Clinical Nutrition Market Report Scope & Overview:

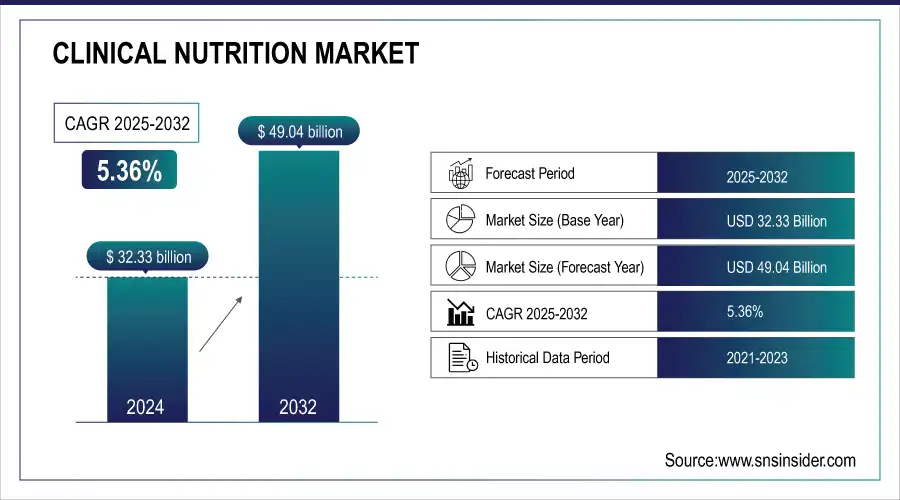

The Clinical Nutrition Market size was valued at USD 32.33 billion in 2024 and is expected to reach USD 49.04 billion by 2032, growing at a CAGR of 5.36% over 2025-2032.

The global clinical nutrition market is witnessing a high growth over the last few years, primarily because of the increase in the geriatric population (as they are more prone to diseases), the increasing number of patients with chronic ailments, and the rise in the number of people being admitted into hospitals due to ailments. A major factor propelling the market is the rising incidence of malnutrition among hospitalized and geriatric populations, especially in critical care areas and oncology. Growing awareness of personalized nutrition, rising incidence of ICU admissions, and a surge in adoption of home-based nutrition therapies drive the growth of the market.

To Get more information on Clinical Nutrition Market - Request Free Sample Report

Higher research and development activities are a key growth driver; invested heavily in therapeutic innovations, leading to substantial investments from larger clinical nutrition companies like Abbott, Nestlé Health Science, and Danone (Nutricia). For instance, in medical nutrition for oncology and gastrointestinal disorders, Nestlé Health Science increased its portfolio. The U.S. clinical nutrition market is expected to register strong growth on account of well-developed clinical practices coupled with coverage policies. Additionally, regulatory backing, such as the FDA guideline for components of parenteral nutrition and EU regulation for disease-specific medical foods, develops market compatibility. The growth is even more pronounced when coupled with growing investments in nutrition R&D, such as Danone's €280 million research budget for Nutrition and the rise of clinical dietetics in hospitals. Dietary transitions, expanding pediatric and geriatric patient population bases, and higher occurrence of diseases such as dysphagia and cancer are prominent factors expected to propel the uptake rate of long-term care settings in the clinical nutrition market.

In April 2024, Abbott introduced its upgraded Ensure High Protein drink (with HMB (β-hydroxy β-methylbutyrate), which enriches the product with health benefits for muscles in an aging population and aligns with personalized nutrition, clinical pipeline, and clinical nutrition market trends.

In February 2024, Fresenius Kabi strengthened its lead in the U.S. clinical nutrition market by broadening its parenteral nutrition portfolio and scaling up production for nutrition therapy in ICU and oncology care, reflecting demand growth and supply-side innovation alike.

Market Dynamics:

Drivers:

-

Rising Disease Burden and Advancements in Therapeutic Nutrition Propel Market Growth

The growth of the clinical nutrition market is predominantly driven by the rising prevalence of chronic diseases, growing awareness among patients, and an increasing number of initiatives undertaken by government associations. This has increased the demand for disease-specific enteral and parenteral nutrition globally. With WHO reporting a 74% contribution towards the global deaths by non-communicable diseases, it has resulted in an increased requirement for clinical dietetics and nutrition-based interventions. Moreover, increased prevalence of premature births and NICU admissions is projected to propel demand for infant and neonatal clinical nutrition.

For instance, increased adoption of technologies like nutrient profiling and designing-to-order medical foods. Meiji Holdings has increased R&D spending by 9.1% in FY2023 to develop the next generation of therapeutic nutrition, almost as much as it did in FY2020, from any other company that also allocated significant R&D budgets.

Improved nutrient compositions and parenteral formulations are fast-tracking product approvals, with updated FDA and EFSA regulations at the forefront. In addition, the growing scarcity of nursing and dietetic professionals on a global scale may have further boosted demand for enteral feeds in hospitals and long-term care facilities, thereby providing considerable impetus to the supply-side dynamics as well. Up surging patient awareness combined with the introduction of personalized AI-based nutrition planning systems to enhance clinical nutrition market demand in specialty and home care end-use.

Restraints:

-

Regulatory Complexity, High Cost & Product Accessibility Barriers Hinder Market Expansion

The global clinical nutrition market growth will continue to be negatively impacted by restraints such as stringent regulatory compliance norms, high product costs, and lower accessibility in developing healthcare systems. The regulatory environments for clinical nutrition products (particularly medical foods or total parenteral nutrition) vary drastically from one region to another, often delaying approvals and market access. Very well led by the food-to-pharma segment; however, strict compliance must be under 21 CFR Part 104 from the US FDA, and FSMP (Foods for Special Medical Purposes) in the EU is increasing the time to innovation for formulations.

A 2023 survey conducted by the American Society for Parenteral and Enteral Nutrition (ASPEN) found that almost 42% of healthcare providers reported obstacles like changing insurance coverage related to home enteral or parenteral nutrition therapy. Supply chain weaknesses can also disrupt access, particularly in the setting of health emergencies during which lipid emulsions or amino acid blends may be unavailable. A second problem is the under-provision of trained dietitians and nutritionists in clinical settings, who are needed to effectively prescribe and monitor nutritional therapies. All these factors together have, in a way, hampered clinical nutrition market analysis from garnering its full benefits despite clear patient indications and demands.

Segmentation Analysis:

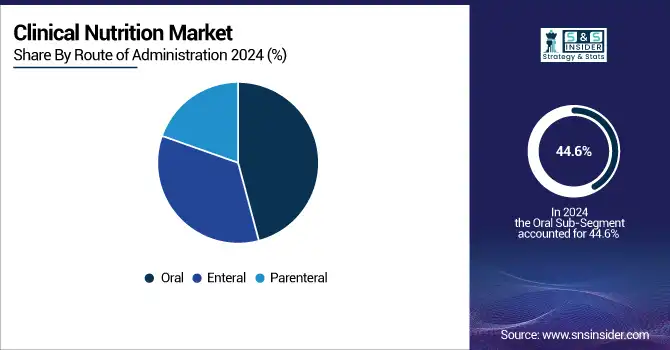

By Route of Administration

In 2024, oral nutrition was the leading route and held a market share of 44.6% of the clinical nutrition market. It is the most preferred choice as it is easily digestible, cost-efficient, and it's suitable for pediatric, adult, and geriatric populations. Oral nutritional supplements are frequently used to provide nutritional support in chronic conditions and post-discharge convalescence. Its leading position, however, is mainly due to the growing presence of oral nutritional supplements in retail and home care channels. Conversely, the Parenteral nutrition route is growing at a faster rate due to the demand in critical care, surgical recovery, and GI-related hospital admissions. This approach is necessary in cases when oral or enteral feeding is not feasible, and newer compounds with greater tolerability have facilitated its acceptance, especially among intensive care units and oncology departments.

By Product Type

In 2024, enteral feeding formulas were the highest shareholder in the clinical nutrition segment with a share of 38.2%, as they are widely used in hospitals and home settings for patients having functional gastrointestinal systems. General as well as disease-specific formulations are widely used to deal with such conditions, including cancer, dysphagia, and chronic diseases. They are also further supported by the emerging aging population cohort that seeks care and better reimbursement. Conversely, the total parenteral nutrition (TPN) solutions segment displayed the highest CAGR. Because with some types of surgeries, GI disorders, or trauma, the patient cannot be given enough nutrition through the enteral route. The rapid adoption of TPN therapies, due to improved clinical practices in ICUs and oncology, and the introduction of innovations in lipid emulsions and amino-acid blends on a global scale.

By Application

In 2024, malnutrition and nutritional deficiency application accounted for the largest value of 27.5% owing to the high prevalence associated with hospitalized patients, geriatrics, & individuals in long-term care. Malnutrition is a major global clinical problem, especially in patients with low immunity or post-operation. Prevalence of nutrition screening protocols and increased awareness among clinicians were identified as contributing to this dominance. On the other hand, cancer care is one of the fastest-growing application segments. Cachexia, impaired nutritional status, and adverse effects due to treatment, which are frequent in patients with cancer, require individualized management. Increasing global cancer incidence, along with advances in immunonutrition and oncology-specific formulas, has increased the demand for personalized clinical nutrition based on the disease condition in oncology care.

By Distribution Channel

Hospital pharmacies were the leading distribution channel in 2024 with 36.4% of market share. Traditionally, hospitals are the main setting for enteral and parenteral nutritional systems, particularly for acute and surgical, and ICU patients. Centralized procurement, direct administration, and physician-supervised delivery ensure better compliance and treatment outcomes. The fastest-growing channel is online pharmacies and E-commerce platforms. Oral and tube-feeding nutrition has been one category that experienced a surge in online sales during COVID, exacerbated by post-pandemic movement to the home and going digital. Increasingly, patients managing chronic conditions or recuperating at home would like to have nutrition delivered directly to their doorstep on a subscription basis. This trend is being further driven by the increased partnerships between nutrition players and e-commerce in both established and developing healthcare markets.

Regional Analysis:

North America occupied the largest share of the market, in terms of revenue, in 2024, accounting for 38% owing to a well-established healthcare infrastructure, high incidence rate of lifestyle diseases, and increased use of enteral parenteral nutrition across hospital and home care settings.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S. clinical nutrition market size was valued at USD 9.72 billion in 2024 and is expected to reach USD 13.90 billion by 2032, growing at a CAGR of 4.55% over 2025-2032. This prominence of the U.S. in the market again is attributed to a combination of factors, including high spending on healthcare, a rapidly increasing elderly population, and widespread adoption of advanced nutritional therapies. In 2024, the US represented more than 82% of the market in North America. Canada is also a growing market, fueled by rising interest in nutritional management for chronic disease. The North American market is the fastest-growing in North America, and the U.S. has the highest cancer, GI disorders requiring clinical nutrition support.

The region of Asia Pacific accounts for the highest CAGR in 2024 due to the increased rate of clinical nutrition solutions in China and India. The region is growing on the back of its large malnourished base, a rise in cases of cancer, and nutrition programs from the government. Rapidly aging populations and increased rates of chronic diseases helped drive China's portion of the Asia Pacific clinical nutrition market to over 40% in 2024. The fastest growth was observed in India, where increased adoption of nutritional supplements, coupled with greater awareness and increasing hospital admissions for chronic diseases and pediatric malnutrition, continues to drive demand.

Key Players:

Notable clinical nutrition companies include Abbott Nutrition, Pfizer Inc., Bayer AG, Nestlé Health Science, Baxter International Inc., Otsuka Holdings Co., Ltd., Mead Johnson & Company, LLC, Danone (Nutricia), Victus Inc., Fresenius Kabi, Meiji Holdings Co., Ltd., AbbVie (Allergan), Grifols S.A., Perrigo Company plc, Hormel Health Labs, B. Braun Melsungen AG, Cargill Incorporated, Ajinomoto Co. Inc., Nutricia North America, NUTRIMED Healthcare, Nutribio, Kate Farms, Smartfish AS, and Alcresta Therapeutics.

Recent Developments:

In January 2024, Hologram Sciences partnered with Mayo Clinic to develop a Precision Nutrition Platform, integrating machine-learning and clinical malnutrition recovery protocols to improve outcomes in surgical and critical care patients.

In May 2024, Danone acquired U.S.-based medical nutrition provider Functional Formularies, significantly expanding its enteral tube-feeding portfolio and strengthening its presence in the U.S. clinical nutrition market.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 32.33 billion |

| Market Size by 2032 | USD 49.04 billion |

| CAGR | CAGR of 5.36% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Oral Clinical Nutrition Products, Enteral Feeding Formulas (Standard & Disease-Specific), Parenteral Nutrition Components (Carbohydrates, Parenteral Lipid Emulsions, Amino Acid Solutions, Trace Elements, and Vitamins & Minerals), Infant Nutrition Products, and Total Parenteral Nutrition (TPN) Solutions) • By Route of Administration (Oral, Enteral, and Parenteral) • By Application (Malnutrition/Nutritional Deficiency, Cancer Care, Chronic Kidney Diseases, Diabetes Management, Neurological Disorders, Gastrointestinal Disorders, Dysphagia, Orphan/Rare Diseases, Pain Management, and Metabolic Disorders) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies/E-commerce, Homecare & Specialty Clinics, and Institutional Sales) |

| Regional Analysis/Coverage | North America (U.S., Canada), Europe (Germany, France, UK, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Nutrition, Pfizer Inc., Bayer AG, Nestlé Health Science, Baxter International Inc., Otsuka Holdings Co., Ltd., Mead Johnson & Company, LLC, Danone (Nutricia), Victus Inc., Fresenius Kabi, Meiji Holdings Co., Ltd., AbbVie (Allergan), Grifols S.A., Perrigo Company plc, Hormel Health Labs, B. Braun Melsungen AG, Cargill Incorporated, Ajinomoto Co. Inc., Nutricia North America, NUTRIMED Healthcare, Nutribio, Kate Farms, Smartfish AS, and Alcresta Therapeutics. |