Tire Pressure Monitoring System Market Key Insights:

Get More Information on Tire Pressure Monitoring System Market - Request Sample Report

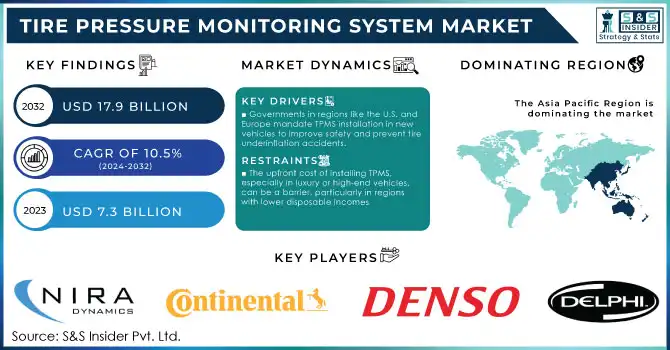

The Tire Pressure Monitoring System (TPMS) Market Size was valued at USD 7.3 Billion in 2023 and will reach USD 17.9 Bn by 2032, growing at a CAGR of 10.5% during the forecast period of 2024 -2032.

The rising number of government regulations and stringent safety regulations to prevent road accidents due to under-inflated tires is primarily driving the global tire pressure monitoring system (TPMS) market. TPMS Installation in Vehicles Governments globally, more so in North America and Europe, have imposed strict regulations for the installation of TPMS in vehicles for overall better safety and fuel savings. For example, because of not properly inflating tires, The National Highway Traffic Safety Administration (NHTSA) has a record of nearly 11,000 car crashes in the United States and more than 200 deaths, annually. It assists in alerting the driver about under-inflated tires and enhances vehicle safety and fuel efficiency.

All light vehicles weighing under 10,000 pounds (including passenger cars and light trucks) sold in the U.S. have had to be equipped with TPMS since 2007, per NHTSA regulations. In Europe, by 2014 the European Commission laid down regulations enforcing TPMS in every new car, which also drives the market potential for the TPMS system in Europe. The demand for TPMS is driven by government initiatives toward road safety and fuel efficiency which has prompted the adoption of TPMS in passenger vehicles as well as commercial fleets. Secondly, the TPMS market is supported as rising environmental awareness amongst customers is driving demand for tire pressure monitoring systems, helping improve fuel efficiency and reduce CO2 emissions by maintaining correct tire pressure. As such, government initiatives have played a major role in promoting mass TPMS adoption across the world, with some nations looking towards stricter regulations to maximize the benefits of TPMS for road safety.

Tire Pressure Monitoring System Market Dynamics

Drivers

-

Governments across various regions, including the U.S. and Europe, mandate the installation of TPMS in all new vehicles to enhance safety and reduce accidents caused by tire underinflation.

-

Growing awareness about the importance of maintaining optimal tire pressure for better fuel efficiency, reduced wear, and increased safety has led to higher adoption of TPMS, especially in consumer vehicles.

-

The rising number of road accidents due to under-inflated tires has accelerated the demand for TPMS, as it is a critical safety feature that can prevent accidents.

Regulatory safety mandates are one of the significant driving factors for the growth of the Tire Pressure Monitoring System (TPMS) market. To enhance safety while driving, governments all over the world in particular the U.S. and Europe enforced rigorous requirements on all new passenger vehicles to be fitted with a Tire Pressure Monitoring System (TPMS). For example, the U.S. National Highway Traffic Safety Administration (NHTSA) ruling from 2007 requiring TPMS (tire pressure monitoring systems) on nearly every passenger vehicle and light truck a ruling that drove widespread adoption of that technology. The need for this regulation comes from the fact that tire underinflation is a leading factor in tire-related accidents.

The European Union has similarly mandated TPMS for all new passenger cars, with the regulation coming into effect in 2014. These regulations help to lower the chances of an accident caused due to tire failure, lower fuel consumption, and increase overall vehicle safety. Consequently, the TPMS adoption rate increased in these areas, with TPMS being featured in the majority of new vehicle models by most car manufacturers. These safety regulations do not just minimize the damage in road accidents, but they also contribute to various global movements for improving automotive safety. According to the NHTSA, about 10 percent of all motor vehicle crashes are the result of tire-related incidents. Hence, regulatory mandates remain a major driver, with the evolution of TPMS being one of the essential forces shaping automotive safety systems.

Restraints:

-

Retrofitting older vehicle models with TPMS can be challenging due to compatibility issues, which limits the market potential for aftermarket TPMS solutions.

-

The upfront cost of installing TPMS, especially in luxury or high-end vehicles, can be a barrier, particularly in regions with lower disposable incomes

Compatibility issues with older vehicles are one of the major restraints for the growth of the Tire Pressure Monitoring System (TPMS) market. Installing TPMS in vehicles that were not made with the system can be a time-consuming and expensive process. Ideally, you would need the sensors or the wiring to it, as many older cars do not have these systems, and retrofitting it can be difficult. Vehicle owners may still incur new costs in the form of more sensors, wiring, or even software updates for the integration of the sensors into the vehicle’s existing systems. In addition, in old vehicles in which the advanced TPMS solutions had no infrastructure, there is no wide adoption of the aftermarket segment. This issue is more prominent in regions where older vehicle fleets are common, reducing the overall market potential for retrofitting solutions.

Tire Pressure Monitoring System Market Segment Analysis

By Type

In 2023, the direct TPMS (dTPMS) held the largest market share with a share of 59%. The growing consumer need for more accurate and reliable tire pressure monitoring systems is primarily responsible for the dominance of this segment. The Direct TPMS does not calculate tire pressures through wheel speed sensors like the Indirect TPMS (iTPMS) that derives tire pressure from rotational differences, instead, it has a pressure sensor in each tire offering direct, real-time & accurate tire pressure readings to the Vehicle driver. This use of technology gives direct TPMS an edge over indirect TPMS and thus, is favored by manufacturers in safety regulations-intensive regions. The NHTSA mandates direct TPMS for cars over 10,000 pounds in the U.S., and this has propelled the growth of the direct TPMS market. Another reason direct systems are chosen is due to advancements in sensor technology lower costs and better system reliability.

The direct TPMS's capability to immediately alert the driver to tire pressure changes ensures greater safety, particularly in critical driving conditions. According to government statistics, TPMS has proven to be a key factor in reducing accidents and improving fuel efficiency, which aligns with the global push for automotive safety innovations. The research by the U.S. NHTSA revealed that direct TPMS has decreased tire-related crashes by as much as 55%. This has subsequently led to an increased adoption of direct TPMS by automakers for both new and repowered vehicle models, thus establishing direct TPMS as the dominant type of TPMS in the market.

By Vehicle Type

In 2023, the TPMS market was led by the passenger vehicle segment with a 69% share. The passenger vehicle segment held the largest share within the global tire pressure monitoring systems because of the higher sales of passenger cars, and government mandates for TPMS as a standard feature in passenger vehicles. As an example, the National Highway Traffic Safety Administration (NHTSA) requires every light vehicle (like passenger cars) sold in the U.S. to include a tire pressure monitoring system or TPMS. Moreover, the rising knowledge of consumers regarding vehicle safety along with the health of tires further plays a key factor in driving passenger vehicle demand across the global TPMS market.

With the increasing concern related to fuel efficiency and carbon dioxide (CO2) emissions, governments worldwide are underscoring the impact of tire management on total fuel use. Under-inflated tires are among the top three causes of fuel inefficiency and with TPMS offering up to 3% fuel improvement in studies, it is a good selling point with consumers who want to cut their fuel expense levels. In addition, the increasing number of consumers purchasing luxury vehicles, which are mostly equipped with additional safety features inclusive of TPMS, supports the growth of the passenger vehicle segment in the TPMS market. Attracting adoption in markets such as Europe, where TPMS regulations have been operating for almost 5 years, government policies have been a key driver in the market. In addition, the regulation of a TPMS in the European Union has seen it as standard on passenger vehicles, further sustaining the dominance of the segment.

By Sales Channel

In 2023, the OEM (Original Equipment Manufacturer) segment accounted for the largest market share at 73%. The high percentage of cars equipped with TPMS and the focus on safety and fuel efficiency by automakers and regulators have contributed to this trend. Government mandates have led to the evolution of TPMS fitments in new vehicles in developed regions, particularly North America and Europe, where regulations around fitting TPMS in new vehicles are already in place. The U.S. National Highway Traffic Safety Administration (NHTSA) reports that installing TPMS in new vehicles since 2007 has improved road safety by helping drivers be alert to low tire pressure. Furthermore, vehicle manufacturers are making it a point to offer TPMS with every fleet as a part of the standard safety package, boosting the dominance of the VOEM segment.

Moreover, automakers are still working on improving the TPMS technology by fusing it with other advanced driver-assistance systems (ADAS) which will provide a broader safety solution making TPMS a major selling point in new vehicles. With more OEMs tying up with TPMS suppliers for the seamless integration of TPMS technology during the production process, the OEM segment is holding the greater share of the TPMS market. These factors will keep the OEM segment to retain its position in the TPMS market in the coming years.

Tire Pressure Monitoring System Market Regional Overview

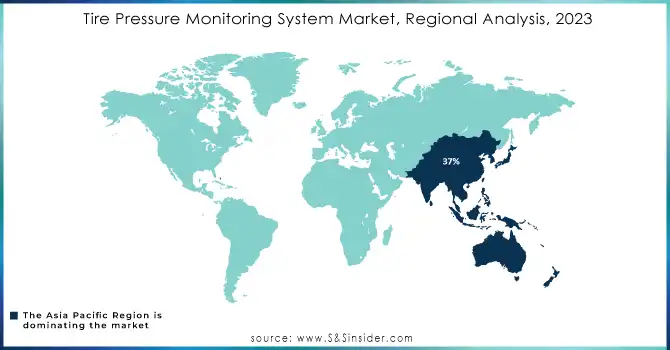

The Asia Pacific region led the global Tire Pressure Monitoring Systems (TPMS) market in 2023 with a considerable 37% revenue share. This prevalence is linked to the automotive sector with impressive growth in major markets such as China, India as well as Japan with decades of growing the production as well as sales of vehicles. The increasing demand for TPMS in the region is further fueling demand because of consumer awareness towards vehicle safety and fuel efficiency, along with stringent government regulations. Specifically, China, the world's biggest automotive market is a key driver in TPMS take-up spurred by the government's push for increased vehicle safety and fuel efficiency. China implements automotive safety regulations which is stricter and more mandatory for installing TPMS in new cars. This regulation is accelerating the domestic automakers and international brands in China for TPMS adoption. Similarly, the Indian government too, has been moving towards setting realistic and stringent vehicle safety standards considering even the promotion of installing TPMS in vehicles.

Additionally, as the automotive industry in the Asia Pacific region continues to grow, the increasing number of vehicle sales, especially passenger vehicles, has bolstered the demand for advanced safety features such as TPMS. Countries such as India and South Korea are witnessing a significant shift in consumer preference for vehicles with new technologies like TPMS due to the increasing middle-class population and rising disposable income.

The North American region is expected to register a lucrative growth rate during the forecast period. The growth of the advanced tire pressure monitoring system is due to stringent regulatory mandates, particularly in the United States where TPMS became mandatory for all new passenger vehicles in 2007. Domestic vehicle production and sales remain high, making the U.S. a crucial market for the TPMS market. In addition, the rising emphasis on automotive safety and on-road fuel economy coupled with the growing awareness regarding tire-related accidents has projected market growth. The U.S. NHTSA has consistently reiterated that the integration of TPMS will enhance vehicle safety and reduce the number of tire-related accidents, and this has boosted the growth of the market in the region.

Need Any Customization Research On Tire Pressure Monitoring System Market - Inquiry Now

Recent Analysis

-

In June 2024, Continental AG increased its TPMS production capacity at its Bangalore facility in India, expanding it to meet the growing demand for passenger car safety. The company also unveiled an advanced generation of Tire Pressure Monitoring Systems designed to enhance both safety and sustainability. This initiative aligns with Continental’s broader commitment to its Vision Zero goal, which aims for zero fatalities, zero injuries, and zero accidents in road traffic.

Key Players in Tire Pressure Monitoring System Market

Key Service Providers/Manufacturers:

-

Delphi Automotive (TPMS sensors, Tire Pressure Monitoring System ECU)

-

DENSO Corporation (Direct TPMS Sensors, Wireless TPMS)

-

Continental AG (Direct TPMS, Tire Pressure Monitoring System ECU)

-

NXP Semiconductors (TPMS Sensors, Automotive Microcontrollers)

-

NIRA Dynamics AB (Indirect TPMS, Tire Data Analytics Solutions)

-

Valor TPMS (TPMS Sensors, TPMS Kits)

-

Pacific Industrial (TPMS Sensors, TPMS ECU)

-

ZF Friedrichshafen AG (TPMS sensors, Vehicle Safety Solutions)

-

ATEQ (TPMS diagnostic tools, TPMS sensors)

-

Sensata Technologies, Inc. (Direct TPMS, Wireless TPMS)

Key Users

-

Ford Motor Company

-

General Motors

-

BMW Group

-

Volkswagen Group

-

Toyota Motor Corporation

-

Honda Motor Co. Ltd.

-

Nissan Motor Co. Ltd.

-

Hyundai Motor Company

-

FCA (Fiat Chrysler Automobiles)

-

Kia Motors Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.3 Billion |

| Market Size by 2032 | USD 17.9 Billion |

| CAGR | CAGR of 10.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Vehicle, Commercial Vehicle) • By Sales Channel (OEM, Aftermarket) • By Type (Direct TPMS, Indirect TPMS) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Delphi Automotive, DENSO Corporation, Continental AG, NXP Semiconductors, NIRA Dynamics AB, Valor TPMS, Pacific Industrial, ZF Friedrichshafen AG, ATEQ, Sensata Technologies, Inc. |

| Key Drivers | • Governments across various regions, including the U.S. and Europe, mandate the installation of TPMS in all new vehicles to enhance safety and reduce accidents caused by tire underinflation. • Growing awareness about the importance of maintaining optimal tire pressure for better fuel efficiency, reduced wear, and increased safety has led to higher adoption of TPMS, especially in consumer vehicles. |

| Restraints | • Retrofitting older vehicle models with TPMS can be challenging due to compatibility issues, which limits the market potential for aftermarket TPMS solutions. |