Synthetic Quartz Market Size & Overview

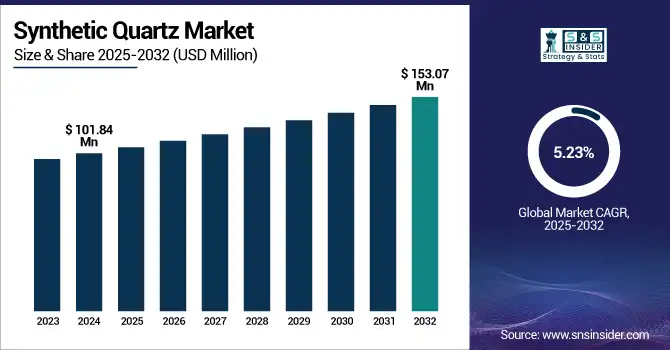

The Synthetic Quartz Market size was USD 101.84 million in 2024 and is expected to reach USD 153.07 million by 2032, growing at a CAGR of 5.23% over the forecast period of 2025-2032.

To Get more information on Synthetic Quartz Market - Request Free Sample Report

Synthetic Quartz Market Analysis highlights significant growth, largely propelled by the expansion of the semiconductor industry, which demands high-purity quartz for advanced electronic components. It is due to semiconductor manufacturers ramping up production to cater to the ever-increasing global demand for high-end electronic devices, such as smartphones, laptops, electric vehicles, and artificial intelligence (AI)-enabled systems. Coming to this sector, synthetic quartz finds its application in semiconductor fabrication processes as the synthetic quartz has high purity, thermal stability, and chemical resistance, which becomes crucial in fabrication processes, especially for silicon wafers, photomasks, and etching equipment. Moreover, the proliferation of 5G, internet of things (IoT), and edge computing has further driven the demand for high-performance semiconductors and thereby creating good opportunities for growth in the synthetic quartz components market.

The U.S. semiconductor manufacturing sector invested USD 47.4 billion in R&D in 2021, a 9.8% increase over the previous year. It highlights the thirst for innovation that shapes the market and is a great driver for products such as synthetic quartz.

For instance, the Indian Union Cabinet approved a semiconductor plant in Jewar, Uttar Pradesh, to be constructed by the HCL-Foxconn joint venture. The site will manufacture 36 million display driver chips per month and process 20,000 wafers per month, and is expected to be fully operational by 2027. It will be expected to satisfy 40% of the demand in India and meet global demand, especially for Foxconn, one of Apple's chief electronics manufacturers in India.

Synthetic Quartz Market Dynamics:

Drivers:

-

Increased Use in Solar and Renewable Energy Applications Drives the Market Growth

Growing global interest in clean and sustainable energy solutions stimulates the Synthetic Quartz Market Analysis. Known for important qualities, such as thermal stability, optical clarity, and environmental resistance, synthetic quartz is an essential material in PV cells used for solar panels. These strong features in combination make it perfect for applications in environments with high temperatures and high precision, which are usual for solar energy systems. Along with synthetic quartz is used in a series of elements, such as lenses, covers, and crucibles in the manufacturing and functioning of solar panels. With ambitious renewable energy goals and significant investments in solar infrastructure in many nations, countries are relying on increasingly efficient and enduring materials, such as synthetic quartz. Global policy support, with tax incentives and technological advances for solar technologies, will further propel the trend as renewable energy emerges as a pillar of synthetic quartz market growth.

The Indian government's exploration of potential solar energy resources demonstrates its commitment to expanding solar energy capabilities in the country. India has tremendous potential for solar energy, about 748 GWp as per the National Institute of Solar Energy (NISE) from the Waste Land Atlas of India 2010. To tap this potential government has approved 51 solar parks in 12 states with a capacity of up to 37,740 MW. As of 31 December 2023, 10,504 MW of solar projects have been commissioned in 20 solar parks

Restraints:

-

High Production Costs May Hamper the Market Growth

The high cost of production is one of the main restraints identified in the synthetic quartz market analysis, which can severely curtail the growth of the market. Synthetic quartz is made through highly elaborate procedures, such as hydrothermal synthesis or flame fusion, both of which are extremely energy and technology-intensive processes in and of themselves. The processes require high-purity raw materials, specialty equipment, and a controlled environment, so the cost of operation and manufacturing is much higher. Since natural quartz is much cheaper and sits in larger volumes, synthetic quartz can be sold at a price premium. For instance, natural quartz sand is a few cents per kilogram, but high-purity synthetic quartz may be hundreds of dollars per kilogram. This cost difference is a barrier for sectors sensitive to costs or geographic areas with limited investment capacity, limiting the applications of synthetic quartz.

Opportunities:

-

Integration in Next-Gen Technologies (AI, IoT, 5G) Creates Opportunities in the Market

Synthetic quartz is being utilized in key enabling technologies, including Artificial Intelligence (AI), the Internet of Things (IoT), and 5G, creating tremendous market opportunity. Such technologies need high-frequency, high-precision electronic components, and therefore, synthetic quartz, which has excellent piezoelectric properties, thermal stability, and frequency control capability, is an essential material. All AI-based systems use Quartz crystals in timing and synchronization circuits to ensure accurate processing speeds. Likewise, even in many IoT devices, which are undoubtedly small and function in different conditions, synthetic quartz wafer can always be relied upon. With the ultimate need for low latency and high-speed data transmission for 5G networks, quartz is used for the manufacture of specialized filters and oscillators used in most communication equipment. With increasing demand for high-purity synthetic quartz components and the large-scale proliferation of these technologies around the world, there will always be healthy growth opportunities for synthetic quartzs companies in this market and driving the synthetic quartz market trends.

For instance, the large investments are being made to strengthen semiconductor capabilities. South Korea, unveiled a USD 470 billion plan to create the largest semiconductor cluster in the world in Gyeonggi Province in the next 23 years or so. China's National Integrated Circuit Industry Investment Fund introduced its third phase in 2024 with a USD 47.5B registered capital, targeting advanced manufacturing and AI semiconductor development.

These initiatives underline the commitment from countries worldwide towards the evolution of semiconductor technologies and, hence, act as a driver for the demand for synthetic quartz components required in chip manufacturing.

Synthetic Quartz Market Segmentation Analysis:

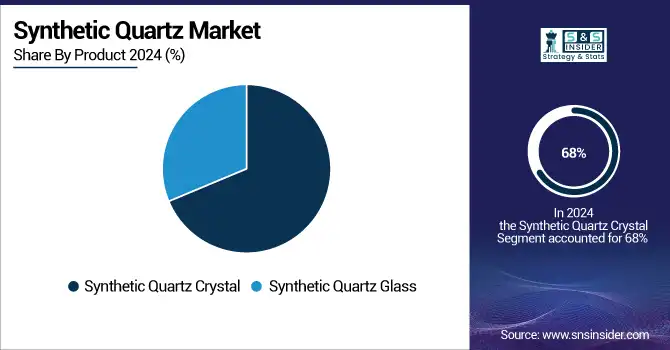

By Product

Synthetic Quartz Crystal held the largest synthetic quartz market share, around 68%, in 2024 owing to its presence in a wide array of high-growth end-use industries, including electronics, telecom, and semiconductor manufacturing. Due to its excellent piezoelectric characteristics, high purity, and stability at different temperatures and pressures, it is widely used in high-stability frequency control elements such as oscillators, resonators, and filters. These parts play a critical role in smartphones, computers, GPS, and advanced communication equipment. Furthermore, due to the ongoing development of consumer electronics and data transmission technology, especially with new 5G and internet of things (IoT) technologies emerging, synthetic quartz crystals continue to play an important role in precision and dependability.

Synthetic Quartz Glass held a significant market share due to the unique physical and chemical characteristics of synthetic quartz glass that make it ideal for high purity synthetic quartz glass, which has, in turn, garnered a significant share of synthetic quartz in the global market. This material has excellent thermal stability, optical transparency in the whole spectrum of wavelengths, chemical resistance, and low thermal expansion. These properties ensure it has great utility in harsh environments, such as those found in semiconductor fabrication, optics, and laboratory systems.

By Application

Electrical & Electronics held the largest market share, approximately 48%, in 2024 owing to the insignificance of synthetic quartz in the manufacture of various high-precision electronic components. Synthetic quartz is used in oscillators, resonators, frequency filters, and timing devices that are essential for the proper operation of electronic devices, such as smartphones, computers, TVs, wearable devices, and automotive electronics. Due to its excellent performance as a piezoelectric material, thermal stability, and environmental stability, it is used for maintaining the signal accuracy and performance consistency of a variety of devices in widespread use.

Automotive holds a significant market share in the synthetic quartz market owing to high electronic system and sensor integration in modern vehicles. While the automotive industry transitions to electric vehicles (EVs), autonomous driving, and connected car technologies, these changes have increased the need for high-precision components that have traditionally included sensors, oscillators, and timing devices, many of which utilize synthetic quartz. The excellent piezoelectric properties, thermal stability, and durability of synthetic quartz under harsh environmental conditions make it an excellent candidate for automotive electronics, where long-term and reliable operation is required.

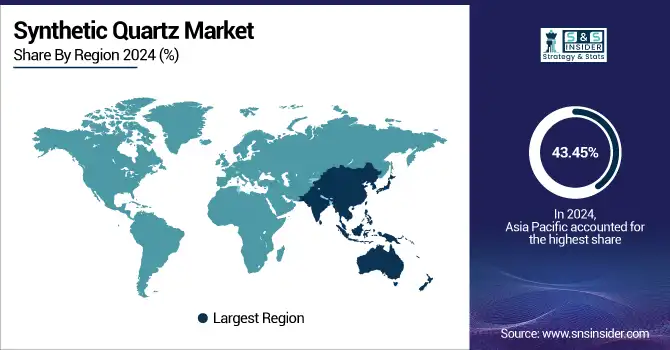

Synthetic Quartz Market Regional Outlook:

Asia Pacific held the largest market share of around 43.45%, in 2024. The region’s growth is driven by the region's industrial efficiencies, growing electronics manufacturing market, and presence of semiconductor fabrication plants. The countries including China, Japan, South Korea, and Taiwan are the giants of electronics production and semiconductor manufacturing, the main consumers of synthetic quartz for manufacturing high-precision components. The region boasts massive technology infrastructure investments, government initiatives that encourage semiconductor and electronics industries, and an ever-expanding consumer electronics market driven by higher disposable incomes and the move to urbanization. Moreover, the burgeoning demand for synthetic quartz is fueled by Asia Pacific, the global manufacturing hub for smartphones, automotive electronics, and renewable energy technologies.

For instance, in April 2024, Heraeus Holding GmbH expanded its quartz glass production facilities to meet the increasing demand from semiconductor manufacturers in China and Japan.

North America Synthetic Quartz market held a significant market share and is the fastest-growing segment in the forecast period. The growth is propelled by the presence of established semiconductor and electronics industries, coupled with established research and development capabilities, and considerable investments in advanced technology manufacturing. This region comprises a few of the top synthetic quartz manufacturers and semiconductor companies that drive demand for high-quality quartz materials for use in oscillators and resonators, and other precision components. Moreover, the focus on innovation in sectors like aerospace and defense, healthcare, and telecommunications also drives demand for reliable synthetic quartz products in North America. Strong regional presence by virtue of the favorable government policies and funding initiatives directed towards bolstering the domestic semiconductor supply chain and reducing reliance on imports further adds to this stronger foothold.

The U.S. Synthetic Quartz market size was USD 20.17 million in 2024 and is expected to reach USD 33.50 million by 2032 and grow at a CAGR of 6.55% over the forecast period of 2025-2032. It is owing to the wide range of industries such as semiconductors, advanced electronics, and other innovation-led segments. The U.S. remains the leading producer of chips globally, with more than 47% of semiconductor manufacturing equipment shipments all going to the States currently, according to the Semiconductor Industry Association (SIA) as of 2024.

The U.S. government has earmarked more than USD 52 billion via the CHIPS and Science Act to boost domestic semiconductor research, development, and manufacturing capacity, creating more demand for materials such as synthetic quartz. Aerospace and defense, telecommunication, and healthcare sectors have been strong in the country, resulting in strong consumption for synthetic quartz used in components with demand for high reliability and precision.

Europe held a significant market share over the forecast period due to the technological strength of various high-tech manufacturing sectors, such as aerospace, automotive, telecommunications, and renewable energy, in the region. Advanced semiconductor fabrication plants and electronics manufacturers in countries such as Germany and France, and the Netherlands depend on synthetic quartz for precision components such as oscillators, resonators, and optical devices, all of which are essential for today's advanced electronics. Also, the focus on innovation and sustainability in the region creates demand for high-end quartz materials used in solar energy applications and newer communication technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The synthetic quartz companies are Momentive, Heraeus, Nikon, Shin-Etsu Chemical, Murata Manufacturing, Tosoh, Seiko Epson, CoorsTek, KYOCERA, Guangdong Fenghua Advanced Technology, and Others.

Recent Developments:

-

In December 2023, CoorsTek plans to invest in its European facilities to support growing demand for synthetic quartz components for the electronics and semiconductor markets. Investment intention in upgrading facilities and product lines to meet the growing demand from the European market.

-

In 2022, Shin-Etsu Chemical increased the production capacity of synthetic quartz crystal to meet the high demand of semiconductors. The expansion consisted of the expansion of manufacturing processes and increased volume to deliver high-end synthetic quartz crystals for electronics applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 101.84 Million |

| Market Size by 2032 | USD 153.07 Million |

| CAGR | CAGR of 5.23% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Synthetic Quartz Crystal, Synthetic Quartz Glass) •By Application (Electrical & Electronics, Automotive, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Momentive, Heraeus, Nikon, Shin-Etsu Chemical, Murata Manufacturing, Tosoh, Seiko Epson, CoorsTek, KYOCERA, Guangdong Fenghua Advanced Technology. |