security protocols. Additionally, smaller organizations struggled to implement robust cybersecurity measures and compliance frameworks. These factors collectively restrain market expansion, even as demand for cost-efficient and scalable outsourcing solutions rises.

Business Process Outsourcing (BPO) Market Opportunities:

-

Growing Adoption of AI, Automation, and Cloud-Based Solutions Unlocks New Business Process Outsourcing Opportunities Globally.

Rising adoption of AI, automation, and cloud-based solutions is creating significant opportunities for BPO providers. In 2025, more than 9,300 IT and software outsourcing projects leveraged automation tools, while 5,400 HR outsourcing initiatives incorporated digital workflows. Early trends indicate that 15% of BPO engagements involved multi-vendor or cross-border collaborations, highlighting growing demand for advanced technology-driven services. This surge in digital adoption is expected to continue expanding market opportunities through 2033.

Customer support outsourcing accounted for 28% of activities, reflecting growing client interaction requirements.

Business Process Outsourcing (BPO) Market Segmentation Analysis:

-

By Service Type, Customer Support Outsourcing held the largest market share of 28.37% in 2025, while Knowledge Process Outsourcing (KPO) is expected to grow at the fastest CAGR of 10.53%.

-

By Industry Vertical, Banking & Financial Services contributed the highest market share of 32.45% in 2025, while Healthcare & Life Sciences is forecasted to expand at the fastest CAGR of 11.07%.

-

By Delivery Mode, offshore held the largest share of 70.42% in 2025, while Nearshore is anticipated to grow at the fastest CAGR of 10.27%.

-

By Organization Size, Large Enterprises accounted for the dominant share of 63.29% in 2025, while SMEs are projected to grow at the fastest CAGR of 10.48%.

By Organization Size, Large Enterprises Lead While SMEs Grow Rapidly:

Large enterprises accounted for 15,800 BPO projects in 2025, demonstrating their dominant role in outsourcing adoption. SMEs undertook 9,200 projects in the same year and are projected to exceed 19,600 by 2033. Smaller firms are increasingly outsourcing IT, finance, and HR functions to access advanced technologies and skilled services without high in-house costs, driving faster growth in SME-driven BPO adoption globally.

By Service Type, Customer Support Leads While KPO Expands Rapidly:

In 2025, over 12,500 customer support outsourcing projects were executed globally, reflecting strong demand for client interaction services. Knowledge Process Outsourcing (KPO) initiatives totaled 3,600 in the same year and are expected to exceed 8,100 by 2033. Companies are increasingly leveraging KPO to manage analytics, research, and specialized knowledge functions, helping them optimize operations, support decision-making, and address growing digital and analytical service needs worldwide.

By Industry Vertical, Banking & Financial Services Dominates While Healthcare & Life Sciences Accelerates:

Banking & Financial Services led with 13,100 BPO engagements in 2025, highlighting strong outsourcing adoption in core financial processes. Healthcare & Life Sciences projects numbered 2,400 in 2025 and are projected to reach over 5,800 by 2033. Rising demand for digital patient services, medical billing, and regulatory compliance outsourcing is driving growth, while banks continue to focus on cost-efficient operations and technology-driven process management.

By Delivery Mode, Offshore Remains Largest While Nearshore Gains Traction:

Offshore outsourcing projects dominated with 14,200 engagements in 2025, driven by cost efficiency and access to skilled labor. Nearshore projects totaled 2,500 in 2025 and are expected to surpass 5,200 by 2033. Enterprises are increasingly adopting nearshore strategies to reduce time-zone challenges and regulatory risks, while maintaining operational efficiency. The trend reflects a growing preference for flexible, geographically strategic outsourcing models.

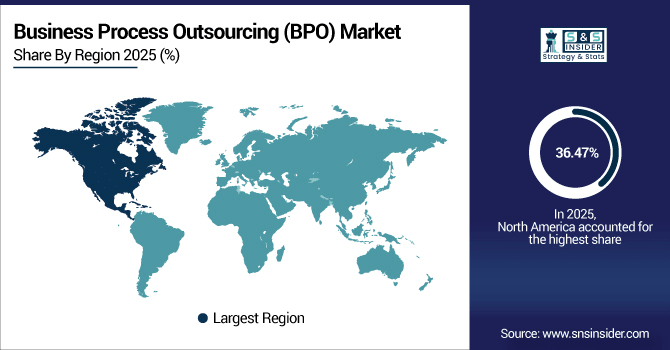

Business Process Outsourcing (BPO) Market Regional Analysis:

North America Business Process Outsourcing (BPO) Market Insights:

North America accounted for 36.47% of the global BPO market in 2025, with over 13,300 projects executed across customer support, IT & software services, finance & accounting, and HR outsourcing. Automation and cloud adoption drove 9,600 digital transformation initiatives, while 4,200 finance & accounting projects enhanced back-office efficiency. Large enterprises represented 63% of clients, and rising nearshore collaborations indicate continued strong growth, with the region projected to remain a market leader through 2033.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Business Process Outsourcing (BPO) Market Insights:

In 2025, the U.S. completed over 8,200 BPO projects, including 3,150 IT & software services and 2,300 customer support initiatives. Large enterprises represented 64% of engagements, SMEs 36%, and nearshore or cross-border collaborations accounted for 15%. Strong adoption of digital workflows and cloud-based outsourcing continues to drive market expansion.

Asia-Pacific Business Process Outsourcing (BPO) Market Insights:

The Asia-Pacific BPO market accounted for 10.92% of the global market in 2025, with over 3,900 outsourcing projects executed across India, China, Japan, and Australia. Key focus areas included IT & software services, customer support, and finance & accounting outsourcing. Rising adoption of automation, cloud solutions, digital workflows, and cross-border collaborations is driving strong growth, with SMEs and large enterprises increasingly leveraging regional outsourcing opportunities through 2033.

India Business Process Outsourcing (BPO) Market Insights:

India leads the Asia-Pacific BPO market in 2025, accounting for over 1,850 outsourcing projects across IT & software services, customer support, and finance & accounting. Rising adoption of automation, cloud solutions, digital workflows, and cross-border collaborations is driving strong market growth, with both large enterprises and SMEs expanding outsourcing initiatives through 2033.

Europe Business Process Outsourcing (BPO) Market Insights:

Europe completed over 4,250 BPO projects in 2025, with Germany, the UK, and France accounting for the largest share. Key services included IT & software outsourcing, customer support, and finance & accounting. More than 1,050 large enterprises adopted outsourcing solutions, while SMEs contributed 820 projects. Increasing automation, cloud adoption, and cross-border collaborations, along with regulatory support and industry partnerships, are expected to drive steady growth in the European BPO market through 2033.

Germany Business Process Outsourcing (BPO) Market Insights:

Germany’s BPO market executed over 1,350 outsourcing projects in 2025, covering IT & software services, customer support, and finance & accounting. Strong adoption of automation, cloud solutions, and digital workflows, supported by mature infrastructure and regulatory frameworks, positions Germany as a leading European BPO hub, with steady growth expected through 2033.

Latin America Business Process Outsourcing (BPO) Market Insights:

The Latin America BPO market recorded over 950 outsourcing projects in 2025, led by Brazil, Mexico, and Argentina. Key services included customer support, IT & software, and finance & accounting. Growth is driven by rising digital adoption, nearshore outsourcing, and multinational collaborations. Market expansion is expected through 2033, supported by automation, cloud solutions, and analytics-driven process optimization.

Middle East and Africa Business Process Outsourcing (BPO) Market Insights:

The Middle East & Africa BPO market recorded over 620 outsourcing projects in 2025, led by the UAE, Saudi Arabia, and South Africa. Growth is driven by IT & software services, customer support, and finance outsourcing, supported by government initiatives, multinational partnerships, and increasing adoption of automation and analytics-driven workflows across the region.

Business Process Outsourcing (BPO) Market Competitive Landscape:

Accenture is a dominant force in the global BPO market, executing over 12,400 outsourcing projects in 2025 across IT services, finance & accounting, and customer support. The company served more than 4,200 large enterprises worldwide, leveraging its SynOps platform to integrate automation, analytics, and AI. Accenture's expansive global footprint and proprietary methodologies position it as a leader in driving digital transformation and operational efficiency.

-

In May 2025, Accenture opened its first regional office in Ballarat, Australia, aiming to meet the growing demand for sovereign technology services and onshore support.

Teleperformance leads the global customer experience BPO market, employing over 420,000 people across 170 countries. In 2025, the company executed more than 4,500 outsourcing projects, focusing on customer support, technical assistance, and back-office services. Teleperformance's acquisition of Intelenet and Language Line has expanded its capabilities, enabling it to serve clients in more than 265 languages, enhancing its global service delivery.

-

In February 2025, Teleperformance implemented AI technology developed by Sanas to neutralize the accents of Indian customer service agents, aiming to improve clarity and customer interactions.

Concentrix executed over 3,800 outsourcing projects in 2025, specializing in customer engagement, IT services, and back-office operations. The company served more than 3,000 clients globally, leveraging AI and automation to deliver scalable solutions. Concentrix's commitment to innovation and customer-centric approach has solidified its position as a key player in the BPO industry, driving efficiency and enhancing client satisfaction.

-

In February 2025, Concentrix launched iX Hello 2.0, an enhanced AI solution designed to improve customer engagement through customizable bots and tools.

Business Process Outsourcing (BPO) Market Key Players:

Some of the Business Process Outsourcing Market Companies are:

-

Accenture

-

Teleperformance

-

Concentrix

-

Alorica

-

Foundever

-

TaskUs

-

TTEC

-

WNS Global Services

-

Genpact

-

HGS (Hinduja Global Solutions)

-

Sitel Group

-

Sutherland

-

Tech Mahindra

-

TELUS International

-

Transcom

-

Conduent

-

Konecta

-

IBM

-

Wipro

-

Infosys

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 340.11 Billion |

| Market Size by 2033 | USD 732.86 Billion |

| CAGR | CAGR of 10.09% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Customer Support, IT & Software Services, Finance & Accounting, Human Resources, Knowledge Process Outsourcing, Others) • By Industry Vertical (Banking & Financial Services, Healthcare & Life Sciences, Manufacturing, Retail & Consumer Goods, Technology & IT, Telecom, Energy & Utilities, Others) • By Delivery Mode (Onshore, Offshore, Nearshore) • By Organization Size (Large Enterprises, SMEs) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Accenture, Teleperformance, Concentrix, Alorica, Foundever, TaskUs, TTEC, WNS Global Services, Genpact, HGS (Hinduja Global Solutions), Sitel Group, Sutherland, Tech Mahindra, TELUS International, Transcom, Conduent, Konecta, IBM, Wipro, Infosys |