Cable Modem Termination System And Converged Cable Access Platform Market Report Scope & Overview:

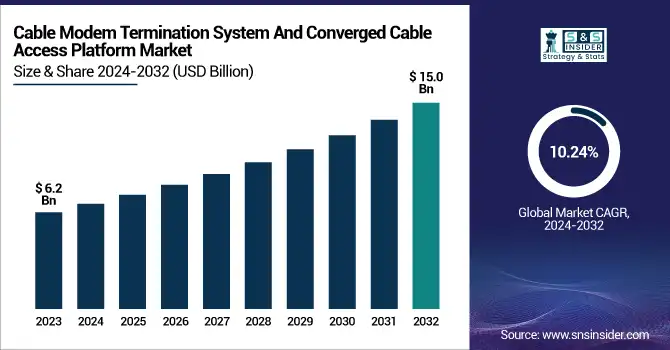

The Cable Modem Termination System and Converged Cable Access Platform Market was valued at USD 6.2 billion in 2023 and is expected to reach USD 15.0 billion by 2032, growing at a CAGR of 10.24% from 2024-2032.

To Get more information on Cable Modem Termination System and Converged Cable Access Platform Market - Request Free Sample Report

This report consists of a detailed analysis of the Cable Modem Termination System and Converged Cable Access Platform Market, covering adoption trends, technological advancements, and market dynamics. The adoption rate of CTMS and CCAP solutions varies by region, with North America and Europe leading due to high broadband penetration and increasing demand for high-speed internet services. Broadband subscriber growth by technology highlights the ongoing transition from DOCSIS 3.0 to DOCSIS 3.1, with DOCSIS 4.0 set to drive future network expansion. Investments in cable network upgrades by key operators are increasing as they focus on infrastructure modernization to handle rising data traffic. Additionally, data traffic growth in cable networks is surging globally, fueled by video streaming, cloud computing, and IoT adoption. The report also explores regulatory impacts, competitive landscapes, and future market trends.

The U.S. The Cable Modem Termination System and Converged Cable Access Platform Market was valued at USD 1.9 billion in 2023 and is expected to reach USD 4.5 billion by 2032, growing at a CAGR of 9.98% from 2024-2032. driven by rising broadband demand, increasing fiber deployments, and the shift to DOCSIS 4.0 for faster speeds. Major cable operators are investing in network modernization to support high-bandwidth applications like streaming, gaming, and IoT. The market is expected to grow steadily through 2032, with advancements in hybrid fiber-coaxial networks enhancing scalability and performance.

Cable Modem Termination System And Converged Cable Access Platform Market Dynamics

Driver

-

The increasing need for faster internet due to video streaming, online gaming, and IoT adoption is driving CTMS and CCAP market growth.

The increasing demand for high-speed internet, driven by rising data consumption, video streaming, online gaming, and remote work, is a key growth driver for the CTMS and CCAP Market. With the rapid expansion of smart homes, IoT devices, and cloud-based applications, broadband providers are upgrading their infrastructure to ensure seamless connectivity. The adoption of DOCSIS 3.1 and DOCSIS 4.0 technologies is accelerating to enhance network efficiency and bandwidth capacity. Additionally, telecom operators are investing in hybrid fiber-coaxial networks to deliver faster and more reliable internet services, fueling the market's expansion. This trend is expected to continue as digital transformation accelerates globally.

Restraint

-

Upgrading to DOCSIS 4.0 and modernizing network infrastructure requires significant investment, limiting adoption for smaller operators.

One of the major challenges in the CTMS and CCAP Market is the high cost of infrastructure deployment and network upgrades. Transitioning from legacy cable systems to advanced DOCSIS 4.0 technology requires substantial investment in equipment, software, and skilled labor. Additionally, operators must navigate regulatory hurdles and licensing requirements, further adding to operational costs. Smaller service providers often struggle with the financial burden of modernizing their networks, limiting widespread adoption. Although large telecom players are making strategic investments, the overall cost factor remains a key restraint, potentially slowing down deployment rates in emerging markets.

Opportunity

-

The integration of fiber with existing cable infrastructure enhances network performance and creates new growth opportunities.

The growing focus on fiber-optic and hybrid fiber-coaxial networks presents a significant opportunity for the CTMS and CCAP Market. Operators are increasingly integrating fiber with existing cable infrastructure to enhance network performance while reducing costs. This hybrid approach allows for scalable bandwidth solutions, enabling service providers to support ultra-fast broadband, 5G backhaul, and next-generation digital services. Moreover, government initiatives promoting broadband expansion in underserved areas are further driving investments in fiber and HFC technologies. As network operators continue to enhance their fiber-coaxial ecosystems, the demand for advanced CTMS and CCAP solutions is expected to surge in the coming years.

Challenge

-

The rise of FTTH broadband, offering superior speed and reliability, threatens the long-term growth of cable-based networks.

The increasing adoption of Fiber-to-the-Home solutions poses a competitive challenge for the CTMS and CCAP Market. Consumers and businesses are shifting toward fiber-based broadband, which offers superior speed, lower latency, and higher reliability compared to traditional cable networks. Many telecom providers are aggressively rolling out FTTH infrastructure, reducing dependency on coaxial cable networks. This trend puts pressure on cable operators to upgrade their networks and justify continued investment in DOCSIS-based technologies. While hybrid fiber-coaxial solutions remain viable, the long-term shift toward full-fiber connectivity could impact the growth trajectory of the CTMS and CCAP market.

Cable Modem Termination System And Converged Cable Access Platform Market Segmentation Analysis

By Type

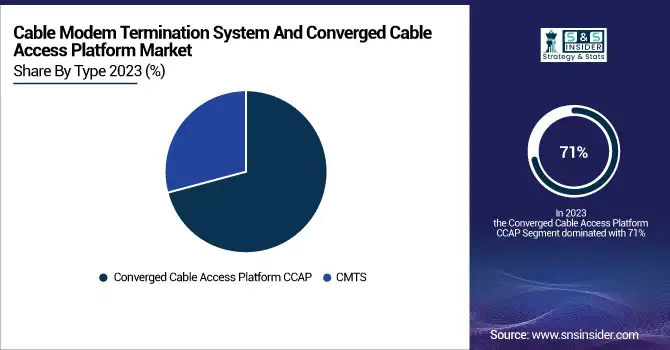

The Converged Cable Access Platform CCAP dominated the market and accounted for 71% of revenue share, owing to the increasing demand for high-speed internet and advanced video services, and its integration of both data and video services into a single platform, reducing operational costs and improving network efficiency. It made massive adoption of CCAP technology with the growing demand for high-speed broadband, 4K/8K video streaming, and cloud–based applications. Major players are also investing in DOCSIS 3.1 and 4.0 upgrades, upgrading network capacity and performance.

CMTS is estimated to grow at the fastest CAGR during the forecast period, owing to an increase in cable operators upgrading their traditional infrastructure to meet the increasing broadband demand. The growing adoption is being fueled by the migration to CMTS in the clouds for scalability, cost savings, and better network management. Investments in DOCSIS 4.0 continue to drive speed, latency, and performance improvements.

By DOCSIS Standard

The DOCSIS 3.1 segment dominated the market and accounted for due to its ability to provide gigabit-speed internet and reduced latency as well as better network efficiency. Its emerging applications, low-latency, high-bandwidth applications, such as 4K/8K video streaming, cloud gaming, and connectivity for Internet of Things devices and sensors, have spurred its ubiquitous adoption. And demand is also being further bolstered by network upgrades in the big three cable operators, as well as government initiatives to improve broadband infrastructure.

The DOCSIS 3.1 segment is forecasted to witness the fastest CAGR owing to its offer of multi-gigabit speeds, improved spectral efficiency, and enhanced network reliability. With data consumption hitting the roof, cable operators are working overtime to deploy DOCSIS 3.1 technology to enable hybrid fiber-coaxial networks for smooth connectivity. The growing use of remote work, online education, and digital entertainment, the gathering wrote, has sped up the demand for speedier broadband services.

Regional Landscape

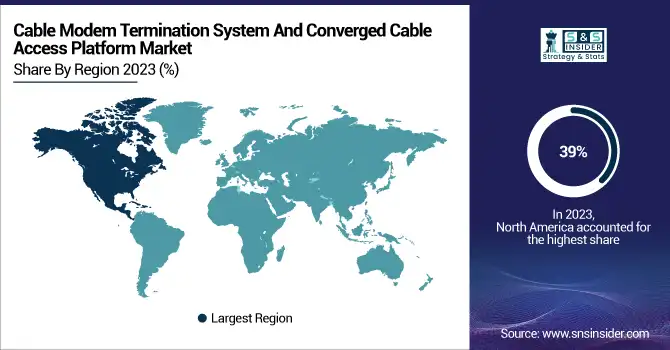

North America dominated the market and accounted for 39% of the revenue share in 2023 due to the high broadband penetration in the region, demand for gigabit-speed internet, and investments from some of the largest cable operators. Comcast, Charter Communications, and Cox Communications are rolling out DOCSIS 3.1 and DOCSIS 4.0 technologies throughout their networks to improve speed and efficiency.

Asia-Pacific is anticipated to register the highest CAGR during the forecast period due to the increasing penetration of the internet and growing urbanization, and increasing demand for high-speed broadband. Countries like China, India, and Japan are aggressively investing in fiber-coaxial hybrid networks for broadband access improvement. The demand for advanced CMTS and CCAP solutions is further receiving impetus from government programs that are pushing digitalization and smart city initiatives.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Cisco – cBR-8 CCAP

-

ARRIS (CommScope) – E6000 Converged Edge Router

-

Casa Systems – C100G CCAP

-

Harmonic Inc. – CableOS Virtualized CMTS

-

Nokia – Gainspeed Unified CCAP Solution

-

Vecima Networks – Entra Access Node

-

Broadcom – BCM3390 Cable Modem SoC

-

Technicolor – TC4400 DOCSIS 3.1 Modem

-

ZTE Corporation – ZXHN H298A GPON Gateway

-

Sumavision – Intelligent CCAP Platform

-

WISI Communications – Chameleon Headend Platform

-

Huawei – MA5800-X7 Cable Access Platform

-

Edgecore Networks – ASXvOLT16 Virtualized OLT

-

Calix – E7-2 Intelligent Modular System

-

Teleste – Luminato Dense QAM Platform

Recent Developments

-

In January 2024, Casa Systems unveiled the AurusXT 5G Industrial IoT Router Series, introducing the NTC-500 5G IIoT router, which features proprietary 5G Dynamic Network Slicing technology for cost-efficient and reliable industrial IoT connectivity.

-

In March 2024, Vecima Networks launched the Entra Virtualized Cable Modem Termination System (vCMTS), designed to integrate seamlessly with Vecima's Remote PHY devices, enhancing network scalability and performance.

-

In May 2024, CommScope acquired Casa Systems' cable assets, including virtual CMTS and QAM video solutions, expanding its portfolio in the cable network infrastructure sector.

-

In August 2024, CommScope announced its first major sale of the newly acquired Casa vCCAP solution to Kábelszatnet, a leading Hungarian provider of cable, Internet, and voice services. The deployment includes CommScope's Distributed Access Architecture (DAA) Remote PHY shelves and DC2180 DAA Cabinet Nodes, aiming to enhance Kábelszatnet's network capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.2 Billion |

| Market Size by 2032 | US$ 15.0 Billion |

| CAGR | CAGR of 10.24 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (CMTS, CCAP) • By DOCSIS Standard (DOCSIS 3.1, DOCSIS 3.0, Below) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco, ARRIS (CommScope), Casa Systems, Harmonic Inc., Nokia, Vecima Networks, Broadcom, Technicolor, ZTE Corporation, Sumavision, WISI Communications, Huawei, Edgecore Networks, Calix, Teleste |