Cell to Pack Battery Market Scope & Overview:

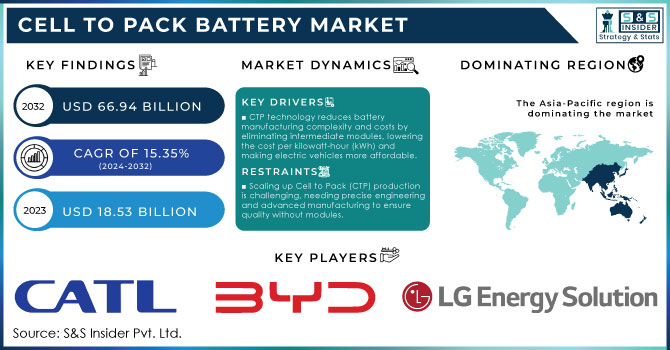

The Cell to Pack Battery Market size was estimated at USD 18.53 billion in 2023 and is expected to reach USD 66.94 billion by 2032 at a CAGR of 15.35% during the forecast period of 2024-2032.

Get More Information on Cell to Pack Battery Market - Request Sample Report

The Cell to Pack (CTP) battery technology is gaining significant momentum in the electric vehicle (EV) and energy storage sectors due to its potential to improve energy density and reduce manufacturing costs. Unlike traditional battery systems, which involve connecting individual cells into modules before they are integrated into a pack, the CTP approach eliminates the need for modules, allowing cells to be directly integrated into the battery pack. This results in a more compact design, lower weight, and improved efficiency in terms of space utilization, offering a crucial advantage for industries relying on energy storage and electric vehicles. One of the key benefits of CTP technology is its ability to increase the energy density of batteries. By removing the extra components needed for modular assembly, the space that would be used for module casings can be repurposed for additional cells, leading to a more energy-efficient system. This direct integration not only enhances performance but also offers a cost-effective solution for battery production, as it reduces the complexity of the manufacturing process. Studies show that CTP designs can achieve up to a 10-15% increase in energy density, which directly translates into longer driving ranges for EVs and higher performance in energy storage applications.

Recent advancements in CTP batteries have been driven by technological improvements in battery cell design, materials, and thermal management systems. Companies like CATL (Contemporary Amperex Technology Co. Ltd.), one of the leading players in the market, have already showcased the advantages of CTP technology in their batteries used for EVs. These improvements are expected to play a significant role in scaling up EV production by increasing vehicle range and reducing charging time. CATL’s CTP battery solution, the "CTP 3.0," claims a 13% increase in energy density compared to previous designs. Moreover, the demand for high-performance energy storage systems in grid storage applications is also contributing to the growing adoption of CTP technology. The increasing push towards sustainable energy solutions is likely to further accelerate the growth of the Cell to Pack battery market. As industries strive for greater energy efficiency and reduced environmental impacts, CTP technology provides a compelling option for both electric mobility and energy storage applications. The market’s growth is expected to be influenced by a projected 25% year-on-year growth in the EV industry, with CTP technology becoming a key enabler of this trend.

| Feature | Description | Commercial Products |

|---|---|---|

| High Energy Density | Cell to pack battery technology optimizes energy storage, providing higher energy density than traditional battery designs, enhancing the performance of electric vehicles (EVs) and other applications. | Tesla 4680, CATL Qilin Battery |

| Reduced Number of Components | The design eliminates the need for modules, reducing the number of components and simplifying the overall battery structure, leading to cost and weight savings. | BYD Blade Battery, LG Chem LFP Battery |

| Improved Thermal Management | Advanced thermal management systems ensure better heat dissipation, preventing overheating and improving the lifespan of the battery. | Panasonic 4680, Samsung SDI High-Energy Cells |

| Enhanced Safety Features | Integrated safety mechanisms such as thermal sensors, pressure relief systems, and robust casings to prevent failures and improve operational safety. | A123 Systems Cell to Pack, EVE Energy Lithium-Ion Battery |

| High Efficiency Manufacturing | Streamlined manufacturing processes reduce the time and cost involved in producing battery packs, increasing overall production efficiency. | CALB Battery Packs, Guoxuan New Energy Cell-to-Pack Batteries |

| Flexible Design for Different Applications | Offers flexibility in design, making it suitable for multiple industries such as electric vehicles, energy storage systems, and consumer electronics. | Contemporary Amperex Technology (CATL) Cell to Pack, Northvolt Battery Packs |

| Longer Battery Life | The compact design with efficient power storage increases the longevity of the battery, reducing the need for frequent replacements. | Tesla Battery Packs, Envision AESC Cell-to-Pack Technology |

| Cost-Effective Manufacturing | Reduced material usage and fewer components help lower the overall cost of production, making advanced battery technology more affordable for large-scale adoption. | Pylontech Battery Solutions, SK Innovation Battery Packs |

Cell to Pack Battery Market Dynamics

DRIVERS

-

Advancements in battery technology, including improved energy density, cycle life, and safety, are driving the adoption of Cell to Pack (CTP) solutions by eliminating traditional battery modules and enhancing overall performance.

Innovations in battery technology have played a pivotal role in the rapid adoption of Cell to Pack (CTP) solutions. Traditional battery systems rely on multiple intermediate battery modules to package cells, which adds complexity and weight to the overall battery structure. CTP technology eliminates this need, integrating the cells directly into the battery pack. This simplification allows for better utilization of space, reduces weight, and enhances the energy density of the battery, which is crucial for applications like electric vehicles (EVs) and large-scale energy storage. CTP solutions can increase energy density by up to 10-15% compared to traditional battery designs, enabling longer driving ranges for EVs an essential factor for consumer adoption. Advances in materials, such as solid-state electrolytes and silicon-based anodes, have pushed the boundaries of battery performance, improving overall efficiency. These innovations contribute to a 25-30% extension in battery lifespan, meaning CTP batteries can be charged and discharged more times without significant degradation. This is critical for EVs that require long-lasting battery life. Additionally, energy efficiency improvements of CTP batteries are estimated to enhance overall vehicle performance by 15-20%, further driving the shift towards electric mobility. Furthermore, safety advancements are addressing concerns about battery fires or failures, with new technologies focusing on temperature control and fault detection.

-

CTP technology reduces battery manufacturing complexity and costs by eliminating intermediate modules, lowering the cost per kilowatt-hour (kWh) and making electric vehicles more affordable.

The Cell to Pack (CTP) battery technology offers significant advantages in terms of cost reduction in battery manufacturing, which is crucial for making electric vehicles (EVs) more affordable and accessible to a wider audience. Traditional battery packs consist of multiple cells arranged into modules, which are then assembled into a final pack. Each stage in this assembly process requires additional components and labor, which increases the overall cost of production. In contrast, CTP technology eliminates the need for these intermediary modules by directly integrating the battery cells into the pack. This streamlined design reduces the number of manufacturing steps, simplifies the production process, and cuts down on the materials and labor required for assembly.

CTP batteries can reduce the number of components in a battery pack by up to 30%, resulting in more efficient manufacturing processes. By bypassing the module stage, CTP technology can lower the cost per kilowatt-hour (kWh) of battery capacity, which is one of the key cost drivers in EV production. The elimination of the module assembly process can cut the overall cost of battery production by up to 15%, depending on the scale and materials used. Furthermore, CTP technology increases energy density by up to 20% compared to traditional battery packs, leading to better performance per unit cost. Additionally, the reduction in steps required for assembly can lead to a reduction in manufacturing time by approximately 10-20%. This reduction in battery cost and manufacturing time has a direct impact on the price of electric vehicles, making them more competitive with internal combustion engine vehicles. Lower battery costs can also enable automakers to allocate resources towards improving other vehicle features, such as performance, range, and design. As the EV market continues to grow and demand for affordable electric cars increases, the cost benefits of CTP technology will become even more significant. Additionally, cost reductions in battery manufacturing can spur further adoption of renewable energy storage systems, where lower upfront costs play a crucial role in large-scale deployments.

RESTRAIN

-

Scaling up Cell to Pack (CTP) production is challenging due to the need for precise engineering of individual cells and advanced manufacturing processes to maintain consistent quality and performance without traditional modules.

Cell to Pack (CTP) battery technology is gaining attention for its potential to reduce costs, improve energy density, and simplify battery design, particularly for electric vehicles and energy storage systems. However, scaling up production remains a significant challenge. Unlike traditional battery designs that use modules to house individual cells, CTP directly integrates the cells into the pack, which streamlines manufacturing but also introduces complexities. The main issue lies in ensuring consistent quality and performance across large volumes of cells. Each cell must be engineered with high precision, as any variability can affect the overall pack performance, requiring advanced manufacturing processes and strict quality control. Furthermore, without modules, real-time monitoring technologies are necessary to track factors like temperature, voltage, and health status of each cell, increasing production complexity. This also demands significant investments in new infrastructure and research to ensure scalable, cost-effective production. Despite these challenges, CTP batteries offer advantages, such as up to a 20% improvement in energy density and a 30% reduction in assembly time compared to modular designs. Additionally, the advanced production techniques used in CTP can increase efficiency by reducing the number of parts required, lowering labor and material costs. Overcoming these technical challenges is crucial for CTP batteries to reach their full potential in large-scale applications like electric vehicles.

Cell to Pack Battery Market Segmentation Overview

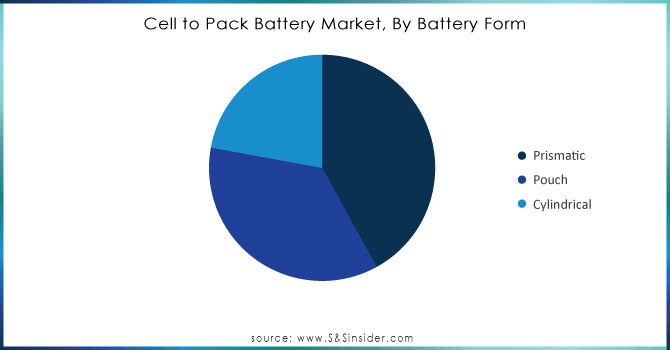

By Battery Form

Prismatic cells segment dominated the market share over 42% in 2023. This cell type is preferred because of its larger size, which allows for higher energy density and a more compact structure compared to cylindrical cells. Unlike cylindrical cells, prismatic cells are constructed with folded internal layers comprising the anode, cathode, and separators arranged in a cubic or flattened spiral form. This design enables a single prismatic cell to store energy equivalent to 20 to 100 cylindrical cells. These attributes make prismatic cells an ideal choice for use in cell-to-pack battery technology, driving their increased adoption in the market.

Need Any Customization Research On Cell to Pack Battery Market - Inquiry Now

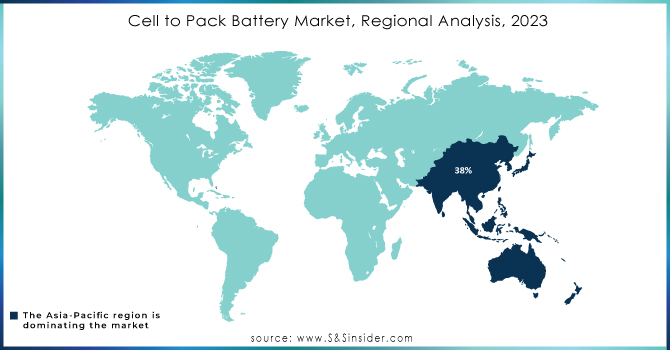

Cell to Pack Battery Market Regional Analysis

Asia-Pacific (APAC) region dominated the market share over 38% due to its significant contribution to the global production and adoption of advanced battery technologies. The region is home to major battery manufacturers, such as CATL, LG Energy Solution, and BYD, who supply batteries for electric vehicles (EVs) and energy storage systems. APAC countries like China, Japan, and South Korea lead in the development of electric mobility infrastructure and renewable energy storage, driving the demand for more efficient battery solutions. China, in particular, has become a global hub for the EV market, supported by government policies, subsidies, and investments in electric vehicles and battery technology.

Europe is emerging as the fastest-growing region in the Cell to Pack Battery Market, driven by increasing investments in electric vehicle (EV) manufacturing, renewable energy solutions, and green energy transition initiatives. The European Union has been pushing for a cleaner, more sustainable energy future, which has led to policies favoring the adoption of electric vehicles and renewable energy. The European Commission’s Green Deal and the push for carbon neutrality by 2050 are key drivers for the growth of the battery market, as these policies stimulate demand for advanced battery technologies like cell-to-pack.

Some of the major key players of Cell to Pack Battery Market

-

Contemporary Amperex Technology Co., Limited (Product: Lithium-ion battery cells, CATL Powerwall)

-

BYD Company Ltd. (Product: Blade Battery, Lithium Iron Phosphate Battery)

-

LG Energy Solution (Product: LG Chem lithium-ion batteries, PHEV battery modules)

-

Tesla (Product: Tesla battery packs, Powerwall, Powerpack)

-

XPENG INC. (Product: Lithium-ion battery packs for electric vehicles)

-

C4V (Product: Lithium-ion battery cells, Custom battery packs)

-

Sunwoda Electronic Co., Ltd. (Product: Lithium-ion battery packs for EVs, Energy storage solutions)

-

Panasonic Corporation (Product: Panasonic lithium-ion batteries, Tesla battery supply)

-

Samsung SDI (Product: EV battery modules, Power storage solutions)

-

CATL (Contemporary Amperex Technology Co. Limited) (Product: CATL lithium-ion battery cells, Battery packs for EVs)

-

SK Innovation (Product: Lithium-ion batteries, EV battery packs)

-

A123 Systems LLC (Product: A123 lithium-ion batteries for automotive, Commercial battery solutions)

-

Northvolt AB (Product: Northvolt Voltpack, Lithium-ion battery cells and packs)

-

CALB (China Aviation Lithium Battery Co., Ltd.) (Product: CALB lithium-ion battery cells for EVs, ESS)

-

Guoxuan (Guoxuan High-tech) (Product: Lithium-ion batteries, Power storage systems for EVs)

-

Lishen Battery (Product: Lithium-ion battery cells for EVs, Consumer electronics batteries)

-

Farasis Energy (Product: Lithium-ion battery cells, Automotive battery solutions)

-

EVE Energy Co., Ltd. (Product: Lithium-ion battery packs, Energy storage solutions)

-

Envision AESC (Product: EV battery packs, Lithium-ion battery cells for automotive)

-

QuantumScape (Product: Solid-state lithium batteries, EV battery technologies)

Suppliers for Lithium-ion batteries, including cell-to-pack battery solutions for electric vehicles (EVs) and energy storage systems of Cell to Pack Battery Market:

-

BYD Co. Ltd.

-

CATL (Contemporary Amperex Technology Co. Limited)

-

LG Energy Solution

-

Samsung SDI

-

Panasonic Corporation

-

SK Innovation

-

Guoxuan (Gotion High-tech)

-

CALB (China Aviation Lithium Battery Co. Ltd.)

-

A123 Systems

-

Northvolt

RECENT DEVELOPMENT

-

In February 2024: BorgWarner, a provider of automotive and e-mobility solutions, partnered with FinDreams Battery, a subsidiary of BYD, to accelerate the adoption of Lithium Iron Phosphate (LFP) battery packs in commercial vehicles. Under the agreement, BorgWarner will exclusively use FinDreams Battery Blade cells to manufacture LFP battery packs for commercial vehicles, targeting markets in Europe, the Americas, and select regions of Asia Pacific.

-

In November 2023: Volkswagen Group China commenced battery system production at a new facility in Hefei, China, for its MEB platform electric vehicles. This marks the Group’s first wholly-owned battery manufacturing venture in China and the first VW Group plant to produce next-generation cell-to-pack (CTP) EV batteries.

-

In July 2023: FAW-Fudi, part of BYD (FinDreams), rolled out its first battery pack based on BYD Blade battery technology. This development strengthens the localization of power battery production, and the batteries will be used in electric vehicles from the FAW Group, as well as those from joint ventures like FAW-Volkswagen and FAW-Toyota.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.53 Billion |

| Market Size by 2032 | USD 66.93 Billion |

| CAGR | CAGR of 15.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Battery Form (Prismatic, Pouch, Cylindrical) • By Battery Type (Lithium Iron Phosphate, Nickel Manganese Cobalt, Other Battery Type) • By Electric Vehicle Type (Electric Passenger Cars, Electric Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Contemporary Amperex Technology Co., Limited, BYD Company Ltd., LG Energy Solution, Tesla, XPENG INC., C4V, Sunwoda Electronic Co., Ltd., Panasonic Corporation, Samsung SDI, CATL, SK Innovation, A123 Systems LLC, Northvolt AB, CALB, Guoxuan, Lishen Battery, Farasis Energy, EVE Energy Co., Ltd., Envision AESC, QuantumScape Corporation. |

| Key Drivers | • Advancements in battery technology, including improved energy density, cycle life, and safety, are driving the adoption of Cell to Pack (CTP) solutions by eliminating traditional battery modules and enhancing overall performance. • CTP technology reduces battery manufacturing complexity and costs by eliminating intermediate modules, lowering the cost per kilowatt-hour (kWh) and making electric vehicles more affordable. |

| RESTRAINTS | • Scaling up Cell to Pack (CTP) production is challenging due to the need for precise engineering of individual cells and advanced manufacturing processes to maintain consistent quality and performance without traditional modules. |