Case Management Market Report Scope & Overview:

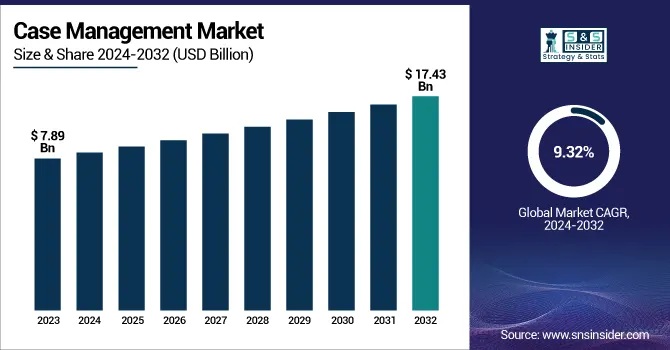

The Case Management Market Size was valued at USD 7.89 Billion in 2023 and is expected to reach USD 17.43 Billion by 2032 and grow at a CAGR of 9.32% over the forecast period 2024-2032.

To Get more information on Case Management Market - Request Free Sample Report

The increasing need for workflow automation, compliance management, and fraud detection solutions across industries is driving the growth of the Case Management Market. In addition; to reduce redundancies, maintain compliance, and deliver productivity, Businesses are moving towards case management solutions. Advancements in AI, cloud computing, and analytics driving the market for smarter decision-making and improved case resolution. The market is anticipated to grow at a steady pace due to digital transformation initiatives on the rise and increasing security concerns.

The U.S. Case Management Market was valued at USD 2.62 billion in 2023 and is projected to reach USD 5.41 billion by 2032, growing at a CAGR of 8.51% from 2024 to 2032.The U.S. Case Management Market is on a rising growth curve, attributed to growing regulatory requirements, increasing fraud detection requirements, and digital transformation across markets. The advent of case management solutions ultimately boosts efficiency, compliance, and workflow automation among organizations from key sectors including BFSI, healthcare, government, legal services, and enterprise. Cloud-based systems and AI-driven analytics improve case resolution speed and accuracy. Enterprises are investing in secure, scalable solutions, with data security laws such as HIPAA and GDPR.

Case Management Market Dynamics

Key Drivers

-

Rising Need for Efficient Workflow Automation and Regulatory Compliance Fuels the Growth of the Case Management Market

Growing demand for automated work to enterprise solution workflow implementers and regulatory compliance on management acts as a major driver for the Case Management Market. Organizations from BFSI, healthcare, and government sectors are increasingly investing in AI-driven case management platforms to improve comply with legal operations, increase productivity, and and compliance requirements. In a market governed by strict regulations such as HIPAA and GDPR, organizations are on the lookout for platforms that can solve cases and provide cloud-based solutions.

Restraint

-

High Implementation Costs and Integration Complexities Hinder the Widespread Adoption of Case Management Solutions

Despite the advantages that case management systems provide, the high cost of implementation and challenges related to integration have created significant restraints on growth in the global market. Adopting advanced case management software can be financially constrained, especially for small and medium enterprises (SMEs).

Furthermore, seamless integration of these solutions with legacy systems could become complicated, needing heavy IT investment and expertise. Data migration concerns, security scares, and interoperability challenges further delay adoption. These challenges hinder aiming for seamless migration toward a modern case management platform, harboring a risk of market growth potential, particularly in cost-sensitive industries.

Opportunity:

-

Growing Adoption of AI-Powered Case Management Solutions Creates New Business Opportunities for Market Expansion

The use of artificial intelligence (AI) in case management solutions is a highly lucrative growth opportunity for the players in the market. Automated decision-making, predictive analytics, and real-time case resolution are just some of the capabilities that AI-powered platforms can offer, streamlining the process and making it practically hyper-efficient and accurate. Healthcare, BFSI, and legal services industries are adopting machine learning algorithms for fraud detection, compliance tracking, and customer dispute resolution. Chatbots and virtual assistants emerging as a trend in case management contribute to improved customer service and operational efficiency. The expected widespread adoption of AI-driven case management solutions among organizations, as they focus on digital transformation and intelligent automation, is anticipated to pave the way for potential growth opportunities in the global market.

Challenge

-

Ensuring Data Security and Privacy Compliance Remains a Critical Challenge for Case Management Solution Providers

These challenges leaving organizations exposed to data security risks and a significant challenge of ensuring compliance with regulations, as organizations migrate to cloud-based case management platforms. Businesses that manage confidential customer records, including healthcare, BFSI, and legal services, have strict laws (for example, HIPAA, GDPR, CCPA) that must be followed to ensure the data privacy of their customers. A breach or compromise of case-related data can lead to legal penalties, reputation damage, and increased liability worldwide. The rising threat of cyberattacks and ransomware adds complexity to security measures. To combat this issue, companies and solution providers need to spend quite a bit of money on secure encryption, multi-factor authentication, and cutting-edge cybersecurity protocols to protect data integrity and compliance.

Case Management Market Segments Analysis

By Business Function

The Investigation Management segment accounted for the 36.51% revenue share in 2023 owing to rising demand for fraud detection, compliance monitoring, and risk management solutions across industries such as BFSI, government, and healthcare. IBM, NICE Systems, and Pega are some of the companies that have rolled out AI-powered investigation tools designed to improve fraud detection and case tracking. IBM’s Watson AI for investigation analytics, for instance, allows real-time fraud detection, and NICE Actimize introduced next-gen financial crime risk management solutions. With a growing focus on regulation compliance and security, investigation management solutions are being implemented by many, contributing to the overall growth of the Case Management Market.

The Service Request segment is expected to grow at the highest CAGR of 10.49% during the forecast period, due to increasing demand for automated customer service, IT support, and workflow management solutions. To facilitate doing so, businesses are using AI-driven chatbots, self-service portals, and cloud-based case-tracking systems to manage service requests. Salesforce stepped up its Service Cloud in a bid to automate the handling of customer service cases with AI, and ServiceNow rolled out new tools to streamline case workflows to optimize IT service management.

By Development Mode

The Cloud-based case management segment accounted for the largest market share, and this trend is expected to continue with its rising deployment across the BFSI, healthcare, and government industries as organizations choose Cloud-based systems to offer scalable cost-efficient solutions that can be accessed seamlessly anywhere. Companies like ServiceNow, Pegasystems, and IBM have also improved their cloud-based offerings, adding AI-based automation and more advanced security features.

For example, ServiceNow introduced its Case and Knowledge Management app to facilitate the orderly processing of service requests and compliance management. Later, Microsoft’s cloud-based Dynamics 365 enhanced its case management for legal and financial services.

The On-Premises case management segment is to register the fastest revenue growth rate during the forecast period inadvertently, hoisted by essential data security, regulatory compliance, and IT infrastructure control. On-premises deployments are more suited to industries that process sensitive information (such as banking, government, and legal services), which value a model that allows full control of data privacy. On the other hand, companies such as MicroPact (Tyler Technologies) and OpenText have enhanced their on-premises case management solutions to include advanced AI-driven analytics and workflow automation capabilities. IBM's Case Manager also offers powerful on-premise solutions for enterprises with higher security and compliance needs.

By Vertical

The BFSI sector held the largest revenue share of 23.12% of the Case Management Market, due to the growing requirement of regulatory compliance, fraud detection, and risk management. Top financial institutions invest in AI AR-based case management and workflow automation with security enhancements. IBM improved the Financial Crimes Insight solution for preventive fraud in real-time. This is significant since the growing need for a secure and cloud-based case management system in the BFSI sector is gradually transforming the evolution of the market and concerned financial operations for increased efficiency and customer service.

The healthcare segment is expected to witness progressive growth over time, with the highest CAGR of 11.195% during this period, owing to the growing need to track cases of patients, improved compliance management, and enhanced flows in an automated manner. As healthcare regulations increase (HIPAA) and the usage of electronic health records (EHRs) rises (2021), hospitals and clinics adopt AI-driven case management solutions for the best patient experience. Companies such as Salesforce released Operations Cloud, enriching patient engagement case management capabilities. In another example, IBM Watson Health created AI-driven services for the analysis of medical cases. Clinical case management software in healthcare is essential to optimize processes and enhance the overall quality of care as the healthcare sector rapidly adapts to a digital transformation.

By Component

Solutions segment based on Component dominated the Case Management Market Share is in 2023, which generated the highest revenue during the forecast period resulting from the increased adoption of workflow automation, AI-based case tracking, and compliance management software. Over the years, enterprises have started investing in tailor-made and scalable case management solutions for better operational efficiency. Key players such as Pegasystems released Pega Case Management, utilizing AI to support case resolution efforts. ServiceNow diversified its Case and Knowledge Management services to blend into the enterprise workflow.

The Services segment is projected to record the quickest growth during the predicted period, as the demand for implementation, consulting, training, and managed services continues to rise. Companies look for professional guidance to adopt case management solutions alongside their existing infrastructure and regulatory compliance procedures. IBM Consulting and other organizations broadened their piede service portfolio adding capabilities to optimize system deployment and process automation. Introducing Azure-driven consulting services for optimized case workflows by Microsoft With increasing digital transformation, enterprises depend on professional and managed services to make their case management systems more efficient, secure, and scalable, thereby driving the rapid expansion of the market.

By Organization Size

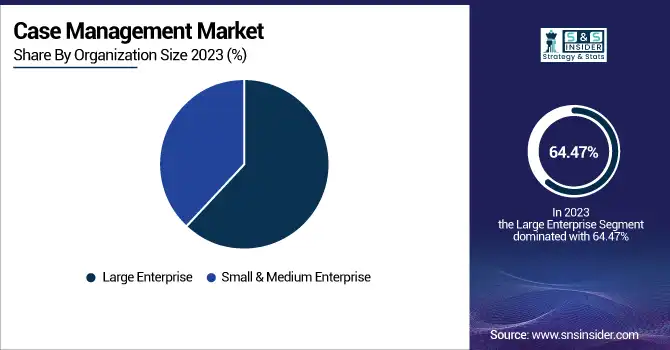

The large enterprise segment maintained the leading revenue market share of 64.47% in 2023 for the Case Management Market due to the widespread adoption of AI-driven solutions, cloud platforms, and compliance management software. Large enterprises from industries like BFSI, healthcare, and government spend significantly on workflow automation and fraud prevention to improve operational effectiveness. Players like ServiceNow introduced Legal Service Delivery, a case management solution optimizing enterprise legal functions. Moreover, Microsoft Dynamics 365 added more AI-powered case management capabilities. With companies focusing on scalability, security, and regulatory compliance, enterprise-class case management software requirements continue to grow.

The Small & Medium Enterprise segment in the Case Management Market is registering the highest CAGR of 9.99% over the forecast period due to growing digital transformation and the demand for effective workflow automation. SMEs are implementing case management solutions in order to automate operations, improve customer service, and meet regulatory compliance requirements. Firms such as Salesforce have rolled out Service Cloud innovations, while Pegasystems has introduced AI-powered case management solutions to streamline business operations. IBM has also further developed its Cloud Pak for Business Automation to enhance scalability for SMEs.

Regional Analysis

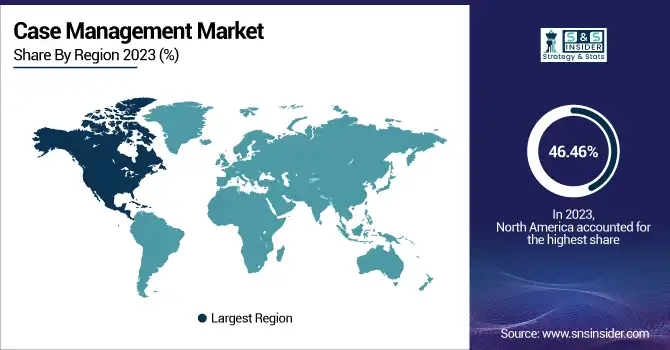

North America leads the Case Management Market with 46.46% of overall revenue in 2023, with growth fueled by technological innovation, regulatory requirements, and growing adoption of AI-based solutions. The region's large presence of market leaders such as Pegasystems, IBM, and Salesforce has driven innovation in cloud-based and AI-based case management solutions. For example, Salesforce introduced an AI-powered case management module in its Health Cloud, enhancing patient case tracking. Besides that, IBM introduced Watson-driven compliance management automation.

The Asia-Pacific region is showing the highest growth rate of 11.38% in Case Management Market through rapid digitalization, government actions, and growing adoption of cloud-based solutions within industries. Economies such as China, India, and Japan are heavily spending on automation and AI-based processes to improve the efficiency of their businesses. Oracle has added cloud-based case management offerings in the region, while Microsoft added Power Platform capabilities to automate enterprise workflows. Zoho Corporation, an India-headquartered company, also rolled out Zoho Desk updates for feature-rich case handling.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Maximus – (Case Management Solutions, Eligibility & Enrollment Services)

-

IBM – (IBM Case Manager, IBM Watson AI for Case Management)

-

Appirio – (Appirio Cloud Management, Appirio Case Management Services)

-

Pilpstream – (Pilpstream Case Management System, Pilpstream Workflow Automation)

-

Pegasystems – (Pega Case Management, Pega Customer Service)

-

Micropact – (Entellitrak Case Management, MicroPact iComplaints)

-

American Case Management Association – (ACMA Compass, ACMA Learning Management System)

-

Newgen Software – (Newgen OmniDocs, Newgen Case Management System)

-

PriMedical, Inc. – (PriMedical Case Management, PriMedical Medical Review Services)

-

PeopleDoc Inc. – (PeopleDoc HR Case Management, PeopleDoc Document Management)

-

Circle Case Management – (Circle Case Tracker, Circle Medical Case Management)

-

Appian – (Appian Case Management, Appian Low-Code Automation)

-

Ains – (AINS eCase Case Management, AINS FOIA Software)

-

Northern Case Management Limited – (NCM Rehabilitation Case Management, NCM Disability Support Services)

-

DST Systems – (DST Case Management, DST Automated Workflow Solutions)

-

Dell Technologies – (Dell EMC Case Management, Dell Digital Case Solutions)

-

Kofex – (Kofex Business Process Management, Kofex Case Management Suite)

-

VONA Case Management, Inc. – (VONA Medical Case Management, VONA Disability Case Solutions)

Recent Trends

-

February 2024 – Pegasystems Launched Pega GenAI, an AI-based automation engine for case management and business process automation.

-

January 2024 – Maximus Launched Maximus Intelligent Assistant, an AI-driven case management tool for government service automation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.89 Billion |

| Market Size by 2032 | US$ 17.43 Billion |

| CAGR | CAGR of 9.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component - (Solutions, Services) • By Business Function - (Investigation Management, Service Request, Legal Workflow Management, Fraud Detection and Anti-Money Laundering, Incident Management) • By Deployment Mode - (Cloud, On-Premises) • By Organization Size - (Large Enterprise, Small & Medium Enterprise) • By Vertical - (BFSI, Government, Healthcare, Telecommunication and IT, Manufacturing, Retail) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Maximus, IBM, Appirio, Pilpstream, Pegasystems, Micropact, American Case Management Association, Newgen Software, PriMedical, Inc., PeopleDoc Inc., Circle Case Management, Appian, Ains, Northern Case Management Limited, DST Systems, Dell Technologies, Kofex, VONA Case Management, Inc. |