Drug Discovery Informatics Market Report Scope & Overview:

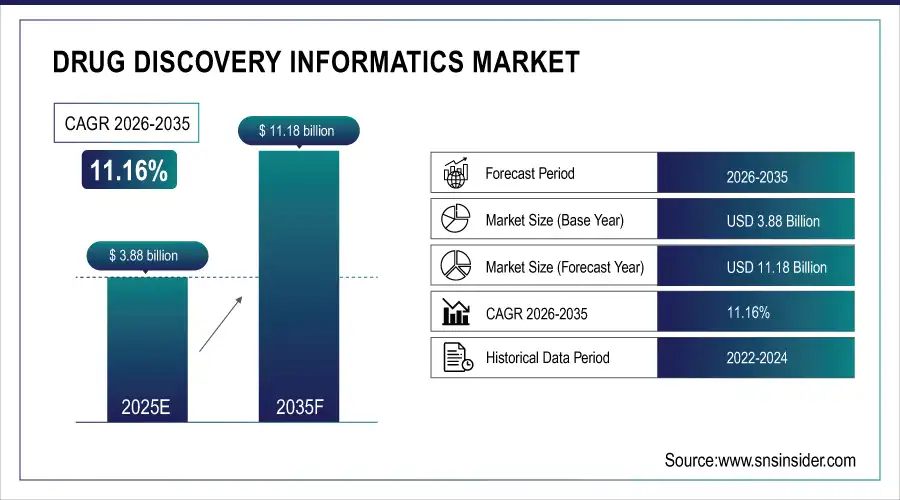

The drug discovery informatics market size is estimated at USD 3.88 billion in 2025 and is expected to reach USD 11.18 billion by 2035, growing at a CAGR of 11.16% over the forecast period of 2026-2035.

The global drug discovery informatics market growth is driven by rising adoption of artificial intelligence, machine learning, and bigdata analytics in pharmaceutical research and development, due to the need to accelerate drug discovery timelines, reduce costs, and improve success rates. The increasing complexity of biological data, growing demand for personalized medicine, and expansion of genomics and proteomics research are impacting the growth of the market. Increasing investments in computational biology and bioinformatics infrastructure are other catalysts to this market trend as pharmaceutical companies and research institutions become increasingly reliant on advanced informatics solutions to manage massive datasets and streamline clinical trial processes, which will lead to growth in both discovery informatics and biocontent management segments, both domestically and globally.

For instance, in April 2024, growing adoption of AI-driven drug discovery platforms drove a 22% increase in pharmaceutical R&D spending on informatics solutions in North America, boosting early-stage compound identification and clinical trial optimization.

Drug Discovery Informatics Market Size and Forecast:

-

Market Size in 2025E: USD 3.88 billion

-

Market Size by 2035: USD 11.18 billion

-

CAGR: 11.16% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Drug Discovery Informatics Market - Request Free Sample Report

Drug Discovery Informatics Market Trends

-

Growing complexity of drug development procedures and the need for faster time-to-market is fueling the demand for sophisticated informatics solutions and computational tools.

-

Development of AI-driven predictive models using molecular structures, biological pathways, and genomic information of patients for better identification of drug candidates and toxicity prediction.

-

Development of cloud-based platforms, data management solutions, and automated tools to improve collaboration and accelerate preclinical and clinical research.

-

Application of advanced analytics, machine learning algorithms, and visualization techniques for compound screening, target identification, and biomarker discovery.

-

Growing demand for sequence analysis platforms, molecular modeling software, and docking tools for structure-based drug design and virtual screening.

-

Collaborations between pharmaceutical, biotech, technology, and academic organizations to develop the next generation of informatics solutions and improve the efficiency of drug discovery.

-

FDA, EMA, and regulatory bodies emphasizing the need for data standardization, interoperability guidelines, and validation of computational models, while encouraging the use of digital technologies in drug development.of computational models, while encouraging the use of digital technologies in drug development.

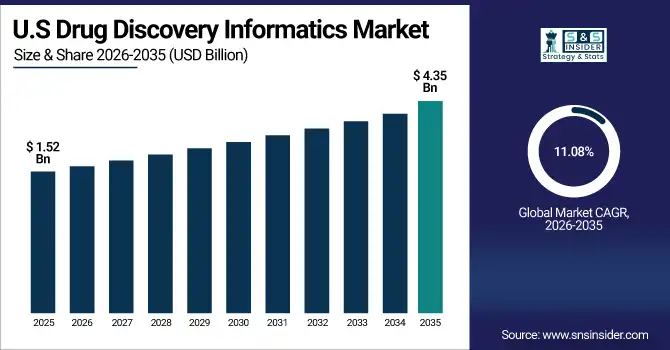

The U.S. drug discovery informatics market is estimated at USD 1.52 billion in 2025 and is expected to reach USD 4.35 billion by 2035, growing at a CAGR of 11.08% from 2026-2035. The U.S. has the highest market share as the drug discovery informatics market is highly affected due to the presence of leading pharmaceutical and biotechnology companies, substantial R&D investments, and advanced computational infrastructure. Factors that contribute to the growth of the market include the high adoption rate of AI and machine learning tools, the presence of qualified bioinformatics experts, and the collaboration of academia and industry. In addition, the support of regulations and the early adoption of cloud-based informatics platforms and data management systems propel the U.S. to be the largest market in the region, making it the biggest market in the world.

Drug Discovery Informatics Market Growth Drivers:

-

AI and Machine Learning Integration is Driving the Drug Discovery Informatics Market Growth

Artificial intelligence and machine learning integration take the center stage as a growth driver for the drug discovery informatics market share, and are driven by the deployment of deep learning algorithms, predictive analytics, and automated screening platforms for enhanced target identification and lead optimization. These solutions for accelerating drug candidate selection and reducing failure rates in clinical trials are driving the base of the market, the penetration of discovery informatics and biocontent management segments, and adding to the overall market share globally.

For instance, in August 2025, AI-powered molecular modeling and virtual screening platforms accounted for ~26% of the total global drug discovery software market, reflecting growing pharmaceutical industry adoption and expanding market share.

Drug Discovery Informatics Market Restraints:

-

High Implementation Costs and Data Integration Challenges are Hampering the Drug Discovery Informatics Market Growth

The high cost of implementation and data management also limit the growth of the drug discovery informatics market, as small and medium-sized pharmaceutical firms and research institutions encounter high financial hurdles in implementing advanced informatics solutions and lack the expertise to implement them. As a result, market penetration suffers, and growth is stunted in regions where infrastructure is limited and budgets for computational biology remain constrained.

Drug Discovery Informatics Market Opportunities:

-

Cloud-Based Solutions and SaaS Models Drive Future Growth Opportunities for the Drug Discovery Informatics Market

The opportunity in cloud-based solutions and Software-as-a-Service (SaaS) models in drug discovery informatics market is in the form of scalable platforms, collaborative research environments, and subscription-based pricing structures. These solutions provide for reduced upfront capital expenditure, enhanced data accessibility, and seamless integration across distributed research teams. Through improved cost-effectiveness, flexibility, and real-time collaboration capabilities, particularly for organizations with limited IT infrastructure, these technologies may accelerate innovation, democratize access to advanced informatics tools, and expand the market.

For instance, in May 2024, a pharmaceutical industry survey indicated that 38% of global drug discovery projects utilized cloud-based informatics platforms, highlighting rapid technology adoption and increasing demand for scalable computational solutions.

Drug Discovery Informatics Market Segment Analysis

-

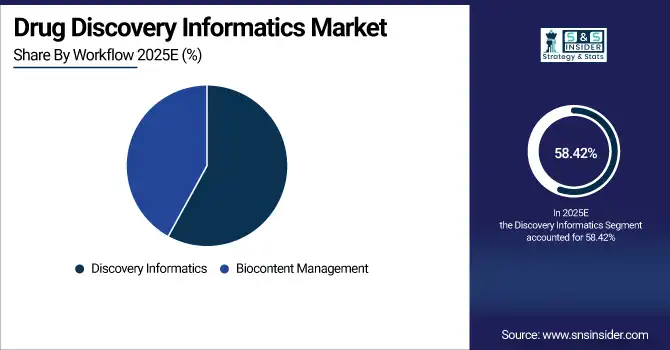

By workflow, discovery informatics held the largest share of around 58.42% in 2025E, and the biocontent management segment is expected to register the highest growth with a CAGR of 11.85%.

-

By services, the sequence analysis platform segment dominated the market with approximately 32.16% share in 2025E, while molecular modelling is expected to register the highest growth with a CAGR of 11.94%.

By Workflow, Discovery Informatics Leads the Market, While Biocontent Management Registers Fastest Growth

The discovery informatics market contributed the largest revenue share of about 58.42% in 2025 due to widespread use in target identification, compound screening, and lead optimization. New trends include the growing use of computational chemistry software, structure-based drug design software, and predictive modeling software powered by AI. On the other hand, the biocontent management market is expected to register the fastest CAGR of approximately 11.85% in the 2026-2035 period due to the rapid expansion of biological data, the need for standardized data storage, and the need for effective knowledge management solutions. Factors include the increasing complexity of genomic and proteomic data, government mandates for data traceability.

By Services, the Sequence Analysis Platform Segment dominates, while the Molecular Modelling Segment Shows Rapid Growth

The sequence analysis platform segment held the largest revenue share of approximately 32.16% in 2025, owing to widespread use in genomics research, biomarker discovery, and personalized medicine initiatives. Key factors driving this dominance are increased genomic sequencing activities, growing importance of precision medicine, and pharmaceutical industry focus on targeted therapies.

The molecular modelling segment is predicted to grow at the strongest CAGR of approximately 11.94% during 2026–2035, driven by advancing computational power, improved algorithm accuracy, and increasing adoption of structure-based drug design approaches. Some causes include enhanced visualization technologies, integration with AI platforms, and pharmaceutical company preference for in silico screening to reduce experimental costs and accelerate lead identification.

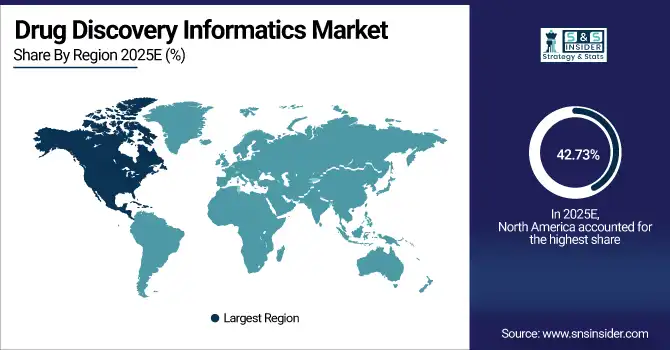

Drug Discovery Informatics Market Regional Highlights:

North America Drug Discovery Informatics Market Insights:

North America accounted for the highest revenue share of approximately 42.73% in 2025 of the drug discovery informatics market, owing to the concentration of major pharmaceutical companies, advanced research infrastructure, and strong culture of innovation in biotechnology. Pushing factors include substantial venture capital funding for biotech startups, high adoption of AI and machine learning platforms, extensive genomics research programs, and well-established regulatory frameworks supporting computational drug discovery. Furthermore, strategic partnerships between technology companies and pharmaceutical giants, academic excellence in bioinformatics education, and significant government funding for precision medicine initiatives are ensuring market dominance and substantial revenues in the global drug discovery informatics landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Drug Discovery Informatics Market Insights:

Asia Pacific is the fastest-growing segment in the drug discovery informatics market with a CAGR of 12.34%, as pharmaceutical outsourcing to contract research organizations, government investments in biotechnology infrastructure, and growing bioinformatics talent pool in countries like India, China, and Singapore are expanding. Factors including rapid digitalization of healthcare systems, increasing number of clinical trials, and cost advantages for drug development are stimulating the market growth. Technology partnerships and knowledge transfer initiatives have gone a long way in enhancing capabilities, especially in emerging biotech hubs. Early adoption of cloud-based platforms and collaborative research programs are also promoted by academic institutions and industry consortia. Lower operational costs in comparison to Western markets, and with the growing availability of skilled computational biologists and data scientists, drive growth in the Asia Pacific region

Europe Drug Discovery Informatics Market Insights:

The drug discovery informatics market in Europe is the second-dominating region after North America on account of strong pharmaceutical industry presence, collaborative research networks, and increasing investment in digital health technologies. Rising adoption of open-source bioinformatics tools, growth of public-private partnerships, favorable intellectual property frameworks, and European Union initiatives promoting data sharing and standardization are also contributing to the sustained growth of the market in leading European countries.

Latin America (LATAM) and Middle East & Africa (MEA) Drug Discovery Informatics Market Insights:

In Latin America, and Middle East & Africa, the growing pharmaceutical manufacturing capabilities and increase in research collaborations with multinational companies support the drug discovery informatics market growth. The rising adoption of affordable informatics solutions and government initiatives to strengthen biotechnology sectors, along with expanding academic research programs, will aid technology transfer and capacity building. The increasing focus on addressing regional disease burdens and rising healthcare expenditure in these regions are continuing to encourage market growth.

Drug Discovery Informatics Market Competitive Landscape:

Thermo Fisher Scientific Inc. (est. 1956) is a global leader in scientific instrumentation and informatics solutions that focuses on advancing drug discovery through integrated laboratory technologies. It uses its comprehensive product portfolio and strategic acquisitions to deliver cutting-edge bioinformatics platforms with cloud-enabled research tools.

-

In February 2025, launched an AI-enhanced molecular modeling suite integrated with its existing laboratory information management systems, enabling pharmaceutical researchers to accelerate structure-based drug design and improve prediction accuracy for lead compounds.

Dassault Systèmes (est. 1981) is a renowned global software company focused on 3D design, simulation, and data intelligence solutions. It invests in advanced computational modeling and virtual twin technologies with the hopes of revolutionizing the drug discovery process through sophisticated in silico experimentation and predictive analytics.

-

In June 2024, expanded its BIOVIA platform with new quantum mechanics capabilities for drug-target interaction prediction, enhancing pharmaceutical companies' ability to optimize small molecule therapeutics and reduce preclinical development timelines.

Schrödinger, Inc. (est. 1990) is a global enterprise specializing in computational chemistry and molecular simulation software. The company's drug discovery platform portfolio focuses on physics-based molecular modeling and machine learning applications, featuring a strong innovation pipeline and collaborative partnerships to complement its market presence in both pharmaceutical and biotechnology sectors.

-

In September 2024, received regulatory validation for its AI-powered docking platform that demonstrated 40% improvement in binding affinity prediction accuracy, strengthening its competitive position and expanding adoption among leading pharmaceutical research organizations.

Drug Discovery Informatics Market Key Players:

-

Thermo Fisher Scientific Inc.

-

Dassault Systèmes

-

Schrödinger, Inc.

-

PerkinElmer, Inc.

-

Certara, Inc.

-

Agilent Technologies, Inc.

-

Bio-Rad Laboratories, Inc.

-

Waters Corporation

-

Jubilant Biosys Ltd.

-

Collaborative Drug Discovery, Inc.

-

Genedata AG

-

Illumina, Inc.

-

QIAGEN N.V.

-

Evotec SE

-

Charles River Laboratories International, Inc.

-

Molecular Devices, LLC

-

OpenEye Scientific Software

-

ChemAxon Ltd.

-

Numedii, Inc.

-

Atomwise Inc.

-

BenevolentAI

-

Instem plc

-

Accelrys (3DS BIOVIA)

-

SIMULIA Corp.

-

GVK Biosciences

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.88 Billion |

| Market Size by 2035 | USD 11.18 Billion |

| CAGR | CAGR of 11.16% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Workflow (Discovery Informatics, Biocontent Management) • By Services (Sequence Analysis Platform, Molecular Modelling, Docking, Clinical Trial Data Management, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Dassault Systèmes, Schrödinger, Inc., PerkinElmer, Inc., Certara, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Waters Corporation, Jubilant Biosys Ltd., Collaborative Drug Discovery, Inc., Genedata AG, Illumina, Inc., QIAGEN N.V., Evotec SE, Charles River Laboratories International, Inc., Molecular Devices, LLC, OpenEye Scientific Software, ChemAxon Ltd., Numedii, Inc., Atomwise Inc., BenevolentAI, Instem plc, Accelrys (3DS BIOVIA), SIMULIA Corp., GVK Biosciences |