Smart and Connected Office Market Size

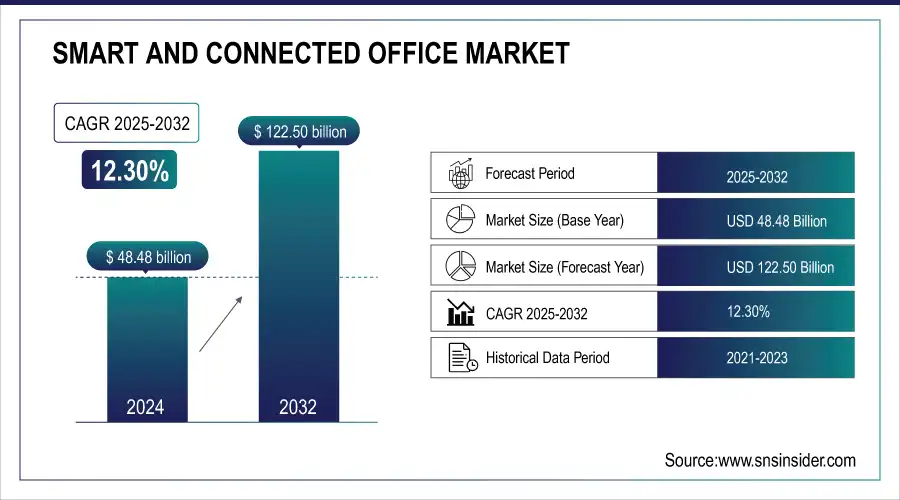

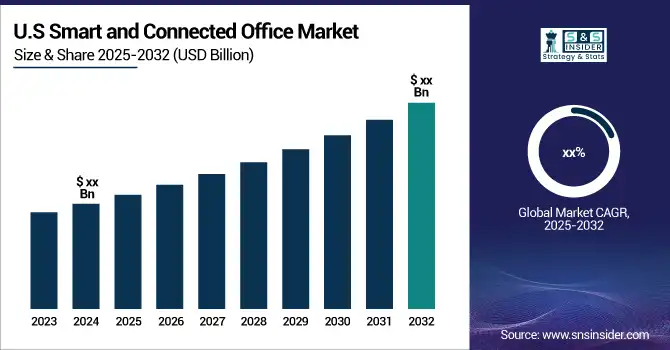

The Smart and Connected Office Market Size was valued at USD 48.48 Billion in 2024 and is expected to grow to USD 122.50 Billion by 2032 and grow at a CAGR of 12.30% over the forecast period of 2025-2032.

The Smart and Connected Office market is experiencing significant transformation, primarily fueled by the increasing adoption of automation technologies that improve workplace efficiency and lower operational expenses. Businesses are now investing in smart devices and IoT solutions, facilitating automated control over essential functions like lighting, climate, and security. This transition not only optimizes energy usage but also fosters comfortable working environments, resulting in substantial improvements in workflow efficiency. For instance, recent reports suggest that intelligent lighting systems can cut energy consumption by as much as 30%, while smart thermostats can provide savings of approximately 10-12% on heating and cooling costs. Furthermore, the integration of cutting-edge technologies such as artificial intelligence and machine learning is reshaping the operational framework of organizations. Industry insights indicate a growing trend, with an estimated 80% of companies expected to adopt automation technologies by 2025, significantly boosting the demand for smart office systems. Additionally, research highlights that smart office implementations lead to enhanced employee satisfaction, which in turn increases productivity. A notable study reveals that organizations employing smart technologies can see employee engagement rise by up to 20%.

Get More Information on Smart and Connected Office Market- Request Sample Report

The emergence of smart cities presents a promising opportunity, particularly through the integration of the Internet of Things (IoT) in sectors such as energy, waste management, and infrastructure. A crucial component of smart cities is the smart home, which offers numerous advantages. Numerous smart city projects and initiatives are anticipated to be completed by 2025, with projections suggesting the establishment of around 30 global smart cities—half of which are expected to be located in North America and Europe. According to the OECD, these developments are bolstered by substantial global investments, estimated at USD 1.8 trillion from 2010 to 2030, targeting urban infrastructure projects. This investment in digitized infrastructure is anticipated to increase the demand for securing these assets. Moreover, the rising global internet penetration is driving the construction of modern infrastructure at business locations, enhancing luxury and convenience, which in turn fuels market growth. As reported by Data Reportal, over five billion people were using the internet as of April 2022, accounting for 63.1% of the world's population. With an increasing number of companies adopting a smart hybrid working model, the demand for smart workplaces is on the rise. These organizations are focused on integrating physical and virtual spaces, people, and technology to achieve improved and faster outcomes.

Market Size and Forecast:

-

Market Size in 2024 USD 48.48 Billion

-

Market Size by 2032 USD 122.50 Billion

-

CAGR of 12.30% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Smart and Connected Office Market Trends:

-

Growing implementation of smart health solutions and indoor air quality monitoring in offices.

-

Integration of wearable and sensor-based devices to track employee wellness and encourage healthy habits.

-

Increasing adoption of smart safety technologies to reduce workplace accidents and manage occupancy.

-

Emphasis on mental health support and health equity initiatives within workplaces.

-

Utilization of IoT-enabled devices to optimize space usage, enhance safety, and promote sustainability.

Smart and Connected Office Market Growth Drivers:

-

Enhancing Workplace Safety and Well-being as the Driving Force Behind Smart and Connected Offices

The focus on health and safety in workplaces has emerged as a critical driver for the Smart and Connected Office market, particularly due to recent global health challenges. Organizations are increasingly implementing smart health solutions and monitoring systems for indoor air quality, which have become essential for ensuring employee safety. For instance, smart scales are now offering multiple metrics for measuring health, enhancing workplace wellness programs and encouraging healthy habits among employees. Research shows that about 70% of employees prefer workplaces that prioritize health and well-being, emphasizing the need for smart technologies that enable real-time data collection on various health metrics. According to an article from Forbes, major companies are actively addressing mental health in the workplace, with 73% of employees indicating that mental health support influences their workplace satisfaction. In terms of safety, connected technologies are transforming traditional safety protocols. A report from Gartner indicates that 62% of organizations are now focusing on smart safety solutions, which significantly reduce workplace incidents. Moreover, a Digital Journal study highlights that the integration of smart monitoring systems can lead to a 25% reduction in workplace accidents by effectively managing occupancy and ensuring social distancing. The emphasis on health equity and access is also gaining traction, as indicated by new research from the University of Kansas, which aims to improve health outcomes for underserved communities. This aligns with Cisco's report stating that smart workplaces can enhance employee health, safety, and well-being, leading to 20% higher productivity levels and improving key business performance indicators.

Smart and Connected Office Market Restraints:

-

Navigating the integration challenges in smart office technology adoption is essential for ensuring seamless functionality and maximizing operational efficiency.

The complexity of integrating smart technologies within office environments remains a significant restraint in the Smart and Connected Office market. As organizations seek to implement Internet of Things (IoT) solutions for office automation, they encounter various challenges that complicate integration efforts. According to industry reports, many businesses are hindered by the disparate nature of smart devices and platforms, which can lead to compatibility issues. For instance, a study by Siemens indicates that nearly 60% of companies struggle with interoperability among their existing systems and new IoT devices, creating delays in project timelines and increasing operational disruptions. Furthermore, the lack of standardized protocols across different manufacturers exacerbates these integration difficulties. As highlighted in a Forbes article, this fragmentation means that organizations often need to invest additional resources in custom solutions to ensure that all devices work seamlessly together, driving up costs and complicating the deployment process. In fact, a survey by Business Tech Weekly noted that over 50% of IT managers cite integration complexities as a primary barrier to adopting smart office solutions, which can stall digital transformation initiatives. The skills gap in the workforce pose another challenge. Many companies find it difficult to recruit personnel with the necessary expertise to manage and integrate sophisticated smart technologies effectively.

Smart and Connected Office Market Segment Analysis:

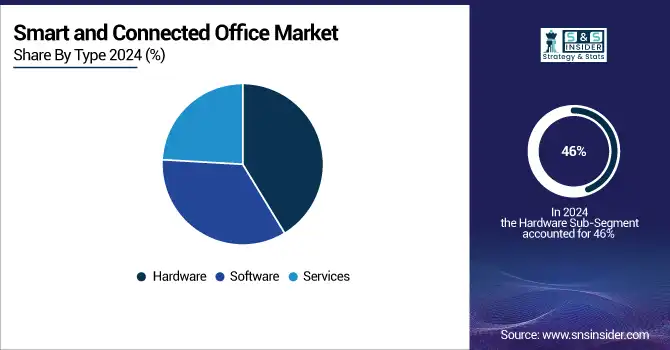

By Type

In the Smart and Connected Office market, the hardware segment has established itself as a key player, accounting for approximately 46% of total revenue in 2024. This prominence is largely due to the critical role hardware plays in developing intelligent workplace environments. Essential components such as sensors, cameras, actuators, and control systems form the backbone of smart office systems, enabling real-time data collection and management to optimize energy use, occupancy, and environmental conditions. Companies like Honeywell and Siemens offer comprehensive hardware solutions that integrate seamlessly into existing infrastructures, enhancing operational efficiency. The rise of advanced hardware solutions, including IoT sensors and smart lighting systems, further automates critical office functions, exemplified by Philips Hue’s lighting products that adjust according to occupancy and natural light, resulting in energy savings and improved comfort. The demand for automation technologies has surged as businesses seek operational efficiency, with companies like Cisco and Crestron leading the development of sophisticated hardware systems for seamless software integration. Additionally, heightened workplace safety concerns have driven investments in surveillance cameras and environmental monitoring devices, with firms like Axis Communications specializing in security solutions.

By Office Type

The retrofit segment in the Smart and Connected Office market has become a leading player, capturing approximately 56% of total revenue in 2024. This remarkable share highlights the growing importance of retrofitting existing office spaces with advanced smart technologies. Retrofitting enables organizations to enhance their current infrastructure without undergoing complete renovations, making it a cost-effective solution for modernizing work environments while minimizing disruption. Companies are increasingly recognizing the value of transforming older buildings into efficient smart spaces. For example, Schneider Electric’s EcoStruxure™ Smart Building platform facilitates the integration of smart technology with minimal structural changes. The economic advantages of retrofit solutions are significant, allowing businesses to utilize existing layouts and systems, thus lowering costs associated with new constructions. Honeywell’s Building Management Solutions provide retrofit options that enhance energy efficiency without the need for extensive overhauls. Moreover, as regulatory pressures mount, retrofitting aligns with sustainability goals, helping companies meet environmental compliance while appealing to eco-conscious employees. Johnson Controls’ OpenBlue platform focuses on improving sustainability through advanced energy management systems in retrofitted buildings.

Smart and Connected Office Market Regional Analysis:

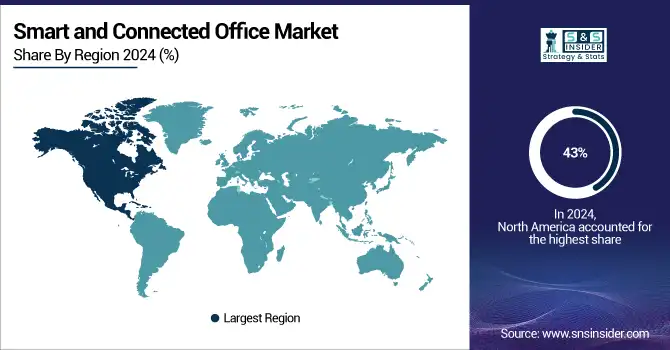

North America Smart and Connected Office Market Insights

In 2024, North America emerged as the dominant region in the Smart and Connected Office market, accounting for approximately 43% of the total revenue. This leadership position is driven by several critical factors that highlight the region’s dedication to adopting advanced technologies in workplace environments. North America stands out as a hub of technological innovation, supported by a strong ecosystem of tech companies like Cisco, Honeywell, and Microsoft, which continuously invest in research and development to deliver cutting-edge smart office solutions. For instance, Cisco has launched its Webex Suite, incorporating advanced collaboration tools with IoT capabilities to enhance productivity in hybrid work settings. Additionally, there is a rising demand for automated solutions that improve operational efficiency while reducing energy consumption. Organizations increasingly recognize the importance of sustainability, aligning their smart office technologies such as advanced lighting systems and occupancy sensors with corporate social responsibility goals. Companies like Siemens and Schneider Electric have introduced platforms like Desigo CC and EcoStruxure to enhance energy management in office buildings. Significant corporate investments are also evident, with tech giants like Google and Amazon implementing smart technologies in their workplaces to boost employee experience and collaboration.

Need Any Customization Research On Smart and connected office Market - Inquiry Now

Asia Pacific Smart and Connected Office Market Insights

In 2024, the Asia-Pacific region emerged as the fastest-growing market for Smart and Connected Offices, driven by rapid urbanization, technological advancements, and a strong emphasis on creating efficient work environments. Countries like China and India are leading this shift, with organizations such as Tata Consultancy Services (TCS) investing heavily in modernizing office spaces to enhance employee productivity. The region is experiencing significant innovations in Internet of Things (IoT) and artificial intelligence (AI), with companies like Alibaba and Tencent developing integrated smart office platforms that utilize cloud computing and data analytics to boost efficiency. Sustainability is also a key focus, as governments in Japan and South Korea implement policies promoting energy-efficient technologies in offices, while initiatives like Singapore's Smart Nation encourage the adoption of smart solutions across various sectors. Rising corporate investments are evident, with major firms like Samsung and Civica deploying advanced technologies to improve workspace functionality and employee engagement. Looking ahead, the Asia-Pacific region is poised for sustained growth in the Smart and Connected Office market, driven by the increasing adoption of hybrid work models and continuous advancements in smart technologies.

Europe Smart and Connected Office Market Insights

Europe is witnessing steady adoption of smart and connected office technologies, driven by the need for enhanced workplace safety, employee wellness, and operational efficiency. Companies are integrating IoT devices, smart air purifiers, and collaborative solutions to optimize space usage, monitor health metrics, and improve productivity. Strong regulatory support and sustainability initiatives further bolster market growth across key European nations.

Latin America (LATAM) and Middle East & Africa (MEA) Smart and Connected Office Market Insights

In LATAM and MEA, smart office adoption is rising as organizations focus on digital transformation, employee safety, and efficient workspace management. IoT-enabled monitoring, smart HVAC, and collaborative technologies are being increasingly deployed to enhance productivity, ensure health compliance, and promote sustainable practices. Government initiatives and growing corporate awareness are driving market expansion across these regions.

Smart and Connected Office Market Key Players:

Some of the Smart and Connected Office Market Companies are

-

Cisco Systems, Inc. (Cisco Webex for Collaboration)

-

Microsoft Corporation (Microsoft Teams for Communication)

-

Honeywell International Inc. (Honeywell Building Management Solutions)

-

Siemens AG (Siemens Desigo CC for Building Management)

-

Johnson Controls International plc (Metasys Building Automation System)

-

Schneider Electric (EcoStruxure for Smart Buildings)

-

Philips Lighting (Signify) (HUE Smart Lighting Solutions)

-

Amazon Web Services (AWS) (AWS IoT Core for Smart Office Solutions)

-

Google Cloud (Google Workspace for Collaboration)

-

Knoll Inc. (Knoll Office Furniture Solutions)

-

IBM Corporation (IBM Watson IoT for Smart Office)

-

LG Electronics (LG Smart Office Solutions)

-

Hewlett Packard Enterprise (HPE) (HPE IoT Solutions for Smart Buildings)

-

Toshiba Corporation (Toshiba Smart Office Solutions)

-

Crestron Electronics, Inc. (Crestron Room Control Systems)

-

Deloitte (Deloitte Smart Office Solutions)

-

Steelcase Inc. (Steelcase WorkSpace Solutions)

-

Atlassian Corporation Plc (Atlassian Jira for Project Management)

-

SAP SE (SAP Leonardo IoT for Smart Buildings)

-

Verizon Communications Inc. (Verizon Smart Building Solutions)

Competitive Landscape for Smart and Connected Office Market:

Huawei Technologies Co., Ltd. is a leading provider of smart and connected office solutions, offering IoT-enabled devices, cloud platforms, and collaborative technologies that enhance workplace efficiency and employee well-being. The company focuses on integrated office ecosystems, including smart lighting, air quality monitoring, and communication platforms, helping organizations optimize space usage, ensure safety, and improve productivity while supporting sustainable and digitally connected work environments.

-

In February 2024, Huawei Technologies Co., Ltd., one of the key companies in the technology industry, launched a new series of products, IdeaHub. The series' smart office portfolio includes IdeaPresence LED, IdeaHub ES2 Plus, IdeaHub ES2, IdeaHub 83, and others. Intelligent collaboration of communication technologies and advanced equipment capabilities is expected to enhance the company’s presence in the smart office industry.

Wipro Commercial delivers comprehensive smart and connected office solutions, integrating IoT, AI, and cloud-based platforms to optimize workplace operations. The company provides smart lighting, energy management, and collaborative technologies that enhance employee productivity and safety. Wipro’s offerings enable real-time monitoring, space utilization analytics, and seamless connectivity, supporting efficient, sustainable, and digitally advanced office environments.

-

July 19, 2024: Wipro Commercial & Institutional Business inaugurated a new IoT Experience Centre in Pune, showcasing advanced Internet of Lighting™ solutions and smart technologies for modern workplaces. The center features Wipro’s iSense, a wireless IoT solution enabling seamless control of lighting, TVs, and AC units.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 48.48 Billion |

| Market Size by 2032 | USD 122.50 Billion |

| CAGR | CAGR of 12.30% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hardware, Software, Services) • By Office Type (Retrofit, New Construction) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cisco Systems, Inc., Microsoft Corporation, Honeywell International Inc., Siemens AG, Johnson Controls International plc, Schneider Electric, Philips Lighting (Signify), Amazon Web Services (AWS), Google Cloud, Knoll Inc., IBM Corporation, LG Electronics, Hewlett Packard Enterprise (HPE), Toshiba Corporation, Crestron Electronics, Inc., Deloitte, Steelcase Inc., Atlassian Corporation Plc, SAP SE, and Verizon |