AI-Driven Medical Coding Market Report Scope & Overview:

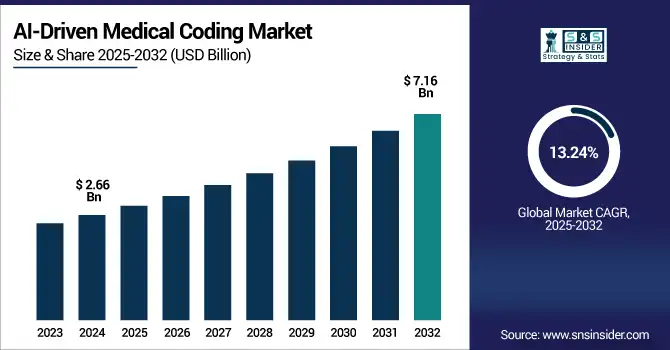

AI-Driven Medical Coding Market was valued at USD 2.66 billion in 2024 and is expected to reach USD 7.16 billion by 2032, growing at a CAGR of 13.24% from 2025-2032.

To Get more information on AI-Driven Medical Coding market - Request Free Sample Report

The AI-driven medical coding market is experiencing significant growth is attributed to the growing need within the pharmaceutical companies for accurate and real-time coding, massive growth in medical record maintenance through EHR systems, and the industry being confronted with complicated and strict clinical documentations. Artificial intelligence technologies can simplify coding processes, minimize human error and improve reimbursements in ways that have become indispensable for healthcare providers and insurers. In addition, the increasing implementation of electronic health records (EHRs), advancements in natural language processing (NLP) and push to alleviate administrative burden drives demand. The demand for fraud prevention and adherence to increasingly complex regulatory regimes also drive adoption, as organizations look for a scalable, cost-efficient solution to the growing volume of healthcare data.

-

The U.S. Centers for Medicare & Medicaid Services (CMS) now serves over 150 million beneficiaries across Medicare, Medicaid, and CHIP, and is actively leveraging AI to improve claims coding, provider analytics, and fraud detection.

-

CMS is also exploring AI applications in clinical tasks, such as the analysis of AI-enabled CT scans (e.g., for coronary plaque), reflecting how billing and coverage frameworks are evolving to accommodate these technologies.

-

Academic studies using MIMIC-III data further validate this trend, with NLP models like BERT achieving 87–94% accuracy in multi-label medical coding tasks—demonstrating that AI can meaningfully reduce manual coding efforts and improve accuracy in high-volume healthcare environments.

U.S. AI-Driven Medical Coding Market was valued at USD 0.64 billion in 2024 and is expected to reach USD 1.47 billion by 2032, growing at a CAGR of 11.03% from 2025-2032.

The U.S. AI-driven medical coding market is growing due to increasing healthcare expenditures, widespread adoption of EHRs, and a strong push toward automation to reduce administrative costs. Rising regulatory compliance needs and the demand for accurate, real-time coding solutions further drive adoption across hospitals, insurers, and diagnostic centers.

Market Dynamics

Drivers

-

Rising Demand For Accurate, Real-Time Clinical Documentation Is Pushing Healthcare Providers To Adopt AI-Driven Medical Coding Systems Globally

The increasing demand for instantaneous and accurate clinical documentation is pushing healthcare providers towards AI-based medical coding. Manual coding is costly and error-prone, resulting in claim rejections, and potential fines and penalties. AI applications, including both natural language processing and machine learning, facilitate work with coding, help eliminate repetitive and clerical work, and enhance accuracy. Rising levels of unstructured data generated by electronic health records (EHRs) are driving demand for automated coding to improve operational efficiency and free up caregivers to concentrate on care, contributing to the swift penetration of technology that leverages AI for coding.

-

Approximately 70–80 % of clinical EHR data is unstructured, including progress notes, radiology reports, and discharge summaries critical inputs for AI-powered coding via NLP.

-

Physicians reportedly spend an average of 4.5 hours per week on coding and documentation; manual coding accuracy falls between 80–85 %, costing providers an estimated USD 15 billion annually in lost or delayed revenue.

-

AI-powered solutions (e.g., MedAlly) have achieved 98.7 % coding accuracy a ~13 % increase over human baseline and reduced coding time by 87 % in a 2024 multicenter study involving over 1,200 physicians.

Restraints

-

Concerns over data privacy and security risks limit trust and slow adoption of AI-driven solutions in medical coding environments

AI-based medical coding uses vast amounts of sensitive patient data, which raises significant questions about privacy and security. These platforms have faced slow adoption in healthcare because of concerns about data breaches, HIPAA violations, and regional-privacy-law non-compliance. Missteps in cybersecurity could have legal and reputation costs. Currently, practitioners, particularly those operating in the area of strict regulation/s, are reluctant to integrate cognitive features on cloud-based systems without strong assurances of encryption, access controls and compliance, and this inhibits the worldwide deployment and growth of AI-enabled medical coding systems.

-

In 2023, the U.S. Department of Health and Human Services (HHS) Office for Civil Rights recorded 725 major breaches affecting 133 million patient records more than double the 51.9 million impacted in the previous year.

-

A massive cyberattack in February 2024 on Change Healthcare disrupted medical claims nationwide and exposed data for 190 million individuals. In response to rising threats, HHS proposed its first major HIPAA Security Rule update since 2013 in January 2025, mandating written security policies, periodic testing, and enhanced safeguards as healthcare data breaches have doubled since 2018.

Opportunities

-

Surging telehealth adoption and digital health records expansion offer a scalable landscape for AI-driven medical coding applications worldwide

The global rise of telehealth and digital health service is now creating an explosion of clinical data and subsequent need for AI medical coding solutions. With virtual care, remote monitoring and e-prescriptions on the rise, real-time automated coding tools support providers who are documenting care at scale, across locations and care settings. Government initiatives in promoting EHR adoption have facilitated this trend. With increased digital footprint and resource deployment in digital healthcare infrastructure, AI based coding can be smoothly integrated for improved coding accuracy, efficient billing processes, and overall operational efficiency in today's care delivery ecosystem.

-

As of early 2024, nearly 3 million Medicare beneficiaries (2.75M) relied on telehealth each quarter. In Q4 2023, 12.6% of Medicare beneficiaries received at least one telehealth service remaining well above pre-pandemic averages. Additionally, 96% of HRSA-funded community health centers used telehealth for primary care during 2023.

-

The American Hospital Association reports that 78% of U.S. hospitals had adopted telemedicine platforms by early 2024, reinforcing the infrastructure readiness for AI-powered medical coding at scale.

Challenges

-

Difficulty in training AI algorithms for highly variable, unstructured clinical data slows accuracy improvements and system maturity

To train AI models for medical coding, a large scale, structured, high-quality development dataset is needed and such datasets are not available or are incomplete. The inconsistency in clinical notes from different specialties, providers, and regions may affect the AI's learning to generalize coding accurately. Natural language processing is difficult due to unstructured text, complex medical terms, and abbreviations. In addition, regular updates to coding standards, as in ICD and CPT require continual modification of algorithms. These challenges prevent AI from achieving reliable performance in actual clinical settings, which results in lack of confidence in AI for deployment and usage at scale.

-

Approximately 60% of U.S. health data remains unstructured chiefly clinical notes, imaging reports, and narratives making it difficult for AI systems to accurately interpret without advanced NLP capabilities.

-

The FDA notes that medical AI systems often suffer from "poor data quality and lack of context", citing the classic "garbage in, garbage out" issue that hampers clinical decision support algorithms.

Segment Analysis

By Mode

Outsourced AI-driven medical coding dominated the market with the highest revenue share of approximately 71% in 2024, owing to the cost savings, quick deployment, and maintaining a stable supply of specialized external coders. They are not in the business of having to setup their infrastructure and their 24/7 team to support and process data at scale. AI powered outsourcing vendors provide unmatched scalability and accuracy, and are the de facto solution for companies dealing with millions of claims and records every year.

In-house AI-driven medical coding is expected to grow at the fastest CAGR of about 14.97% from 2025 to 2032, owing to the increasing preference of the healthcare facilities for the data ownership and privacy. Organizations are increasingly developing capacity to connect and graph AI coding seamlessly within EHRs to ensure real-time coding capability. This approach enables faster feedback loops, greater customization, and better adherence to the evolving health data regulations, and is particularly compelling for mid-to-large providers that want to maintain long-term oversight over coding operations.

By Application

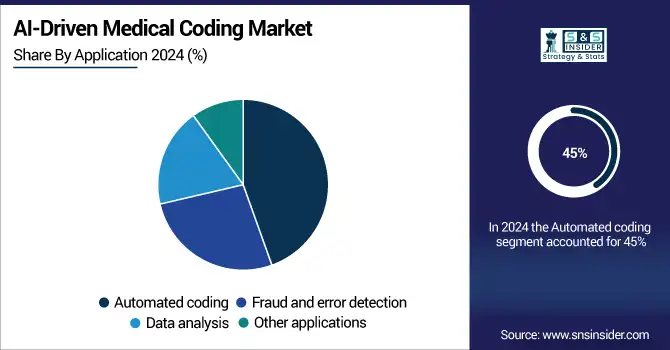

Automated coding held the largest market share at approximately 45% in 2024, owing to its ability to significantly reduce manual workloads and accelerate billing cycles. Using natural language processing and machine learning, automated AI systems streamline the extraction and assignment of diagnostic codes from unstructured clinical notes. This not only increases accuracy but also enhances efficiency in high-volume environments like hospitals, resulting in broad adoption of automated solutions.

Fraud and error detection is projected to grow at the fastest CAGR of about 14.76% from 2025 to 2032, as payer scrutiny is expected to intensify, and incorrect coding has a major financial implication. An AI focused on anomaly detection and code validation tools are catching on among healthcare payers and providers seeking to reduce claims rejections and recapture missed revenue. With the increasing amount of complexity in billing fraud, the need for intelligent auditing solutions only increases.

By End-use

Healthcare providers and diagnostic centers dominated the market with the highest revenue share of about 41% in 2024, as they are operating in mass and are also in urgent need of effective medical coding. These facilities produce significant amounts of clinical data on a daily basis and are dependent upon accurate coding to receive timely payment. AI tools accelerate coding and minimize mistakes, which allows providers to maximize their revenue cycle and improve patient care by providing more thorough documentation.

Insurance companies are expected to register the fastest CAGR of about 14.95% from 2025 to 2032, owing to rising AI applications for claims adjudication, error detection, and compliance management. Insurers can use AI-driven coding to validate codes, spot discrepancies, and ensure overbilling does not occur. With fraud prevention increasingly in the spotlight, and automation being the name of the game in claims processing, payers are investing big in AI tools to increase operational efficiency, save money and improve decisions.

Regional Analysis

North America

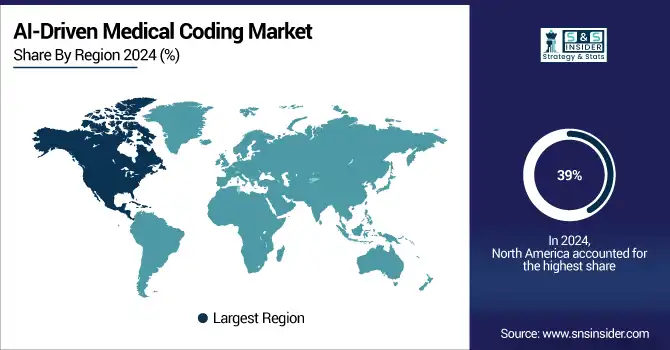

North America dominated the AI-driven medical coding market with the highest revenue share of approximately 39% in 2024, owing to its advanced healthcare infrastructure, high adoption of electronic health records (EHRs), and significant investments in healthcare AI technologies.

-

In the United States, 96% of hospitals now use certified EHR systems, including 93% of small rural hospitals and 97% of large hospitals reflecting near-universal adoption driven by the HITECH Act and Meaningful Use incentives.

-

Furthermore, in 2023, 70% of non-federal acute-care hospitals actively send, find, receive, and integrate patient data via interoperable systems, up from 46% in 2018 enabling richer, more accessible datasets for AI applications.

-

Health systems like Epic now manage 78% of U.S. patient records, illustrating how AI solutions can integrate seamlessly with existing clinical workflows.

The United States is dominating the AI-driven medical coding market in North America due to its advanced healthcare IT infrastructure and early AI technology adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific

Asia Pacific is poised for the fastest CAGR of 14.73% from 2025 to 2032, due to digital health evolution, increasing healthcare expenditure, and infrastructure development. India, China, and Japan are some of them who are investing heavily in AI to increase the accuracy of the code. Very high demand for automation, rising insurance penetration, and the large patient base are a few of the factors boosting the adoption of AI-based medical coding in the region.

-

The Ayushman Bharat Digital Mission (ABDM) is digitizing over 500 million patient records in India, fostering a national digital health infrastructure that supports interoperable, AI-ready clinical data essential for accurate medical coding and analysis.

-

In China, the “DeepSeek” AI platform was deployed across tertiary hospitals in early 2025, accelerating clinical AI integration and reinforcing the country’s leadership in healthcare AI innovation.

China is dominating the AI-driven medical coding market in Asia Pacific due to its large healthcare data volume and aggressive government-led AI healthcare initiatives.

Europe

Europe is experiencing significant growth in the AI-driven medical coding market due to increasing healthcare automation, rising digital health adoption, and supportive regulations for AI integration in clinical documentation, billing processes, and insurance claim management across healthcare systems.

-

Germany launched its electronic patient record (ePA) in January 2021. By January 15, 2025, all statutory health-insured citizens are automatically enrolled unless they opt out a major step toward standardized, AI-ready data.

-

The Digital Health Act (DigiG), passed in December 2023, mandates e-prescriptions and ePA usage for all statutorily insured patients. By early 2024, over 115 million e-prescriptions had been issued by 84,000 medical institutions.

Germany is dominating the AI-driven medical coding market in Europe due to its strong healthcare system, high digitization rate, and robust AI investments.

Middle East & Africa and Latin America

The AI-driven medical coding market in the Middle East & Africa and Latin America is growing due to rising healthcare digitalization, increasing government investment in health IT, and the need to improve coding accuracy and administrative efficiency across evolving healthcare systems.

Key Players

3M Health Information Systems, Optum, Cerner Corporation, nThrive, Dolbey Systems, Athenahealth, AI Health, Ciox Health, ZyDoc, Fathom

Recent Developments:

-

2025: Optum debuted “Integrity One,” an AI‑enabled RCM platform automating tasks from documentation review to final coding, streamlining workflows for hospital staff.

-

2024: Solventum (formerly 3M Health Care) introduced the AI‑powered Revenue Integrity System (in partnership with Sift Healthcare) to reduce claim denials and improve payer reimbursement.

-

2023: 3M HIS announced collaboration with AWS to accelerate ML‑based clinical documentation and virtual assistant tools, reinforcing clinician control over patient records.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.66 Billion |

| Market Size by 2032 | USD 7.16 Billion |

| CAGR | CAGR of 13.24% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mode (Outsourced, In-house) • By Application (Automated coding, Fraud and error detection, Data analysis, Other applications) • By End-use (Healthcare providers and diagnostic centers, Medical coding companies, Insurance companies, Government bodies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | 3M Health Information Systems, Optum, Cerner Corporation, nThrive, Dolbey Systems, Athenahealth, AI Health, Ciox Health, ZyDoc, Fathom |