Cell And Gene Therapy Clinical Trials Market Size Analysis:

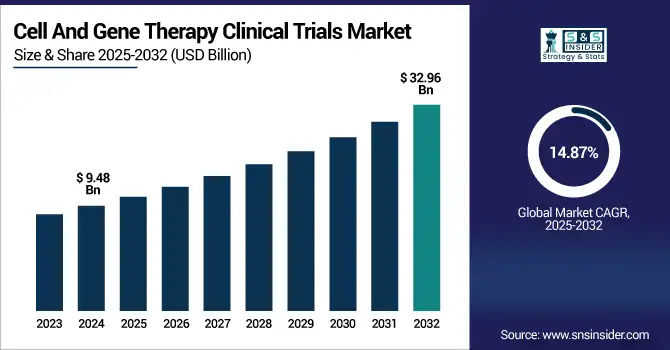

The Cell And Gene Therapy Clinical Trials Market Size was valued at USD 9.48 billion in 2023 and is expected to reach USD 32.96 billion by 2032 and grow at a CAGR of 14.87% over the forecast period 2024-2032. This paper discusses the prevalence and incidence of clinical trials with an emphasis on the rising numbers of studies propelled by genetic research advances and increasing interest in personalized medicine. Sponsorship and funding patterns are analyzed, considering government, private, and venture capital investment as the driving forces of speeding up trial advancement across the globe. Moreover, it analyzes patient enrollment patterns and size distribution, with a focus on geographical differences in trial accessibility and regulatory complexities. The report also compares regulatory approvals and success rates for trials, highlighting the influence of changing policies on market entry and innovation. Generally, the study emphasizes increasing investment in healthcare and market funding due to the potential of cell and gene therapies to revolutionize the treatment of numerous diseases.

To Get more information on Cell And Gene Therapy Clinical Trials Market - Request Free Sample Report

Cell And Gene Therapy Clinical Trials Market Dynamics

Drivers

-

Advancements in biotechnology, increasing regulatory support, and rising investments in innovative therapies.

The FDA has also awarded more than 60 RMAT (Regenerative Medicine Advanced Therapy) designations to facilitate the approval process, promoting greater clinical trials. The growing occurrence of genetic disorders and cancers is also driving demand for advanced therapies. For example, CAR-T cell therapies such as Kymriah and Yescarta have transformed hematologic cancer treatment, resulting in a proliferation of similar clinical trials. The increasing number of biotech firms and pharma partnerships, coupled with government and private investment, has spurred trial development. In addition, advances in CRISPR gene editing and viral vector production have made the clinical trial process more efficient. With more than 2,000 ongoing gene therapy clinical trials worldwide, the market continues to grow as research institutions and biopharma firms focus on innovative treatment methods.

Restraints

-

The Cell and Gene Therapy Clinical Trials Market faces significant restraints due to high development costs and complex regulatory requirements.

The cost of a gene therapy clinical trial can be as high as USD 1 billion on average, making it a capital-intensive process. Moreover, regulatory bodies have strict requirements for trial approval, which tend to result in delays. The high rate of clinical trial failures, especially in Phase III, also contributes to the cost burden for companies. For instance, some gene therapy hopefuls for Duchenne muscular dystrophy have been halted in late-stage trials due to concerns over efficacy. Manufacturing complexity, such as the creation of viral vectors and scalability issues, also slows trial advancement. In addition, recruitment of patients continues to be an issue, as gene therapy trials tend to be highly specific patient populations with unusual genetic mutations, restricting enrollment. Ethical issues related to gene-editing technology and long-term safety concerns delay market growth even further.

Opportunities

-

The growing adoption of personalized medicine and the expansion of research into rare diseases.

The orphan drug designation by the FDA and the EMA incentivizes biopharma firms to spend money on rare disease treatment through rewards such as tax credits and market exclusivity. More than 70% of all current gene therapy trials are aimed at treating rare genetic diseases, showing a profitable sector to expand in. New technologies like next-generation sequencing (NGS) and AI-based trial optimization are also enhancing patient recruitment and trial efficiency. The growing partnership among academia, biotech companies, and contract research organizations (CROs) also speeds up development. For example, collaborations such as Pfizer's partnership with Beam Therapeutics for gene-editing treatments show the commitment of the industry to pushing research forward. Off-the-shelf allogeneic cell therapies are another major opportunity that can lower production costs and increase accessibility. As an increasing number of biopharma firms get regulatory designations like Breakthrough Therapy and Fast Track approvals, the pipeline for innovative therapies continues to grow.

Challenges

-

Patient recruitment and retention are among the biggest challenges in the Cell and Gene Therapy Clinical Trials Market.

In contrast to traditional trials, these treatments frequently address ultra-rare genetic disorders, so finding suitable participants is challenging. Numerous trials have trouble with high dropout rates, particularly because of the long follow-up periods needed to determine long-term safety and efficacy. Another significant hurdle is the worldwide regulatory environment, as countries have different approval mechanisms for gene therapies, making international trial conduct complex. Manufacturing bottlenecks are also a major challenge, as viral vector manufacturing is supplying chain and cost-constrained. For instance, AAV vector demand has increased, resulting in production shortages and trial delays. Moreover, issues related to immunogenic responses and off-target effects in gene-editing treatments present scientific and ethical challenges, impacting trial advancement. For example, initial CRISPR-based trials were criticized for possible unintended genetic changes, triggering regulatory issues. Finally, uncertainty around reimbursement after approval can affect funding for trials since payers are reluctant to pay for expensive treatments.

Cell And Gene Therapy Clinical Trials Market Segmentation Analysis

By Phase

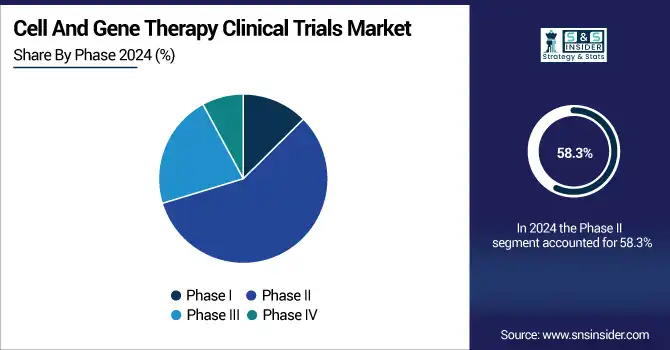

Phase II segment was the leader in the Cell and Gene Therapy Clinical Trials Market in 2023, with 58.3% of the total revenue. This is due to the reason that most of the cell and gene therapy candidates are in mid-stage trials, where safety and efficacy evaluation is essential before advancing into late-stage trials. The increasing presence of biotech companies investing in cell and gene therapy products and the growing regulatory favor for faster routes have further driven the large number of Phase II trials.

The most rapidly expanding segment is Phase III, led by a growing number of cell and gene therapy candidates being able to advance successfully beyond mid-stage trials into late-stage clinical confirmation. Growth in regulatory designations such as RMAT (Regenerative Medicine Advanced Therapy) and Breakthrough Therapy status has further increased the rate at which promising therapies move into Phase III trials, causing this segment to grow significantly.

By Indication

The Oncology segment was the market leader in the Cell and Gene Therapy Clinical Trials Market in 2023 with a commanding revenue share of 49.7%. The prevalence of cancer and the critical need for novel, tailored therapies have fueled extensive clinical trial activity in oncology-oriented cell and gene therapies. The popularity of CAR-T cell therapies and their growing indications have played a big role in segment leadership.

Oncology is the most rapidly growing segment as well, with advances in tumor-targeting cell and gene therapies, growth in patient participation in oncology clinical trials, and growing investment from biotech companies fueling fast growth. The development of next-generation CAR-T, TCR-T, and gene-editing therapies for hematologic and solid tumors has fueled the growth of oncology-skewed trials, making it the most dynamic market segment.

Cell And Gene Therapy Clinical Trials Market Regional Insights

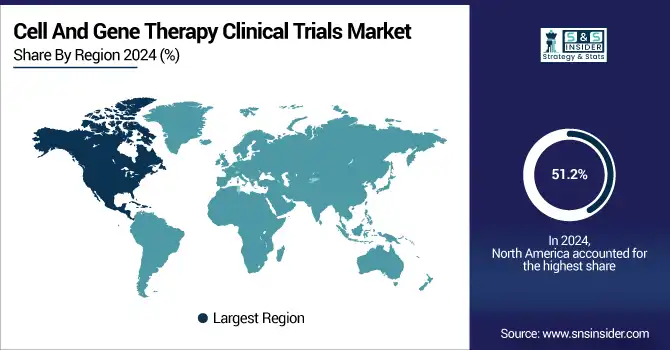

North America held the Cell and Gene Therapy Clinical Trials Market's largest share in 2023, representing 51.2% of global revenue. The region is led by a mature biotechnology industry, robust regulatory environment, and high investment in cutting-edge therapies. The United States dominates the region, with the FDA's accelerated approval programs, including Breakthrough Therapy Designation and RMAT, contributing significantly to streamlining clinical trials. Also, the location of the largest pharmaceutical industries, the highest level of research centers, and growing academic alliances have powered cell and gene therapy trial expansion in North America. Government programs, venture capital, and private investors also provide financing that supports the region's global market leadership.

The Asia-Pacific region is the fastest-growing, fueled by an upsurge in clinical trial activity, rising regulatory progress, and investment in biotechnology. China, Japan, and South Korea are fast becoming important players, with China being at the top in terms of the number of active clinical trials. Support from the Chinese government for cell and gene therapy research and accelerated regulatory approvals has greatly accelerated trial activity. Also, growing patient recruitment, reduced trial expenses, and partnerships with international biotech companies are fueling high growth in Asia-Pacific's cell and gene therapy clinical trials market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their Cell & Gene Therapy Clinical Trial Offerings

-

IQVIA – Cell & Gene Therapy Development Solutions

-

ICON Plc – ICON Cell & Gene Therapy Services

-

Laboratory Corporation of America Holdings (Labcorp Drug Development) – Cell & Gene Therapy Solutions

-

Charles River Laboratories International, Inc. – Cell & Gene Therapy Services

-

PAREXEL International Corp. – Cell & Gene Therapy Clinical Trial Services

-

Syneos Health – Syneos Health Cell & Gene Therapy Solutions

-

Medpace Holdings, Inc. – Medpace Cell & Gene Therapy Development Services

-

PPD Inc. (part of Thermo Fisher Scientific) – PPD Cell & Gene Therapy Services

-

Novotech – Novotech Cell & Gene Therapy CRO Services

-

Veristat, LLC – Veristat Cell & Gene Therapy Clinical Development

Recent Developments in the Cell And Gene Therapy Clinical Trials Market

In March 2025, Amgen and Kyowa Kirin announced that their Phase III IGNITE trial for rocatinlimab in moderate to severe atopic dermatitis (AD) successfully met its co-primary endpoints at 24 weeks. The therapy also achieved all key secondary endpoints, demonstrating statistical significance.

In March 2025, Neurotech Pharmaceuticals' Encelto (revakinagene taroretcel-lwey/NT-501), an allogeneic encapsulated cell therapy, received FDA approval for macular telangiectasia type 2 (MacTel), making it the first approved treatment for the condition. The therapy is expected to be available in the U.S. by June 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.48 billion |

| Market Size by 2032 | USD 32.96 billion |

| CAGR | CAGR of 14.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Phase [Phase I, Phase II, Phase III, Phase IV] • By Indication [Oncology, Cardiology, CNS, Musculoskeletal, Infectious diseases, Dermatology, Endocrine, metabolic, genetic, Immunology & inflammation, Ophthalmology, Hematology, Gastroenterology, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IQVIA, ICON Plc, Laboratory Corporation of America Holdings (Labcorp Drug Development), Charles River Laboratories International, Inc., PAREXEL International Corp., Syneos Health, Medpace Holdings, Inc., PPD Inc. (part of Thermo Fisher Scientific), Novotech, Veristat, LLC. |