In Situ Hybridization Market Size:

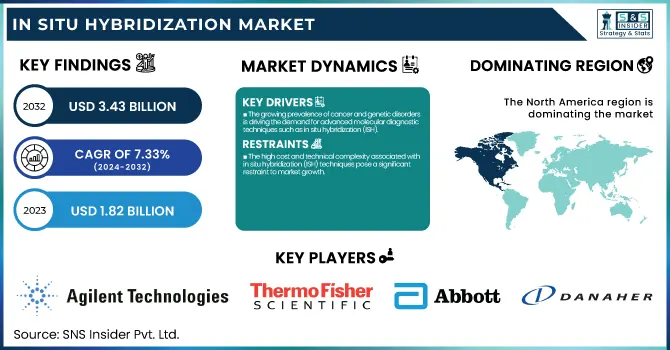

The In-situ Hybridization Market was valued at USD 1.82 billion in 2023 and is expected to reach USD 3.43 billion by 2032, growing at a CAGR of 7.33% from 2024-2032. The In Situ Hybridization (ISH) Market report provides insights with the presentation of incidence and prevalence figures of diseases where ISH is a decisive factor, like cancer, genetic disorders, and infectious diseases in major regions. The report points out the hospital, research institute, and CRO adoption trends with a regional split of ISH adoption. The report also encompasses ISH test volume analysis which enumerates utilization in oncology, cytogenetics, and developmental biology. Further, it analyzes research and clinical expenditure trends by geography, breaking down investments from commercial, government, private, and out-of-pocket origins, providing an overall outlook of investment in ISH-based diagnostics and molecular investigations.

To Get more information on In-situ Hybridization Market - Request Free Sample Report

In Situ Hybridization Market Dynamics

Drivers

-

The growing prevalence of cancer and genetic disorders is driving the demand for advanced molecular diagnostic techniques such as in situ hybridization (ISH).

The increasing incidence of cancer and genetic diseases is fueling the need for sophisticated molecular diagnostic methods like in situ hybridization (ISH). The World Health Organization (WHO) reports that cancer caused almost 10 million deaths in 2023, with rising numbers of lung, breast, and colorectal cancers necessitating accurate diagnostic methods. ISH is an essential tool for the identification of chromosomal abnormalities, gene amplifications, and mutations, allowing for early disease detection and targeted therapy. Furthermore, the growing uptake of companion diagnostics in oncology has also fueled the market as pharmaceutical companies incorporate ISH-based biomarker identification into personalized medicine. Recent developments, including Akoya Biosciences' partnership with Thermo Fisher Scientific in January 2024 to improve protein and RNA biomarker detection, demonstrate the continued innovation in ISH technology, paving the way for its further growth in clinical and research use.

-

Technological Advancements in ISH Techniques driving the market growth.

Major technological developments in in situ hybridization methods, especially fluorescence in situ hybridization (FISH) and chromogenic in situ hybridization (CISH), are propelling market growth. Advancements like RNA-based ISH, multiplexing capabilities, and automated hybridization platforms have enhanced assay sensitivity, specificity, and workflow efficiency. Automated ISH solutions minimize human error and increase reproducibility, making them ideal for high-throughput research and clinical laboratories. In January 2024, Biocare Medical partnered with Molecular Instruments to combine hybridization chain reaction technology with automated bioimaging systems, revolutionizing ISH automation. These advancements are poised to boost ISH adoption across clinical diagnostics, research in academic institutions, and pharmaceutical industries in favor of the early diagnosis of infectious diseases, cancer, and genetic disorders while enhancing overall diagnostic accuracy and efficiency.

Restraint

-

The high cost and technical complexity associated with in situ hybridization (ISH) techniques pose a significant restraint to market growth.

The technical sophistication and high expense of in situ hybridization (ISH) methods are a major hindrance to market expansion. ISH assays, especially fluorescence in situ hybridization (FISH), involve specialized probes, reagents, and imaging equipment, which are costly in comparison to traditional diagnostic techniques. The requirement for trained personnel to carry out hybridization procedures, interpret results, and ensure high assay sensitivity and specificity also contributes to the operational hurdles. Most laboratories, particularly those in developing countries, face the challenge of the cost of sophisticated ISH systems and the infrastructure for automated platforms. Additionally, technical problems like background noise, probe degradation, and long assay times may hinder the interpretation of results. Notwithstanding advancements in technology, these expense and complexity challenges still constrain the dissemination of ISH, especially in resource-constrained environments.

Opportunities

-

The rise in infectious disease prevalence and the need for accurate molecular diagnostic techniques is an opportunity for the in situ hybridization (ISH) market.

As there is a growing concern about emerging and re-emerging pathogens, ISH methods—especially RNA-based assays—are of high sensitivity and specificity for detecting pathogens directly from tissue samples. Recent improvements in ISH enable the detection of several pathogens at once, enhancing disease surveillance and response activities. Furthermore, the combination of ISH with automation and digital pathology increases workflow efficiency in clinical labs. Government programs and grants for infectious disease research, particularly in reaction to outbreaks like COVID-19 and antimicrobial-resistant bacteria, are also propelling adoption. Consequently, ISH is likely to become an important tool in infectious disease diagnosis, moving beyond oncology and genetic disorder uses.

Challenges

-

Standardization and Reproducibility Issues Challenging the in situ hybridization (ISH) market

One of the serious issues in the in situ hybridization (ISH) market is the absence of standardization and reproducibility between laboratories and testing platforms. Differences in sample preparation, probe design, hybridization conditions, and signal detection can result in variable outcomes, impacting diagnostic sensitivity and specificity as well as consistency. Technical know-how plays an important role in the sensitivity and specificity of ISH assays, and it is challenging to achieve uniformity in clinical as well as research environments. In addition, inconsistencies between automated and manual ISH platforms further complicate the process of standardization. Regulatory authorities attempt to define protocols for ISH, which makes it a complex task, as a wide variety of applications and target molecules are involved. Addressing these standardization issues needs persistent investment in automation, quality controls, and cooperation among the industry players to derive universally acceptable protocols.

In Situ Hybridization Market Segmentation Analysis

By Technology

The Fluorescence In Situ Hybridization (FISH) segment dominated the In Situ Hybridization (ISH) market in 2023 with a 54.25% market share, owing to its sensitivity, specificity, and extensive usage in cancer diagnostics and genetic studies. FISH is widely employed in oncology, cytogenetics, and prenatal diagnostics to detect chromosomal abnormalities and gene amplifications with high accuracy. The increasing use of personalized medicine and companion diagnostics further boosted the use of FISH assays, specifically in detecting HER2, ALK, and EGFR mutations in cancer patients. Moreover, advances in technology, including automated FISH image analysis and multiplexing, have improved its efficiency, leading to it becoming the first choice for researchers as well as clinicians. The availability of regulatory clearances for FISH-based tests and robust backing by pharmaceutical and biotechnology firms further entrenched its market leadership.

The Chromogenic In Situ Hybridization (CISH) segment is expected to grow at the fastest rate during the forecast period with 7.71% CAGR because it is cost-effective, easy to interpret under a standard brightfield microscope, and increasingly preferred in resource-constrained environments. In contrast to FISH, however, CISH does not need special fluorescence microscopes, thus being relatively accessible for routine clinical labs. Its growing use in pathology laboratories for the detection of cancer biomarkers, particularly for HER2 and HPV-associated screenings, is fueling its expansion. Furthermore, continuing technological developments, such as dual CISH assays and automation, are enhancing its efficiency and dependability. The increasing need for cost-effective molecular diagnostic devices in developing economies and their capability to offer long-term stable results without fluorescence signal decay are factors that lead to their growing adoption in the international market.

By Probe

The DNA probe segment dominated the market with 58.41% market share in 2023, as it found wide applications in cancer diagnosis, detection of genetic disorders, and chromosomal studies. DNA probes are extremely reliable in the detection of gene amplifications, deletions, and rearrangements and play a key role in cytogenetic and prenatal screening. The high demand for HER2, ALK, and EGFR gene testing in oncology also supported the universal acceptance of DNA probes. In addition, fluorescence in situ hybridization (FISH) and chromogenic in situ hybridization (CISH) methods mainly employ DNA probes for the detection of structural chromosomal abnormalities, enhancing their dominance. Regulatory clearances for companion diagnostics based on DNA probes and their incorporation into automated hybridization platforms have further consolidated their market leadership, establishing them as the gold standard in molecular diagnostics.

The RNA probe segment is anticipated to grow at the fastest rate during the forecast years with the growing need for gene expression analysis, infectious disease diagnosis, and neuroscience research. RNA probes play a critical role in the detection of mRNA and non-coding RNAs, offering useful information on gene regulation and biomarker discovery in cancer and neurodegenerative disorders. The increasing uptake of RNAscope and BaseScope technologies, with high sensitivity and single-cell resolution, has sped up the application of RNA probes in diagnostics and research. Furthermore, increased interest in spatial transcriptomics and liquid biopsy-based cancer diagnostics is widening the scope of applications for RNA probes. With precision medicine and RNA-targeted therapies on the rise, the market for RNA-based ISH assays will grow significantly, thus becoming the fastest-growing segment during the forecast period.

By Product

The Instruments segment dominated the in situ hybridization (ISH) market with a 34.12% market share in 2023 because of the growing adoption of automated ISH platforms that improve efficiency, accuracy, and reproducibility in diagnostic and research laboratories. Demand for high-throughput systems like automated slide stainers and hybridization workstations has played an important role in this segment dominating the market. These devices automate the ISH process, minimizing human errors and enhancing turnaround times, which is especially important in clinical diagnostics, cancer research, and genetic testing. Furthermore, top industry players have come up with cutting-edge imaging and digital pathology solutions coupled with ISH methods for accurate visualization and quantification of biomarkers. The growth of centralized pathology labs and molecular diagnostic facilities, along with growing regulatory clearances for automated ISH devices, has further established the supremacy of this segment in 2023.

By Application

The Cancer segment dominated the market with a 41.26% market share in 2023 on account of the growing worldwide cancer incidence and the escalating usage of molecular diagnostic methods for early diagnosis and targeted therapy. ISH, especially Fluorescence In Situ Hybridization (FISH), is of prime importance in the diagnosis of genetic disorders, chromosomal translocations, and gene amplifications that are involved in the many different kinds of cancers, such as breast cancer, lung cancer, and hematologic cancers. The increasing need for companion diagnostics in oncology, particularly for targeted therapy such as HER2 in breast cancer and ALK in lung cancer, has further strengthened the dominance of the segment. Moreover, technical advancements in digital pathology and artificial intelligence-based image analysis have enhanced the diagnostic accuracy of ISH-based cancer tests. The rising number of biomarker-guided clinical trials and regulatory approvals for ISH-based cancer assays has established its market leadership position.

By End-use

The Hospitals & Diagnostic Laboratories segment dominated the in situ hybridization (ISH) market with a 48.32% market share in 2023 because of the growing need for precise and early disease diagnosis, especially in cancer and genetic disorders. Diagnostic centers and hospitals are the main customers of FISH and CISH technologies for the detection of chromosomal abnormalities, infectious diseases, and cancer biomarkers. An increase in cancer prevalence, government expenditures for sophisticated molecular diagnosis, and growth in hospital-based genetic testing services have all driven this segment to leadership. Moreover, hospitals possess cutting-edge lab infrastructure and trained professionals, making them adopt automated ISH platforms for high-throughput analysis. The increase in hospital-based partnerships with research institutions and pharmaceutical firms has further strengthened the segment's dominance.

The CROs (Contract Research Organizations) segment is expected to grow the fastest during the forecast period due to the trend of outsourcing in drug discovery and biomarker research. Pharmaceutical and biotech firms are increasingly outsourcing clinical trials, companion diagnostics development, and regulatory affairs to CROs to save on in-house operating costs. The growth of personalized medicine and targeted therapies has generated greater demand for ISH-based biomarker verification and genomic analysis, in which CROs play a central role. The increased interest in gene expression analysis and spatial transcriptomics during drug development is also driving the engagement of CROs in ISH-based research. The availability of sophisticated laboratory facilities, affordable services, and proficiency in molecular diagnostics further speeds up CRO adoption, positioning it as the market's fastest-growing end-use segment.

In Situ Hybridization Market Regional Insights

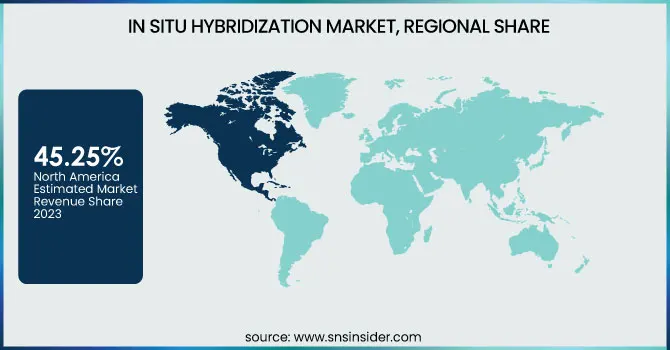

North America dominated the in situ hybridization (ISH) market with a 45.25% market share in 2023, with its well-developed healthcare system, high density of major industry players, and strong adoption of molecular diagnostic methods. The region has high government spending on cancer research, a rising need for personalized medicine, and the extensive use of fluorescence in situ hybridization (FISH) and chromogenic in situ hybridization (CISH) for diagnostics and drug development. Moreover, approval by regulatory agencies like the FDA for new ISH-based tests and increasing investment in precision medicine also fuel the growth of the market. The high incidence of cancer and genetic diseases in the U.S. and Canada also enhances the demand for ISH technology in cytogenetics, oncology, and infectious disease studies.

Asia Pacific is the fastest growing region throughout the forecast period with 8.43% CAGR, driven by growing healthcare investments, rising incidence of genetic diseases, and developing biotech and pharma sectors. Rapid progress in molecular diagnostics is being witnessed in nations such as China, India, and Japan, prompted by government support to improve healthcare infrastructure and encourage genomics research. The increasing demand for early diagnosis of diseases in the region, along with the rising awareness of personalized medicine, is driving the uptake of ISH methods. The availability of new players, growing partnerships among academic institutions and diagnostic firms, and affordable manufacturing capabilities also position Asia Pacific as a prominent center for market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players in the In Situ Hybridization Market

-

Agilent Technologies Inc. (FISH Probes, CISH Probes)

-

F. Hoffmann-La Roche Ltd. (VENTANA BenchMark XT, INFORM HER2 Dual ISH DNA Probe Cocktail)

-

Thermo Fisher Scientific Inc. (ViewRNA ISH Cell Assay Kit, QuantiGene ViewRNA ISH Tissue Assay)

-

BioGenex Laboratories (Xmatrx Elite, FISH Kits)

-

Abnova Corporation (RNA ISH Probes, DNA FISH Probes)

-

Biocare Medical LLC. (ZytoLight FISH Probes, ZytoDot CISH Probes)

-

Genemed Biotechnologies Inc. (FISH Probes, CISH Detection Kits)

-

Zytomed Systems GmbH (ZytoFast PLUS CISH Implementation Kit, ZytoLight SPEC ALK Dual Color Break Apart Probe)

-

Creative Bioarray (RNA FISH Probes, DNA FISH Probes)

-

Bio SB Inc. (Tinto FISH Probes, CISH Detection Systems)

-

Abbott Laboratories (Vysis ALK Break Apart FISH Probe Kit, Vysis CLL FISH Probe Kit)

-

Danaher Corporation (Leica BOND-III, RNAscope ISH Detection Kit)

-

Bio-Techne Corporation (RNAscope Assay, BaseScope Assay)

-

Oxford Gene Technology (Cytocell Aquarius FISH Probes, Cytocell Chromoprobe Multiprobe System)

-

PerkinElmer Inc. (QuantiGene ViewRNA ISH Tissue Assay, ViewRNA eZ-L Detection Kit)

-

Merck KGaA (Panomics QuantiGene ViewRNA ISH Cell Assay, ViewRNA ISH Tissue Assay)

-

Advanced Cell Diagnostics Inc. (RNAscope Multiplex Fluorescent Reagent Kit, BaseScope Duplex Assay)

-

Exiqon A/S (miRCURY LNA microRNA ISH Optimization Kit, miRCURY LNA microRNA Detection Probes)

-

Molecular Instruments Inc. (HCR RNA-FISH Probes, HCR Amplification Kits)

-

ACD - A Bio-Techne Brand (RNAscope HiPlex Assay, RNAscope 2.5 HD Assay)

Suppliers (These companies are prominent suppliers in the In situ hybridization market, offering a range of products that cater to various research and diagnostic needs.)

-

Agilent Technologies Inc.

-

F. Hoffmann-La Roche Ltd.

-

Thermo Fisher Scientific Inc.

-

BioGenex Laboratories

-

Abnova Corporation

-

Biocare Medical LLC.

-

Genemed Biotechnologies Inc.

-

Zytomed Systems GmbH

-

Creative Bioarray

-

Bio SB Inc.

Recent Development

-

In January 2024, Akoya Biosciences signed a license and distribution deal with Thermo Fisher Scientific. Under this partnership, Akoya is permitted to distribute its spatial biology solutions, which include imaging systems and reagents, in conjunction with Thermo Fisher's in situ hybridization assays. Through the partnership, the detection of protein and RNA biomarkers within tissue samples will be improved, enhancing research and diagnostics in spatial biology.

-

In January 2024, Biocare Medical revealed a partnership with Molecular Instruments to boost the automation of in situ hybridization and immunohistochemistry. Through the combination of Biocare Medical's experience in automated bioimaging systems and Molecular Instruments' hybridization chain reaction technology, the partnership aims to establish new benchmarks in automated biomarker detection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.82 Billion |

| Market Size by 2032 | US$ 3.43 Billion |

| CAGR | CAGR of 7.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (FISH, CISH) • By Probe (DNA, RNA) • By Product (Instruments, Consumables & Accessories, Software, Services) • By Application (Cancer, Cytogenetics, Developmental Biology, Infectious Diseases, Others) • By End-use (Hospitals & Diagnostic Laboratories, CROs, Academic & Research Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Agilent Technologies Inc., F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., BioGenex Laboratories, Abnova Corporation, Biocare Medical LLC., Genemed Biotechnologies Inc., Zytomed Systems GmbH, Creative Bioarray, Bio SB Inc., Abbott Laboratories, Danaher Corporation, Bio-Techne Corporation, Oxford Gene Technology, PerkinElmer Inc., Merck KGaA, Advanced Cell Diagnostics Inc., Exiqon A/S, Molecular Instruments Inc., ACD - A Bio-Techne Brand, and other players. |