Cell Analysis Market Report Scope & Overview:

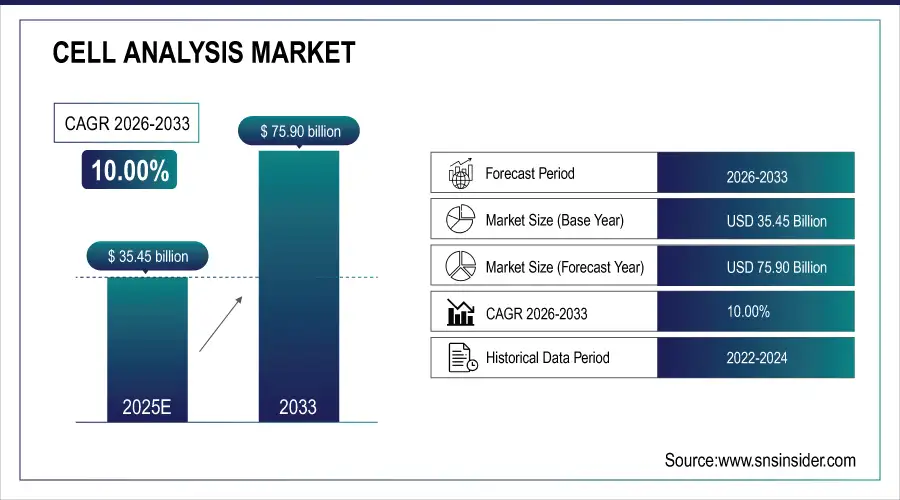

The Cell Analysis Market size was valued at USD 35.45 billion in 2025E and is expected to reach USD 75.90 billion by 2033, growing at a CAGR of 10.00% over the forecast period of 2026-2033.

The global cell analysis market is expanding because of the high prevalence of chronic infectious diseases, for which cell-based assays are required for an effective diagnosis and treatment. Moreover, precision medicine and personalized therapy are highly dependent on single-cell profiling and spatial biology tools, which support new forms of disease-oriented treatment in oncology and regenerative medicine. This cell analysis market trend demonstrates a growing adoption rate in all clinical and research applications.

For instance, in June 2024, Global cancer cases are projected to rise 77% to 35 million by 2050, fueling strong demand for advanced cell analysis technologies in oncology.

Cell Analysis Market Size and Forecast:

-

Market Size in 2025E: USD 32.27 Billion

-

Market Size by 2033: USD 69.09 Billion

-

CAGR: 10.00% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Cell Analysis Market - Request Free Sample Report

Key Cell Analysis Market Trends

-

Advanced analytical technologies: Growing adoption of high-content imaging, flow cytometry, single-cell sequencing, and AI-assisted analysis for precise cellular profiling and functional assessment.

-

Integration with smart systems: Use of cloud-based platforms, AI algorithms, and machine learning models to improve predictive cellular behavior, drug response studies, and real-time monitoring.

-

Personalized medicine applications: Development of patient-specific cell assays for targeted drug testing, immunotherapy evaluation, and disease modeling.

-

Collaborative research solutions: Partnerships among biotech firms, pharmaceutical companies, and academic institutions to co-develop advanced cell analysis tools for drug discovery and toxicity screening.

-

Portable & scalable platforms: Emergence of miniaturized cytometers, lab-on-chip devices, and modular systems enabling high-throughput, on-site cellular assays.

-

Regulatory support & awareness: Growing guidance from FDA, EMA, and other authorities promoting validated human-relevant cell analysis methods, enhancing preclinical testing reliability while reducing animal usage.

U.S. dominates the Cell Analysis Market:

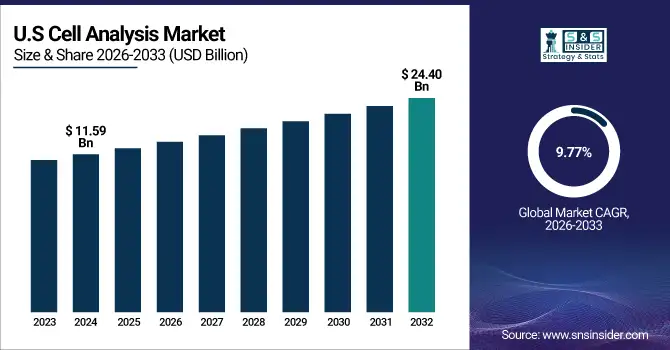

The U.S. cell analysis market size was valued at USD 11.59 billion in 2025E and is expected to reach USD 24.40 billion by 2033, growing at a CAGR of 9.77% over 2026-2033. The U.S. is leading the cell analysis market due to countries’ strong base for biotechnology and pharmaceuticals, highest R&D investments, extensive healthcare infrastructure, and government funding. Rising acceptance of single-cell analysis, precision medicine initiatives, and increasing incidence rate of chronic diseases also trigger demand. This cell market analysis report also compares the U.S. innovation, clinical adoption, and product revenue performance with other regions globally.

Cell Analysis Market Growth Drivers:

-

Rising Adoption of Single-Cell Analysis is Driving the High-Intensity Focused Ultrasound Market Growth

Increasing uptake of the single-cell analysis is a high-impact rendering driver for the cell analysis market share on account of the crucial insights these studies deliver on cellular heterogeneity and to accurately understand disease mechanisms. The modality is now widely applied in a variety of fields, including oncology, immunology, and neuroscience for studies of drug and biomarker discovery and personalized medicine, and is broadening the market for applications with great commercial promise.

For instance, in February 2025, Global single-cell transcriptomics usage rose 22% in 2024, driving deeper insights into cellular heterogeneity in cancer and immunology research.

Cell Analysis Market Restraints:

-

Complexity And Technical Expertise are Hampering the Cell Analysis Market Growth

One important limitation is the lack of technical standardization and the complexity of human liver model development. These platforms are not widely available and vary in the expertise required and across-lab consistency. This hinders the usage of scaling and widespread use. Recent Cell Analysis Market analysis revealed a lack of consensus standards for validation, which slows advances in regulatory adoption to meet the needs of global pharma companies relying on robust liver model platforms.

For instance, in May 2024, a Nature Biotechnology survey revealed 42% of research groups faced reproducibility issues in 3D liver models, highlighting the need for standardized protocols in the Cell Analysis Market.

Cell Analysis Market Opportunities:

-

Integration With AI & Automation Drive Future Growth Opportunities for the Cell Analysis Market

The emerging trend of human-relevant liver models is on account to tightened restrictions and ethical issues. Regulatory agencies, including the FDA and EMA, recommend the use of in vitro methods to assess the safety of drugs to minimize animal experiments. This represents a large market opportunity for providers of advanced human liver models and organ-on-chip platforms.

For instance, in March 2024, Launched the FACSymphony X Series, a high-parameter flow cytometer enabling 50-parameter analysis per cell, achieving 25% faster data acquisition than previous models.

Key Cell Analysis Market Segmentation Analysis:

-

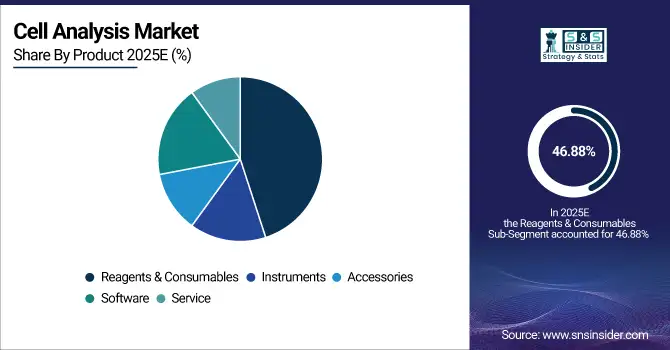

By product, reagents & consumables held the largest share of around 46.88%in 2025, and the service segment is expected to register the highest growth with a CAGR of 12.42%.

-

By technique, the flow cytometry segment dominated the market with approximately 18.83%share in 2025, while high content screening is expected to register the highest growth with a CAGR of 11.10%.

-

By process, cell identification accounted for the leading share of nearly 18.88% in 2025, and single-cell analysis is expected to register the highest growth with a CAGR of 12.02%.

-

By end user, the pharmaceutical & biotechnology companies led the market with about 32.88% share in 2025, while the hospitals & clinical testing laboratories segment is forecasted to grow the fastest at a CAGR of 10.55%.

By Product, Reagents & Consumables Lead the Market, While Service Registers Fastest Growth

The reagents & consumables segment accounted for the highest revenue share of approximately 46.88% in 2025, owing to their frequent use for assays, flow cytometry, and high content screening. As kits, antibodies, dyes, and culture media are used in the lab continuously, revenue for these products is fairly predictable. In comparison, the service segment is anticipated to achieve the highest CAGR of nearly 12.42% during the 2026-2033 period, driven by growing demand for instrument servicing, workflow enhancement, and contract analysis services. The increased usage of sophisticated single-cell, high-content, and automated systems, and increased biotech and pharma R&D activities, are major driving forces.

By Technique, the Flow Cytometry Segment dominates, while the High Content-Screening Segment Shows Rapid Growth

The flow cytometry segment held the largest revenue share of approximately 18.83%in 2025, as it provides flexibility for immunophenotyping, cell counting, and biomarker studies. Increasing demand for oncology, immunology, and infectious disease research, and the rising acceptance of single-cell and high-throughput assays, are major driving factors. On the other hand, the high content-screening segment is predicted to grow at the strongest CAGR of approximately 11.10% during 2026-2033, as there is an increasing need for comprehensive cell imaging, phenotypic profiling, and multiparametric measurements. Among driving factors are growing use in drug discovery, cancer research, regenerative medicine, and automation.

By Process, Cell Identification Lead, and Single-cell Analysis Registers Fastest Growth

The cell identification accounted for the largest share of the Cell Analysis Market with about 18.88%, owing to its importance in immunophenotyping, disease diagnosis, and another research. Key factors contributing to such growth include increasing incidence of cancer and infectious diseases, increased use of flow cytometry and single-cell analysis instruments. In addition, single-cell analysis is slated to grow at the fastest rate with a CAGR of around 12.02% throughout the forecast period of 2026-2033, as it can uncover cell heterogeneity, which is essential in the study of cancer, immunology, and regenerative medicine. Other factors for the segment’s growth include increasing adoption in precision medicine, single-cell sequencing technologies.

By End User, Pharmaceutical & Biotechnology Companies Lead, While the Hospitals & Clinical Testing Laboratories Segment Grows the Fastest

The pharmaceutical & biotechnology companies held the largest revenue share of around 32.88% in the Cell Analysis Market in 2025, owing to their use of cell analysis in drug discovery, toxicology, and biomarker finding. Factors include increasing R&D investment in cell-based research, growing focus on personalized medicine. On the flip side, the hospitals & clinical testing laboratories segment, however, is projected to register the highest CAGR of around 10.55% during the forecast period of 2026-2033, as the utilization of flow cytometry, immunophenotyping, and single-cell assays for diagnostics and patient monitoring has grown. Key factors contributing to this market growth include an increase in the number of in-licensing deals for molecular diagnostics and the launch of new products and technologies for early diagnosis.

Cell Analysis Market Regional Analysis:

North America Cell Analysis Market Insights

North America accounted for the highest revenue share of approximately 40.76% in 2025 of the Cell Analysis Market, driven by its powerful biotech and pharma sector, developed healthcare system, and large R&D investments. Several such factors include high adoption of single-cell analysis, flow cytometry, and high-content screening in research, high incidence of chronic and infectious diseases, and favorable government funding for life science research. The presence of large market players, along with early adoption of technology and vast clinical and research laboratories, is contributing toward the dominance of North America in the global in vitro diagnostics market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Cell Analysis Market Insights

Asia Pacific is the fastest-growing segment in the cell analysis market with a CAGR of 10.83%, owing to the growing biotechnology and pharmaceutical research, government initiatives to support healthcare facilities, and the growing usage of advanced cell analysis tools, including flow cytometry, high-content screening, and single-cell analysis. Factors, including the rising number of clinical research, precision medicine, and regenerative medicine-based research activities, alongside a number of countries, including China, India, Japan, and South Korea, are experiencing an increase in the number of research activities. Rapidly increasing patient pool, rising incidences of chronic and infectious diseases, increasing awareness of advanced diagnostic technologies, and formation of advanced laboratory and research facilities are key drivers for this unprecedented growth. Furthermore, cost benefits, new biotech epicenters, and partnerships with global industry leaders drive technology adoption and expansion in the APAC.

Europe Cell Analysis Market Insights

Europe is the second leading region for the cell analysis market, due to its robust pharmaceutical & biotech industry, increasing clinical research, and developed healthcare system. Prominent factors include the growing use of high-end cell analysis instruments, government funding in research and development, and an increasing demand for precision medicines, well-established research, and the presence of major research institutes and players over the biotech industry are triggering innovations having significant growth in the market.

Latin America (LATAM) and Middle East & Africa (MEA) Cell Analysis Market Insights

The cell analysis market is growing in Latin America and the Middle East & Africa due to developing healthcare infrastructure, government initiatives for research, and increasing use of advanced laboratory technologies. Brazil, Mexico, South Africa, and the UAE are key hubs. Hospitals and biotech labs are investing in flow cytometers, high-content imaging, and single-cell analysis platforms, thereby supporting demand growth in the region.

Competitive Landscape for the Cell Analysis Market:

Danaher: At the forefront of the life sciences and diagnostics industry, the company offers novel cell analysis solutions, including cell cytometry and imaging platforms as an enabling tool for drug discovery, clinical research, and laboratory automation globally.

-

In May 2024, achieved 12% YoY growth in its Life Sciences segment, driven by high global demand for flow cytometry and high-content imaging instruments, strengthening its position in cell analysis markets.

Thermo Fisher Scientific: Thermo Fisher provides an extensive suite of cell analysis technologies from high-content imaging to single-cell sequencing that help advance personalized medicine, biopharma research, and translational discovery with AI-enabled platforms and scalable lab solutions.

-

In August 2024, recorded USD 12.8 billion quarterly sales, with cell analysis products contributing ~28% of Life Sciences growth, reflecting rising adoption of single-cell sequencing and high-throughput platforms globally.

BD Biosciences: BD Biosciences focuses on advanced flow cytometry, cell sorting, and analytical instruments that allow for accurate cell and immunology research, and development and drug discovery research, in academic, clinical, and pharmaceutical settings in regions globally.

-

In February 2024, reported 15% growth in advanced flow cytometry and cell sorting sales, mainly in North America and Asia-Pacific, fueled by expanding research and clinical applications.

Cell Analysis Market Key Players:

Some of the Cell Analysis Market companies are:

-

Danaher

-

Thermo Fisher Scientific

-

BD Biosciences

-

Merck KGaA

-

Agilent Technologies

-

PerkinElmer

-

Bio-Rad Laboratories

-

Sartorius AG

-

GE HealthCare

-

Eppendorf SE

-

Tecan Group

-

Carl Zeiss Meditec

-

Olympus

-

Cytek Biosciences

-

Fluidigm

-

NanoString Technologies

-

10x Genomics

-

Promega Corporation

-

Bio-Techne Corporation

-

Miltenyi Biotec

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 32.27 billion |

| Market Size by 2033 | USD 69.09 billion |

| CAGR | CAGR of 10.00% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Reagents & Consumables, Instruments, Accessories, Software, Service) • By Technique (Flow Cytometry, PCR, Cell Microarrays, Microscopy, Spectrophotometry, High Content-Screening, Other Techniques) • By Process (Cell Identification, Cell Viability, Cell Signaling Pathways, Cell Proliferation, Cell Counting, Cell Interaction, Cell Structure Study, Single-cell Analysis) •By End User (Pharmaceutical & Biotechnology Companies, Hospitals & Clinical Testing Laboratories, Academic & Research Institutes, Other) |

| Regional Analysis/Coverage | "North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America)" |

| Company Profiles | Danaher, Thermo Fisher Scientific, BD Biosciences, Merck KGaA, Agilent Technologies, PerkinElmer, Bio-Rad Laboratories, Sartorius AG, GE HealthCare, Eppendorf SE, Tecan Group, Carl Zeiss Meditec, Olympus, Cytek Biosciences, Fluidigm, NanoString Technologies, 10x Genomics, Promega Corporation, Bio-Techne Corporation, Miltenyi Biotec and other players. |