Standalone 5G Network Market Report Scope & Overview:

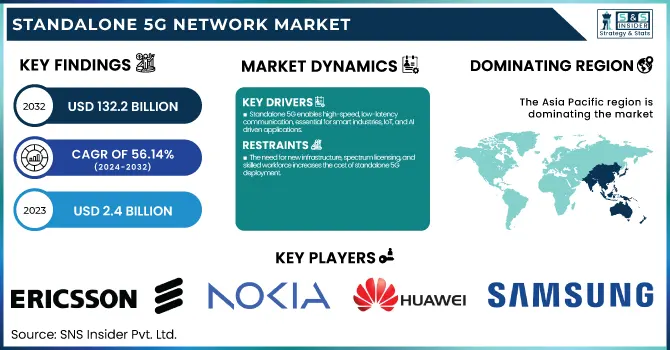

The Standalone 5G Network Market was valued at USD 2.4 Billion in 2023 and is expected to reach USD 132.2 Billion by 2032, growing at a CAGR of 56.14% from 2024-2032.

To Get more information on Standalone 5G Network Market - Request Free Sample Report

The deployment of standalone 5G networks is expanding rapidly across regions, with Asia-Pacific and North America leading due to strong government support and telecom investments. Key market players such as Ericsson, Nokia, and Huawei are heavily investing in infrastructure to enhance ultra-reliable, low-latency connectivity. The growth of 5G data traffic in standalone networks is being driven by increasing adoption of IoT, cloud gaming, and high-speed enterprise applications. Industries such as manufacturing, healthcare, and automotive are increasingly adopting standalone 5G to enable smart factories, remote surgeries, and autonomous vehicle networks.

Standalone 5G Network Market Dynamics

Drivers:

Standalone 5G enables high-speed, low-latency communication, essential for smart industries, IoT, and AI-driven applications.

Demand for ultra-low latency and high-speed connection has led several industries to adopt standalone 5G networks — such as the manufacturing, healthcare, and autonomous transportation sectors. Standalone networks are not dependent upon 4G infrastructure like with non-standalone 5G, allowing for more features, improved speed, and capability in terms of mission critical applications and network slicing. As the adoption of IoT, cloud computing, and AI-driven applications grows, enterprises will need more robust and reliable connectivity solutions. Standalone 5 G also drives demand due to increased smart city and Industry 4.0 initiatives requiring standalone deployments which allow data processing, automation and interaction between devices in real time.

Restraints:

-

The need for new infrastructure, spectrum licensing, and skilled workforce increases the cost of standalone 5G deployment.

Standalone 5G networks require a large amount of new infrastructure, such as base stations, improved core networks, and fiber-optic backhaul. This is a massive challenge among new economies and small network operators who are unable to afford this. Standalone 5G utilizes a separate core network, which drives up capital costs since no existing infrastructure is being used unlike non-standalone 5G that still relies on 4G. Also, high spectrum licensing cost, maintenance cost of the telecommunication network, and cost of skilled labor required to operate and maintain the infrastructure act as a barrier to adoption. Such barriers regarding financing and technology delay deployment, and limit the ability of operators to obtain a high return on investment promptly.

Opportunities:

-

Industries are adopting standalone 5G for secure, high-performance private networks, enabling automation and digital transformation.

Standalone 5G networks have a solid market opportunity from the growing interest in private 5G networks from industries including manufacturing, logistics, and healthcare. Standalone 5G is some enterprises using the technology to build their own highly secure dedicated networks with better connectivity, lower latency and increased reliability. This technology supports key use cases such as smart factories, automated warehouses and remote medical procedures. Meanwhile, the availability of spectrum and policy frameworks from governments and telecom regulators is also helping to spur the expansion of enterprise 5G. With enterprises embracing their digital transformation and automation, demand for tailored standalone 5G solutions is likely to increase, fuelling additional market growth.

Challenges:

-

Delays in spectrum allocation, cross-border frequency harmonization, and compliance with security regulations hinder standalone 5G expansion.

The inclusion of spectrum allocation and regulatory restrictions make this one of the key challenges in the standalone 5G network market, and the number and type of restrictions vary by region. Spectrum controls are in the hands of governments, and a slow auction process or strict policies around dish locations can delay networks significantly. Also, all three frequency bands (low, mid, and high) are not different from each other and need to plan for coverage and performance balance. Deployment complications by interference issues, cross-border frequency harmonization, and security concerns. As regulators introduce more complex frameworks for both network operators and end users, network operators must balance competing demands in ensuring compliance with overall security and privacy standards. Dealing with these regulatory challenges and establishing standardized regulations will be the next step to spread wider 5G stand-alone network rollouts.

Standalone 5G Network Market Segmentation Analysis

By Component

In 2023, the solutions segment dominated the market and held 83% of revenue share. The segment is further bifurcated into 5G radio access network, 5G core network and others (backhaul and front haul, switches, routers). Compliance with this feature is widespread for RAN 5G and significant for RAN 5G core, with many microcell and small cell base stations globally deployed, boosting the segment.

The services segment is expected to register the fastest CAGR during the forecast period. Increasing demand for SA 5G network associated services such as consulting, implementation & integration, support & maintenance, and training & education is driving the growth of the segment. Rising demand for expertise and support in the deployment and management of SA 5G networks is propelling the segment growth higher.

By Spectrum

The sub-6 GHz segment dominated the market and accounted for a majority share of the market in 2023. Sub-6 GHz frequency primarily consists of two spectrum bands, mid-band and low band, and is 6 GHz and below. Leading global communication service providers target low-band and mid-band spectrum with plans for high-value, high-capacity consumer, enterprise, and industry services.

The mmWave is expected to register the fastest CAGR over the forecast period. High-frequency bands that are part of the millimeter wave frequency bands, mmWave bands are characterized by high-bandwidth and ultra-low latency capabilities. This band is especially useful in enabling ultra-reliable connectivity for applications such as remote patient surgeries & Vehicle-to-Vehicle connectivity.

By Network

In 2023, the public segment dominated the market and accounted for 68% of revenue share. This segment is projected to hold the fastest CAGR during the forecast period. Increased investment and deployment of public SA 5G networks by mobile network operators worldwide is aiding segment growth. As an example that illustrates the emergence of such trends, the GSA has reported in its 5G-Standalone July 2023 Summary report that 36 operators in 25 countries have deployed or launched public 5G SA networks.

The private segment accounted for a significant CAGR during the anticipated period. The demand for private SA 5G network is rising due to the advantages private SA 5G provides like enhanced connectivity, security, and privacy, and improved proven reliability. Hence, the growing private network market is also expected to develop during the forecast period.

By Vertical

In 2023, the manufacturing segment dominated the market and accounted for significant revenue share. Due to low latency and high reliability, SA 5G network supports new industrial automated systems in manufacturing. Freedom to monitor, control, and synchronize machinery and processes in real-time, and from a distance becomes another feature it allows. This improves efficiency, productivity, and flexibility within manufacturing as well as other sectors within the industry.

The automotive and transport segment is predicted to register the fastest CAGR over the forecast period. The automotive sector is another domain where SA 5G networks are widely utilized to facilitate instant communication between autonomous vehicles and high-technology infrastructure. Because of its ultra-low latency, vehicles can make split-second decisions.

Regional Landscape

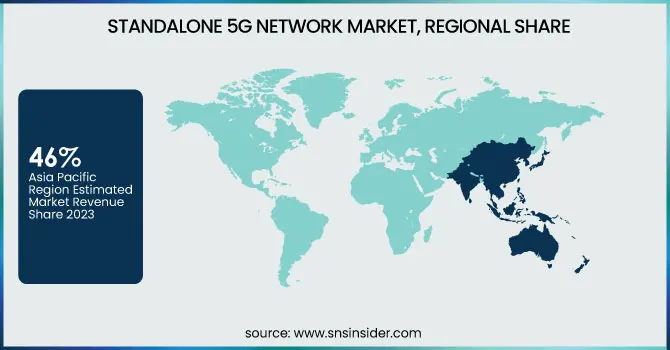

In 2023, The Asia Pacific standalone 5G network dominated the market and accounted for 46% of revenue share. The regional market is primarily driven by the growing deployment and expansion of the SA 5G network in countries like China, Japan, India, South Korea, Singapore, and Australia. In the Asia Pacific region, many governments are encouraging 5G SA expansion through spectrum allocation policies, infrastructure investments, and direct subsidies (China, Japan, and South Korea are the leaders).

The North America is expected to register the fastest CAGR over the forecast period. Regional growth is attributed to the robust presence of market players like T‑Mobile USA, Inc., Verizon Communications Inc., and AT&T, Inc. The fast growth of smart cities in the U.S. has significantly propelled the number of IoT devices being deployed for different applications, including transportation, public safety, security, energy management, etc.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

The major key players along with their products are

-

Ericsson – Ericsson Cloud Core

-

Nokia – Nokia 5G Core

-

Huawei – Huawei 5G Core Network

-

Samsung – Samsung 5G vCore

-

Cisco – Cisco Ultra Cloud Core

-

NEC Corporation – NEC 5G Core Network

-

ZTE Corporation – ZTE Common Core

-

Qualcomm – Qualcomm 5G RAN Platform

-

Intel Corporation – Intel FlexRAN

-

Mavenir – Mavenir 5G Core

-

Parallel Wireless – Parallel Wireless OpenRAN

-

Juniper Networks – Juniper 5G Cloud-Native Core

-

IBM – IBM Cloud Pak for Network Automation

-

Dell Technologies – Dell Telecom Multi-Cloud Foundation

-

Hewlett Packard Enterprise (HPE) – HPE 5G Core Stack

Recent Developments

-

April 2024: Nokia's 5G SA Deployment in Uzbekistan Nokia was selected by Perfectum to build Uzbekistan's first nationwide 5G standalone network, with a commercial launch in Tashkent planned for Q4 2024.

-

October 2024: Airtel's Transition to Standalone 5G FWA Bharti Airtel announced plans to migrate to Standalone 5G for Fixed Wireless Access by December 2024, aiming to enhance uplink performance and support network slicing.

-

December 2024: Verizon's Enhanced Video Calling via 5G SA Verizon introduced Enhanced Video Calling, utilizing 5G network slicing to improve video call quality, marking its first consumer rollout of 5G standalone technology.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 2.4 Billion |

|

Market Size by 2032 |

USD 132.2 Billion |

|

CAGR |

CAGR of 56.14% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solutions, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Ericsson, Nokia, Huawei, Samsung, Cisco, NEC Corporation, ZTE Corporation, Qualcomm, Intel Corporation, Mavenir, Parallel Wireless, Juniper Networks, IBM, Dell Technologies, Hewlett Packard Enterprise (HPE) |