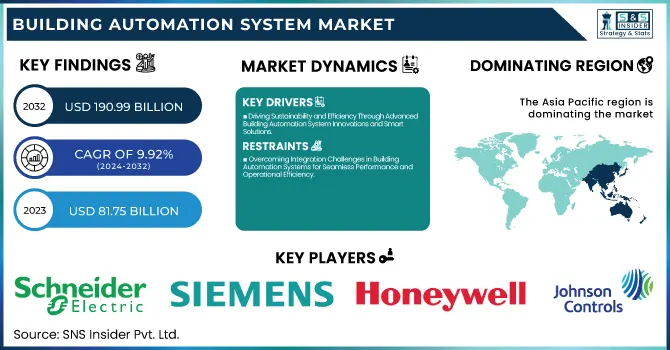

Building Automation System Market Size & Overview:

The Building Automation System Market was valued at USD 81.75 billion in 2023 and is expected to reach USD 190.99 billion by 2032, growing at a CAGR of 9.92% over the forecast period 2024-2032. The Building Automation Systems (BAS) market is developing in terms of diverse building domain automation market sectors. Certainly speaking, the rising need for smart building betterment is taking BAS integration in the direction of adoption & deployment among residential, commercial, and industrial areas. With technology & system performance improvements, data analytics, remote monitoring, and predictive maintenance are advancing.

To Get more information on Building Automation System Market - Request Free Sample Report

Improvements in operational & efficiency continue to permit us to become more effective in managing the energy, security, and comfort of the occupants inside the buildings we live & work in. On the other hand, the innovations in the areas of infrastructure & system design focus on scalable architecture, plug-and-play connectivity, and advanced interoperability that enable BAS solutions to efficiently manage complex building environments and future system upgrades or automation trends.

Building Automation System Market Dynamics

Key Drivers:

-

Driving Sustainability and Efficiency Through Advanced Building Automation System Innovations and Smart Solutions

The success of the Building Automation System (BAS) market is mainly attributed to increasing demand for energy efficiency in buildings, both commercial and residential. The adoption of automation systems to reduce energy consumption has been boosted by the increasing government regulations aimed at energy conservation and sustainability. Furthermore, the growth of the Internet of Things (IoT), artificial intelligence (AI), and cloud computing with development tools is making effective BAS increasingly powerful and helpful with real-time monitoring, predictive maintenance, and control of building operations. Growth in this trend of smart buildings along with demand for better security, fire protection, and comfort drives the market expansion. The rise in investment in infrastructure development, largely evident in emerging economies, also plays a crucial role in the expansion of the BAS market.

Restrain:

-

Overcoming Integration Challenges in Building Automation Systems for Seamless Performance and Operational Efficiency

The system integration complexity is one of the major restraining factors impacting the Building Automation System (BAS) market. Modern BAS solutions require interconnectivity between various subsystems including lighting, HVAC, security, fire protection, etc. Making sure that these different systems work well together on one platform can be a technical challenge especially when redeploying new systems in existing buildings. Both legacy systems and BAS aspire to be integrated; unfortunately, this is difficult to achieve. Legacy technology can create integration delays, pose a risk of integration failure, and eventually lead to increased maintenance and operation costs. The advanced nature of these systems creates some friction, as they require a high degree of training to manage, configure, and maintain, which may be difficult if not impossible to come by in certain areas lacking enough trained technicians.

Opportunity:

-

Harnessing Renewable Energy and Smart Technologies for Future-Ready Building Automation System Solutions

Integration of BAS with renewable energy is another promising trend in the market. Integrating BAS systems to handle the energy produced from solar panels, wind turbines, and other renewable energy sources is becoming popular as organizations seek to sustain their efforts in minimizing carbon footprints. Additionally, due to the rise in technological advancements in building automation, the adoption of various wireless technologies offers an opportunity to implement these systems as they pave the way for effortless connectivity and upgrades of such systems. The increasing shift towards smart home solutions, especially in the residential sector, due to rapid urbanization is expected to generate highly profitable growth opportunities. Further continued advancement of sensor technologies, data analytics along building energy management software offers growth opportunities for the player to make more efficient and user friendly.

Challenges:

-

Addressing Cybersecurity Risks and Adoption Barriers for Secure and Efficient Building Automation Systems

The risks of cybersecurity present a serious challenge in the BAS market. With growing dependence on IoT connectivity and cloud-based platforms for data management, these systems can become targets of cyber-attacks. Security systems, data privacy, and even operational control can be put at risk by unauthorized access to building automation networks. To mitigate these risks, it is crucial to maintain strong security protocols, regular system updates along data encryption. In addition, user reluctance to buy new technologies, especially in traditional markets, can also slow growth. Building managers hesitate to switch solutions because they are comfortable with the manual system and apprehensive about the operational disruption and technical complexities of using an automated solution.

Building Automation System Market Segments Analysis

By Offering

In 2023, the Security & Access Controls segment dominated the Building Automation System (BAS) market, accounting for 47.6% of the total market share. The increased need for increasing security services within commercial, residential, and industrial sectors is one of the factors responsible for this dominance. The need to deter unwanted access, theft, and vandalism has led to the implementation of more complex security systems including biometric readers, keycard access, and video surveillance.

The segment Facility Management Systems is expected to observe the highest CAGR in the forecast period, from 2024 to 2032. It is driven by a rising need for operational efficiencies, energy savings, and occupant comfort. This segment is anticipated to grow at an impressive rate owing to the deployment of smart facility management solutions based on IoT, cloud platforms, and data analytics.

By Communication Technology

The wired technologies share dominated the market in 2023, as they offer reliable, stable connectivity and higher data transmission capabilities, and are expected to gain a significant share of the Building Automation System (BAS) market. Landline supplies are generally utilized in larger businesses as well as industrial centers where communication must remain constant for the system to work appropriately. Similarly, the capacity to handle large data loads and connect a range of devices from mobile devices to standalone sensors has fueled their prowess.

The fastest CAGR during the forecast period from 2024 to 2032 is anticipated for Wireless Technologies. This growth is fueled by the rising need for automation solutions that are flexible, scalable, and cost-efficient. Wireless systems are easier to install than hardwired ones, which is why these systems end up being the best option for retrofit projects as well as for residential applications. Meanwhile, innovations in wireless technologies such as Zigbee, Z-Wave, and LoRaWAN are improving system performance to make them more efficient and secure, while also extending their range, encouraging adoption in all fields.

By Application

In 2023, the Commercial segment led the market, owing to the growing presence of smart technologies in offices, shopping malls, hospitals, and hotels. Build Automation System (BAS) is gaining a lot of attention with rising demand specs on efficiency, security, and [especially] centralized control systems within commercial domains. The segment is expected to further dominate due to the integration of IoT (internet of Things) based solutions for HVAC, lighting, and security management, which further aids in increasing the efficiency of operations.

The Residential segment is expected to grow at the fastest CAGR during the period from 2024 to 2032. The increased awareness among consumers regarding energy savings and improvement of home security is a major factor resulting in the expansion of the market for smart home solutions. One of the key factors driving the growth of the residential BAS market during the forecast period is the increasing penetration of smart thermostats, automatic lighting, and connected home devices.

Building Automation System Market Regional Outlook

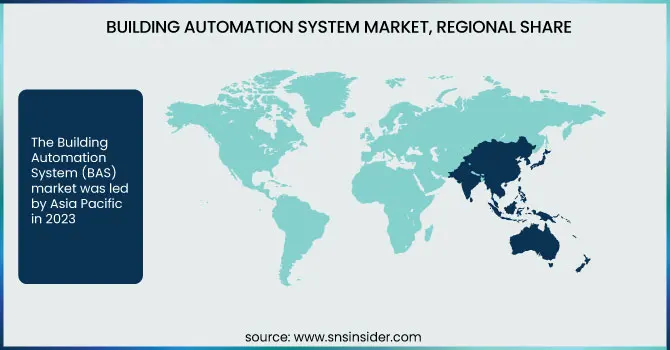

The Building Automation System (BAS) market was led by Asia Pacific in 2023 and is projected to witness the highest growth from 2024 to 2032. The growth is attributed to rapid urbanization, growing investments towards smart city projects, and increasing adoption of energy-efficient solutions in the region. Huge infrastructure investments by countries like China, India, and Japan are creating substantial demand for state-of-the-art automation systems. China has integrated smart building technology into its Tianjin Eco-City project to improve energy efficiency and security. In much the same way, the Smart Cities Mission of India is focusing on smart infrastructure solutions geared for the installation of automated lighting, security, and HVAC systems in both the residential and commercial sectors. Smart building initiatives, such as the Osaka Umeda Future City (Japan), use automation enabled by IoT to improve building performance. Also, an international organization like Honeywell, Johnson Controls, and Siemens are growing their business in Asia Pacific for this increasing demand. Over the forecast period, the rapid digital transformation of the region and ongoing government initiatives to promote green building solutions is anticipated to accelerate the growth of the BAS market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Building Automation System Market are:

-

Schneider Electric (EcoStruxure)

-

Siemens (Desigo CC)

-

Johnson Controls (Metasys)

-

Honeywell International Inc. (WEBs-N4)

-

ABB (Ability™ Building Control)

-

Legrand (MyHome)

-

Bosch Security and Safety Systems (Building Integration System - BIS)

-

Delta Controls (enteliWEB)

-

Distech Controls (EC-Net)

-

Trane Technologies (Tracer SC+)

-

Emerson Electric Co. (Trellis)

-

Rockwell Automation (FactoryTalk)

-

Lutron Electronics (HomeWorks)

-

Crestron Electronics (Crestron Pyng)

-

KMC Controls (KMC Commander)

Recent Trends

-

In June 2024, Schneider Electric launched its SMART Buildings Division in Canada to drive sustainable building innovation, focusing on energy efficiency, automation, and decarbonization solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 81.75 Billion |

| Market Size by 2032 | USD 190.99 Billion |

| CAGR | CAGR of 9.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Facility Management Systems, Security & Access Controls, Fire Protection Systems, Building Energy Management Software, BAS Services, Others) • By Communication Technology (Wireless technologies, Wired Technologies) • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric, Siemens, Johnson Controls, Honeywell International Inc., ABB, Legrand, Bosch Security and Safety Systems, Delta Controls, Distech Controls, Trane Technologies, Emerson Electric Co., Rockwell Automation, Lutron Electronics, Crestron Electronics, KMC Controls. |