Clinical Trial Supplies Market Overview:

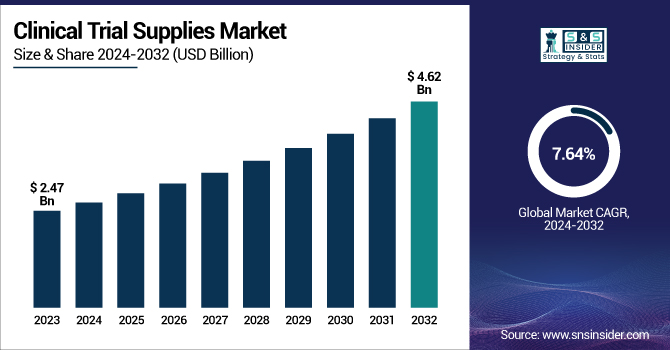

The Clinical Trial Supplies Market was valued at USD 2.47 billion in 2023 and is expected to reach USD 4.62 billion by 2032, growing at a CAGR of 7.20% from 2024 to 2032.

To Get more information on Clinical Trial Supplies Market - Request Free Sample Report

The Clinical Trial Supplies Market report provides a detailed analysis of completed and ongoing clinical trials, grouped by phase and region to identify trial activity trends. It offers insights into the pipeline of drug development, such as regulatory approvals and fast-track designations. The report discusses supply chain challenges and logistics trends with an emphasis on cold chain logistics and decentralized trials. Further, it addresses healthcare expenditure on clinical trials, reporting investments by governments, CROs, and pharma companies. Finally, the report delves into outsourcing trends, highlighting the growing dependence on CROs and CDMOs for managing trial supply.

Clinical Trial Supplies Market Dynamics

Drivers

-

The increasing number of clinical trials worldwide is propelling market growth.

The increasing incidence of chronic diseases and the demand for new therapies have led to a dramatic rise in the number of clinical trials worldwide. As of 2023, ClinicalTrials.gov reported more than 450,000 registered clinical studies worldwide, which indicates the accelerated growth of drug development operations. This growth has created a high demand for effective clinical trial supply chains, such as those for comparator drugs, cold-chain logistics, and biological sample management. In addition, regulatory bodies like the FDA and EMA are making approval processes more streamlined, speeding up clinical trials even further. Thermo Fisher Scientific and Catalent are just a few of the companies that have increased their clinical supply chain services to cater to this need. Furthermore, the move toward decentralized and adaptive trials is bringing new supply challenges, increasing the demand for sophisticated storage, distribution, and logistics solutions in clinical trials.

-

The Clinical Trial Supplies Market is faced with very real challenges due to supply chain breakdown and logistical inefficiency.

Biologics, such as monoclonal antibodies, gene therapies, and RNA-based medicines, demand precise temperature-controlled storage and distribution, heightening dependence on sophisticated clinical supply chain management. The FDA reports that more than 60% of recent new drug approvals were biologics. Furthermore, personalized medicine, fueled by genomic innovation, requires tailored clinical trial supply solutions. Pharmaceutical firms such as WuXi AppTec and Charles River Laboratories are extending their capabilities to accommodate cell and gene therapy trials. Clinical trial supply providers are increasingly required to keep pace with sophisticated logistics, such as cryogenic storage and real-time monitoring solutions, to maintain the integrity of sensitive biological products during worldwide trials.

Restraint

-

The clinical trial supplies market faces serious challenges due to stringent and evolving regulatory guidelines in different regions.

Clinical trials have to satisfy Good Manufacturing Practice (GMP), Good Distribution Practice (GDP), as well as regulatory systems specific to countries, developing complexities in logistical and administrative domains. For example, the U.S. FDA, European Medicines Agency (EMA), and China's National Medical Products Administration (NMPA) have stringent requirements for drug storage, distribution, and labeling, which result in higher operational costs and delays. Brexit has also created new regulatory hurdles for clinical trials in the UK and EU, making supply chain coordination more complex. Companies are also required to comply with the EU Clinical Trials Regulation (CTR), which necessitates centralized trial submissions, affecting trial timelines. These issues slow market expansion, with firms having to spend on bespoke regulatory staff and technology to drive through complicated compliance environments effectively.

Opportunities

-

The increasing use of decentralized and virtual clinical trials offers a great opportunity for the Clinical Trial Supplies Market.

The increasing use of decentralized and virtual clinical trials is a major opportunity for the Clinical Trial Supplies Market. With developments in telemedicine, remote patient monitoring, and digital health technologies, pharmaceutical and biotech industries are moving toward hybrid and fully decentralized trial designs. This transformation minimizes patient burden, improves recruitment rates, and maximizes trial efficiency. More than 70% of trial sponsors are likely to include decentralized aspects in their studies, according to industry reports. This transformation requires creative supply chain solutions, including direct-to-patient drug delivery and remote collection of biological samples. Logistics companies that specialize in temperature-sensitive shipments are also in high demand. Firms that invest in digital monitoring, real-time inventory management, and adaptive distribution networks will be at a competitive advantage, fueling growth in clinical trial supplies and related services.

Challenges

-

The Clinical Trial Supplies Market is faced with very real challenges due to supply chain breakdown and logistical inefficiency.

The COVID-19 pandemic revealed weaknesses in global supply chains, resulting in trial delays and drug shortages. Escalating geopolitical tensions, trade barriers, and volatile demand patterns add to the complexity of supply management. The Russia- Ukraine conflict, for instance, has impacted clinical trial operations in Eastern Europe, interfering with supply channels and regulatory clearances. Furthermore, the rising complexity of clinical trials, including biologics, cell and gene therapies, and personalized medicine, requires robust temperature-controlled logistics, increasing cost and risk. Customs clearance, regulatory paperwork, and drug production delays also affect trial duration. To surmount these problems, firms have to invest in strong contingency measures, risk-reduction strategies, and sophisticated supply chain technologies to support smooth clinical trial operations.

Clinical Trial Supplies Market Segmentation Analysis

By Clinical Phase

The Phase III segment dominated the Clinical Trial Supplies Market with a 55.14% market share in 2023, owing to its complexity, high patient recruitment, and long supply chain needs. Phase III trials are usually conducted on thousands of patients from various geographic locations, and a huge quantity of investigational drugs, comparators, placebos, and ancillary supplies is needed. These trials are critical for regulatory approvals, resulting in greater investments by pharmaceutical and biotechnology firms. Moreover, stringent adherence to Good Manufacturing Practice (GMP) and Good Distribution Practice (GDP) requires customized storage, packaging, and logistics. With the growing volume of biologics, oncology treatments, and precision medicine trials, Phase III trials require state-of-the-art cold chain logistics and real-time tracking. The boom in worldwide clinical research and increasing emphasis on new drug development further cement Phase III as the most prominent segment in the clinical trial supplies market.

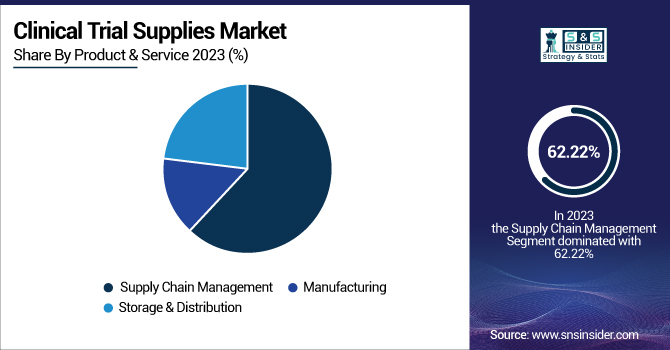

By Product & Service

The Supply Chain Management segment dominated the clinical trial supplies market with a 62.22% market share in 2023 on account of the growing complexity of clinical trials, research site globalization, and the requirement to meet strict regulatory compliance. Contemporary clinical trials are multi-country operations that demand streamlined coordination of drug distribution, cold chain management, and inventory monitoring. Growth in personalized medicine, biologics, and cell and gene therapies has contributed to increased requirements for advanced supply chain solutions to store temperature-sensitive drugs. Furthermore, real-time traceability, risk mitigation tactics, and digital supply chain tools like blockchain and forecasting based on artificial intelligence have gained importance to retain efficiency. As there is an increased emphasis on minimizing delays and optimizing trial operations, pharmaceutical and biotech organizations heavily depend on sophisticated supply chain management tools, and so it emerges as the leading segment in 2023.

By Therapeutic Use

The Oncology segment dominated the clinical trial supplies market with a 65.32% market share in 2023, based on the escalating number of cases of cancer across the globe and the critical requirement for new treatments. With a total of more than 19 million new instances of cancer occurring in 2023, drug and biotechnology firms have raised efforts to develop targeted therapy, immunotherapy, and individualized medicine. The high level of complexity and regulatory demands of oncology trials require sophisticated supply chain management, cold chain logistics, and specialized handling of biologics. The growing number of late-phase oncology trials has also fueled greater demand for clinical trial supplies. Government support, cancer research funding, and accelerated approval mechanisms have also spurred investments in this segment. Increasing attention to precision oncology, biomarker-guided trials, and combination therapies has continued to consolidate oncology's position as the leading therapeutic field in clinical trials.

By End Use

The Pharmaceuticals segment dominated the clinical trial supplies market with a 65.22% market share in 2023 as a result of the large number of drug development processes, particularly for small molecules, biologics, and novel therapies. The pharmaceutical sector represented a major share of clinical trials, spurred by the rising incidence of chronic diseases like cancer, cardiovascular diseases, and autoimmune diseases, which require ongoing drug innovation. In addition, increased expansion of customized medicines and precision therapies has grown the demand for sound clinical trial infrastructure. Established pharma organizations heavily invest in clinical research, regulatory affairs, and supply chain effectiveness, managing trial material delivery efficiently. Also, increased R&D spending, fast-track approval procedures, and increasing partnerships between pharma organizations and contract research organizations (CROs) have fortified the supremacy of the pharmaceuticals division in the industry.

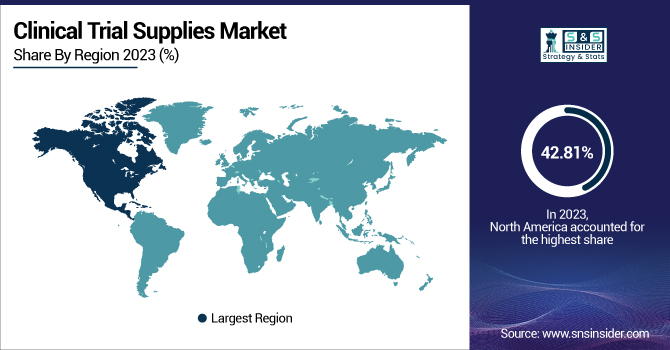

Clinical Trial Supplies Market Regional Insights

North America dominated the clinical trial supplies market with a 42.81% market share in 2023 because of its advanced pharmaceutical and biotechnology sector, sophisticated healthcare infrastructure, and robust regulatory environment. Major players in the market, like Thermo Fisher Scientific, Catalent Pharma Solutions, and Parexel International, contribute to the dominance of the region. The United States has the largest number of clinical trials in the world, with the favorable regulatory environment at the FDA allowing quick approval of the trials. Moreover, high investments in drug development and the implementation of sophisticated supply chain management tools help in dominating the market. The region is also supported by a robust logistics network, facilitating the effective distribution of clinical trial supplies. Moreover, North America's focus on precision medicine, biologics, and gene therapies requires customized supply chain solutions, which makes it the top market.

Asia Pacific is the fastest-growing region in the clinical trial supplies market, fueled by the increasing number of clinical trials, reduced operating costs, and a growing pharmaceutical sector. China, India, and South Korea are emerging as key clinical trial centers because of their huge patient base, rising government support, and positive regulatory reforms. Increased footprints of multinationals from the pharmaceutical and CRO industry in the region drive market growth even further. Progress in cold chain logistics, as well as decentralized trials, also maximizes supply chain effectiveness. With a growing prevalence of chronic disease and increasing need for innovative drugs, the demand for strong clinical trial supply solutions increases. As regulation systems become increasingly harmonized to international standards, Asia Pacific should see further growth in clinical trials.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Clinical Trial Supplies Market

-

Thermo Fisher Scientific (Clinical Ancillary Supplies, Comparator Drugs)

-

VWR International (Laboratory Chemicals, Protective Clothing)

-

Grifols (Plasma-Derived Medicines, In Vitro Diagnostic Products)

-

Catalent Pharma Solutions (Clinical Supply Services, Biologics Development)

-

Parexel International (Clinical Trial Management, Regulatory Consulting)

-

PRA Health Sciences (Clinical Research Services, Data Solutions)

-

ICON plc (Clinical Development, Laboratory Services)

-

PPD (Pharmaceutical Product Development) (Clinical Trial Management, Laboratory Services)

-

Almac Group (Clinical Trial Supply, Analytical Services)

-

Covance Inc. (Clinical Trial Testing, Drug Development Services)

-

Medpace Holdings, Inc. (Clinical Trial Management, Medical Device Development)

-

Eurofins Scientific (Bioanalytical Testing, Genomic Services)

-

WuXi AppTec (Laboratory Testing, Clinical Development)

-

Charles River Laboratories (Preclinical Services, Clinical Support)

-

Biocair International (Specialist Logistics, Temperature-Controlled Transport)

-

Movianto (Healthcare Logistics, Warehousing Solutions)

-

Fisher Clinical Services (Clinical Supply Chain Management, Packaging Solutions)

-

Sharp Clinical Services (Clinical Trial Packaging, Distribution Services)

-

PCI Pharma Services (Clinical Trial Supply, Packaging Solutions)

-

Clinigen Group (Clinical Supplies Management, Comparator Sourcing)

Suppliers (These suppliers commonly provide clinical trial materials, including investigational drugs, comparator drugs, placebos, packaging, labeling, storage, and global logistics services to ensure the efficient supply chain management of clinical trials.) in Clinical Trial Supplies Market.

-

Thermo Fisher Scientific

-

VWR International

-

Catalent Pharma Solutions

-

Almac Group

-

Sharp Clinical Services

-

PCI Pharma Services

-

Biocair International

-

Movianto

-

Fisher Clinical Services

-

Clinigen Group

Recent Developments

-

June 2024 – Thermo Fisher Scientific Inc., the world leader in serving science, has expanded its European clinical trial network with the launch of a new clinical and commercial ultra-cold facility in the EU. Situated in Bleiswijk, Netherlands, the cutting-edge current good manufacturing practice (cGMP) facility is set to speed up advanced therapy development. It provides pharma and biopharma customers with end-to-end, full-service support throughout the clinical supply chain for high-value therapies such as cell and gene therapies, biologics, antibodies, and vaccines.

-

In 2023, Thermo Fisher Scientific launched Grifols sCD38, the first soluble recombinant protein specifically engineered to inhibit anti-CD38 antibodies in patients with multiple myeloma who are receiving daratumumab therapy. This breakthrough improves the speed and precision of blood transfusion tests, guaranteeing high-quality treatment results.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.47 billion |

| Market Size by 2032 | US$ 4.62 billion |

| CAGR | CAGR of 7.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Clinical Phase (Phase I, Phase II, Phase III, Others) • By Product & Service (Manufacturing, Storage & Distribution, Supply Chain Management) • By End Use (Pharmaceuticals, Biologics, Medical Devices, Others) • By Therapeutic Use (Oncology, CNS Diseases, Cardiovascular Diseases, Infectious Diseases, Metabolic Disorders, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, VWR International, Grifols, Catalent Pharma Solutions, Parexel International, PRA Health Sciences, ICON plc, PPD (Pharmaceutical Product Development), Almac Group, Covance Inc., Medpace Holdings, Inc., Eurofins Scientific, WuXi AppTec, Charles River Laboratories, Biocair International, Movianto, Fisher Clinical Services, Sharp Clinical Services, PCI Pharma Services, Clinigen Group, and other players. |