Calibration Services Market Size Analysis:

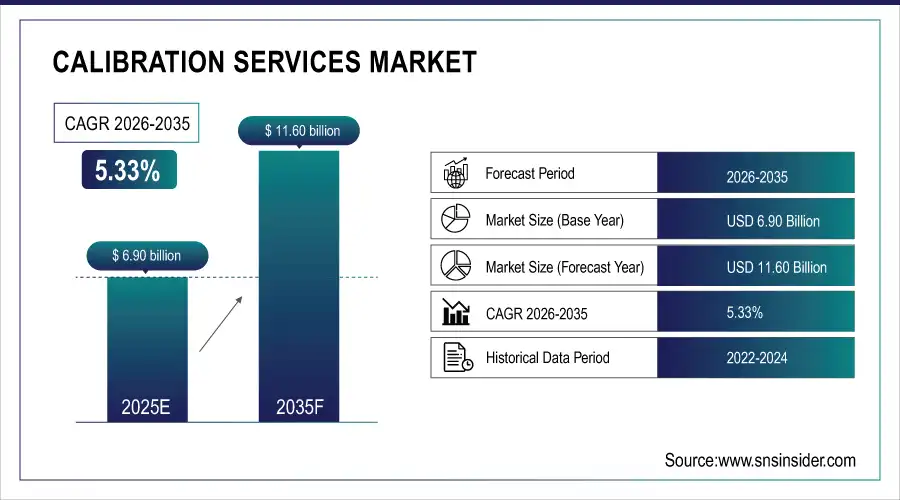

The Calibration Services Market Size is estimated at USD 6.90 Billion in 2025 and is expected to reach USD 11.60 Billion by 2035, growing at a CAGR of 5.33% over 2026–2035.

The Calibration Services Market analysis report covers all aspects of calibration methods, service kinds, applications, compliance requirements, and changing quality assurance practices in industrial, commercial, and institutional settings. Calibration services make sure that the measurement tools used in production, testing, inspection, and following the rules are accurate, reliable, and easy to find. During the projection period, the market will increase because of more automation, stricter quality requirements (ISO, IEC, FDA, FAA), the fast rise of electronics and aerospace industry, and the growing need for traceable and accredited calibration services in supply chains globally.

Calibration services are deployed across over 48 million active measurement instruments 2025 globally, spanning manufacturing plants, laboratories, aerospace facilities, telecom infrastructure, and energy systems, supported by regulatory mandates and preventive maintenance requirements.

Market Size and Growth Projection

-

Market Size in 2025: USD 6.90 Billion

-

Market Size by 2035: USD 11.60 Billion

-

CAGR: 5.33% (2026–2035)

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Get More Information on Calibration Services Market - Request Sample Report

Calibration Services Market Trends:

-

Adoption of ISO/IEC 17025–accredited calibration services is increasing, with over 72% of industrial enterprises prioritizing accredited providers.

-

Growth in third-party and OEM calibration outsourcing is reducing internal maintenance costs by 20–35%.

-

Rising demand for electrical and electronic calibration is driven by semiconductor, EV, and high-precision electronics manufacturing.

-

Expansion of on-site and mobile calibration services is improving equipment uptime by 15–25% in aerospace and industrial facilities.

-

Integration of digital calibration management systems and cloud tracking is enabling predictive maintenance and automated audits.

-

Stricter regulations are increasing calibration frequency, with aerospace and defense requiring 2–3× more cycles than general industry.

U.S. Calibration Services Market Size Outlook:

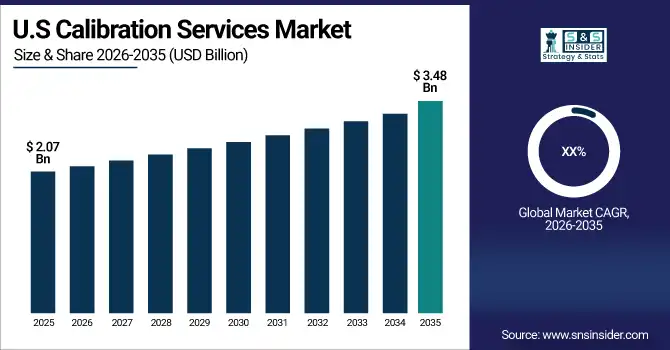

The U.S. Calibration Services Market size is projected to grow from USD 2.07 Billion in 2025 to reach USD 3.48 Billion by 2035. Advanced manufacturing, aerospace and defense spending, semiconductor growth, and tight enforcement of FDA, FAA, NIST, and ISO compliance standards are all factors that promote growth. The industry continues to grow and change since there are so many recognized labs, OEM service centers, and third-party providers.

Calibration Services Market Growth Drivers:

-

Rising Regulatory Compliance and Quality Standards Accelerating Market Growth

The expansion of the Calibration Services Market is primarily driven by more regulatory scrutiny and quality assurance needs across industries. To meet ISO 9001, ISO/IEC 17025, FDA 21 CFR, FAA, and IEC requirements, the manufacturing, aerospace, pharmaceuticals, electronics, and energy industries must keep records of their calibrations that can be traced. Calibration makes sure that measurements are correct, processes are reliable, and products are consistent. This lowers the risk and responsibility of running a business. As supply chains around the world become more integrated, people are starting to see calibration compliance as a strategic need instead than just a maintenance task.

Globally, over 85% of regulated manufacturing facilities undergo mandatory calibration audits at least once annually, reinforcing sustained demand for professional calibration services.

Calibration Services Market Restraints:

-

High Service Costs and Downtime Impacting Adoption of Calibration Services Globally

Calibration costs and equipment downtime are still big problems, especially for small and medium-sized businesses. For high-precision instruments, advanced calibration needs sophisticated equipment, skilled specialists, and accredited labs, which raises the cost of service. Also, off-site calibration might cause problems with operations, especially in places where production is always going on. On-site calibration reduces downtime, but it usually costs more, which makes it less appealing to users who are sensitive to costs.

Calibration-related downtime and service fees account for 18–28% of annual maintenance budgets in small manufacturing facilities, affecting adoption rates in emerging markets.

Calibration Services Market Opportunities:

-

Growth of Automation, Smart Manufacturing, and Digital Calibration Platforms

The Calibration Services Market presents excellent opportunities due to the rise of Industry 4.0, smart factories, and digital quality management systems. Highly accurate and regularly calibrated tools are needed for automated production lines, robots, and procedures that use sensors. Digital calibration solutions let you watch things from afar, plan ahead, and manage certifications automatically, which makes operations run more smoothly. Service providers that combine software, analytics, and IoT-enabled calibration tools are in a good position to offer services that add value and long-term contracts.

Digital calibration solutions are expected to support over 40% of calibration workflows by 2027, significantly improving compliance tracking and asset utilization.

Calibration Services Market Segmentation Analysis:

-

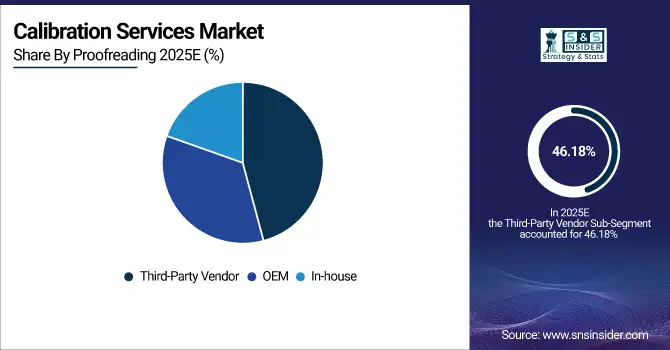

By Proofreading, Third-Party Vendors held the largest market share of 46.18% in 2025, while In-house calibration is expected to grow at a slower pace due to cost and accreditation challenges.

-

By Service Type, Electrical calibration dominated with a 31.74% share in 2025, while Dimensional calibration is projected to grow at the fastest CAGR of 9.12% during 2026–2033.

-

By Application, Industrial & Automation accounted for 38.96% of the market in 2025, while Aerospace & Defence is expected to register the fastest growth through 2033.

By Proofreading, Third-Party Vendors Dominate While OEM Services Remain Critical

Third-party calibration providers dominate due to their accredited laboratories, broad service portfolios, and cost efficiency. These vendors work in many different fields and offer services that may grow with the needs of their customers, which lowers the cost of capital for those customers. In 2025, third-party providers globally calibrated more than 22 million instruments every year.

OEM calibration services remain essential for proprietary and high-complexity equipment, especially in electronics, aerospace, and advanced testing systems. In-house calibration is primarily limited to large enterprises with high-volume, repetitive calibration needs.

By Service Type, Electrical Leads While Dimensional Expands Rapidly

Electrical calibration dominates the market owing to the large use of electrical and electronic instruments across manufacturing, telecom, energy, and electronics sectors. Voltage, current, resistance, and frequency calibration represent critical operational parameters, with over 60% of industrial assets requiring periodic electrical calibration.

Dimensional calibration is the fastest-growing segment due to the surging precision manufacturing, CNC machining, semiconductor fabrication, and metrology-intensive industries. Mechanical and thermodynamic calibration maintain steady demand in heavy industries, energy systems, and process manufacturing.

By Application, Industrial & Automation Leads While Aerospace & Defence Accelerates

Industrial & Automation applications dominate caused by the extensive use of sensors, gauges, controllers, and test instruments in manufacturing environments. Calibration supports process stability, yield optimization, and predictive maintenance.

Aerospace & Defence is the fastest-growing application segment owing to the strict safety standards, complex avionics systems, and increased defense spending. Aerospace instruments require frequent, traceable calibration cycles, contributing to higher service intensity and revenue per asset.

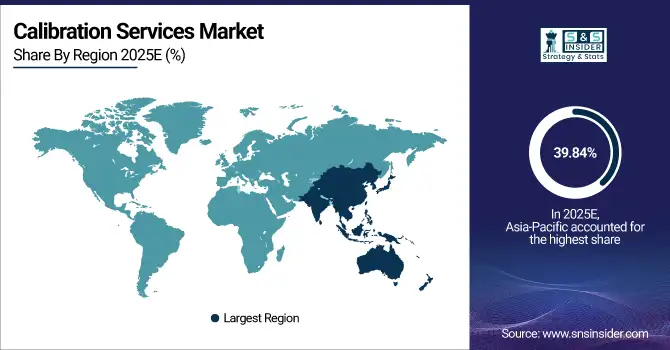

Asia Pacific Calibration Services Market Insights:

Asia Pacific dominated the Calibration Services Market, accounting for 39.84% of global market share in 2025. Demand is rising due to the rapid industrialization, strong electronics and automotive manufacture, and big infrastructure projects in China, Japan, South Korea, and India. Government-mandated quality certifications and industry that is focused on exports are still making it easier for people to use regional calibration services.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Calibration Services Market Insights:

China represents over 46% of Asia Pacific demand, due to its large manufacturing base, high electronics production, and growing aerospace industry. The strict enforcement of quality and compliance standards, together with the quick automation of facilities, is causing a significant demand for electrical, dimensional, and OEM calibration services in both industrial and high-tech settings.

North America Calibration Services Market Insights:

North America is projected to grow at a CAGR of 8.67%, driven by advanced manufacturing, aerospace and defense dominance, increased investments in semiconductors, and strict enforcement of rules. A significant OEM presence, a well-established network of ISO-accredited labs, and the early use of digital calibration and asset management technology are all good things for the area.

U.S. Calibration Services Market Insights:

The U.S. contributes approximately 73% of North American revenue, backed by the aerospace, defense, pharmaceutical, and electronics manufacturing industries. The market is still growing in regulated industries and advanced production environments because more and more companies are using digital calibration management systems, predictive maintenance practices, and compliance-driven recalibration cycles.

Europe Calibration Services Market Insights:

Europe holds a significant share of the global Calibration Services Market due to strong rules, advanced industrial automation, and the ability to make things with great accuracy. EU-wide quality requirements, a solid metrology infrastructure, and production upgrades that are good for the environment all help keep calibration demand steady across the automotive, aerospace, electronics, and industrial processing industries.

Germany Calibration Services Market Insights:

Germany accounts for nearly 28% of European demand, as it is the leader in automotive manufacturing, industrial automation, and metrology-intensive production. The country’s strong focus on precision engineering, quality compliance, and Industry 4.0 adoption sustains high penetration of accredited calibration services across manufacturing and testing environments.

Latin America Calibration Services Market Insights:

Latin America is experiencing steady growth due to industrial expansion, energy infrastructure projects, and improving regulatory enforcement. Increasing adoption of third-party calibration services is supported by manufacturing modernization initiatives, export-driven production, and rising awareness of measurement accuracy and compliance requirements across industrial and energy-intensive sectors.

Brazil Calibration Services Market Insights:

Brazil holds approximately 36% of regional market share, supported by industrial modernization, energy and oil & gas infrastructure, and aerospace component manufacturing. Growing reliance on accredited third-party calibration providers and increasing compliance with international quality standards are strengthening demand across manufacturing and industrial testing facilities.

Middle East & Africa Calibration Services Market Insights

The Middle East & Africa market is growing steadily, supported by energy, oil & gas, aerospace, and large-scale infrastructure projects. Increasing enforcement of operational compliance and safety standards in industrial facilities is strengthening demand for electrical, mechanical, and on-site calibration services across the region.

Saudi Arabia Calibration Services Market Insights:

Saudi Arabia contributes nearly 31% of regional revenue, driven by industrial diversification, energy sector expansion, and Vision 2030 megaprojects. Strong emphasis on operational excellence, quality compliance, and advanced industrial systems is accelerating adoption of calibration services across manufacturing, energy, and aerospace applications.

Calibration Services Market Competitive Landscape:

Ametek Inc., based in Berwyn, Pennsylvania, and established in 1930, is a worldwide supplier of sophisticated electrical devices and expert calibration services. The company supports high-precision measurement, compliance, and reliability requirements for the aerospace, defense, industrial, power, and energy applications. Ametek's calibration capabilities cover temperature, mechanical, and electrical disciplines in sites all around the world.

-

In July 2023, Ametek expanded its calibration service network to support high-precision aerospace and power applications.

Carl Zeiss AG, is a world pioneer in optical systems, industrial metrology, and dimensional calibration solutions. It was founded in 1846 and has its headquarters in Germany. Zeiss provides traceable, high-accuracy measurement systems and services to support precise manufacturing in the automotive, aerospace, electronics, and medical sectors. Initiatives for smart manufacturing and sophisticated quality assurance are supported by its calibration expertise.

-

In June 2023, Zeiss enhanced its industrial metrology calibration services with advanced digital measurement traceability solutions.

Eurofins Scientific, established in 1987, this Luxembourg-based company offers certified testing, inspection, and calibration services in the culinary, industrial, pharmaceutical, and environmental sectors. The business runs an extensive worldwide network of laboratories that assist product validation, quality control, and regulatory compliance. International accreditation requirements, precision, and traceability are the main focuses of Eurofins' calibration services.

-

In August 2023, Eurofins expanded its ISO/IEC 17025-accredited calibration laboratories across Europe and Asia.

Intertek Group plc, London-based and founded in 1885, it is a world-renowned supplier of assurance, testing, inspection, certification, and calibration services. Intertek provides end-to-end compliance and quality solutions to the consumer products, industrial manufacturing, electronics, and energy sectors. Consistent measurement accuracy across areas is made possible by its global calibration network.

-

In September 2023, Intertek strengthened its global calibration footprint with new laboratories serving electronics and industrial clients.

Fluke Corporation, established in 1948, this multinational pioneer in electrical test tools and calibration instruments has its headquarters in Washington, USA. To guarantee measurement precision and regulatory compliance, the company's solutions are extensively utilized in utilities, industrial maintenance, electrical, and metrology labs. Software-driven calibration management systems are another feature offered by Fluke.

-

In April 2023, Fluke expanded its digital calibration management solutions to improve compliance automation and asset traceability.

Calibration Services Companies are:

-

Exfo Inc.

-

Carl Zeiss AG

-

Testo AG

-

Intertek Group plc

-

Danaher Corporation

-

Agilent Technologies (now Keysight Technologies)

-

Yokogawa Electric Corporation

-

Mitutoyo Corporation

-

Honeywell International Inc.

-

National Instruments Corporation

-

Global Calibration Services Inc.

-

Fluke Corporation

-

Mettler Toledo International Inc.

-

Endress+Hauser

-

Bureau Veritas

-

Pace Analytical Services

-

Kistler Group

-

Flir Systems Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.90 Billion |

| Market Size by 2035 | USD 11.60 Billion |

| CAGR | CAGR of 5.33% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Proofreading (In-house, OEM, Third-Party Vendor) • By Service Type (Mechanical, Electrical, Dimensional, Thermodynamics) • By Application (Industrial & Automation, Electronics, Aerospace & Defence, Communication, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ametek Inc., Exfo Inc., Carl Zeiss AG, Testo AG, Eurofins Scientific, Intertek Group plc, Danaher Corporation, Agilent Technologies (now Keysight Technologies), Yokogawa Electric Corporation, Mitutoyo Corporation, Honeywell International Inc., National Instruments Corporation, Global Calibration Services Inc., Fluke Corporation, Mettler Toledo International Inc., Endress+Hauser, Bureau Veritas, Pace Analytical Services, Kistler Group, and Flir Systems Inc. offer various calibration and measurement services across industries. |