Global Disposable Endoscopes Market Overview

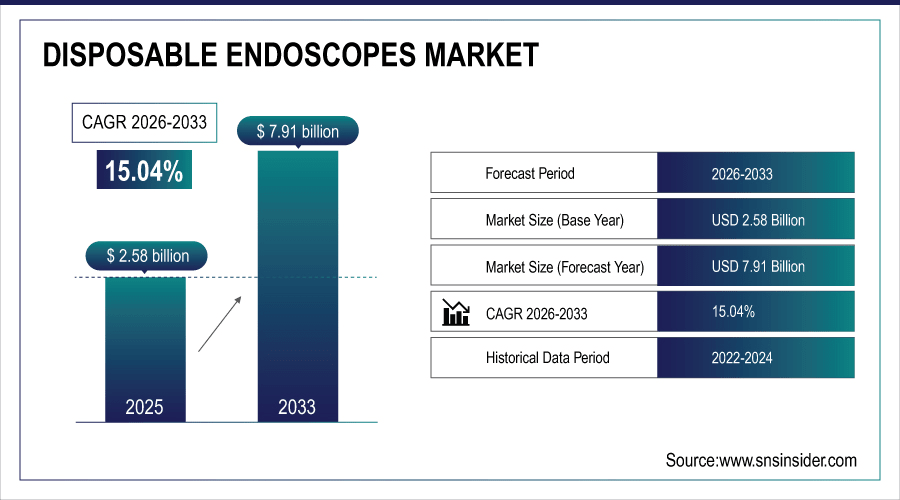

The Disposable Endoscopes Market size was valued at USD 2.58 billion in 2025E and is projected to reach USD 7.91 billion by 2033, growing at a CAGR of 15.04% during the forecast period 2026–2033.

The worldwide disposable endoscopes industry is experiencing robust growth, due to approximately 50 million annual endoscopic procedures conducted globally. Growing emphasis on infection prevention and reduction of risk of cross contamination is stimulating the demand for single use devices. Disposable flexible endoscopes rule in pulmonology, urology and gastroenterology, while rigid types are taking basic applications within orthopedics and gynecology.

Flexible disposable endoscopes held over 60% of global market demand in 2025, driven by rising use in pulmonology and gastroenterology.

To Get More Information On Disposable Endoscopes Market - Request Free Sample Report

Disposable Endoscopes Market Size and Forecast

-

Market Size in 2025: USD 2.58 Billion

-

Market Size by 2033: USD 7.91 Billion

-

CAGR: 15.04% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Key Disposable Endoscopes Market Trends

-

Over 15 million single use bronchoscopies were conducted worldwide in 2025, with the number of procedures anticipated to surpass 30 million by a decade later.

-

Disposable endoscopes were used in over 10 million urology procedures in 2025 and adoption is projected to nearly double by 2033, as the number of kidney stone and prostate cases increase.

-

Ambulatory surgical centers would have performed roughly 8 million disposable endoscope-based procedures in 2025, a number that’s expected to exceed 15 million by the year 2033.

-

Online healthcare marketplace provided about half a million one-time-use endoscopes last year, with deliveries projected to top 1.5 million by 2033.

-

More than 20 million disposable endoscopes were utilized in hospitals around the world in 2025 and demand is expected to exceed 35 million by 2033.

U.S. Disposable Endoscopes Insights:

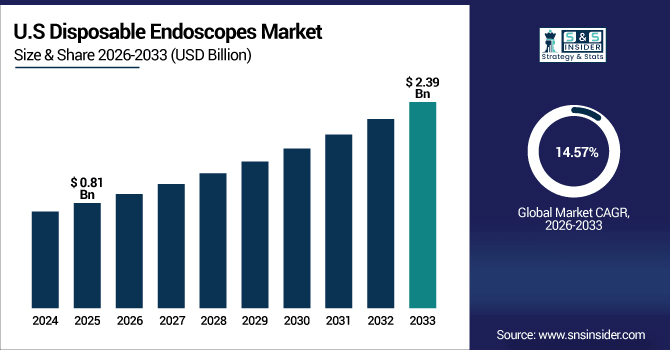

The U.S. Disposable Endoscopes Market was valued at USD 0.81 billion in 2025E and is forecast to reach USD 2.39 billion by 2033, growing at a CAGR of 14.57% from 2026–33. The country conducted more than 4.2 million endoscopic procedures in 2025, heavily backed by sophisticated hospital infrastructure, stringent infection control guidelines and increasing uptake of single-use devices. Adoption by hospitals and ambulatory surgical centers remains a key market growth driver.

Disposable Endoscopes Market Growth Drivers

Increasing Global Burden of Hospital-Acquired Infections Drives Surge in Single-Use Disposable Endoscope Adoption Worldwide.

Increasing global burden of hospital-acquired infections is accelerating adoption of single-use disposable endoscopes across healthcare systems. In 2025, nearly 7 million hospital-acquired infections occurred each year in U.S., driving the transition from reusable to disposable equipments. More than 45 million disposable endoscopy procedures are projected globally by 2033, minimizing the risk of cross-contamination. Infection-free patient treatment is the primary focus for hospitals and ambulatory centers, which is driving rapid adoption of disposable endoscopes in various clinical specialties.

In 2026, flexible disposable endoscopes are projected to grow by nearly 20% year-on-year, making them the fastest-growing segment in the market.

Market Restraints

High Device Costs and Limited Reimbursement Policies Restrict Widespread Adoption of Disposable Endoscopes in Emerging Healthcare Markets.

Expensive disposable endoscopes and lack of insurance coverage are the market restrains, especially for underdeveloped healthcare zones. Disposable flexible endoscopes are designed to be used after every procedure, versus reusable scopes which are used for hundreds of cases. Hospitals performing over 5,000 procedures annually face operational and logistical challenges, causing nearly 35% of small and mid-sized clinics in Asia-Pacific to delay adopting single-use devices. This hinders a faster entry of safer, and infection-free endoscopy technologies into more healthcare settings worldwide.

Market Opportunities

Rising Demand for Infection-Free Procedures Drives Opportunities for Innovative Disposable Endoscopes with Advanced Imaging Capabilities.

Increasing number of demands for infection free procedures is anticipated to provide opportunities for next generation integrated imaging disposables endoscope. More than 40% of new endoscopes are to be equipped with high-definition imaging by 2033, giving the ability to increase diagnostic accuracy. A clinical survey demonstrates approximately 36%, shorter procedural times vs. standard reusable scopes. Improved ergonomics, intuitive operation drive adoption in hospitals & ASCs and better endoscopy procedures and patient outcomes across important medical specialties.

By 2026, disposable endoscopes with integrated imaging are projected to account for nearly 12% of new installations, enhancing procedural accuracy.

Disposable Endoscopes Market Segmentation Analysis

-

By Product Type, Bronchoscopes held the largest market share of 28.45% in 2025, while Gastrointestinal Endoscopes are expected to grow at the highest CAGR of 16.21%.

-

By Application, Pulmonology contributed the highest market share of 34.12% in 2025, while Gastroenterology is anticipated to expand at the fastest CAGR of 16.53%.

-

By End User, Hospitals accounted for the largest market share of 55.36% in 2025, while Ambulatory Surgical Centers are expected to record the fastest growth with a CAGR of 17.02%.

-

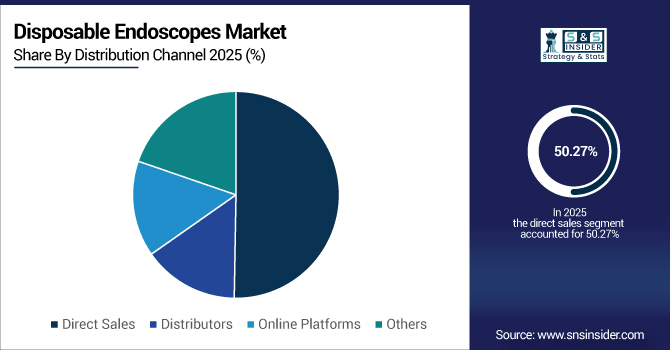

By Distribution Channel, Direct Sales comprised 50.27% in 2025, while Online Platforms are projected to grow at the fastest CAGR of 17.98%.

By Distribution Channel, Direct Sales Dominate While Online Platforms Grow Rapidly

Direct sales provided nearly 5.5 million single-use endoscopes in 2025, because hospitals and large clinics prefer to directly purchase from manufacturers. Approximately 0.85 million test volumes were sold online in 2025, which were majorly for small clinics and diagnostic centers. The digital transformation push will see the online procurement surpass 2.0 million units by 2033 offering timely access to high volumes, logistical consolidation and simplicity for growing and mid-sized healthcare facilities across the world.

By Product Type, Bronchoscopes Dominate While Gastrointestinal Endoscopes Grow Rapidly

The use of bronchoscopes is growing around the world with more than 4.5 million procedures conducted in 2025 because their utility across numerous pulmonology and bronchoscopy procedures, and interventions. Gastrointestinal Endoscopes are used in approximately 2.9 million procedures in 2025, with over 5.5 million procedures anticipated by the end of 2033 owing to surging prevalence of gastrointestinal diseases and growing number hospital and diagnostic centers across the world.

By Application, Pulmonology Dominates While Gastroenterology Grows Rapidly

Pulmonology procedures would contribute more than 5.2 million endoscopy interventions by 2025, owing to increasing prevalence of respiratory diseases across the world. Gastroenterology is seeing quick rapid adoption from disposables that lower cross- contamination with approximately 4.1M procedures anticipated in 2025. Colonoscopy demand and growing awareness for infection-free endoscopy in hospitals as well as ambulatory centers are expected to drive the gastroenterology procedures with disposable endoscopes that are anticipated to cross 8 million by 2033.

By End User, Hospitals Dominate While Ambulatory Surgical Centers Grow Rapidly

Hospitals continue to be the largest end users, carrying out more than 6 million disposable endoscope procedures by 2025 on account of high patient volumes and infection prevention demand. In 2025, about 2.7 million procedures were performed in ambulatory surgical centers and their use likely will surpass 5 million by 2033 as a greater number of minor surgical and diagnostic procedures move to an outpatient basis and single-use endoscopes are used for safety or efficiency.

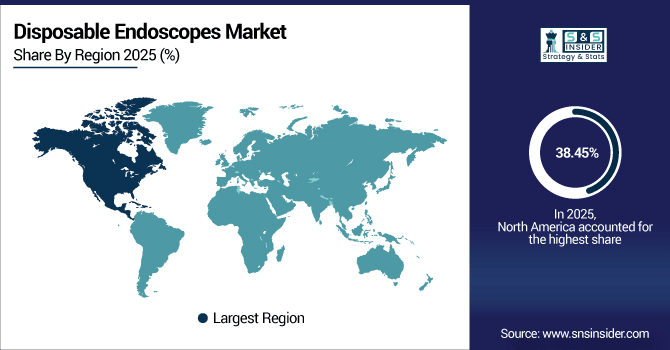

Disposable Endoscopes Market Regional Insights

North America Disposable Endoscopes Market

North America leads the global disposable endoscopes market with a 38.45% market share in 2025E, supported by advanced healthcare infrastructure and strong infection-control initiatives. More than 6 million endoscopic procedures were conducted in the region in 2025 for bronchoscopy, gastroenterology, and urology procedures. With more than 42 million procedures performed in the United States, alone, over 4.2 million of those done by U.S. Hospitals & Ambulatory Surgical Centers have now adopted this single-use device to help avert cross-contamination. This high number of procedures will drive market growth through 2033.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Disposable Endoscopes Market Insights

In 2025, there are more than 15,000 hospitals and clinics in the United States capable of bronchoscopy using nearly half a million disposable endoscopes for high-risk procedures. Robust infection control measures, an increasing number of gastrointestinal & pulmonary interventions being performed and regulatory requirements for single-use devices support acceptance, making the US the largest market for disposable endoscope innovation.

Asia-Pacific Disposable Endoscopes Market Insights

The Asia-Pacific disposable endoscopes market is expected to grow at a CAGR of 16.07% during 2026–2033, emerging as the fastest-growing region globally. The region is composed of more than 8500 hospitals and 12,000 ambulatory surgical centers performing over 7 million endoscopic procedures per year. Increasing infection-control needs, growing gastrointestinal and pulmonary procedures, and government healthcare support are also contributing to adoption. Asia-Pacific is expected to represent close to 1/3rd of the overall disposable endoscope adoption by 2033.

China Disposable Endoscopes Market Insights

China is the largest market for disposable endoscopes in Asia Pacific region with more than 4,200 hospitals and over 6,500 ambulatory surgical centers conducting over 3.5 million endoscopic procedures every year. rapid healthcare infrastructure spend, robust infection-control programs, and increasing gastrointestinal and pulmonary procedures will make China the regional leader in embracing brand new disposable endoscope technology.

Europe Disposable Endoscopes Market Insights

Europe commands significant growth in the disposable endoscopes market, with over 6,800 hospitals and 9,500 ambulatory surgical centers performing more than 5.8 million endoscopic procedures annually. Countries such as Germany, France and the UK are increasing procedural capacity and shifting to single-use devices. More than 65% of Western European hospitals use single-use endoscopes for infection control. EU healthcare projects, increasing gastrointestinal and pulmonary procedures and restrictive safety guidelines in the region are driving the demand for advanced endoscopes making Europe a significant market.

Germany Disposable Endoscopes Market Insights

Germany will account for more than 30% of Europe disposable endoscopes market share by volume in 2025. The company’s 2,100+ hospitals and ambulatory surgical centers conduct significant numbers of gastrointestinal and pulmonary procedures. Strong infection-control focus, advanced healthcare infrastructure, and EU-supported initiatives accelerate adoption, positioning Germany as the hub for disposable endoscope deployment and innovation in Europe.

Latin America Disposable Endoscopes Market Insights

The Latin American disposable endoscopes market is steadily expanding, projected to grow strongly through 2033. Brazil is the region’s leading country with nearly 55% of regional procedures, including more than 1,200 high volume hospitals and ambulatory surgical centers performing endoscopy. Mexico and Argentina are not far behind with rising infection-control practices, growth in outpatient procedures, and government backed healthcare infrastructure upgrade.

Middle East and Africa Disposable Endoscopes Market Insights

The Middle East & Africa disposable endoscopes market is growing steadily, with over 1,800 hospitals and ambulatory surgical centers operating regionally by 2025. Saudi Arabia is the early adopter with Vision 2030, along with state-of-the-art hospitals. South Africa is trailing this trend, with increasing demand for sophisticated, single-use endoscope solutions in gastrointestinal and pulmonary procedures.

Competitive Landscape

Ambu A/S leads the global disposable endoscopes market with a 20–25% share in 2025, selling over 1.5 million single-use endoscopes annually. Its scope of applications includes bronchoscopy, urology and gastroenterology. Since inventing single-use technology and taking infection control to a new level with inspired double barriers, Ambu’s single-use device has been used in more than 5,000 hospitals worldwide as the most trusted brand in single use endoscopy.

-

In February 2025, Ambu A/S launched the aScope™ 5 Uretero, a single-use ureteroscope with high-definition imaging for urological procedures.

Boston Scientific holds 15–20% market share in 2025, with over 800,000 disposable scopes used annually. Its EXALT™ Model D duodenoscope became the initial fully disposible approach to high-risk procedures. With an emphasis on innovation, patient safety and a comprehensive portfolio of GI, urology and bronchoscopy single-use endoscopes, the company has become a world market leader in single-use endoscopy.

-

In August 2025, Boston Scientific introduced Endura Weight Loss Solutions, including endoscopic sleeve gastroplasty and intragastric balloon procedures.

Karl Storz commands 12–16% of the market in 2025, with over 600,000 single-use endoscopes deployed globally. Focusing on high-definition, ergonomically designed scopes, Karl Storz is about quality and flow efficiency. Its products are popular in both hospitals and ambulatory centers, and its commitment to innovation and education has cemented its position as a trusted name in single-use endoscopy worldwide.

-

In February 2025, Karl Storz unveiled the Slimline C-MAC S, a single-use video laryngoscope enhancing airway management in hospitals.

Disposable Endoscopes Market Key Players

Some of the Disposable Endoscopes Market Companies are:

-

Ambu A/S

-

Boston Scientific Corporation

-

Karl Storz GmbH & Co. KG

-

Olympus Corporation

-

Pentax Medical (HOYA Corporation)

-

Fujifilm Holdings Corporation

-

Medtronic

-

Stryker Corporation

-

STERIS plc

-

Baxter International Inc.

-

Verathon Inc.

-

Richard Wolf GmbH

-

CooperSurgical Inc.

-

Coloplast A/S

-

Micro-Tech (Nanjing) Co., Ltd.

-

3NT Medical Ltd.

-

ScoutCam Inc.

-

OTU Medical Inc.

-

Innovex Medical Co.

-

Flexible Medical Systems Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.58 Billion |

| Market Size by 2033 | USD 7.91 Billion |

| CAGR | CAGR of 15.04% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Bronchoscopes, Urologic Endoscopes, Arthroscopes, Laparoscopes, Gastrointestinal Endoscopes, Others) • By Application (Pulmonology, Urology, Gastroenterology, Orthopedics, Gynecology, Others) • By End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Diagnostic Centers, Others) • By Distribution Channel (Direct Sales, Distributors, Online Platforms, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ambu A/S, Boston Scientific Corporation, Karl Storz GmbH & Co. KG, Olympus Corporation, Pentax Medical (HOYA Corporation), Fujifilm Holdings Corporation, Medtronic, Stryker Corporation, STERIS plc, Baxter International Inc., Verathon Inc., Richard Wolf GmbH, CooperSurgical Inc., Coloplast A/S, Micro-Tech (Nanjing) Co., Ltd., 3NT Medical Ltd., ScoutCam Inc., OTU Medical Inc., Innovex Medical Co., Flexible Medical Systems Ltd. |