Timber Laminating Adhesives Market Report Scope & Overview:

Get More Information on Timber Laminating Adhesives Market - Request Sample Report

The Timber Laminating Adhesives Market Size was valued at USD 949.6 million in 2023 and is expected to reach USD 1687.9 million by 2032 and grow at a CAGR of 6.6% over the forecast period 2024-2032.

The Timber Laminating Adhesives Market has experienced substantial growth because of the rise in demand for environmentally friendly and high-performance adhesives across various industries. Among the resin types used are polyurethane, epoxy, and melamine-urea-formaldehyde (MUF), mainly due to their application in the construction, furniture, and flooring sectors. Companies are striving to produce more advanced adhesive solutions with enhanced durability, water resistance, and cost-effectiveness to meet evolving consumer and regulatory demands. Innovations such as the incorporation of sustainable materials also form a key role in defining the market.

The trend indicates that strategic growth is going to be a significant expansion within the packaging adhesive business. In December 2024, Arkema concluded its acquisition of Dow's laminating adhesives for flexible packaging, thus enhancing opportunities for diversification and wider penetration in the flexible packaging space. The US$250 million acquisition will help Arkema increase its portfolio with quality solutions for food, medical, and industrial applications, given that the business was conducted through its subsidiary, Bostik. It also marks a step toward leveraging synergies and driving future growth by integrating advanced technologies into their adhesive solutions, complementing their existing operations and boosting profitability.

Timber Laminating Adhesives Market Dynamics:

Drivers:

-

Increasing Health Awareness and Demand for Hygiene Products Fuel Antimicrobial Plastics Adoption Across Multiple Industries

The increase in consumer consciousness about health has primarily resulted in the demand for antimicrobial plastics. There are growing applications of the use of these plastics within health care, packaging, and consumer goods industries due to their ability to create enhanced hygiene and safety through their products. Manufacturers today concentrate on developing antimicrobial products that are not only very effective but also do not harm the environment. The growing awareness of the importance of hygiene in daily life, especially with recent health crises, has led to a surge in demand for products that offer antimicrobial properties. This trend is particularly evident in medical devices, food packaging, and household items where preventing bacterial growth is paramount. This trend is also being fueled by consumers' increasing focus on health and safety, leading companies to expand their product lines to include antimicrobial plastics.

-

Regulatory Support and Standards for Antimicrobial Plastics Promote Market Growth and Consumer Confidence

-

Rising Demand for Antimicrobial Plastics in the Healthcare Sector Accelerates Market Development

The healthcare sector is witnessing rising demand for antimicrobial plastics because of the growing apprehensions over infections and the safety of patients. The rising adoption of antimicrobial materials by hospitals and healthcare institutions for various applications, including surgical instruments, medical devices, and hospital furnishings, to minimize the risk of healthcare-associated infections (HAIs) is another reason. This increasing focus on infection control has made manufacturers introduce specialized antimicrobial plastics that are specifically designed to meet the stringent needs of the healthcare sector. Besides, the advanced antimicrobial technology is further allowing materials that not only prevent microbial growth but also remain resistant to severe cleaning and sterilization processes. As the healthcare field focuses increasingly on safety and hygiene, the demand in the antimicrobial plastics market is expected toward great growth.

Restraint:

-

High Production Costs of Antimicrobial Plastics Hinder Widespread Adoption in Price-Sensitive Markets

Although antimicrobial plastics have many attractive advantages, the higher manufacturing cost remains one of the significant drawbacks preventing them from reaching their full potential, particularly in sensitive price markets. Higher material costs often result from more complex antimicrobial agents and processing methods. This often reduces manufacturers' willingness to use antimicrobial plastics for applications, especially where there are significant considerations regarding cost competitiveness in industries. Consequently, companies may opt for traditional plastics that, while less effective in preventing microbial growth, offer a more cost-effective solution. This challenge is particularly pronounced in developing regions where budget constraints are prevalent, limiting the penetration of antimicrobial plastics in various applications. As a result, the market faces hurdles in achieving its full potential, necessitating further innovations to reduce production costs and enhance the affordability of antimicrobial solutions.

Opportunity:

-

Growing Demand for Sustainable and Eco-Friendly Antimicrobial Plastics Creates New Market Opportunities

The growing awareness of environmental issues and sustainability is creating significant opportunities for the development of eco-friendly antimicrobial plastics. Consumers and industries are increasingly seeking sustainable alternatives that not only provide antimicrobial benefits but also minimize environmental impact. Manufacturers that focus on developing biodegradable or bio-based antimicrobial plastics can capitalize on this trend and meet the growing demand for sustainable materials. This shift towards eco-friendly solutions provides the companies with an opportunity to create differentiated products that can serve as a market differentiator. With the growing concerns of consumers towards sustainability, this market for eco-friendly antimicrobial plastics is likely to have a huge growth potential.

-

Expansion of Applications in Emerging Markets Opens New Growth Avenues for Antimicrobial Plastics

The emerging markets offer great growth prospects for antimicrobial plastics as their industrial sectors expand and consumer awareness increases. Hygiene-related products are in high demand with the development of economies in the construction, automotive, and consumer goods industries. Antimicrobial plastics can improve product performance and create a competitive edge in these industries. Also, the growing middle class in developing economies is increasingly demanding products of high quality and hygiene, which has further enhanced the adoption of antimicrobial materials. While manufacturers pursue these new markets, expansion of applications and innovation of antimicrobial plastics is promising, thus holding potential for great market growth.

Consumer Preferences and End-user Behavior in the Timber Laminating Adhesives Market

|

Consumer Preference/Behavior |

Explanation |

|

Sustainability |

Growing preference for eco-friendly and bio-based adhesives due to environmental concerns. |

|

Performance and Durability |

Preference for high-performance adhesives that ensure durability and strength in applications. |

|

Cost Efficiency |

Importance of competitive pricing and overall cost-effectiveness in adhesive selection. |

|

Brand Reputation |

Influence of brand trust and reputation in purchasing decisions, favoring established manufacturers. |

|

Regulatory Compliance |

Preference for products that meet safety and environmental regulations, ensuring compliance in projects. |

Consumer preferences and end-user behavior significantly influence the Timber Laminating Adhesives Market. As sustainability becomes a critical focus, end-users increasingly seek eco-friendly and bio-based adhesives to minimize environmental impact. Performance and durability are paramount, as customers prioritize adhesives that ensure long-lasting results in construction applications. Additionally, cost efficiency plays a vital role in the selection process, with buyers gravitating towards competitive pricing. Brand reputation also impacts decision-making, as trusted manufacturers are favored. Lastly, adherence to regulatory compliance is essential, ensuring that products meet necessary safety and environmental standards.

Timber Laminating Adhesives Market Segments

By Resin Type

In 2023, the Urea-Formaldehyde (UF) segment dominated the Timber Laminating Adhesives Market, accounting for a market share of approximately 40%. The dominance is attributed to UF's widespread use in various applications due to its cost-effectiveness and strong bonding properties, making it a preferred choice in the woodworking and furniture industries. UF adhesives, for example, are typically used in the manufacture of plywood and particleboard; such products require a high bonding strength with very short curing times. More importantly, the improvement of the formulation has further consolidated its position in the market.

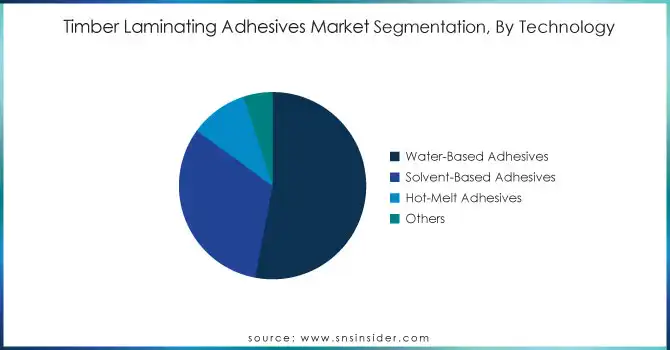

By Technology

In 2023, the Water-Based Adhesives segment dominated the Timber Laminating Adhesives Market with a market share of around 50%. The preference for environmentally friendly and low-emission products has increased the popularity of water-based adhesives. They are less harmful to health and the environment as compared to solvent-based options. Companies are increasingly opting for these adhesives because they can be used for the production of furniture and construction where the volatility control on volatile organic compounds needs to be strictly maintained. This trend is exemplified by manufacturers marketing their water-borne adhesive products as not only safe but performance-grade as well.

By Application

The Floor Beams segment dominated the Timber Laminating Adhesives Market in 2023, accounting for a market share of about 35%. This can be credited to the increase in construction activities, especially in residential and commercial buildings where laminated beams made from engineered wood products are highly used due to their strength and stability. The use of adhesives in floor beams aids in efficient assembly and enhances structural strength, which is why builders prefer to use adhesives for this part. Innovations in adhesive formulation that improve the resistance against moisture and loads support further growth in this segment.

By End-use Industry

The Residential segment dominated the Timber Laminating Adhesives market in 2023, with a market share of approximately 60%. Growth in this segment is influenced by increasing demand for residential construction and renovation projects, in which laminated wood products are widely used for flooring, roofing, and structural applications. Sustainable building practices and the trend towards the adoption of lightweight, high-strength materials are further contributing to the use of timber laminating adhesives in the residential sectors. Increased home improvement activities and the construction of environmentally friendly homes also drive demand for these adhesives.

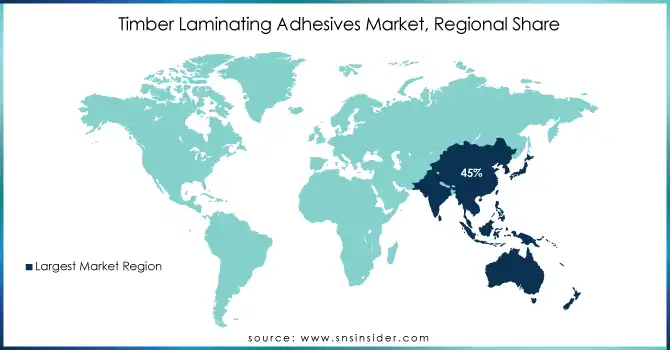

Timber Laminating Adhesives Market Regional Analysis

In 2023, the Asia Pacific region dominated the Timber Laminating Adhesives Market, holding a market share of around 45%. This dominance can be attributed to the booming construction industry in countries like China, India, and Japan. China, being the largest construction market globally, has seen significant demand for engineered wood products such as laminated beams and plywood, which use timber laminating adhesives extensively. India’s growing urbanization and infrastructural development further contribute to the demand for these adhesives in residential and commercial projects. Japan’s advanced construction techniques and the preference for high-quality, durable materials have also driven the market growth in the region. As the region continues to urbanize rapidly and focus on sustainable building practices, the demand for timber laminating adhesives is expected to remain strong.

However, North America emerged as the fastest-growing region in 2023 with a CAGR of around 6%. The U.S. is leading this growth, driven by increasing demand for residential and commercial construction, where timber laminating adhesives are used in flooring, roofing, and structural elements. The focus on eco-friendly materials and the rising trend of sustainable architecture in North America has fueled the growth of this market segment. Additionally, the expanding use of engineered wood in the construction sector as a substitute for traditional materials further contributes to this region's robust growth. In Canada, the demand for green building materials and the construction of energy-efficient homes has also added to the market's expansion. This trend is expected to continue as both countries push for more sustainable construction practices, offering new opportunities for the timber laminating adhesives market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

-

3M Company (Scotch-Weld Structural Wood Adhesives, Fastbond Contact Adhesive)

-

Akzo Nobel N.V. (EPI Resin Systems, Prefere 4050 Adhesive)

-

Arkema (Sartomer Specialty Adhesives, Bostik Wood Adhesives)

-

Ashland Inc. (Isogrip Adhesives, Aroset Adhesives)

-

BASF SE (Joncryl Adhesives, Basotect Systems)

-

Bostik SA (XPU Systems, MSR Construction Adhesives)

-

Collano AG (Collano PUR Adhesives, Collano EPI Systems)

-

Dow Inc. (Methocel Adhesives, Vorafuse Adhesives)

-

Franklin International (Titebond Original Wood Glue, Titebond Polyurethane Glue)

-

H.B. Fuller Company (Rakoll Adhesives, Advantra Wood Adhesives)

-

Henkel AG & Co. KGaA (Loctite Adhesives, Technomelt PUR Systems)

-

Huntsman Corporation (Araldite Adhesives, Vitrox Systems)

-

ITW Performance Polymers (Devcon Epoxy Adhesives, Plexus Structural Adhesives)

-

Jowat SE (Jowapur Adhesives, Jowacoll Adhesives)

-

Momentive Performance Materials Inc. (SilGrip Adhesives, SPUR+ Polyurethane Adhesives)

-

Pidilite Industries (Fevicol Marine, Fevicol HeatX)

-

RPM International Inc. (DAP Weldwood Adhesives, Rust-Oleum Specialty Adhesives)

-

Sika AG (SikaBond Wood Floor Adhesives, SikaFast Adhesives)

-

Titebond (Franklin International) (Titebond III Ultimate Wood Glue, Titebond Liquid Hide Glue)

-

Wacker Chemie AG (Vinnapas Dispersions, Elastosil Adhesives)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 949.6 Million |

| Market Size by 2032 | USD 1687.9 Million |

| CAGR | CAGR of 6.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type (Urea-Formaldehyde (UF), Melamine-Urea-Formaldehyde (MUF), Phenol-Resorcinol-Formaldehyde (PRF), Polyurethane (PU), Epoxy, Others) • By Technology (Solvent-Based Adhesives, Water-Based Adhesives, Hot-Melt Adhesives, Others) • By Application (Floor Beams, Roof Beams, Window and Door Headers, Trusses and Supporting Columns, Others) • By End-use Industry (Residential, Non-residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M company, Collano AG, Akzo Nobel N. V., Pidilite Industries , Sika AG, Arkema, Pidilite Industries, Ashland inc., Jowat SE, Dow Inc and Others |

| Key Drivers | • Regulatory Support and Standards for Antimicrobial Plastics Promote Market Growth and Consumer Confidence • Rising Demand for Antimicrobial Plastics in the Healthcare Sector Accelerates Market Development |

| Restraints | • High Production Costs of Antimicrobial Plastics Hinder Widespread Adoption in Price-Sensitive Markets |