Ink Resin Market Analysis & Overview:

The Ink Resin Market Size was valued at USD 3.6 billion in 2023 and is expected to reach USD 5.3 billion by 2032 and grow at a CAGR of 4.1% over the forecast period of 2024-2032.

Get More Information on Ink Resin Market - Request Sample Report

Ink resin market demand is rising due to increase the packaging in consumer goods, food and beverage, and medication sectors which drive the market growth. These industries need top-notch, aesthetically pleasing durable packaging to improve the look of goods, create brand awareness, and provide safety for the product. The essential adjunct properties of adhesion, gloss, flexibility, and resistance to wear and environmental factors provided by ink resins make them the building blocks to achieve these goals. As an example, packaging inks in the food & beverage sector should have well-defined functional performance characteristics such as they should be non-toxic and food-grade compliant as they require higher safety standards.

The innovative packaging demand is rising for instance, Mexico’s remittances reached USD 58.5 billion in 2022, along with USD 32.8 billion increased consumption of packaged beverages, processed foods, medical products, and personal care items which drives the Ink resin market.

Digital printing technologies are transforming the printing industry, including printing for advertising and packaging. The flexibility of digital printing, along with the growing demand for short-run and personalized marketing collateral and packaging designs, is a major driver of this technology. It is driven by consumer trends requesting customized products and brands looking to improve their custom engagement. At the core of this evolution are improved ink resin formulations which are vital to advance, offering better adhesion, durability, and more vibrant colors required for quality digital prints. They also increase the ability of inks to work with different substrates, from paper and rolls of plastic to fabrics, which makes them critical to use in digital printing programs.

In 2024, Xerox expanded its Adaptive CMYK+ Kit for the Versant Press. This innovation helped the company with the addition of specialty inks, including metallic and fluorescent, enabling greater creative possibilities for personalized marketing materials.

Ink Resin Market Drivers

-

Increasing adoption of UV and water-based inks drives the market growth.

Inks & paint market has been increasing rapidly across various applications. This cutting-edge technology also provides some benefits over traditional solvent inks, including instant curing under UV light, fast drying speed, less environmental impact, and stronger durability. In addition, they can achieve bright shades and excellent surface quality, making these inks popular in packaging, labels, and textile purposes. Likewise, water-based inks, which are considered environmentally friendly, have increased in popularity as they disperse lower levels of volatile organic compounds (VOCs) than solvent-based inks, thus satisfying more stringent regulations and the corresponding demand for eco-friendly merchandise. The transition to these types of inks is also driven by consumer demand for greener and safer products, as well as governmental regulation concerning VOC emissions. Both the UV and water-based inks provide better performance, as well as environmental benefits, and therefore they are expected to continue supporting the evolution of the global ink resin market.

For example, the European Union's stringent environmental regulations, such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), encourage the adoption of water-based inks in the packaging and printing industries. In the U.S., the Environmental Protection Agency (EPA) also promotes cleaner technologies, which has led to a rise in the use of water-based inks across various industries.

Restraint

-

Competition from alternative printing technologies hamper the market growth.

The growth of the ink resin market is facing stiff competition from alternative printing technologies, such as digital printing and flexographic printing. There is a booming demand for digital printing, especially digital printing due to relatively shorter lead times and costs associated with equipment setup time are low, and it produces high-quality prints in smaller print runs. For instance, in the case of digital printing, there is no need for traditional ink resins and hence, does not drive the market for conventional applications. Likewise, flexo printing, a more efficient printing process involving the use of flexible plates, is increasingly preferred in several packaging and label printing applications, contributing to a decreased market value for conventional ink resins.

Ink Resin Market Segmentation Analysis

By Resin Type

Acrylic resins held the largest market share around 22% in 2023. The robust share is primarily driven by better performance attributes like adhesion, gloss, and durability of these acrylic resins which consequently find their use in high-end printing applications including packaging, labels, and commercial printing. Another widely used resin is acrylic resins, which, due to their versatility, are used in solvent-based and water-based inks and for a variety of printing techniques, such as flexographic and gravure printing. This wide adoption is further attributed to the ability of micronutrient paints to give bright colors and high levels of durability under changing environmental conditions

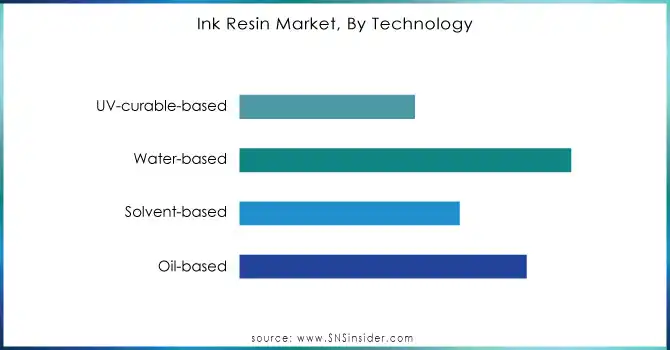

By Technology

Water-based ink held the largest market share around 38% in 2023. Water-based inks have gained wide acceptance due to increased focus on sustainability and eco-friendly products. These inks are especially popular because they are generally more environmentally friendly, containing relatively low concentrations of volatile organic compounds (VOCs) than solvent-based or oil-based inks. Applications such as packaging, labels, and textiles often use water-based inks due to both stringent environmental regulations and increasing consumer demand for more environmentally friendly alternatives. This transition to water-based technology is also being fuelled by developments in high-performance resins with better adhesion, gloss, and durability properties, allowing them to be used across a broader range of printing techniques including flexographic and gravure printing.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Printing Process

Flexography held the largest market share around 29% in 2023. It is prevalent due to its versatility, speed, and cost-effectiveness, especially in packaging and label printing applications. Flexo printing is suited for bulk production spreads and works with various substrates: plastic, film, as well as corrugate. Increased demand for flexible packaging from e-commerce, food and beverage industries, and consumer goods has greatly strengthened the preference for flexography as a printing method.

Ink Resin Market Regional Outlook

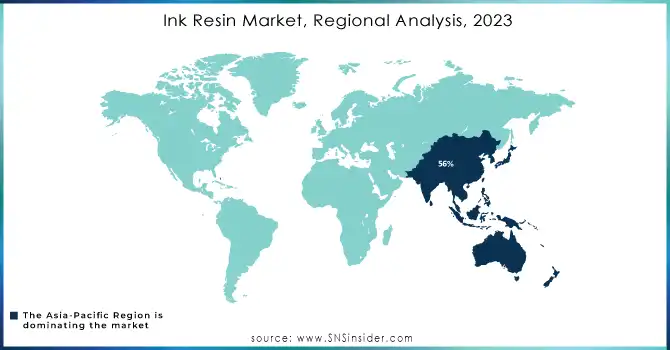

Asia Pacific held the highest market share around 56% in 2023. The region hosts the world's largest manufacturing centers, particularly for the packaging, automotive, and consumer goods industries, which are the key end-use industries driving the demand for ink resins. The growing industrial sectors of countries, such as China, India, Japan, and South Korea use printing inks in bulk for packaging, labeling, and promotional materials. Continuous growth in e-commerce and retail sectors has led to an increase in packaging, particularly in China & India, thereby driving the demand for ink resins used in flexographic & gravure printing

Also, Asia Pacific is an incubation area for large-volume ink resin manufacturers such as China and Japan, which will reduce production costs and manufacture resins, that are inexpensive to local and foreign markets. Its combination of low labor costs, which makes economic sense for manufacturing roles, is another competitive benefit for the region. However, government policies in such countries as China and India, which encourage industrial growth along with infrastructure developments, have created a suitable environment for the expansion of the ink resin market

Key Players in Ink Resin Market

-

KRATON CORPORATION (Kraton D1102, Kraton G1650)

-

Lawter (Lawter's KenoRes, Lawter's Resilon)

-

Evonik Industries AG (Tego Rad 250, Dynasylan)

-

IGM Resins Inc (Reactant 8600, Regalite)

-

Royal DSM NV (Arnite X-TQ, DSM Keppel)

-

DowDuPont Inc (Dow Coating Materials, DuPont Tedlar)

-

BASF SE (BASF Tinuvin, BASF 3D Printing Resins)

-

Arizona Chemical Company LLC (Arizon 6700, Arizon 7200)

-

Hydrite Chemical (Hydrite 2120, Hydrite 417)

-

Indulor Chemie GmbH (Indulor Resin 800, Indulor ACR)

-

Arakawa Chemical Industries Ltd (AROMAX 700, ARONOL)

-

US-Polymers-Accurez LLC (Accurez 250, Accurez 400)

-

Eastman Chemical Company (PU Adhesives, Eastman 9178)

-

Momentive Performance Materials Inc (EPIKOTE Resin, EPON Resin)

-

Hexion Inc (EPOLENE C-10, EPIKOTE Resin 828)

-

Worlee Chemie GmbH (WorleeResin, WorleeFill)

-

SABIC (LNP Stat-KON, Valox iQ)

-

Synthomer plc (Synthomer 8401, Synthomer 5230)

-

Allnex (Ebecryl 370, Ebecryl 330)

-

Chemtura (SYN-THANE, Chem-Cast)

Recent Development:

-

In 2023, Kraton continues to focus on sustainable growth, advancing its sustainability initiatives and reducing environmental impact. Furthermore, Kraton has significantly reduced its carbon emissions and made strides in developing biobased alternatives to fossil-based.

-

In 2023, Lawter has been expanding its product offerings in the specialty chemicals market, particularly with its environmentally friendly adhesives and resins for the packaging industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.66 Billion |

| Market Size by 2032 | US$ 5.3 Billion |

| CAGR | CAGR of 4.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type ( Modified Rosin, Hydrocarbo, Modified Cellulose, Acrylic, Polyamide, Polyurethane, Others) • By Technology (Oil-based, Solvent-based, Water-based, UV-curable-based) • By Printing Process (Lithography, Gravure, Flexography, Others) • By Application: (Printing & Publication, Flexible Packaging, Corrugated Cardboard & Cartons, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KRATON CORPORATION, Lawter, Evonik Industries AG ,IGM Resins, Inc, Royal DSM NV, DowDuPont Inc, BASF SE, Arizona Chemical Company LLC, Hydrite Chemical, Indulor Chemie GmbH, Arakawa Chemical Industries, Ltd ,US-Polymers-Accurez LLC, and other players. |

| DRIVERS | • Better access to raw materials for making ink resins • Packaging and energy-curable inks industries are getting bigger. • Environmental worries, more people becoming aware, and strict rules |

| Restraints | • Changes in demand and prices for raw materials caused by competition from other industries that use resins • Situations in the world that are not stable • Suppliers of ink resin are getting together more and more. |