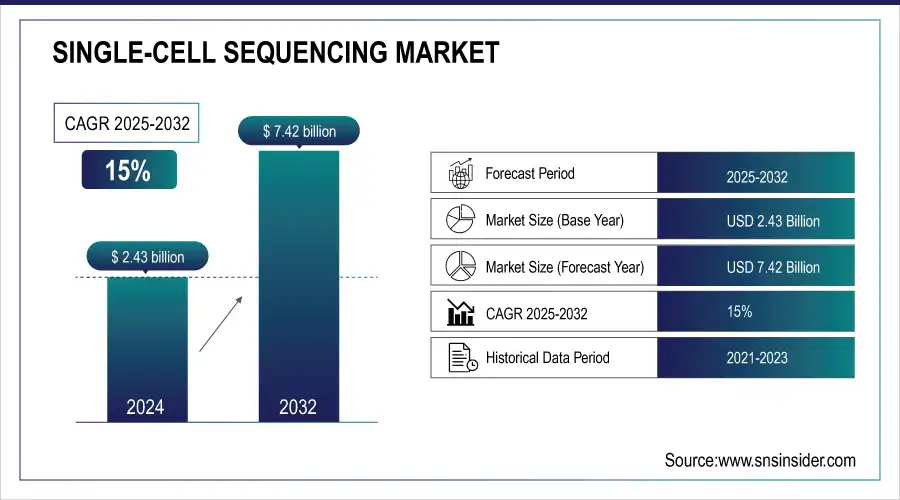

Single-Cell Sequencing Market Size & Overview:

The Single-Cell Sequencing Market was valued at USD 2.43 billion in 2025E and is expected to reach USD 7.42 billion by 2033, growing at a CAGR of 15% from 2026-2033.

The single-cell sequencing market is expanding rapidly due to advances in genomics and rising demand for personalized medicine. It enables analysis of individual cells, uncovering cellular heterogeneity, rare populations, and disease mechanisms, critical for cancer, immunology, neurology, and developmental biology research. Growing adoption in clinical and academic settings, technological improvements, and increased funding support its use. By facilitating accurate diagnosis, biomarker discovery, and targeted therapies, single-cell sequencing is becoming essential in tailored healthcare solutions, driving sustained market growth and continuous innovation across research and clinical applications.

Market Size and Forecast

-

Single-Cell Sequencing Market Size in 2025E: USD 2.43 Billion

-

Single-Cell Sequencing Market Size by 2033: USD 7.42 Billion

-

CAGR: 15% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To get more information on Single-Cell Sequencing Market - Request Free Sample Report

The U.S. Single-Cell Sequencing market size was valued at an estimated USD 1.05 billion in 2025 and is projected to reach USD 3.15 billion by 2033, growing at a CAGR of 14.5% over the forecast period 2026–2033. Market growth is driven by increasing adoption of single-cell analysis in genomics research, oncology, immunology, and precision medicine. Rising investments in life sciences research, expanding applications in drug discovery and biomarker identification, and growing demand for high-resolution cellular insights are fueling market expansion. Additionally, continuous advancements in sequencing technologies, bioinformatics tools, and rising funding from government and private organizations further strengthen the robust growth outlook of the U.S. single-cell sequencing market during the forecast period.

Single-Cell Sequencing Market Trends

-

Rising demand for precision medicine and genomics research is driving single-cell sequencing adoption.

-

Advances in high-throughput sequencing, microfluidics, and bioinformatics are enhancing resolution and efficiency.

-

Growing applications in cancer research, immunology, and developmental biology are boosting market growth.

-

Integration with AI and machine learning is enabling deeper insights into cellular heterogeneity and disease mechanisms.

-

Expansion of academic, pharmaceutical, and biotech research initiatives is fueling adoption.

-

Development of multi-omics approaches is increasing the scope and utility of single-cell analysis.

-

Collaborations between sequencing platform providers, research institutions, and pharmaceutical companies are accelerating innovation.

Single-Cell Sequencing Market Growth Drivers:

-

The rapid progress in genomic technologies has significantly driven the adoption of single-cell sequencing.

The swift advancement of genomic technologies has greatly propelled the use of single-cell sequencing. Advancements in sequencing technologies, including enhancements in throughput, precision, and cost-effectiveness, are rendering single-cell sequencing increasingly attainable and scalable. This has broadened its uses across various research areas, such as cancer biology, immunology, and neurology. The creation of advanced tools, including microfluidics and droplet-based methods, has enabled the sequencing of individual cells with unmatched accuracy, revealing cellular diversity that was previously obscured. As scientists and medical professionals keep investigating the genetic foundations of diseases, single-cell sequencing is emerging as a vital resource for comprehending intricate biological mechanisms and creating more tailored therapies.

According to NCBI, Over the last forty years, sequencing technologies have developed into three generations. Sanger sequencing, as the first generation, preceded DNA sequencing, and the second generation consisted of massively parallel sequencing on the Illumina and Ion Torrent platforms that supported high-throughput sequencing. The third generation comprises PacBio and Nanopore, as the most advanced long-read and single-molecule sequencing technologies.

-

The increasing emphasis on personalized medicine is the key driver of the single-cell sequencing market.

The increasing need for personalized medicine and targeted therapies has driven the expansion of the single-cell sequencing market. Personalized medicine aims to customize treatments according to unique genetic profiles, leading to greater effectiveness and fewer side effects. Single-cell sequencing allows for accurate characterization of cellular and genetic diversity in tissues, enhancing the understanding of disease development and helping to identify possible therapeutic targets. This is especially important in oncology, as the intricacy of the tumor microenvironment frequently hinders treatment advancement. Single-cell sequencing is crucial in promoting targeted therapies and precision medicine strategies by offering insights into rare cell populations and their interactions, which drives its extensive use in research and clinical settings.

Single-Cell Sequencing Market Restraints:

-

One of the major restraints for the single-cell sequencing market is the high cost and technical complexity associated with these technologies.

Single-cell sequencing needs sophisticated equipment, specific reagents, and expertise, resulting in a costly procedure. The requirement for careful management of samples, data examination, and computational resources further increases the expense, which may restrict its availability, particularly for smaller research laboratories and organizations with constrained funding. Moreover, the technical intricacy of these techniques, necessitating specialized expertise in bioinformatics and data analysis, presents a hurdle for broad acceptance. Consequently, even with the increasing demand, these elements could hinder the market's expansion, especially in areas with inadequate infrastructure or financial means.

-

Data Complexity and Analysis Challenges restraining the single Cell sequencing market.

The amount of data generated from single-cell sequencing is huge, and it requires sophisticated computational tools and expertise in bioinformatics for its analysis. This can become a major bottleneck as the data are difficult to interpret, involving handling variability and noise in the information coming from individual cells. The lack of suitable tools for analyzing the data, together with the necessity for very specialized knowledge, forms a major barrier for researchers to tap the full potential of single-cell sequencing technologies.

Single-Cell Sequencing Market Segment Analysis

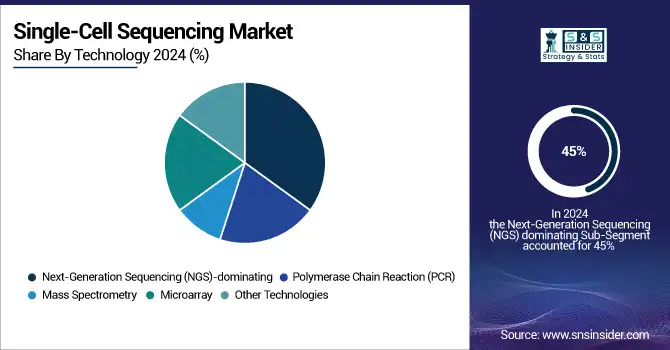

By Technology, NGS dominates the single-cell sequencing market

In 2025, the NGS segment dominated the market of single-cell sequencing with a market share of 45% due to its unmatched capability in sequencing efficiency and precision. It has revolutionized genomic research, allowing for the full-scale analysis of single-cell transcriptomics, epigenomics, and genomics. Moreover, it is cost-effective nowadays, especially with the advent of more advanced platforms such as Illumina's NovaSeq and Oxford Nanopore's PromethION, enabling large-scale studies at high accuracy.

Adaptability to all sorts of research needs, from cancer to developmental biology; compatibility with multi-omics approaches; continuous innovation, such as single-molecule real-time (SMRT) sequencing and CRISPR-enabled technologies, further strengthens NGS as the leader.

By Application, Cancer research dominates the single-cell sequencing market

In 2025, The cancer research segment dominated the market with a market share of 36%, driven by the increasing worldwide prevalence of cancer and the essential function of single-cell sequencing in revealing tumor diversity, immune evasion strategies, and resistance to treatments. The knowledge acquired from this technology is crucial in creating personalized cancer treatments, immunotherapies, and liquid biopsies. The application is additionally bolstered by worldwide efforts like the Cancer Moonshot program and partnerships between academia and industry in cancer research.

The drug discovery and development segment is experiencing the fastest growth, as single-cell sequencing allows for the identification of new drug targets and biomarkers. The uptake of single-cell technologies by pharmaceutical firms is fast-tracking the creation of precision therapies. For instance, research involving patient-derived organoids and in vitro drug testing utilizing single-cell sequencing is revolutionizing drug development processes. The rise in collaborations between technology suppliers and pharmaceutical companies is driving this expansion.

By End User, Academic and research organizations dominate the single-cell sequencing market

Academic and research organizations segment dominated the market with a 74% market share in 2025, because of their prominence in promoting essential and translational single-cell research. Substantial financial backing from government and non-government entities, including the National Institutes of Health (NIH) and the European Research Council (ERC), aids their initiatives in extensive genomic projects and partnerships. The presence of cutting-edge facilities and specialized knowledge further solidifies their standing.

The biotechnology and pharmaceutical companies segment experiencing the fastest growth due to incorporating single-cell sequencing technologies into their research and development processes. This expansion is fueled by their emphasis on discovering drugs, identifying biomarkers, and creating personalized medicine. Businesses are utilizing single-cell data to improve the design of clinical trials and patient grouping, allowing for more effective and precise therapeutic strategies. Moreover, alliances with educational institutions and tech developers are promoting the uptake of single-cell sequencing in industrial uses.

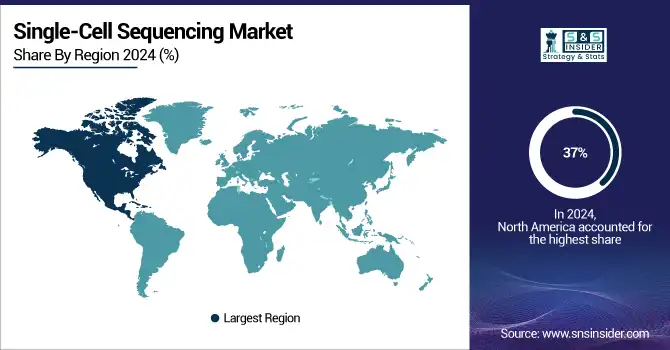

Single-Cell Sequencing Market Regional Analysis

North America Single-Cell Sequencing Market Insights

In 2025, North America dominated the market with a 37% market share of the single-cell sequencing market, primarily due to the presence of major market players, advanced healthcare infrastructure, and high adoption rates of genomic technologies. The region benefits from a well-established healthcare sector and significant investments in research and development, further strengthening its market dominance. Europe also maintains a strong position in the market, driven by similar factors, including robust healthcare infrastructure and substantial research investments. The region's unwavering commitment to scientific research and development has contributed to its significant share in the single-cell sequencing market, although North America remains the leading region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Single-Cell Sequencing Market Insights

The Asia-Pacific region is experiencing the fastest growth in the single-cell sequencing market with a 20.16% CAGR in the forecasted period 2026-2033, driven by increasing investments in healthcare and research, a rising number of academic and research institutions, and a growing emphasis on personalized medicine. Countries like China and India are making significant strides in genomic research and healthcare infrastructure, contributing to the region's accelerated market expansion. Additionally, government initiatives and collaborations with international organizations are playing a pivotal role in advancing genomic research and applications, further fueling the rapid growth of the market in this region.

Europe Single-Cell Sequencing Market Insights

Europe holds a significant position in the single-cell sequencing market, driven by advanced research infrastructure, strong biotechnology and pharmaceutical industries, and substantial government and private funding. Increasing adoption in cancer, immunology, and neurological research, coupled with collaborations between academic institutions and technology providers, supports market growth. Countries like Germany, the UK, and France are leading in innovation, making Europe a key hub for single-cell sequencing development and application.

Middle East & Africa and Latin America Single-Cell Sequencing Market Insights

The Middle East & Africa and Latin America are emerging markets for single-cell sequencing, driven by growing healthcare investments, expanding research infrastructure, and rising interest in personalized medicine. Increasing collaborations with global genomics companies and adoption in academic and clinical research are accelerating market growth. Countries like Brazil, Mexico, UAE, and Saudi Arabia are witnessing rising demand, positioning these regions as high-potential areas for single-cell sequencing expansion.

Single-Cell Sequencing Market Competitive Landscape:

Illumina, Inc.

Illumina, Inc. is a global leader in genomics and DNA sequencing technologies, providing innovative platforms for genetic analysis, research, and clinical applications. Its products and solutions enable researchers and healthcare providers to explore genomic variations, understand disease mechanisms, and develop precision medicine approaches. Illumina focuses on advancing sequencing throughput, accuracy, and cost-efficiency, serving academic, pharmaceutical, biotechnology, and clinical laboratories worldwide.

-

In July 2024, Illumina acquired Fluent BioSciences, a leader in single-cell technology, to enhance its DNA sequencing capabilities. The acquisition aims to drive advancements in single-cell genomics, positioning Illumina for further growth in the field.

Thermo Fisher Scientific, Inc.

Thermo Fisher Scientific is a global biotechnology company offering a wide range of analytical instruments, reagents, consumables, and software for life sciences research, diagnostics, and applied markets. Its advanced platforms, including real-time PCR, sequencing, and mass spectrometry systems, support innovation in genomics, molecular biology, and clinical applications. Thermo Fisher is committed to accelerating scientific discoveries, improving patient care, and enabling breakthroughs in personalized medicine.

-

In May 2024, Thermo Fisher Scientific highlights the rise of Next-Generation Sequencing (NGS)-based companion diagnostics (CDx) for oncology. Their Ion Torrent Genexus System offers quicker turnaround times, delivering results in 24 hours compared to the usual 2-3 week wait.

QIAGEN N.V.

QIAGEN N.V. is a leading provider of sample and assay technologies for molecular diagnostics, applied testing, and life sciences research. The company develops solutions for nucleic acid isolation, gene expression, and variant analysis, supporting clinical, pharmaceutical, and academic customers. QIAGEN emphasizes innovation in bioinformatics, high-throughput sequencing, and precision medicine, enabling efficient workflows and accurate interpretation of complex genomic and molecular data.

-

In May 2024, QIAGEN introduced QCI Secondary Analysis, a cloud-based SaaS solution designed for high-throughput secondary analysis of clinical NGS data. This service integrates with QIAGEN’s clinical variant interpretation software to streamline workflows in oncology and inherited disease applications.

GenScript Biotech

GenScript Biotech is a global leader in gene synthesis, synthetic biology, and RNA technology, providing innovative solutions for research, therapeutics, and vaccine development. Its offerings include protein production, gene editing, and RNA-based platforms that enable advancements in cancer immunotherapy, gene therapy, and vaccine design. GenScript’s focus on high-quality, scalable solutions makes it a key partner for academic, biotech, and pharmaceutical organizations worldwide.

-

In May 2024, GenScript Biotech has broadened its in vitro transcription (IVT) RNA synthesis portfolio with self-amplifying RNA (saRNA). This addition supports applications in vaccine development, cancer immunotherapy, and gene therapy, further solidifying GenScript's leadership in RNA technology.

Key Market Players

-

Illumina, Inc. (NovaSeq 6000 System, MiSeq System)

-

Thermo Fisher Scientific, Inc. (Ion Torrent Genexus System, QuantStudio 6 and 7 Pro Real-Time PCR Systems)

-

10x Genomics, Inc. (Chromium Single Cell Gene Expression Solution, Visium Spatial Gene Expression)

-

Becton, Dickinson, and Company (BD Biosciences) (BD Rhapsody Single-Cell Analysis System, BD FACSMelody Cell Sorter)

-

Fluidigm Corporation (Now Standard BioTools) (C1 Single-Cell Auto Prep System, Hyperion Imaging System)

-

Agilent Technologies (SureSelect Target Enrichment, Bravo NGS Workstation)

-

PerkinElmer, Inc. (LabChip GX Touch System, NEXTFLEX Single Cell RNA-Seq Kit)

-

Pacific Biosciences (PacBio) (Sequel IIe System, SMRTbell Library Preparation Kit)

-

Takara Bio, Inc. (SMARTer Single-Cell RNA-Seq Kit, ICELL8 Single-Cell System)

-

Bio-Rad Laboratories, Inc. (ddSEQ Single-Cell Isolator, QX200 Droplet Digital PCR System)

-

QIAGEN N.V. (QIAseq Single Cell RNA Library Kits, GeneGlobe Data Analysis Center)

-

Merck KGaA (MilliporeSigma) (GenomePlex Single Cell Whole Genome Amplification Kit, Smartflare RNA Detection Probes)

-

Sony Biotechnology (SH800 Cell Sorter, SP6800 Spectral Analyzer)

-

Dolomite Bio (Nadia Instrument, Nadia Innovate)

-

Oxford Nanopore Technologies (MinION Sequencer, GridION Sequencer)

-

GenScript Biotech (CytoFLEX Flow Cytometer, CloneSelect Single-Cell Printer)

-

Mission Bio (Tapestri Platform, Tapestri Designer Software)

-

Roche Sequencing and Life Science (KAPA RNA HyperPrep Kits, LightCycler 480 System)

-

Sartorius AG (CellCelector Single-Cell Isolation System, iQue Advanced Flow Cytometry Platform)

-

Bruker Corporation (MALDI Biotyper, TimsTOF Pro Mass Spectrometer)

Key suppliers

These suppliers provide a range of products that enable advancements in single-cell sequencing technology across different workflows, including gene expression, genomic analysis, and single-cell isolation.

-

Illumina, Inc.

-

Thermo Fisher Scientific, Inc.

-

10x Genomics, Inc.

-

Becton, Dickinson and Company (BD Biosciences)

-

Fluidigm Corporation (Now Standard BioTools)

-

Agilent Technologies

-

PerkinElmer, Inc.

-

Pacific Biosciences (PacBio)

-

Takara Bio, Inc.

-

QIAGEN N.V.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 2.43 billion |

| Market Size by 2033 | US$ 7.42 billion |

| CAGR | CAGR of 15.00% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Mass Spectrometry, Microarray, Other Technologies) • By Workflow (Single-Cell Isolation, Sample Preparation, Genomic Analysis) • By Application (Cancer Research, Immunology Research, Neurobiology Research, Stem Cell Research, Drug Discovery and Development, Other Applications) • By End User (Academic and Research Laboratories, Biotechnology and Pharmaceutical Companies, Hospitals and Diagnostic Laboratories, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, Inc., Thermo Fisher Scientific, Inc., 10x Genomics, Inc., Becton, Dickinson, and Company (BD Biosciences), Fluidigm Corporation (now Standard BioTools), Agilent Technologies, PerkinElmer, Inc., Pacific Biosciences (PacBio), Takara Bio, Inc., Bio-Rad Laboratories, Inc., QIAGEN N.V., Merck KGaA (MilliporeSigma), Sony Biotechnology, Dolomite Bio, Oxford Nanopore Technologies, GenScript Biotech, Mission Bio, Roche Sequencing and Life Science, Sartorius AG, Bruker Corporation, and other players. |