Fleet Management Software Market Report Scope and Overview:

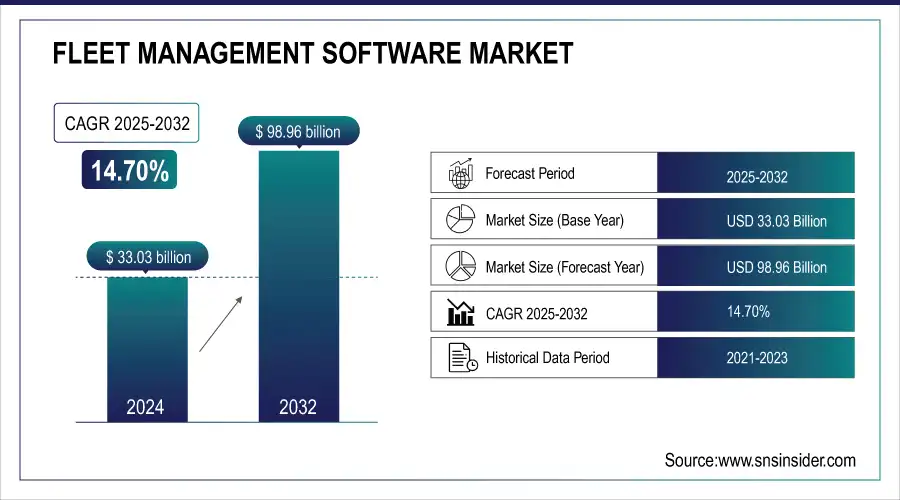

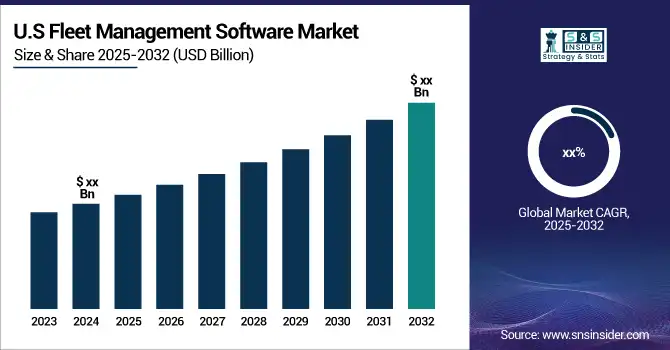

The Fleet Management Software Market Size was worth USD 33.03 billion in 2024 and is expected to reach USD 98.96 billion by 2032 and grow at a CAGR of 14.70% over the forecast period 2025-2032.

Get more information on Fleet Management Software Market - Request Free Sample Report

Fleet management software provides decision-makers with vital information including location details of vehicles, vehicle diagnostics, and the behaviour of a driver. The growth of the market is driven by due to rising numbers of electric cars available, an increasing dominance of mobility-as-a-service, escalating investments in company vehicle fleets, and effective business strategies. Approx. 65% of fleet managers have implemented real-time tracking solutions which have become essential in monitoring vehicle location and facilitating operational tasks like route optimization and task scheduling. Close to 50% of companies now have electric cars, and there is a growing trend that will be driven especially by developing environmental regulations and increasing investments by companies in charging solutions. Open usage of cloud-based solutions in fleet management has increased by 35% over the past years. This is fuelled by an increasing trend of cloud-based solutions that are highly scalable and flexible. The latest upgrades that have had a massive impact on the fleet sectors include Internet of Things and the connected truck

Fleet Management Software Market Size and Forecast:

-

Market Size in 2024 – USD 33.03 Billion

-

Market Size by 2032 – USD 98.96 Billion

-

CAGR – 14.70% (2025–2032)

-

Base Year – 2024

-

Forecast Period – 2025–2032

-

Historical Data – 2021–2023

Fleet Management Software Market Highlights:

-

Fleet management software optimizes routes, reduces fuel consumption, and lowers operational costs.

-

Growth in e-commerce and logistics is driving demand for efficient fleet solutions.

-

AI, IoT, and real-time tracking enhance software capabilities and operational efficiency.

-

Rising adoption of electric vehicles increases need for EV-specific fleet management solutions.

-

High upfront costs, complex integration, and ongoing maintenance remain key adoption challenges, especially for SMEs.

The deployment of 5th-generation technology is likely to shape the fleet sector by enhancing information transfer rates, limiting delays, and raising overall productivity. Thanks to 5th-generation technology, companies will rapidly notify one another about a variety of urgent tasks and be capable of increasing overall performance and efficiency. This is likely to be highly influential in developing the sector due to the positive impact on company performance. Over 50% of companies predict that 5G technology will be highly influential in their company performance. Various notable developments in the past include a January 2023 Geotab launch of custom maps, these tools and systems leverage and utilize a range of advanced technological solutions. Some of these include the addition of artificial intelligence. These trends and developments will be highly influential in the fleet management sector, driving its development through enhanced innovation. Fleet management is used by companies that depend on transportation to manage expenses, productivity, fuel use, and compliance. Therefore, managing costs, increasing profitability, and minimizing fleet vehicle risks are the duties of fleet managers. It also includes driver management, vehicle telematics, and financing for vehicles used for trains, boats, airplanes, and commercial vehicles (LCVs & HCVs).

Fleet Management Software Market Drivers:

-

Fleet management software helps companies optimize routes, reduce fuel consumption, and lower operational costs, driving its adoption across various industries.

-

The expansion of e-commerce and logistics sectors has heightened the need for effective fleet management solutions to handle increased delivery volumes and improve supply chain efficiency.

-

Innovations in technologies such as real-time tracking, artificial intelligence, and the Internet of Things (IoT) are enhancing the capabilities of fleet management software, making it more attractive to businesses.

-

The growing integration of electric vehicles into fleets is driving demand for fleet management solutions that can support EV-specific needs, such as charging infrastructure and battery management.

One of the major factors driving the growth of the fleet management software market is the focus on operational efficiency. It is imperative to note that both medium and large businesses recognize that their fleet operation can be improved to suit relevant requirements. As such, businesses are focused on reducing their costs, improving their market competitiveness, and supporting their marketing objectives. The use of fleet management software processes and tools helps companies reduce their operation costs, increase their productivity, and enhance their service delivery. The report by U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy shows that companies that use advanced fleet management software have realized up to 20% reduction in fuel use and a 15% decrease in vehicle operation costs. This is supported by findings from a 2024 survey by the Fleet Management Association, which indicates that 72% of businesses using fleet management software have seen significant improvements in operational efficiency, with 65% citing better route planning and 58% noting reduced vehicle downtime. For instance, the U.S. Environmental Protection Agency has encouraged individuals and organizations to use technologies that enhance fuel operation efficiency and reduce excessive emissions.

Fleet Management Software Market Restraints:

-

The upfront costs of purchasing and implementing fleet management software can be significant restrain.

-

Integrating fleet management software with existing systems and infrastructure can be complex and time-consuming, potentially causing disruptions during transition.

-

Fleet management solutions may face challenges in achieving interoperability with various vehicle models and third-party systems, potentially limiting their effectiveness.

High investment in fleet management software is one of the major restraints in the market. Most companies have to spend high upfront costs on buying licenses, hardware, and installation services related to the software. According to recent data, initial implementation costs associated with fleet management solutions can be in the range of $10,000 to $50,000. Such prices depend on fleet size and the complexity of the system. This could be quite a barrier for companies, especially small to medium-scale enterprises. In a survey conducted early in 2024, 42% of SMEs stated that high upfront costs were one of the major obstacles to fleet management software implementation. Aside from the initial capital outlay for its acquisition, there is also continuous maintenance and/or periodic upgrades to consider, further increasing the overall budgetary impact. Owing to this fact, many organizations may not invest in fleet management solutions so that the benefits due in the long run could result.

Fleet Management Software Market Segment Analysis:

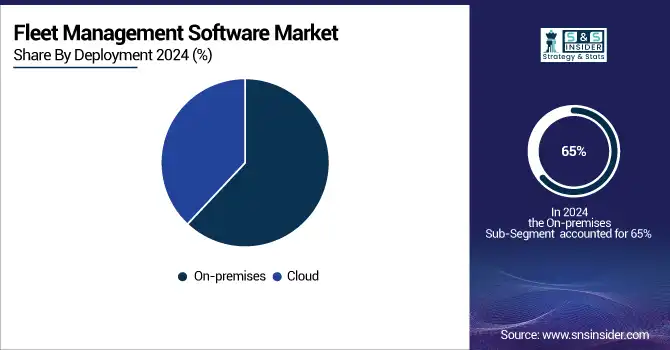

By Deployment

In 2024, the on-premises segment held the largest market share more than 65%, as it requires an upfront investment that reduces the monthly costs and provides more control over data storage and security. The cloud-based segment is projected to grow with a significant growth rate in the forecast period due to the ease of integration and cost-efficiency. Cloud connectivity has notably benefited fleet management by improving GPS tracking, especially in areas with low or no connectivity. Owing to these advantages, the leading companies have been developing their cloud-based solutions. For instance, Pro-Vision, a vendor of mobile video solutions, released CloudConnect, which is a cloud-based fleet video management software in March 2023. The new solution is aimed at simplifying the access, management, storage, and sharing of video data, which is evidence of the ongoing shift toward cloud-based technologies in the fleet management market.

By Fleet Type

Commercial fleet led the market in 2024 and is anticipated to continue dominating throughout the forecast period as the deployment of strong supply chains leverages this fleet type. Manufacturing, logistics, and transportation are some of the industries that are increasingly deploying efficient supply chains for timely deliveries and using fleet management software to handle fleet schedules and material tracking.

The market is also expected to observe significant growth opportunities owing to the rising demand for advanced passenger vehicles, including connected and electric cars. The fleet management software application optimizes the functionality of such vehicles, enhancing their self-driving functions and deploying advanced safety technologies like collision avoidance systems. This application fulfills the purposes, of serving the mounting expectations for improved features in personal and fleet vehicles.

By Industry

The manufacturing sector dominated the market with the largest revenue share of more than 22% in 2024 and is expected to dominate the market because of its critical need for timely delivery of materials and components to prevent production delays. Fleet management software helps in planning the route, reducing relocation costs, and increasing efficiency. Real-time fleet monitoring ensures driver safety and prevents theft and timely delivery. Management systems can aid the logistics industry in broadening its adoption of software. Logistics requires timely, real-time detection solutions to trace the movement of vehicles due to the substantial transportation of merchandise. As a result, the sector’s need for real-time log monitoring is likely to increase. For beneficial outcomes, companies like LogiNext can make use of such a Vehicle Tracking System. LogiNext reported in October 2023 that the VKV system had achieved over 95% fleet management compliance for companies. Implementation has permitted insurance companies to reduce their premiums by 50 percent, and accidents have fallen by 30%.

Furthermore, in the oil, gas sectors, the distribution of products must be accurate and timely and must meet a high standard of security. The market for fleet management software is expected to expand due to the increased efficiency and lower operational expenses provided by such systems.

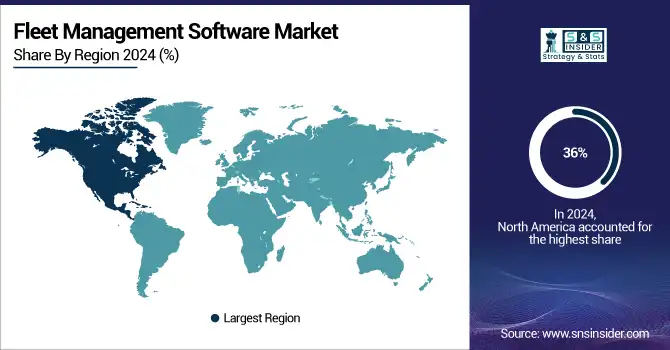

Fleet Management Software Market Regional Analysis:

North America Fleet Management Software Market Trends:

The fleet management software market was led by North America with more than 36% share in 2024, as the majority of the industries have deployed real-time tracking solutions to ensure smooth business operations. The United States’ main automobile manufacturers, such as General Motors, Ford, and Fiat-Chrysler have adopted the vehicle tracking system.

Need any customization research on Fleet Management Software Market - Enquiry Now

Asia-Pacific Fleet Management Software Market Trends:

Asia Pacific region is projected to grow with significant CAGR, as the radio cap industry is increasing rapidly and more and more people need mobility services. In addition, numerous manufacturing units operating in countries such as China, Japan, and India, will also contribute to the further expansion of the market. It is also important to note that the Indian market will experience the fastest growth as a result of the stringent emission regulations and the emphasis on the reduction of fossil fuel usage.

Europe Fleet Management Software Market Trends:

Europe is witnessing steady growth in the fleet management software market, driven by stringent regulatory compliance, advanced logistics networks, and the increasing emphasis on sustainable transportation solutions. The adoption of telematics and real-time tracking across key industries such as logistics, retail, and manufacturing is further supporting market expansion.

Latin America Fleet Management Software Market Trends:

Latin America’s fleet management software market is growing due to the expansion of e-commerce and logistics sectors, modernization of commercial vehicle fleets, and increasing awareness about operational efficiency and cost management. Countries with strong logistics networks are adopting advanced fleet management solutions to optimize operations.

Middle East & Africa (MEA) Fleet Management Software Market Trends:

The MEA region is expected to grow steadily as rising transportation and logistics activities, coupled with government initiatives promoting smart mobility and digitalization, drive demand for fleet management solutions. Expansion in commercial vehicle fleets and adoption of advanced technologies are also contributing to market growth.

Fleet Management Software Market Key Players:

-

Donlen

-

Samsara

-

Inseego

-

Fleetonomy

-

Teletrac Navman

-

Verizon Connect

-

Holman

-

Azuga

-

GPS Insight

-

Orbcomm

-

Gurtam

-

Titan GPS

-

ClearPathGPS

-

Chevin

-

Zebra Technologies

-

Trimble

-

Masternaut

-

Omnitracs

-

MiX Telematics

-

Geotab

-

TomTom

-

Zonar Systems

-

Motive

-

Fleet Complete

-

Automile

-

Fleetio

-

Fleetroot

-

Freeway Fleet

-

Avrios

Fleet Management Software Market Competitive Landscape:

Fleet Logistics Group is a leading European mobility service provider with over 25 years of experience, managing approximately 180,000 vehicles across 27 countries. In December 2023, it was acquired by TraXall International, creating Europe's largest independent fleet and mobility management company with around 400,000 contracts under management.

-

In December 2023 was of the Fleet Logistics Group by Traxall International, a sister company of Fleet Operations. This acquisition aimed at creating one of Europe’s largest mobility and fleet management providers, uniquely independent and managing over 400,000 contracts.

Bridgestone Fleet Care is an integrated tire and fleet management solution combining Bridgestone's premium tires with Webfleet's telematics platform. It offers real-time tire monitoring, predictive maintenance, and data-driven insights to reduce downtime and total cost of ownership. Tailored for commercial fleets, it enhances safety, sustainability, and operational efficiency.

-

In June 2023, Bridgestone’s fleet management software, Webfleet, launched a new trailer management solution, Webfleet Trailer. The tool will support companies engaged in transport and logistics with trailer fleets on long-haul routes.

| Report Attributes | Details |

| Market Size in 2024 | USD 33.03 Billion |

| Market Size by 2032 | USD 98.96 Billion |

| CAGR | CAGR of 14.70% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Deployment (On-premises, Cloud) • By Vehicle Type (Heavy Commercial Vehicle, Aircraft, Railway, Watercraft, Light Commercial Vehicle) • By Fleet Type (Commercial Fleets, Passenger Cars) • By Vertical (Retail, Healthcare and Pharmaceutical, Construction, Transportation and Logistics, Utilities, Oil, Gas, and Mining, Government, Other Verticals) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Donlen, Samsara, Inseego, Fleetonomy, Teletrac Navman, Verizon Connect, Holman, Azuga, GPS Insight, Orbcomm, Gurtam, Titan GPS, ClearPathGPS, Chevin, Zebra Technologies, Trimble, Masternaut, Omnitracs, MiX Telematics, Geotab, TomTom, Zonar Systems, Motive, Fleet Complete, Automile, Fleetio, Fleetroot, Freeway Fleet, Avrios |