Robotic Dogs Market Report Scope & Overview:

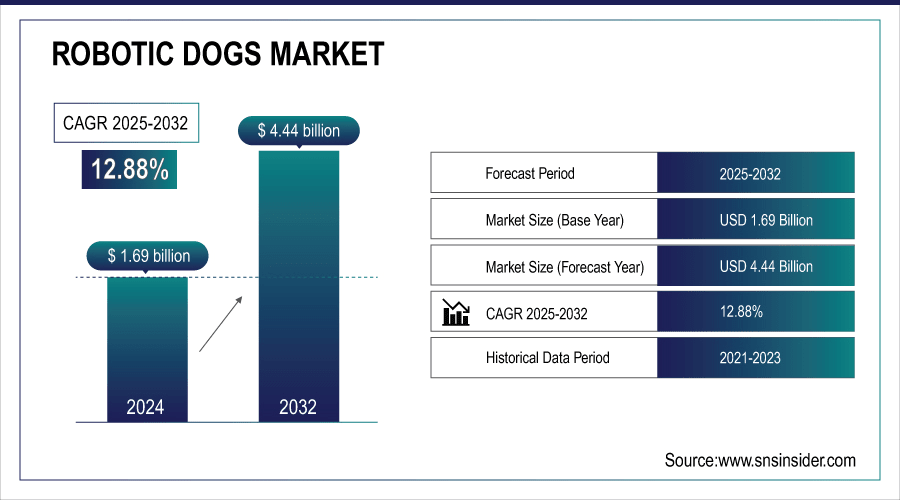

The Robotic Dogs Market Size was valued at USD 1.69 Billion in 2024 and is expected to reach USD 4.44 Billion by 2032 and grow at a CAGR of 12.88% over the forecast period 2025-2032.

The Increasing demand for interactive and intelligent robotic pets providing companionship and entertainment along with therapeutic value are the major factors driving growth of the global robotic dog’s market. The growing adoption of robotic dogs among children, the elderly, and people with disabilities, primarily to provide targeted emotional support, promote cognitive growth, and help reduce loneliness, is anticipated to fuel market growth over the forecast period. Recent machine learning model improvements and sensor technologies contribute to robotic dog capabilities and will attract consumers to such devices. Besides these, increased awareness on hypoallergenic alternatives of live pets and comfort with low-maintenance robotic counterparts also fuel market growth. According to study, about 50–65% of children interacting with robotic dogs show improvements in empathy, social interaction, or responsibility.

To Get More Information On Robotic Dogs Market - Request Free Sample Report

Robotic Dogs Market Trends

-

Growing demand for robotic dogs as companions and emotional support for children and the elderly.

-

Increasing adoption of robotic dogs in therapy programs to reduce stress, depression, and loneliness.

-

AI-driven robotic dogs capable of realistic pet behaviors and voice command responses.

-

Expansion of healthcare and eldercare applications, including dementia care and pediatric therapy.

-

Collaborations between robotic dog manufacturers and healthcare institutions for customized solutions.

-

Rising global awareness of the therapeutic benefits of robotic pets driving market growth.

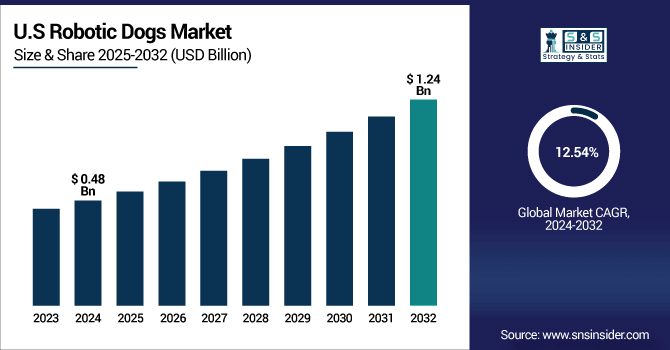

The U.S. Robotic Dogs Market size was USD 0.48 Billion in 2024 and is expected to reach USD 1.24 Billion by 2032, growing at a CAGR of 12.54% over the forecast period of 2025-2032. due to early adoption of AI-driven robotics, strong consumer interest in interactive companion robots, and robust technological infrastructure. High disposable income and a growing preference for low-maintenance, hypoallergenic alternatives to live pets drive residential adoption.

Robotic Dogs Market Segment Analysis

-

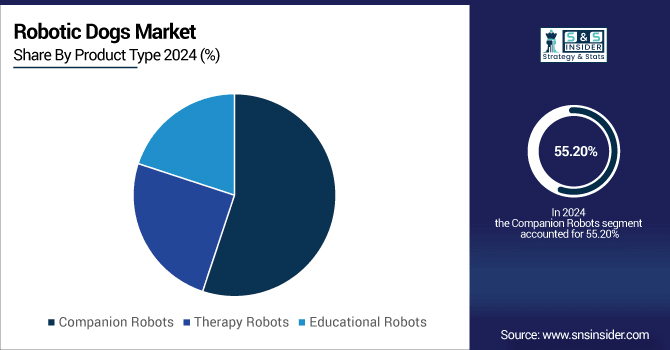

By Product Type, Companion Robots accounted for around 55.20% of the market in 2024, while Therapy Robots emerged as the fastest-growing segment with a CAGR of 14.07%.

-

By Application, Residential dominated with about 45.20% share in 2024, whereas Healthcare is witnessing the fastest growth at a CAGR of 14.23%.

-

By Distribution Channel, Online Retail led the market with nearly 52.06% share in 2024, while Electronics Stores are projected to grow fastest with a CAGR of 14.34%.

-

By End-User, the Children held the largest share at 35.50% in 2024, with Elderly expected to be the fastest-growing vertical at a CAGR of 14.14%.

By Product Type, Companion Robots Leads Market While Therapy Robots Segment Witnesses Fastest Growth

On the basis of product type, Robotic Dogs Market has been segmented into Companion Robots, Therapy Robots, and Educational Robots. The Companion Robots today stand on top of the market owing to their germane ubiquity at home and adoption among the children, elderly and the individual consumers looking for interactive Pets for companionship, leisure and rudimentary enhancing cognition. These humanoids, thanks to their lifelike structure, AI-based interactivity, and ease of use, are highly desirable in a residential/personal context, cementing their leading status. However, the fastest-growing type in the market is Therapy Robots. Growing demand for eldercare, healthcare facilities, and rehabilitation centers is boosting its uptake. Robotic dogs are being used to help with emotional support, stress, anxiety and therapeutic exercises for the elderly and people with disabilities.

By Application, Residential Dominates Market While Healthcare Segment Grows Fastest

Residential applications are leading in the market, owing to the relatively very high adoption rate in companion, entertainment, and cognitive development in the house. Increasing adoption of low-maintenance, engaging robotic pets among elderly, children, and disabled patients, coupled with rising hypoallergenic solutions to real pets, further substantiates the prominence of the residential segment. Moreover, robotic dogs offer improved comfort through integration with mobile applications and smart home systems. On the other hand, the Healthcare segment is the fastest growing in the market. They are also used by hospitals, nursing homes, and assisted living facilities for therapeutic purposes, such as reducing stress, providing comfort, or physical rehabilitation activities. These robots interact with the patient, providing better quality care, driven by advanced AI, machine learning, and sensor technologies.

By Distribution Channel, Online Retail Leads Market While Electronics Stores Segment Exhibits Fastest Growth

The online retail still dominates the market supported by the increasing e-commerce penetration, convenience, and the availability of different robotic dog brands. Consumers love the online platform since it makes it easy for them to compare features, pricing, and customer reviews amongst different products. Moreover, an increase in the availability of digital payment solutions, speedy delivery choices, and promotional activities by manufacturers has strengthened the dominance of online retail channels in the market at the global level. By distribution channel, Electronics Stores are growing the fastest. This segment is driven by higher consumer appetite towards in-store experiences, product demonstrations, and hands-on contact with robotic dogs. Having these robots available in electronics stores provides the opportunity for consumers to test out the interactive Ness, AI capabilities, and sensors of the robots before purchase, making consumers more comfortable and likely to adopt the robots.

By End-User, Children Holds Largest Share While Elderly Segment Grows Fastest

The children segment currently accounts for the largest share of the market driven by growing penetration of robotic dogs as interactive companions offering entertainment, cognitive development and learning to children. Between wanting low-maintenance furry companions for your kids but knowing not to introduce live animals into the household, parents have more recently turned towards low-maintenance, and often, hypo-allergenic options. Earlier, robotic dogs commanded this space through captivating designs, advanced AI features, and engaging behaviors that helped woo their young users. At the same time, the growth of the Elderly segment in the market is the most rapid. We've been using robotic dogs for some time now within both health care and assisted living where they seem to be effective in not only providing emotional support but relieving stress and loneliness in seniors. They can be more therapeutic when they include AI, voice recognition, and adaptive behaviours.

Robotic Dogs Market Growth Drivers:

-

Rising Demand for Companionship and Therapeutic Benefits

The demand for robotic pet dogs, which provide emotional support, entertainment, and therapeutic benefits, is driving growth in the Robotic Dogs Market. As more and more families shrink to just parents and kids, more and more families move to the city, and more and more elderly people are lonely, robotic dogs are going to become a fantastic solution. The appeal factor received a boost as these robots simulate real pet behaviors on an artificial intelligence (AI) drive, which makes them responsive to voice commands and interaction as well. Robot dogs have been used in therapy programs for seniors to relieve stress, decrease depression and increase socialization in healthcare and eldercare settings.

Approximately 65–70% of elderly individuals report feeling less lonely after interacting with robotic pets in pilot studies.

Robotic Dogs Market Restraints:

-

High Cost of Advanced Robotic Dogs

High prices of advanced robotic dogs act as a key restraint to the market growth. Despite their potential to be used for educational experiences that could fill in some of the gaps in physical schooling, the advance models that have AI capabilities, realistic motion, and interactive sensors run into the hundreds to thousands of dollars a scale well beyond what most middle-income consumers could afford. Finally, maintenance, battery replacement and firmware up upgrade costs can potentially be rolled into the total cost of ownership. Affordability is, of course, one of the biggest barriers among developing regions where disposable income is lower. Similar to above point, the high cost does restrict mass market penetration but also delays adoption in the segments that are especially price sensitive like commercial or even education segments for non-residential use.

Robotic Dogs Market Opportunities:

-

Expansion in Healthcare and Therapy Applications

One of the biggest opportunities is the growing need for robotic dogs in healthcare and therapeutic environments. As hospitals, nursing homes and assisted-living facilities incorporate robotic dogs into their programs, they become effective in promoting well-being, combating loneliness, and helping with rehabilitation exercises. With the realization that these robots provide more than just warm and cuddly material, many therapy programs utilized by healthcare providers for a mat, dementia care, and pediatric hospitals will see an increase in demand. Additionally, this enables collaborations between robotic dog manufacturers and health care institutions to create bespoke solutions like therapy robots for seniors, or children with developmental disorders. The strong potential for expansion here is very strong because the world is now becoming increasingly aware of the therapeutic power of robotic pets.

Over 70% of surveyed caregivers recognize robotic pets as effective tools for mental and emotional support.

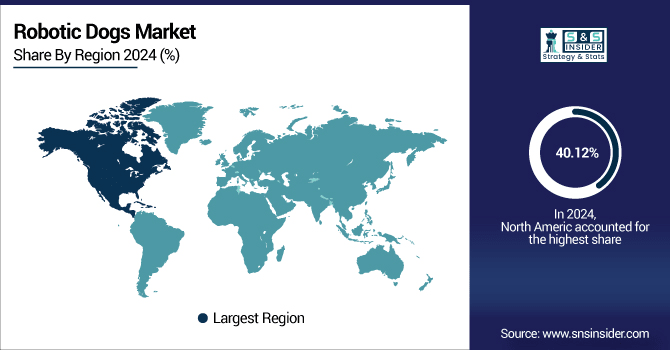

North America Dominates Robotic Dogs Market with Advanced Technology and Early Adoption:

North America has held the most dominant position globally in the Robotic Dogs Market share 40.12%, owing to the existence of big technology firms, advanced research facilities in robotics and a well-structured AI ecosystem in the region. The market is also witnessing early adoption of AI powered robotic solutions in sectors such as healthcare, eldercare, and entertainment which is supporting the growth of the overall market. AI infrastructure gains, including robotics platforms, sensors, and cloud-connected devices, expand the capabilities of robotic dogs within real-time engagements. The leadership of the North America robotic dogs’ market is reinforced by high consumer awareness, well-established distribution channels, and dynamic R&D initiatives that provide a conducive environment for innovation and adoption of robotic dogs in the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Leads Robotic Dogs Market with Policy Support and Technological Adoption:

The United States is at the forefront of the Robotic Dogs Market, driven by strong policy support and rapid technological integration. Government agencies have facilitated the deployment of robotic dogs for applications ranging from security and surveillance to healthcare and therapy.

Asia Pacific Emerges as Fastest-Growing Robotic Dogs Market Driven by Industrialization and Technology Adoption:

The Robotic Dogs Market in Asia Pacific is growing at the fastest with a CAGR 13.92%, due to the rapid uptake of AI, robotics, and smart consumer electronics. An increase in urbanization, improvement in discretionary incomes, and the establishment of a smart manufacturing infrastructure are expected to act as catalysts for the rise in acceptance of interactive robotic pets in the market. Extensive government support for robotics research, increased investments in AI development and the availability of skilled human resources enhances the adoption of robotics solution across the healthcare, education, and personal entertainment sectors. With the rapid growth of sensors, AI, and machine learning of robotic dogs, Asia pacific is expected to be the fastest-growing regional market for robotic dogs over the next few years.

China and South Korea Drive Rapid Growth in Asia Pacific Robotic Dogs Market:

China is taking advantage of the widespread use of large-scale AI in robotics, manufacturing and smart infrastructure to increase the implementation of robot dogs. The rapid growth trajectory of the market in the region is complemented by the factors such as increasing consumer awareness and demand, along with government policies promoting innovation and technology adoption in the country.

Europe Strengthens Robotic Dogs Market through Industrial Automation and Collaborative Initiatives

Europe accounts for a lucrative region for robotic dogs, and the growth of driven by industrial automation, and the growing adoption of research cooperation, and smart technology. There are many investments which include AI based robotics, healthcare, and educational applications. The innovation and deployment of robotic dogs is further accelerated by collaborative efforts among governments, research institutions, and private enterprises. AI adoption-related regulatory support, robotic application development in healthcare and entertainment segments enrich Europe market capabilities, while gradual technology advancement is backed through edge and cloud AI platforms.

Germany Leads Europe in Robotic Dogs Market with Industry 4.0 and Smart Manufacturing Initiatives

Germany, with its long history in Industry 4.0 and smart manufacturing, is a leading hub of robotic dogs in Europe. Growth in the industrial and healthcare applications with AI integration in robotics, predictive maintenance, and automation also supports adoption.

Latin America and MEA Witness Steady Robotic Dogs Market Growth Driven by Digital Transformation and Smart Initiatives

The gradual growth of the Robotic Dogs Market in Latin America and the Middle East & Africa can be attributed to the digital transformation, smart city initiatives, and adoption of robotic dogs in healthcare, retail, and industrial sectors. Regional stakeholders are putting money into robotics, AI and improved infrastructure to increase efficiency and be more connected with customers. The market growth is going to be fuelled by government support, urbanization, and rising awareness about AI-based solutions for daily use. The long-term opportunity for manufacturers and solution providers to introduce advanced robotic dogs for therapeutic, educational, and personal applications exist in these emerging regions.

Robotic Dogs Market Competitive Landscape

Sony is a pioneer in consumer robotic pets, primarily through its Aibo robotic dog series. Leveraging advanced AI, sensor technologies, and machine learning, Sony delivers highly interactive, lifelike companion robots. The company focuses on enhancing emotional engagement, entertainment, and therapeutic applications, positioning Aibo as a premium offering in the global robotic dogs market.

-

In August 2024, Sony introduced the Aibo Kinako Edition, a two-tone color variant of its robotic dog, featuring new eye color options.

Ubtech Robotics develops AI-driven robotics solutions, including humanoid and educational robots, showcasing advanced perception, navigation, and interaction capabilities. While not exclusively focused on robotic dogs, Ubtech’s Walker X and related platforms demonstrate its expertise in autonomous movement, AI integration, and smart robotics, contributing to the broader companion robot and therapeutic robotic pet’s market.

-

In March 2024, Ubtech Robotics introduced the Walker X robot, an advanced AI robot incorporating six cutting-edge AI technologies, including upgraded vision-based navigation and hand-eye coordination. While not specifically a robotic dog, the Walker X exemplifies Ubtech's advancements in robotics.

Boston Dynamics is a leader in commercial and industrial robotic dogs, including its Spot series. The company emphasizes mobility, AI-driven perception, and versatile applications across industries such as security, research, and healthcare. Spot’s advanced sensors, autonomous navigation, and modular functionality make Boston Dynamics a key player in high-performance robotic dog solutions.

-

In September 2024, Boston Dynamics released Spot v4.1, an upgraded version of its robotic dog with several new software features to support growing market demand and expand applications in various industries.

Robotic Dogs Market Key Players

Some of the Robotic Dogs Market Companies are:

-

NVIDIA

-

Intel

-

Google (TPU)

-

Broadcom

-

Huawei

-

Alibaba (MetaX)

-

Cambricon Technologies

-

Positron

-

Inspur Systems

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

Lenovo

-

IBM

-

GigaByte Technology

-

H3C Technologies

-

Lambda Labs

-

Qualcomm

-

Xilinx

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 1.69 Billion |

| Market Size by 2032 | US$ 4.44 Billion |

| CAGR | CAGR of 12.88 % From 2025 to 2032 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Companion Robots, Therapy Robots, Educational Robots) • By Application (Residential, Commercial, Healthcare, Education, Others) • By Distribution Channel (Online Retail, Specialty Stores, Electronics Stores, Others) • By End-User (Children, Elderly, Individuals with Disabilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | NVIDIA, Intel, AMD, Google (TPU), Broadcom, Huawei, Alibaba (MetaX), Cambricon Technologies, Positron, MediaTek, Inspur Systems, Dell Technologies, Hewlett Packard Enterprise (HPE), Lenovo, IBM, GigaByte Technology, H3C Technologies, Lambda Labs, Qualcomm, and Xilinx. |