Cell Lysis and Disruption Market Size Analysis:

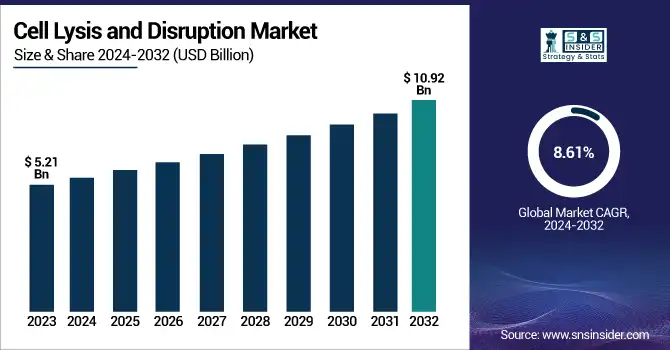

The Cell Lysis and Disruption Market was valued at USD 5.21 billion in 2023 and is expected to reach USD 10.92 billion by 2032, growing at a CAGR of 8.61% from 2024-2032.

This report delivers insights into the Cell Lysis and Disruption Market by examining comparative usage of reagents compared to instruments, noting changes in preference according to efficiency and application requirements. It discusses developments in cell-based research and therapeutics, outlining the growing contribution of lysis technologies to single-cell analysis, gene therapy, and regenerative medicine. The study further analyzes emerging technology innovations, like automation and microfluidic-based lysis platforms, determining emerging market directions. It also presents a detailed overview of trends in investment within life sciences and biotechnology, along with prominent patterns of funding guiding research and development efforts.

To Get more information on Cell Lysis and Disruption Market - Request Free Sample Report

The United States holds a leading position in the Cell Lysis and Disruption Market with 8.67% CAGR throughout the forecast period of North America due to a strong biotechnology and pharmaceutical industry, high R&D spending, and developed healthcare infrastructure. Presence of prominent market players, rising precision medicine adoption, and expanding applications in proteomics and genomics also reinforce the nation's position as a market leader in this industry.

Cell Lysis and Disruption Market Dynamics

Drivers

-

Rising Demand for Biopharmaceuticals is propelling the cell lysis and disruption market.

The increasing manufacture of biopharmaceuticals, including monoclonal antibodies, vaccines, and recombinant proteins, is a major growth driver for the cell lysis and disruption market. Effective cell lysis methods are essential for releasing intracellular contents required for these therapeutics. With the rising incidence of chronic diseases, there is an increased demand for sophisticated treatments, and hence, biopharmaceutical research and development is on the rise. This phenomenon requires effective cell disruption techniques for high yield and purity of the target molecules. Moreover, growth in personalized medicine underscores the necessity of accurate cell lysis operations to acquire special cellular materials for customized therapies. Therefore, the market is seeing an increasing deployment of novel lysis technologies for fulfilling the challenging demands of biopharmaceutical production.

-

Technological Advancements in Cell Lysis Techniques driving the market demand.

Technological innovations in cell lysis technologies are driving market growth by increasing the efficiency and scalability of cell disruption processes. Advances like high-pressure homogenizers, bead mills, and sonicators have transformed the extraction of cellular contents, enabling improved handling of complex and sensitive biological materials. Automation integration in these systems has enhanced throughput and reproducibility, especially useful in large-scale bioprocessing and high-throughput screening applications. In addition, microfluidic device adoption provides stringent control of processing conditions, minimizing sample volumes and allowing for single-cell analysis. These technological advances not only simplify workflows but also accommodate the increased demands of research in genomics, proteomics, and metabolomics, hence driving the growth of the cell lysis and disruption market.

Restraint

-

High Cost and Complexity of Advanced Lysis Techniques restraining the market growth.

The expense of advanced cell disruption and lysis technologies is a major hindrance to market growth, especially for small- and medium-sized research institutions and biopharmaceutical organizations. Technologies like high-pressure homogenizers, ultrasonication equipment, and microfluidic devices are capital-intensive, and hence less affordable for budget-limited laboratories. Moreover, the operational sophistication of these technologies requires trained personnel, adding further to training and maintenance costs. Numerous conventional cell disruption techniques, including manual homogenization and detergent-mediated lysis, continue to be utilized owing to their low cost, though they are not as efficient and reproducible as newer methods. The high capital investment and maintenance costs act as deterrents for widespread use, especially in emerging economies, retarding the overall growth of the cell lysis and disruption market despite increasing demand for biopharmaceutical and research purposes.

Opportunities

-

The increasing use of single-cell analysis and precision medicine is a great growth opportunity for the Cell Lysis and Disruption Market.

Improvements in genomics, transcriptomics, and proteomics are fueling demand for efficient and accurate cell lysis methods to separate single cells for subsequent applications. Single-cell sequencing, an integral part of personalized medicine, necessitates highly controlled lysis processes with minimal RNA and protein degradation. As researchers turn their attention to disease-specific biomarkers, drug response research, and regenerative medicine, demand for mild but effective lysis technologies will continue to grow. Microfluidic-based lysis for high-throughput screening is also being pursued by biopharmaceutical companies, and this extends market opportunities. Increasing adoption of automated and scalable lysis solutions in personalized medicine and drug discovery will lead to innovation and new product development in this market.

Challenges

-

One of the most important challenges in the Cell Lysis and Disruption Market is the absence of standardization of various lysis methods and increasing regulatory complexity.

Different cell types need to be processed using specific lysis protocols, and it is hard to define universally applied methods that offer consistent results for various applications. This heterogeneity influences downstream processing in proteomics, metabolomics, and nucleic acid extraction with the potential to cause reproducibility problems in research and clinical diagnostics. Moreover, rigorous regulatory standards established by organizations such as the FDA and EMA necessitate ensuring the safety, purity, and efficiency of cell lysis reagents and instruments utilized in biopharmaceutical production. Compliance with changing compliance requirements increases the cost and complexity of product development, constraining innovation and postponing market entry for new entrants.

Cell Lysis and Disruption Market Segmentation Analysis

By Technique

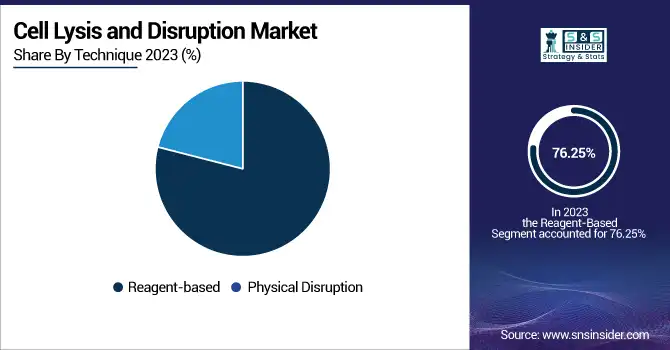

The reagent-based segment dominated the cell lysis and disruption market with a 76.25% market share in 2023 as it has extensive usage in research and biopharmaceutical industries. Reagent-based lysis procedures such as detergent-based, enzymatic, and chemical lysis provide convenience of use, economic viability, and versatility for usage across a variety of cell types. The techniques are highly desired in protein extraction, nucleic acid extraction, and drug discovery due to the fact that they facilitate mild but effective disruption of cells without affecting intracellular materials. The increasing demand for high-throughput workflows in proteomics, genomics, and molecular biology also fueled the segment's growth. Reagent-based approaches are scalable and can be easily adapted to small-scale or large-scale use, so they are also the preferred method among academic research centers, biopharmaceutical firms, and diagnostic laboratories. Optimized lysis buffers and customized reagents released by market leaders also contributed to its lead position in 2023.

By Product

Reagents & Consumables dominated the cell lysis and disruption market with a 65.41% market share during 2023, due to the high level of demand they received from research labs, pharmas, and biotech corporations. Reagents including detergents, enzymes, and buffers play a necessary role in fast and controlled lysis of the cell, such that they repeat business in the domains of molecular biology, proteomics, and drug discovery. While instruments present an initial buy and subsequent setup expenses, reagents and consumables are called upon repeatedly to power market demand. Besides, the growing genomic and proteomic research and higher biopharmaceutical production drove demand for reagents of high quality and specialty. Industry players launched tailored lysis buffers and enzyme-based solutions to enhance efficiency further cementing dominance of the segment. The cost-savings and scalability of reagent-based cell lysis procedures further encouraged their usage in academic and clinical research environments.

By Cell Type

Mammalian Cells segment dominated the cell lysis and disruption market with a 46.30% market share in 2023 because of the global application of mammalian cell cultures in biopharmaceutical research, drug development, and the production of therapeutic proteins. Mammalian cells are used widely to produce monoclonal antibodies, develop vaccines, and conduct gene therapy research, necessitating effective cell lysis procedures to extract intracellular components. Moreover, the growing emphasis on cancer research and regenerative medicine, in which mammalian cells are of utmost importance in disease modeling and stem cell research, further accelerated segment growth. With biologics and cell-based therapies continuing to grow, the need for improved lysis methods to recover proteins, nucleic acids, and organelles from mammalian cells continued to be strong, cementing the segment's leadership.

The Yeast/Algae/Fungi segment is anticipated to be the fastest-growing over forecast years with increasing demand for biofuels, renewable bioproducts, and microbial-derived biopharmaceuticals. Both yeast and fungi are major sources for the production of recombinant protein, enzyme production, and industrial biotechnology processes, which are prompting the demand for effective cell disruption techniques to recover intracellular products. Algal bioprocessing is also picking up pace in biofuel production and nutraceutical uses, further increasing the demand for specialized lysis methods. Microbial fermentation and synthetic biology advancements, along with growing research on alternative protein sources and bioengineering, are likely to propel the swift uptake of enzymatic, mechanical, and high-pressure lysis processes in this segment, positioning it as the fastest-growing category in the next few years.

By Application

The Protein Isolation segment dominated the Cell Lysis and Disruption Market with 42.25% market share in 2023 with the growing need for proteins in biologics manufacturing, drug discovery, and proteomic studies. Cell lysis methods are highly dependent on pharmaceutical and biotechnology organizations to retrieve intracellular proteins for uses including monoclonal antibody production, enzyme manufacturing, and therapeutic protein production. The increased usage of recombinant protein expression systems in mammalian, yeast, and bacterial cells also enhanced the need for effective and scalable lysis techniques.

Further, growth in proteomics has augmented the demand for good-quality protein samples for structural biology, functional analysis, and biomarker discovery, further stressing the significance of high-performance cell disruption methods. Growth in personalized medicine and protein-based therapeutics along with innovation in next-generation protein purification technology has further strengthened the dominance of this segment in 2023.

By End-use

The Pharmaceutical and Biotechnology Companies segment dominated the Cell Lysis and Disruption Market with a 38.15% market share in 2023 because of the widespread application of cell disruption methods in biologics manufacturing, drug discovery, and gene therapy studies. These firms depend on effective cell lysis techniques to isolate proteins, nucleic acids, and other biomolecules for therapeutic development, vaccine development, and recombinant protein production. The increasing demand for cell-based treatments, monoclonal antibodies, and biosimilars has further hastened the demand for scalable and high-throughput lysis solutions. The growth in personalized medicine and biopharmaceutical research. It has fueled extensive investment in latest cell lysis technologies, such as automated systems and specialized reagents. As more R&D spending and regulatory approvals for cell-based therapies and biologics are observed, pharmaceutical and biotechnology firms have been the biggest end-users, cementing their grip on the market.

Regional Insights

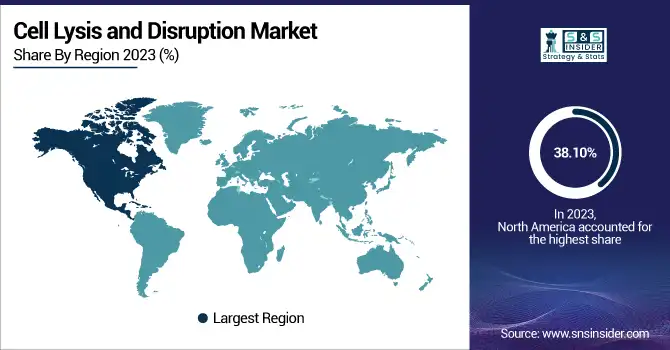

North America dominated the cell lysis and disruption market with 38.10% market share in 2023 because of its highly developed pharmaceutical and biotechnology sectors, high government and private investment in life sciences, and established market players. It has advanced research facilities, a large number of research and academic institutions, and robust regulatory environments facilitating biopharmaceutical innovation. Furthermore, the growing need for proteomics, genomics research, and personalized medicine, along with the extensive use of automated cell lysis technologies, further supports North America's market dominance. The United States, specifically, plays a major role in this dominance due to its strong funding for biopharma and biotechnology R&D.

Asia Pacific is the fastest growing region in the cell lysis and disruption market with 9.26% CAGR throughout the forecast period due to growing investments in biotechnology, increasing pharmaceutical production, and rising government programs backing life science research. China, India, and Japan are experiencing greater use of sophisticated cell lysis technologies as a result of the fast growth of biopharmaceutical firms and contract research organizations (CROs). Increased emphasis on regenerative medicine, stem cell therapy, and molecular diagnostics, coupled with an escalation in academic research, drives the growth of the market. Furthermore, reduced operational expenses and growing collaborations among global and regional biotech companies increase the potential of Asia Pacific as a major growth center.

Get Customized Report as per Your Business Requirement - Enquiry Now

Cell Lysis and Disruption Market Key Players

-

Thermo Fisher Scientific, Inc. (GeneJET RNA Purification Kit, Pierce RIPA Buffer)

-

Merck KGaA (CelLytic M Cell Lysis Reagent, ProteoExtract Subcellular Proteome Extraction Kit)

-

Bio-Rad Laboratories, Inc. (ProteoPrep Sample Extraction Kit, ReadyPrep Protein Extraction Kit)

-

F. Hoffmann-La Roche Ltd. (MagNA Lyser Instrument, High Pure RNA Tissue Kit)

-

QIAGEN N.V. (RNeasy Mini Kit, QIAshredder)

-

Danaher Corporation (Beckman Coulter's Echo Liquid Handler, Leica Biosystems' Tissue Dissociation Kit)

-

Miltenyi Biotec (gentleMACS Dissociator, MACS Tissue Dissociation Kits)

-

Claremont BioSolutions, LLC (MicroLyse Rapid Bacterial Lysis Kits, OmniLyse Cell Lysis Kits)

-

IDEX Corporation (Microfluidics M-110P Microfluidizer, Microfluidics M-110EH-30 Microfluidizer)

-

Parr Instrument Company (Parr High Pressure Homogenizer, Parr Pressure Reaction Vessels)

-

Covaris, LLC (LE220-plus Focused-ultrasonicator, M220 Focused-ultrasonicator)

-

Cell Signaling Technology, Inc. (PathScan Sandwich ELISA Lysis Buffer, SignalSilence siRNA Kits)

-

Qsonica, LLC (Q700 Sonicator, Q125 Sonicator)

-

Becton, Dickinson and Company (BD) (BD FACSDuet Sample Preparation System, BD Lyse/Wash Assistant)

-

BioVision, Inc. (Mammalian Cell Lysis Kit, Cytoplasmic Extraction Kit)

-

Microfluidics International Corporation (LV1 Low Volume Microfluidizer, M-110Y Microfluidizer)

-

Norgen Biotek Corp. (Total RNA Purification Kit, Plasma/Serum Circulating RNA Purification Kit)

-

NZYTech Lda (NZY Tissue gDNA Isolation Kit, NZY Total RNA Isolation Kit)

-

PromoCell GmbH (Primary Cancer Culture System, Fibroblast Growth Medium)

-

STEMCELL Technologies Inc. (EasySep Cell Separation Kits, STEMdiff Differentiation Kits)

Suppliers (These suppliers commonly provide reagents and kits essential for cell lysis and disruption processes, including detergents like Triton X-100 and specialized buffers.) in the Cell Lysis and Disruption Market

-

Sigma-Aldrich (a subsidiary of Merck KGaA)

-

Thermo Fisher Scientific, Inc.

-

Bio-Rad Laboratories, Inc.

-

QIAGEN N.V.

-

Miltenyi Biotec

-

Claremont BioSolutions, LLC

-

Covaris, LLC

-

Qsonica, LLC

-

Norgen Biotek Corp.

-

STEMCELL Technologies Inc.

Recent Development in the Cell Lysis and Disruption Market

-

February 2025: Thermo Fisher Scientific launched the Invitrogen EVOS 1000 Spatial Imaging System, a state-of-the-art solution that is aimed at optimizing cell lysis research. The innovative system is used to perform high-quality, multiplexed imaging, speeding up spatial tissue proteomics and saving time in biomolecule analysis for diagnostics and biopharmaceutical development.

-

February 2025: Bio-Rad said it is planning to acquire Stilla Technologies in a strategic move to enhance its digital PCR business. The acquisition would enhance Bio-Rad's capabilities in oncology diagnosis, gene therapy, infectious disease testing, and biomolecular analysis, fueling the market for cell lysis and disruption.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.21 Billion |

| Market Size by 2032 | US$ 10.92 Billion |

| CAGR | CAGR of 8.61 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technique (Reagent-based, Physical Disruption) • By Product (Instruments, Reagents & Consumables) • By Cell Type (Mammalian Cells, Bacterial Cells, Yeast/Algae/Fungi, Plant Cells) • By Application (Protein Isolation, Downstream Processing, Cell Organelle Isolation, Nucleic Acid Isolation) • By End-use (Academic And Research Institutes, Hospitals And Diagnostic Labs, Cell Banks, Pharmaceutical And Biotechnology Companies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Inc., Merck KGaA, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., QIAGEN N.V., Danaher Corporation, Miltenyi Biotec, Claremont BioSolutions, LLC, IDEX Corporation, Parr Instrument Company, Covaris, LLC, Cell Signaling Technology, Inc., Qsonica, LLC, Becton, Dickinson and Company (BD), BioVision, Inc., Microfluidics International Corporation, Norgen Biotek Corp., NZYTech Lda, PromoCell GmbH, STEMCELL Technologies Inc., and other players. |