Ceramic Chip Inductors Market Size Analysis:

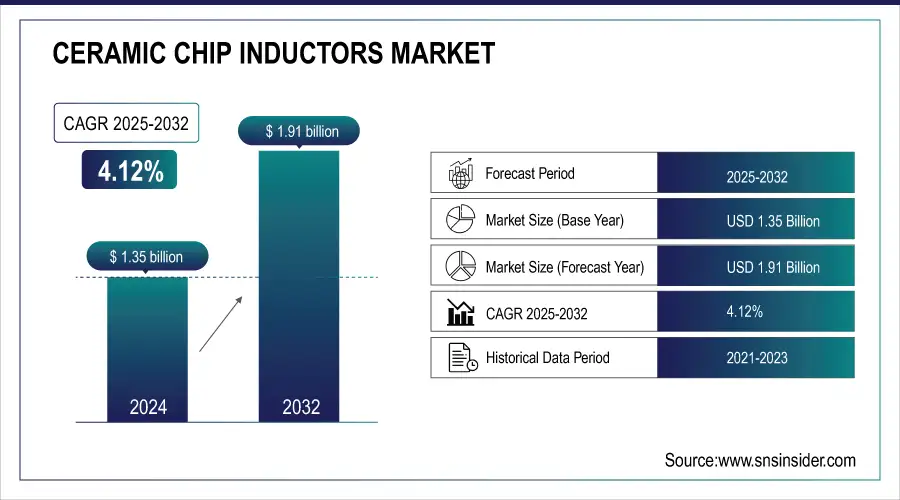

The Ceramic Chip Inductors Market Size was valued at USD 1.40 billion in 2025E and is expected to grow at 4.12% CAGR to reach USD 1.94 billion by 2033.

The global market is segmented on the basis of type, application, distribution channel, and core material, and covered across major countries within the regions of North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The global market is witnessing increasing demand from the consumer electronics, telecom, industrial, and healthcare industries—signaling miniaturization, integration of high-frequency circuits, and rapid infrastructure development for 5G and IoT technologies in developed and developing countries.

For instance, over 80% of manufacturing firms in advanced economies have integrated some form of industrial automation by 2024, relying on compact electronics built with ceramic inductors.

To Get more information on Ceramic Chip Inductors Market - Request Free Sample Report

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 1.40 Billion

-

Market Size by 2033 USD 1.94 Billion

-

CAGR of 4.12% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Ceramic Chip Inductors Market Trends:

• Increasing data traffic and high-speed signal transmission are driving demand for compact, efficient, and thermally stable ceramic chip inductors.

• Miniaturization of automotive electronics and medical devices is accelerating adoption of high-performance passive components with small form factors.

• Rising electric vehicle production is boosting demand for ceramic chip inductors in battery management systems, onboard chargers, and power electronics.

• Manufacturers are prioritizing inductors with high heat tolerance, low losses, and stable performance to meet harsh automotive and industrial operating conditions.

• Expanding use of ceramic chip inductors in non-telecom applications such as medical imaging, LiDAR, and industrial automation is creating new growth avenues.

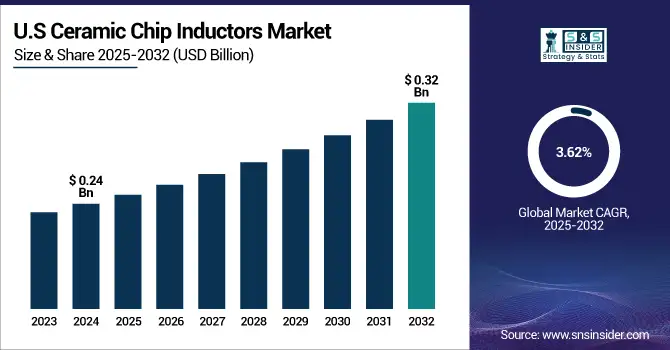

The U.S. Ceramic Chip Inductors Market size was USD 0.24 billion in 2025E and is expected to reach USD 0.32 billion by 2033, growing at a CAGR of 3.62% over the forecast period of 2026–2033.

The U.S. market is witnessing significant Ceramic Chip Inductors Market growth due to the growing demand for the high-performance ceramic chip inductor in cutting-edge automotive electronics, aerospace systems, and telecom infrastructure. Market growth is further aided by the rising use of such devices in defense-grade communication equipment and radar systems. This is further driving the demand for small-sized and thermally stable inductors in turn promoting the growth of U.S. ceramic chip inductors industry, on the context of advancing electric vehicles and investments towards next-generation mobility technologies.

For instance, over 1.6 million EVs were sold in the U.S. in 2024, accounting for nearly 10% of total vehicle sales, driving demand for ceramic chip inductors in power electronics and BMS systems.

Ceramic Chip Inductors Market Growth Drivers:

-

Growing Data Traffic and High-Speed Optical Communication Are Driving Demand for Efficient Modulation Solutions

Compact, thermally stable inductors are a basic requirement in modern automotive electronics to enable ADAS, infotainment & EV power modules. Ceramic chip inductors are popular in automotive applications with tight space constraints due to their optimal ratios in size to performance. Likewise, medical devices such as portable monitors and diagnostic equipment require tiny components to stay miniature and up-to-date. Growing production of comparatively compact medical and automotive systems has been a prominent growth influencer for this market, as increasing adoption of high-performing passive components including ceramic chip inductors are enabling miniaturization.

For instance, electric vehicles contain up to 100 inductors per vehicle, many of which are ceramic-based due to their ability to perform under thermal stress and tight space constraints.

Ceramic Chip Inductors Market Restraints:

-

Thermal Management and Signal Distortion at High Frequencies Hamper Performance and Reliability

While providing high efficiency and a small footprint, ceramic chip inductors are largely rigid, brittle, and prone to cracking or failing due to mechanical stress or high vibration. In high-shock or high-temperature industrial environments, performance may falter or components will fail, and manufacturers will thereby select more rugged alternatives. According to the manufacturer, this sensitivity limits their use in challenging applications — for instance, heavy industrial machinery or military-grade systems, where less mechanical resilience can detract from overall system reliability.

Ceramic Chip Inductors Market Opportunities:

-

Growing Applications in Medical Imaging, Lidar, and Industrial Automation Open Non-Telecom Market Potential

Business demand for ceramic chip inductors in Battery Management Systems (BMS), power electronics, and onboard chargers is starting to grow due to the rapid global adoption of electric vehicles (EVs). Having these components allow for a more handled noise filtering and signal integrity within a compact power system. Driven by the demand for miniaturization and thermal stability enabled by these devices, ceramic chip inductors meet the need for high-efficiency, lightweight designs by the EV manufacturers. As EV sales in Asia, Europe, and the U.S. ramp up plastic-looking for high growth ceramic chip inductor market segments.

For instance, modern EV power electronics operate at temperatures exceeding 150°C, necessitating compact inductors with high heat tolerance and low loss profiles.

Ceramic Chip Inductors Market Segment Analysis:

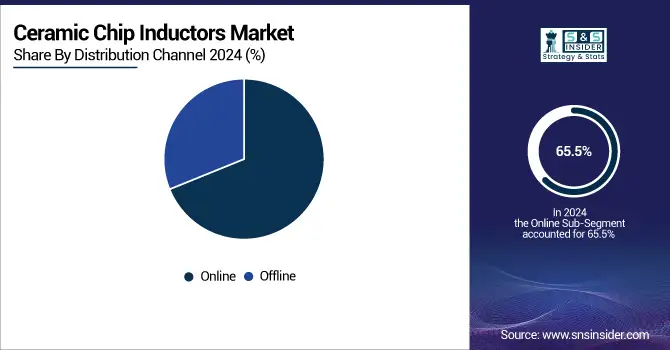

By Distribution Channel

In 2025E, online distribution accounted for the largest share of the market, generating revenue share of 65.5%, as a result of easy access to digital procurement, immediate product delivery, and access to global inventory. More small and mid-sized OEMs now turn to e-commerce-based platforms to aggregate individual components more directly than ever before. For decades, Digi-Key Electronics has played a key role in enabling online procurement with real time inventory, datasheets and shipment of ceramic chip inductors from leading suppliers globally. The offline segment is expected to grow at the fastest CAGR of 4.35% till 2033, due to the preference of OEMs and industrial buyers for face-to-face service, credit support and technical assistance on complex bulk orders. Automotive, Aerospace and Industrial as these sectors are particularly strong with this model. Arrow Electronics has kept excellent regional partnerships and logistics ability, so that it has high-touch offline sales of passive components, such as ceramic chip inductor.

By Type

In 2025E, Multilayer Ceramic Chip Inductor dominated the market, generating 52.6% of total revenue as they are small in size, cost-effective, and exhibit excellent frequency stability. These are mostly used in smart phones, automotive ECUs, and other consumer electronic items. They are great for mass production since they are compatible with surface-mount assembly lines. Widely employed commercially in multilayer inductor products, Murata Manufacturing Co., Ltd. holds a diversified product range suiting the needs of global telecom and consumer electronics manufacturers further consolidating global dominance of this segment. Thin Film Ceramic Chip Inductors are expected to grow at the highest CAGR of 4.92% during the forecast period 2026 to 2033 owing to increasing high frequency RF modules, wireless chips, and precision filters. This capability is becoming particularly important in 5G handsets and other IoT applications that require tighter tolerances and smaller footprints. With ultra-compact thin-film inductors for new applications such as edge computing and high-speed wireless communication systems, TDK Corporation is one of the largest innovators in this area.

By Application

In 2025E, Consumer Electronics segment is estimated to be the largest in Ceramic Chip Inductors Market share, accounting for 38.2% in revenue owing to the consumer electronics indispensable applications including smartphones, tablets, laptops, and wearables. Ceramic chip inductors are suitable for many of these products, which require high-frequency performance in ever-smaller packages. Samsung Electro-Mechanics leads the path with scalable, miniaturized induction, powering the next-gen smart tech and electronics manufacturing across Asia & North America. The healthcare segment will grow at the highest CAGR of 7.54% from 2026 to 2033 owing to increase in adoption of portable diagnostic devices, implantable medical devices, and wearable health monitors. Such medical applications have specific requirements on high-reliability, thermally stable, and miniaturized passive components. Vishay Intertechnology, Inc. is cementing its commitment to addressing growing demand in remote patient monitoring, digital health, and hospital-grade instrumentation with the development of new medical-grade inductors with improved performance.

By Core Material

The Ferrite Core inductors had the largest share of revenue in 2025E, with 47.5% share that is largely due to it being able to provide high performance at relatively high frequencies with a comparatively lower cost, which also drives the high adoption on RF circuit and power supply module application. These chips are used widely in everything from consumer devices to telecom routers to computing hardware. Taiyo Yuden Co., Ltd is another big name for ferrite as ceramic inductors supplier which has large selection series of magnetic materials where compactness and frequency are the key features. Non-Magnetic Under Ceramic Core inductors are estimated to grow at the highest CAGR during the forecast years from 2026 to 2033, since they are least affected by magnetic interference and possess high thermal stability, hence, are widely utilized in high-frequency and precision-critical systems. Hence these attributes ideal for applications such as 5G antennas and aerospace electronics and radar. Coilcraft Inc., a leading global provider of non-magnetic ceramic core inductors designed specifically for various RF and satellite applications where reliable performance is essential in small packages.

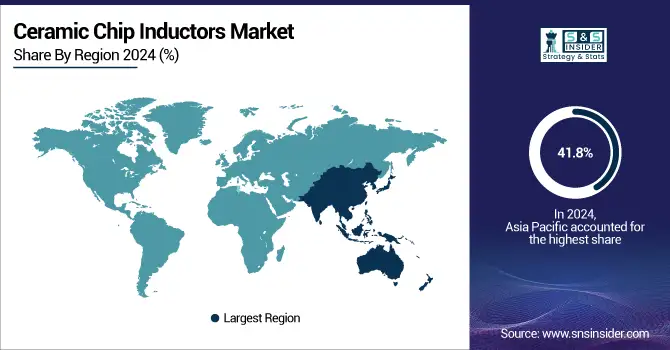

Ceramic Chip Inductors Market Regional Analysis:

Asia Pacific Ceramic Chip Inductors Market Insights

Asia Pacific held the greatest revenue share of around 41.8% in 2025E, due to electronics manufacturing hubs in China, Japan, South Korea, and Taiwan, which are aided by domestic consumption and global exports. The Asia Pacific regional market is also anticipated to gain momentum with the fastest CAGR of nearly 4.75% from 2024 to 2032 owing to the increasing automotive electronics, consumer devices production scaling, and 5G networks across countries such as India, Vietnam, and other Southeast Asian countries.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China leads the Asia Pacific ceramic chip inductors market due to its large-scale consumer electronics production, robust 5G infrastructure deployment, and government-backed investments in automotive, industrial automation, and semiconductor manufacturing capabilities.

North America Ceramic Chip Inductors Market Insights

In North America, ceramic chip inductors market is witnessing strong demand from the U.S. thereby supported by developments in automotive electronics, aerospace systems, and telecom infrastructure. Strong electronics manufacturing base, growing EV adoption and investments in defence-grade communication systems provides adequate impetus to the region. The roll-out of 5G and industrial automation add to the consumption of components in these critical applications.

-

The U.S. dominates North America’s ceramic chip inductors industry due to its advanced electronics manufacturing ecosystem, strong presence of aerospace and defense industries, and growing demand for high-frequency components in automotive, telecom, and next-generation mobility applications.

Europe Ceramic Chip Inductors Market Insights

Europe’s ceramic chip inductors market is driven by advancements in automotive electronics, industrial automation, and renewable energy systems. Countries such as Germany and France lead in integrating high-frequency inductors into electric vehicles and precision control systems. The region also benefits from robust R&D investments, stringent quality standards, and a growing focus on sustainable, miniaturized components in medical and telecom sectors.

-

Germany dominates the European ceramic chip inductors market due to its strong automotive electronics sector, advanced manufacturing, and high demand for precision components in EVs and industrial automation. Its robust semiconductor and R&D ecosystem further supports continuous innovation and growth.

Latin America (LATAM) and Middle East & Africa (MEA) Ceramic Chip Inductors Market Insights

The Middle East & Africa and Latin America ceramic chip inductors markets are growing steadily, led by the UAE and Brazil respectively. UAE’s smart city initiatives and telecom expansion drive demand, while Brazil benefits from a strong consumer electronics base, growing automotive production, and increasing adoption of miniaturized electronic components.

Ceramic Chip Inductors Market Key Players:

Major Key Players in Chip Inductors Market are Murata Manufacturing Co., Ltd., TDK Corporation, Taiyo Yuden Co., Ltd., Samsung Electro-Mechanics, Vishay Intertechnology, Inc., Panasonic Industry Co., Ltd., Coilcraft, Inc., KYOCERA AVX Components Corporation, Laird Technologies, Würth Elektronik GmbH & Co. KG, Bourns, Inc., Johanson Technology, Inc., Chilisin Electronics Corp., API Delevan, Sumida Corporation, YAGEO Corporation, Shenzhen Sunlord Electronics Co., Ltd., Pulse Electronics (a Yageo company), Viking Tech Corporation and Token Electronics Industry Co., Ltd and others.

Competitive Landscape for Ceramic Chip Inductors Market:

Murata Manufacturing Co., Ltd. is a global leader in electronic components, offering a broad portfolio of ceramic chip inductors for automotive, consumer electronics, and medical applications. The company focuses on high-reliability, miniaturized, and thermally stable inductors that support advanced power management, signal integrity, and compact system designs in EVs and next-generation electronic devices.

-

In January 2025, Murata unveiled the world’s smallest chip inductor in a 006003‑inch package (0.16 × 0.08 mm), achieving approx. 75% size reduction to support ultra‑miniaturized electronics like smartphones and wearables.

Coilcraft is a leading manufacturer of high-performance magnetic components, including ceramic chip inductors for automotive, industrial, and medical electronics. The company specializes in compact, low-loss, and thermally robust inductor designs that support power management, signal integrity, and reliable operation in space-constrained and high-temperature environments.

-

In March 2024, Coilcraft introduced a new line of low-profile ceramic-core chip inductors ranging from 1 nH to 56 nH, designed for high-Q performance in compact RF modules.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.40 Billion |

| Market Size by 2033 | USD 1.94 Billion |

| CAGR | CAGR of 4.12% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Multilayer Ceramic Chip Inductors, Wire Wound Ceramic Chip Inductors and Thin Film Ceramic Chip Inductors) • By Application (Consumer Electronics, Automotive, Industrial, Telecommunications, Healthcare and Others) • By Distribution Channel (Online and Offline) • By Core-Material (Ferrite Core, Iron Powder Core, Air Core, Ceramic Core (Non-Magnetic) and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Murata Manufacturing Co., Ltd., TDK Corporation, Taiyo Yuden Co., Ltd., Samsung Electro-Mechanics, Vishay Intertechnology, Inc., Panasonic Industry Co., Ltd., Coilcraft, Inc., KYOCERA AVX Components Corporation, Laird Technologies, Würth Elektronik GmbH & Co. KG, Bourns, Inc., Johanson Technology, Inc., Chilisin Electronics Corp., API Delevan, Sumida Corporation, YAGEO Corporation, Shenzhen Sunlord Electronics Co., Ltd., Pulse Electronics (a Yageo company), Viking Tech Corporation and Token Electronics Industry Co., Ltd. |