Carrier Aggregation Solutions Market Report Scope & Overview:

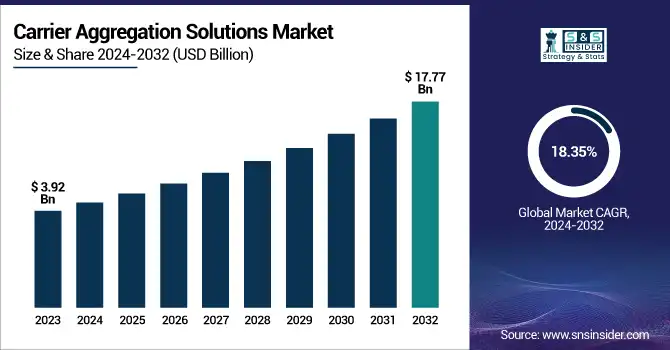

The Carrier Aggregation Solutions Market was valued at USD 3.92 billion in 2023 and is expected to reach USD 17.77 billion by 2032, growing at a CAGR of 18.35% from 2024-2032. This report includes key insights into traffic and throughput improvements, spectrum utilization efficiency, enhanced device and network support, performance metrics, and forecasted data volumes. Market growth is driven by rising demand for faster mobile broadband, efficient use of fragmented spectrum assets, and the increasing number of connected devices. Carrier aggregation plays a crucial role in boosting network capacity and performance, especially amid the growing adoption of 5G. The technology enhances spectral efficiency and minimizes latency, which is vital for supporting high-bandwidth applications and delivering a seamless user experience. As telecom operators strive to meet escalating data demands, carrier aggregation is becoming a core component of advanced network deployment strategies.

To Get more information on Carrier Aggregation Solutions Market - Request Free Sample Report

U.S. Carrier Aggregation Solutions Market was valued at USD 1.10 billion in 2023 and is expected to reach USD 4.88 billion by 2032, growing at a CAGR of 18.02% from 2024-2032.

The market's growth is primarily driven by increasing mobile data consumption, rapid 5G rollout, and the need for improved network performance. With the rising adoption of smart devices and bandwidth-intensive applications, operators are leveraging carrier aggregation to enhance spectral efficiency and deliver higher data speeds. Additionally, the push toward better rural and suburban connectivity and the growing demand for seamless user experiences across regions are prompting investments in advanced network infrastructure. Supportive regulatory initiatives and spectrum availability further contribute to the expansion of carrier aggregation solutions across the U.S.

Carrier Aggregation Solutions Market Dynamics

Drivers

-

Growing demand for high-speed mobile data services is fueling the need for enhanced network capacity and spectral efficiency.

Increased mobile data usage is compelling telecom operators to leverage advanced technologies such as carrier aggregation. With consumer expectations for faster and buffer-free connectivity growing particularly for applications such as streaming, gaming, and IoT carriers have to deliver improved performance. Carrier aggregation optimizes spectrum utilization by aggregating multiple frequency bands, thus expanding data throughput as well as total network capacity. The rollout of 4G LTE-Advanced and initial 5G networks further speeds the implementation of the solution. Network operators view carrier aggregation as an essential facilitator for ensuring quality of service and supporting growing traffic loads. Moreover, competitive forces to deliver better user experiences are forcing telecom operators to adopt carrier aggregation in their infrastructure, thereby driving gradual expansion of this market.

Restraints

-

High deployment costs and complex network integration are limiting the scalability of carrier aggregation in developing regions.

Carrier aggregation requires substantial investment in latest hardware and software upgrades, which is a monetary impediment for smaller telecom companies. Upgrading base stations, backhaul network optimization, and device compatibility drive capital and operational costs. Telecom budgets in most developing countries are limited, and the return on investment in carrier aggregation is still unclear in low-ARPU markets. Technical challenges like inter-band interference management and handover smoothness need advanced engineering and expertise, which might not be easily available. These challenges slow down deployments and promote hesitation among network providers to adopt carrier aggregation at scale, thereby constraining market growth, particularly in cost-conscious settings where infrastructure upgrade is a sluggish process itself.

Opportunities

-

Expansion of IoT and smart devices presents a strong opportunity to leverage carrier aggregation for efficient data transmission.

Iot device explosion in industries from households to factory automation requires smooth, high-throughput, and low-latency connectivity. Carrier aggregation offers a solution to satisfy these demands by allowing improved utilization of fragmented spectrum resources. As billions of connected devices send data at the same time, network operators need to provide consistent quality of service without congestion. Carrier aggregation enables dynamic spectrum management and enhanced network responsiveness, particularly in dense IoT deployments. Additionally, mission-critical use cases such as remote monitoring, autonomous driving, and telemedicine will gain from the increased bandwidth and reliability enabled by carrier aggregation. This increasing reliance on real-time connectivity presents tremendous opportunities for carrier aggregation solutions to be integrated into future IoT strategies and 5G-powered smart ecosystems.

Challenges

-

Interoperability issues between network components and varying vendor technologies hinder seamless carrier aggregation deployment.

Carrying out carrier aggregation typically requires integrating hardware components from different vendors, and this has the potential to cause compatibility problems and performance degradation. Disparities in proprietary solutions, configurations, and software interfaces can cause inequities in the treatment of aggregated channels, leading to poor spectrum utilization or poor quality of experience. This issue is most seen when combining legacy network equipment with newer aggregation-enabled systems. In addition, multi-vendor systems make network management, testing, and troubleshooting more complex, needing greater expertise and resources. Such interoperability issues can cause deployment schedules to be pushed back and operational complexity to rise, particularly for operators wishing to scale carrier aggregation rapidly. This can be overcome through industry-wide collaboration and standardization, which may take time and be hard to implement uniformly across global networks.

Carrier Aggregation Solutions Market Segment Analysis

By Deployment

4G/LTE commanded the highest revenue share of around 60% in 2023 owing to its large-scale global uptake and mature networks. LTE networks have been extensively funded by telecom operators in the last decade, resulting in extensive coverage and good device support. Carrier aggregation is extensively used in LTE-Advanced networks for enhancing throughput and network capacity, providing the natural choice. The large user base and ongoing demand for reliable mobile performance cemented LTE leadership. in taking advantage of carrier aggregation solutions at scale.

5G is expected to expand at the fastest CAGR of around 19.63% during 2024-2032 due to growing rollout of the technology and diversity in the spectrum. Carrier aggregation is pivotal to 5G performance as it unites low-, mid-, and high-band frequencies for greater speed and lower latency. With the rollout of standalone 5G networks by operators and the focus on applications with high performance, demand for sophisticated aggregation capabilities will rise dramatically across industries and geographies.

By Application

Mobile Broadband Connectivity held the largest market share of approximately 34% in 2023 because of the growing global use of the internet, video streaming, and work-from-home tendencies. The need for unbroken, high-speed access to a mobile data network puts carrier aggregation in the lead when it comes to network optimization. It enables operators to provide improved user experiences in terms of data rates and uninterrupted connectivity, particularly in over-subscribed urban environments. The dominance of the segment is also indicated by the increasing smartphone penetration and requirements of uninterrupted, reliable broadband connectivity in a range of environments.

Applications of Smart City are poised to grow at the fastest CAGR of 19.96% during 2024 to 2032 due to the increased investment in digital infrastructure and city innovation. These programs necessitate stable high-speed communication networks for real-time information sharing, traffic management, public security, and monitoring environmental factors. Carrier aggregation boosts connectivity by maximizing spectral efficiency and enhancing coverage in high-density urban environments. As cities embrace smart technologies and IoT-based services, the importance of carrier aggregation comes into play to enable scalable, smart urban environments.

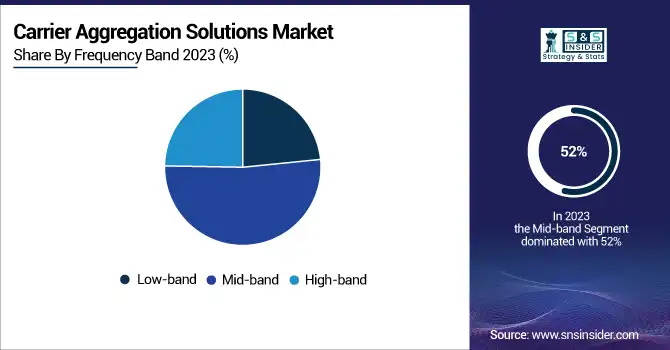

By Frequency Band

Mid-band spectrum held the largest market share of around 52% in 2023 due to its ideal balance between coverage and network capacity. It is commonly employed in LTE and future 5G rollouts, providing predictable performance in metropolitan and suburban settings. Carrier aggregation over mid-band frequencies enhances end-to-end throughput without degrading signal range, positioning it for scalable network performance-oriented operators. Its relative scarcity and regulatory preferability also fueled its market leading position among providers.

High-band is expected to expand at the fastest CAGR of 20.29% during 2024-2032 due to its unparalleled capability for ultra-high-speed data communication. Though with a limited coverage area, high-band (millimeter wave) is critical to next-generation technologies like AR/VR, self-driving cars, and smart manufacturing. Carrier aggregation bridges high-band constraints by coupling it with middle- or low-band frequencies to deliver better performance. As 5G applications become more mature and require low-latency, high-throughput networks, high-band carrier aggregation solutions will become more popular.

By Spectrum Band

Licensed spectrum led the Carrier Aggregation Solutions Market, yielding 65% of revenue in 2023 and is expected to advance at the highest CAGR of 15.22% from 2024 to 2032. Operators prefer licensed bands because they provide assured quality of service, less interference, and greater levels of security as compared to unlicensed or shared spectrum. Licensed spectrum is pivotal to utilizing carrier aggregation efficiently, particularly for commercial and high-density deployments. Furthermore, 5G deployment heavily depends on licensed bands in low, mid, and high frequencies, cementing this segment's ongoing relevance. As international spectrum auctions and policy initiatives further increase availability of new licensed frequencies, carrier aggregation solutions in this segment are anticipated to grow at a rapid pace. Its dual role of leadership and rapid expansion underscores its significance in both existing and upcoming network plans.

By Cell Type

Microcells captured the highest revenue share of 57% in 2023 and are also anticipated to grow at the fastest CAGR of 17.85% from 2024 to 2032. Their dominance stems from their optimal deployment in dense urban areas where macro cells face limitations due to building interference and traffic congestion. Microcells allow efficient reuse of spectrum and improved signal quality in high-demand zones. As operators seek to improve user experience through densified networks, microcells become ideal candidates for carrier aggregation implementation. The rising need for seamless, high-capacity coverage especially in commercial buildings, stadiums, and city centers is fueling rapid growth. Additionally, their lower power and cost-effective deployment make them attractive for expanding capacity in both 4G and 5G networks, solidifying their position as a crucial enabler of advanced carrier aggregation strategies.

Regional Analysis

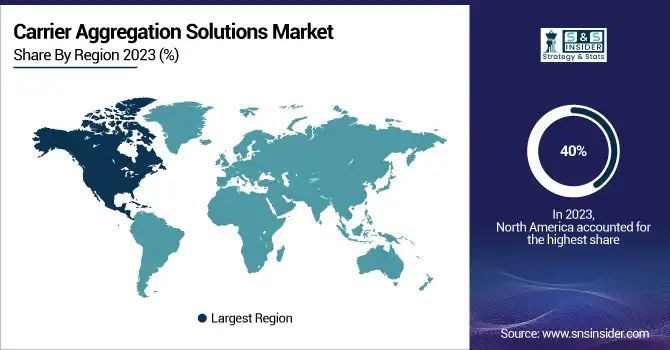

North America dominated the Carrier Aggregation Solutions Market with around 40% revenue share in 2023, fueled by early adoption of cutting-edge mobile technologies and strong telecom infrastructure. Major network operators in the U.S. and Canada have extensively rolled out LTE-Advanced and are aggressively building 5G networks, generating high demand for carrier aggregation to improve spectrum efficiency. The area also enjoys robust R&D investments, supportive regulatory environments, and good smartphone penetration that allows for more rapid deployment of aggregation solutions within commercial and enterprise networks.

Asia Pacific is expected to expand at the fastest CAGR of 20.39% from 2024 to 2032 as a result of huge investments in 5G networks and a surge in mobile data consumption. Nations such as China, India, Japan, and South Korea are rolling out next-generation networks aggressively to cater to expanding digital ecosystems. Urbanization growth, growing smartphone penetration, and government-supported smart city projects are further accelerating carrier aggregation demand, turning the region into a hotspot for scalable, high-capacity mobile connectivity solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Anritsu (MD8430A Signaling Tester, MT8821C Radio Communication Analyzer)

-

Artiza Networks, Inc. (DuoSIM-5G, 5G Load Tester)

-

Cisco Systems Inc. (Cisco Ultra Packet Core, Cisco 5G Cloud Core)

-

Huawei Technologies (SingleRAN LTE, SingleRAN@Broad)

-

Nokia Corporation (AirScale Baseband, AirScale Radio Access)

-

Qualcomm Technologies, Inc. (Snapdragon X75 Modem-RF System, Snapdragon X65 Modem-RF System)

-

Rohde and Schwarz GmbH and Co. KG (CMW500 Tester, SMW200A Vector Signal Generator)

-

Sprint.com (Sprint Spark, Sprint LTE Advanced Pro)

-

Telefonaktiebolaget LM Ericsson (Ericsson Radio System, Ericsson Cloud RAN)

-

ZTE Corporation (Uni-RAN, 5G NR Base Station)

-

Broadcom Inc. (5G RF Front-End Modules, 5G Modem SoCs)

-

Verizon Communications Inc. (5G Ultra Wideband, LTE Advanced)

-

Qorvo Inc. (RF Front-End Modules, High Band PADs)

-

Alcatel Lucent S.A. (9926 eNodeB, 9768 Metro Cell Outdoor)

-

AT&T Inc. (AT&T 5G+, LTE Advanced Network)

-

Capestone BV (5G Outdoor Routers, Industrial IoT Gateways)

-

Ciena Corporation (6500 Packet-Optical Platform, Adaptive IP)

-

CommScope, Inc. (ERA DAS, Small Cell Antennas)

-

Fujitsu Limited (5G NR Base Station, Carrier Aggregation Solution)

-

Hewlett Packard Enterprise L.P. (HPE 5G Core Stack, Open RAN Solution)

-

Intel Corporation (vRAN Accelerator ACC100, FlexRAN Platform)

-

Juniper Networks (Contrail Networking, Cloud-Native Router)

-

Keysight Technologies (CMW500 LTE Test Solution, Signal Studio Software)

-

LG Electronics (V60 ThinQ 5G, Velvet 5G)

-

NEC Corporation (5G Radio Units, Open RAN Solution)

-

NetScout Systems, Inc. (nGeniusONE, nGeniusPULSE)

-

Samsung Electronics Co., Ltd. (5G NR Base Station, Galaxy S21 5G)

-

SK Telecom Co., Ltd. (5G CA Services, Multi-View Streaming)

-

Skyworks Solutions, Inc. (Sky5 RF Modules, SkyOne Ultra 3.0)

-

T-Mobile US, Inc. (5G Carrier Aggregation Network, Home Internet)

-

Vodafone Group PLC (5G Carrier Aggregation, Gigabit Broadband)

Recent Developments:

-

In 2024, Nokia, BT Group, and Qualcomm achieved Europe’s first 5G Standalone downlink using five-component carrier aggregation. The test combined three FDD and two TDD carriers, reaching peak speeds of 1.85 Gbps, showcasing enhanced spectrum efficiency and network performance.

-

In February 2025, Ericsson, in collaboration with Mobily and MediaTek, successfully tested six-component carrier aggregation (6CC) on a live 5G Standalone network in Saudi Arabia. This test combined three FDD and three TDD carriers, achieving a downlink throughput of 4.2 Gbps. The implementation utilized Ericsson Spectrum Sharing and 5G Carrier Aggregation software features, aggregating six 5G carriers spanning a total spectrum of 310 MHz.

-

In April 2024, ZTE, China Mobile's Zhejiang Branch, and Qualcomm conducted the industry's first end-to-end field test combining 3CC carrier aggregation with 1024QAM modulation, achieving a downlink speed exceeding 5.4 Gbps in Jiaxing, China.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.99 Billion |

| Market Size by 2032 | US$ 17.77 Billion |

| CAGR | CAGR of 18.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (4G/LTE, 5G) • By Frequency Band (Low-band, Mid-band, High-band) • By Cell Type (Picocells, Microcells, Femtocells) • By Spectrum Band (Licensed, Non-licensed) • By Application (Mobile Broadband Connectivity, Smart City, Industrial IoT, Maritime Communications, Satellite Communication, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Anritsu, Artiza Networks, Inc., Cisco Systems Inc., Huawei Technologies, Nokia Corporation, Qualcomm Technologies, Inc., Rohde and Schwarz GmbH and Co. KG, Sprint.com, Telefonaktiebolaget LM Ericsson, ZTE Corporation, Broadcom Inc., Verizon Communications Inc., Qorvo Inc., Alcatel Lucent S.A., AT&T Inc., Capestone BV, Ciena Corporation, CommScope, Inc., Fujitsu Limited, Hewlett Packard Enterprise L.P., Intel Corporation, Juniper Networks, Keysight Technologies, LG Electronics, NEC Corporation, NetScout Systems, Inc., Samsung Electronics Co., Ltd., SK Telecom Co., Ltd., Skyworks Solutions, Inc., T-Mobile US, Inc., Vodafone Group PLC. |