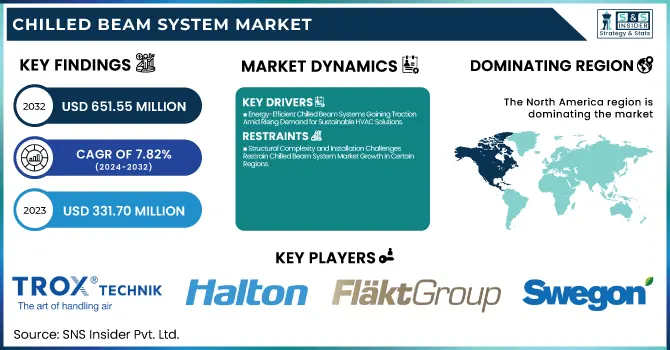

Chilled Beam System Market Size & Growth Insights:

The Chilled Beam System Market Size was valued at USD 331.70 million in 2023 and is expected to reach USD 651.55 million by 2032, growing at a CAGR of 7.82% over the forecast period 2024-2032. As the Chilled Beam System innovations and developments are ongoing with extensive research and development integration in this advanced chilled beam system to enhance the comfort and distribution of airflow with smart integration and climate management with intelligent thermal transfer, the Chilled Beam System has various advantages over its operating system. Thus, companies are spending on training human resources and ensuring installation, maintenance, and optimizations for performing functional systems.

To Get more information on Chilled Beam System Market - Request Free Sample Report

Modern chilled beams are constructed with better heat exchange, quieter performance, and more cooling capacity than was the norm in past installations. Energy optimization continues to be an important design driver, with enhanced energy savings owing to capabilities like demand-based cooling, effective heat recovery, and incorporation with smart building management systems for improved environmental sustainability.

Chilled Beam System Market Dynamics

Key Drivers:

-

Energy-Efficient Chilled Beam Systems Gaining Traction Amid Rising Demand for Sustainable HVAC Solutions

A major driver for the chilled beam systems market is the increasing demand for energy-efficient HVAC solutions in both commercial and residential buildings. With the increasing concern about worldwide energy consumption, developers are turning toward sustainable technologies for cooling and heating to lower operational costs. Chilled beam systems are the world's most efficient indoor climate systems, which have been designed to meet the modern requirements of thermal comfort, climate control, cost-effectiveness, air quality, and a low-noise environment needed by today's infrastructure. Besides, the strict government environmental standards favoring green HVAC systems further its acceptance rate for chilled beams. This, along with the increasing construction of green buildings across Europe and North America, is further driving the growth of the market. Higher demand for accurate temperature maintenance, as well as better air circulation in the healthcare sector, is also resulting in a rise in the adoption of chilled beams.

Restrain:

-

Structural Complexity and Installation Challenges Restrain Chilled Beam System Market Growth in Certain Regions

One of the major factors that is restraining the growth of the chilled beam system market is the design of buildings that need to be very accurate along with structural compatibility. They only work in controlled ceiling heights with specific ventilation conditions so they are better for chilled beam systems. While these options are useful, their complexity prohibits their use in older buildings or spaces where drastic structural changes need to be made. Finally, chilled beams need to be used with care since condensation needs to be avoided and this could be difficult if the installation environment has a high humidity level. Such factors make the installation process complicated and demand proficiency, which slows the market adoption in some regions.

Opportunity:

-

Smart Building Integration and Urbanization Drive Growth Opportunities for Chilled Beam System Market

The latest trends for smart buildings can be promising growth opportunities for the chilled beam system market. Combining chilled beam systems with smart controls, IoT sensors, and building automation improves energy efficiency and the overall performance of the system. Moreover, the rising use of passive chilled beams in schools and hospitals owing to their silent functioning and lower maintenance offers immense growth. With economic development, growing urbanization in developing areas will also open up new opportunities for the market players through increased investment in commercial office spaces. Moving Beyond Traditional HVAC Systems Demand for HVAC products and services continues to grow. Companies can meet this growing demand by providing customized solutions to fulfill specific building requirements.

Challenges:

-

Lack of Awareness and Technical Knowledge Limits Chilled Beam System Adoption in Developing Regions

The other big challenge to the uptake of chilled beam systems, particularly in developing parts of the world, is the lack of awareness and technical knowledge of the systems. Because chilled beams and their technologies are relatively new to the HVAC industry, many contractors/ building managers still have experience with more traditional systems such as fan coil units rather than chilled beams. In addition, maximizing performance will require fine-tuning and integration with other building systems, which could prove difficult for facilities with less adaptive automation capabilities. Moreover, the requirement of dedicated maintenance and monitoring for maintaining optimal performance may also discourage prospective end-users from opting for these systems. To artfully achieve this goal, however, will require some serious focus on education and training from those in the industry to overcome such barriers to entry.

Chilled Beam System Market Segmentation Outlook

By Design

Active Chilled Beams accounted for 38.8% of the valued share among chilled beam systems in 2023. They are more commonly used due to more effective cooling, improved air distribution, and compatibility with newer systems in HVAC design. Active chilled beams are popular for commercial offices, health care, and educational buildings where increased cooling loads can occur while providing enhanced indoor air quality.

Passive Chilled Beams are projected to witness the fastest CAGR from 2024 to 2032. Their energy efficiency, noiseless performance, and low maintenance requirement also make them popular, which results in this high growth. Passive systems have been growing in adoption in places such as hotels, libraries, and schools that require low ambient noise levels and energy savings. The passive chilled beam market is anticipated to witness favorable market momentum in their deployment throughout the forecast period owing to this sustainability trend.

By Function

In 2023, Cooling Only dominated the chilled beam system market with a share of 55.6%. This domination is driven by factors like lower costs, uncomplicated design, and appropriate facilities providing continuous cooling these applications include commercial offices, schools, and data centers. Areas where only cooling is needed, but no or low heating, prefer the cooling-only systems very much.

The Cooling and Heating segment is estimated to record the highest CAGR throughout the period from 2024 to 2032. This growth is being driven by the demand for energy-efficient, multi-functional HVAC solutions. They also provide better (climate) control, so they suit environments where the temperature can vary seasonally. Tapping into the growing adoption of the latter in healthcare facilities, hotels, and mixed-use commercial spaces is likely to drive sales for dual-function chilled beam systems during the forecast period, as per the study.

By Application

Commercial Offices were the biggest application segment in the chilled beam system market in 2023 with a 28.6% share. The key factor contributing to this dominance is the increasing adoption of energy-efficient HVAC solutions in new office buildings to optimize employee comfort and lower operating costs. Further, commercial offices are still focused on integrated climate control systems, such as chilled beams, to improve air quality and thermal comfort, with further investments being out into smart office and green building certifications.

The Hotels segment is expected to witness the fastest CAGR from 2024 to 2032. The hospitality sector is increasingly emphasizing developing a comfortable and no-noise-concentive environment, thereby driving demand for chilled beam systems. These systems are now gaining traction in hotels due to their noise-free operation, effective temperature control, and reduction in indoor air contaminants, which collectively lead to a better guest experience while helping with energy conservation goals.

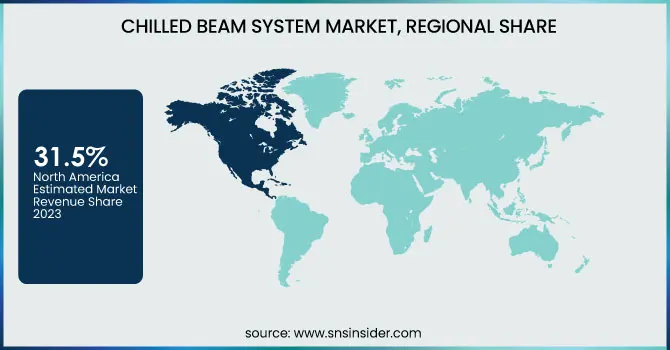

Chilled Beam System Market Regional Analysis

The chilled beam system market in North America accounted for a 31.5% share in 2023 driven by an emphasis on energy-efficient buildings and advanced HVAC technologies in the region. Until recently, limited usage of chilled beam systems in commercial and institutional buildings was due to the absence of strict regulations on HVAC performance in many regions, such as ASHRAE standards. City green-certified office buildings, such as those in New York, Chicago, and Toronto, incorporated chilled beam systems to improve indoor air quality and energy consumption. Even educational institutions such as Harvard University, as well as healthcare facilities like the Mayo Clinic are implementing these systems for their benefits of efficiency and low maintenance cost.

Asia Pacific is projected to register the fastest CAGR from 2024 to 2032, Driven by rapid urbanization and the development of commercial infrastructure in developing cities, in addition to rising awareness regarding sustainable cooling solutions. In countries such as China, Japan, and India, smart buildings and green buildings are major investments. Chilled beam systems have been adopted in pockets for energy-efficient space conditioning in green building developments such as Marina One in Singapore and the International Commerce Centre (ICC) in Hong Kong. This increasing trend is making the Asia Pacific a potential market for the installation of the chilled beam system.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Chilled Beam System Market are:

-

TROX GmbH (Active Chilled Beam)

-

Halton Group (Halton Rex Integrated Beam)

-

FläktGroup (Fläkt Woods IQID Chilled Beam)

-

Swegon AB (Parasol Zenith)

-

Lindab AB (Lindab Pascal Water Chilled Beam)

-

Systemair AB (Swegon PACIFIC Chilled Beam)

-

Price Industries (Price Active Chilled Beam)

-

Caverion Corporation (Caverion Chilled Beam System)

-

FTF Group (FTF Smart Beam)

-

Barcol-Air UK Ltd (Barcol-Air Chilled Beam)

-

Climate Technologies (CT Chilled Beam System)

-

Titus HVAC (Titus Active Chilled Beam)

-

Dadanco (Dadanco Acclimate Chilled Beam)

-

Mitsubishi Electric (Mitsubishi Active Chilled Beam System)

-

LTG Aktiengesellschaft (LTG Silent-Air Chilled Beam)

Recent Trends

-

In March 2024, FläktGroup launched its eco-friendly FGAH-AH heat pumps, featuring R-32 refrigerant with 66% lower GWP, offering versatile applications with high energy efficiency and reliable performance in extreme temperatures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 331.70 Million |

| Market Size by 2032 | USD 651.55 Million |

| CAGR | CAGR of 7.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Design (Active Chilled Beams, Passive Chilled Beams, Multi-Service Chilled Beams) • By Function (Cooling Only, Cooling and Heating) • By Application (Commercial Offices, Educational Institutions, Healthcare Facilities, Hotels, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TROX GmbH, Halton Group, FläktGroup, Swegon AB, Lindab AB, Systemair AB, Price Industries, Caverion Corporation, FTF Group, Barcol-Air UK Ltd, Climate Technologies, Titus HVAC, Dadanco, Mitsubishi Electric, LTG Aktiengesellschaft. |