Clinical Trials Matching Software Market Report Scope & Overview:

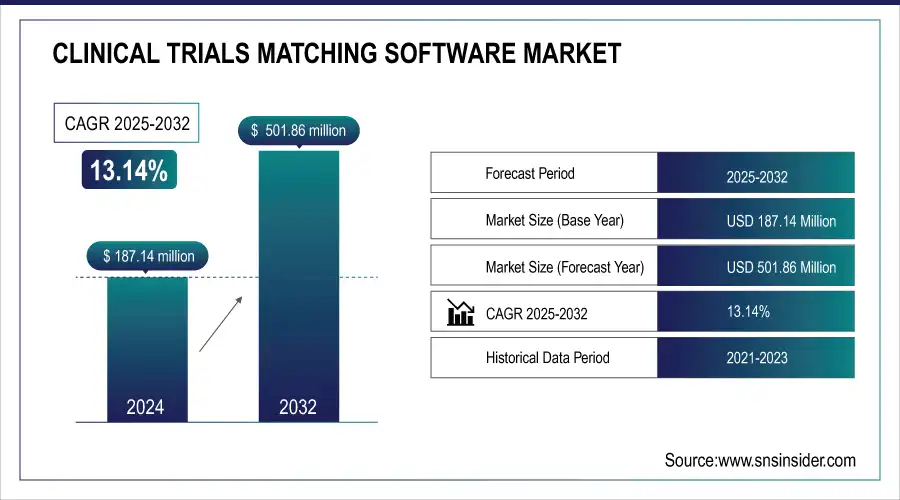

The clinical trials matching software market was valued at USD 187.14 million in 2024 and is expected to reach USD 501.86 million by 2032, growing at a CAGR of 13.14% over the forecast period of 2025-2032.

The global clinical trials matching software market is growing strongly, with the trends of increased trial complexity (DCT) and AI-based patient recruitment. A prominent clinical trials matching software market trend is witnessing increasing integration with EHR, real-time eligibility matching, and patient-facing platforms. Sponsors and CROs are also to cut down on enrolment timelines and improve something they call trial efficiency. There is also a move in the market towards interoperability, value-based recruitment, and precision-medicine informed matching strategies.

For instance, in January 2025, AI-based trial matching software reduced patient enrollment time by 32% in Phase II oncology trials, enhancing recruitment speed and trial efficiency across the U.S. and Europe.

To Get More Information On Clinical Trials Matching Software Market - Request Free Sample Report

Key Clinical Trials Matching Software Market Trends

-

AI-driven and automated patient matching gaining traction: Tools using AI, NLP, and EHR integration improve accuracy, reduce manual errors, and accelerate trial enrollment.

-

Integration with digital health platforms: Cloud-based and interoperable solutions enhance data accessibility, real-time monitoring, and trial efficiency.

-

Personalized and adaptive matching algorithms emerging: Customized trial recommendations based on genomic, demographic, and clinical data improve recruitment for complex or rare disease trials.

-

Rising prevalence of chronic and rare diseases: Growing patient populations with cancer, autoimmune, and genetic disorders increase demand for precise trial matching.

-

Expansion in emerging markets: APAC, LATAM, and MEA regions see increasing clinical research activity, digital infrastructure adoption, and regulatory support, boosting market growth.

-

Focus on cost-efficiency and faster enrollment: Reducing recruitment time, operational costs, and trial delays drives adoption among sponsors and CROs.

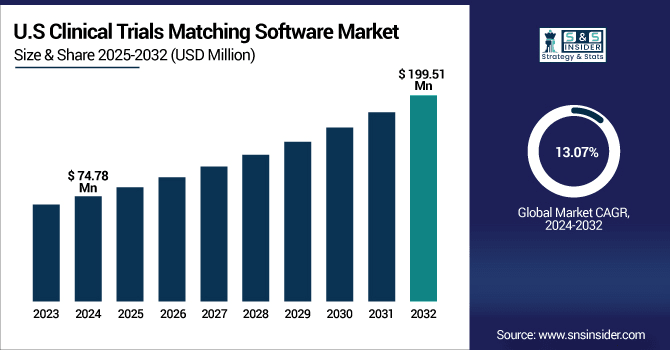

The U.S. clinical trials matching software market was valued at USD 74.78 million in 2024 and is expected to reach USD 199.51 million by 2032, growing at a CAGR of 13.07% over 2025-2032. The clinical trials matching software market is led by the U.S. on account of, highly developed healthcare IT infrastructure, an increased number of clinical trials, and surging AI adoption. Regulatory leniency and the integration with EHRs foster innovation. These clinical trials matching software market analysis demonstrates that the U.S.-based pharma, CROs, and tech companies are making significant investments in AI to expedite patient recruitment and improve trial operations.

Clinical Trials Matching Software Market Growth Drivers:

-

Growing Integration with EHR/EMR Systems is Driving the Clinical Trials Matching Software Market Growth

The increasing integration of clinical trials matching software with EHR/EMR has been attributed as the primary factor that has facilitated real-time patient data access for accurate eligibility screening. Such expedited enrollment, which is far beyond the expected number, minimizes recruitment lag time and increases the efficacy of the study. Solutions with EHR integration, accordingly, are gaining the clinical trials matching software market share, particularly among U.S. and European hospitals and research networks.

For instance, in March 2025, over 72% of U.S. hospitals integrated trial matching software with EHRs, driving a 28% market share increase among large healthcare networks since 2023.

Clinical Trials Matching Software Market Restraints:

-

Lack of standardized data across healthcare systems is Hampering the Clinical Trials Matching Software Market Growth

Lack of data standardization among healthcare systems is a significant limitation to the clinical trials matching software market growth. Variations in formats and lack of complete information in EHRs, and difficulties in EHR interoperability, represent barriers to accurate patient-trial matching. This fragmentation impedes the effectiveness of software, especially in multi-center or global trials, delaying use and integration despite an increasing need. Attacking the problem of data harmonization continues to be a key enabler to realizing the full potential of the market.

Clinical Trials Matching Software Market Opportunities:

-

Decentralized and Virtual Clinical Trials Creates Lucrative Opportunities for Innovative Testing Equipment

Decentralized and virtual clinical trials describe this transformation from the conventional site-based trials to remote and patient-focused ones. Clinical trials matching platforms also scale quickly to identify and enroll eligible participants wherever they are and can be integrated with a telemedicine platform and monitor patients remotely. This strategy lessens travel burden, increases patient access, accelerates recruitment timelines, and enhances trial diversity and retention.

For instance, in September 2025, APAC decentralized clinical trials grew 50% year-over-year, with patient-matching software enabling enrollment of rural and underrepresented populations, expanding trial reach and diversity.Top of FormTop of Form

Clinical Trials Matching Software Market Segment Analysis

-

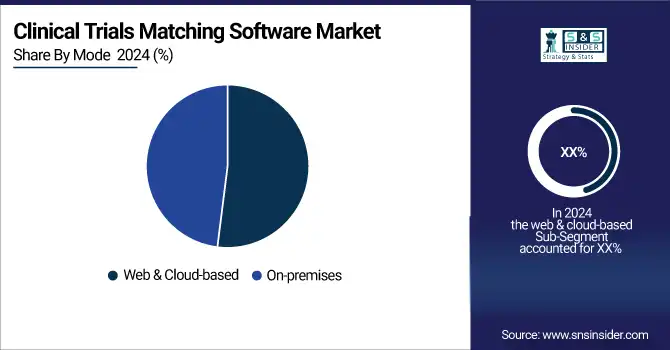

By mode, web & cloud-based led the clinical trials matching software market with a 90.94% share in 2024, while on-premises is the fastest-growing segment with a CAGR of 14.32%.

-

By component, the software/platform dominated the market with a 65.83% share in 2024, whereas the services segment is expected to grow fastest with a CAGR of 13.44%.

-

By application, patient recruitment & matching led the market with 45.34% share in 2024, and data integration & interoperability registered the fastest growth with a CAGR of 13.48%.

-

By end user, pharmaceutical & biotechnology companies held a 60.86% share in 2024, while cros are growing the fastest with a CAGR of 13.86%.

By Mode, Web & Cloud-based Lead Market While On-premises Registers Fastest Growth

In 2024, web & cloud-based lead the clinical trials matching software market, holding the largest share owing to their ability to be scaled, accessed in real time, and onboarded into EHRs. These tools facilitate decentralized trials and remote patient recruitment, in line with ever-changing trial models. On-premises are registering the fastest growth, driven by increasing requirements for data security, regulatory standards, and also by organizational dominion over sensitive patient data.

By Component, Software/Platform Dominates, While the Services Show Rapid Growth

By component, the software/platform dominates the clinical trials matching software market, as it is the heart of computerized patient-trial matching, eligibility screening, and protocol feasibility. With advanced AI algorithms, real-time analytics, and EHR integration. The services are showing rapid growth fueled by increased demand for implementation, systems integration, and consulting services. As sponsors leverage more sophisticated, AI-enabled platforms, sponsors increasingly depend on service providers to help them onboard, train, and configure systems.

By Application, Patient Recruitment and Data Integration & Interoperability Register Fastest Growth

By application, patient recruitment & matching leads the clinical trials matching software market, driven by directly shortening the time to enrollment and increasing the efficiency of the trials. Growth of trial complexity, AI-driven matching algorithms, and sponsor demand for accelerated recruitment are among the principal motivating forces. And data integration & interoperability is registering the fastest growth, due to demand to aggregate broken parts of healthcare data across EHRs, labs, and wearables. Sponsors and CROs are demanding interoperable solutions in order to better identify patients across sites.

By End User, Pharmaceutical & Biotechnology Companies Leads While CROs Grows Fastest

By end user, pharmaceutical & biotechnology companies lead the clinical trials matching software market, owing to their high throughput of clinical trials, robust R&D spend, and the need to speed up patient recruitment; they are also strong candidates for taking this approach. Whereas CROs are growing the fastest, fueled by the growing outsourcing of clinical operations by pharma and biotech. CROs are using matching software to make their patient recruitment more efficient, to administer multi-site trials, and provide competitive, tech-enabled services.

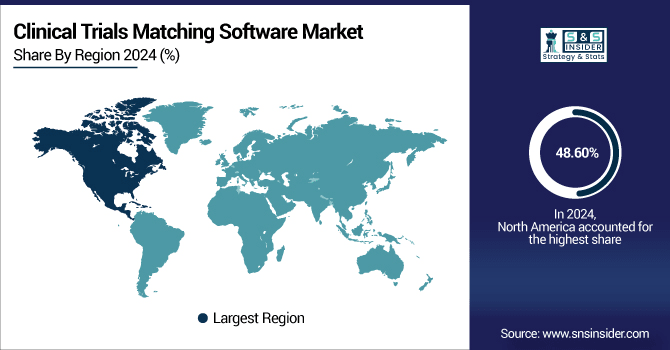

Clinical Trials Matching Software Market Regional Analysis:

North America Clinical Trials Matching Software Market Insights

In 2024, North America dominated the clinical trials matching software market and accounted for 48.60% of the revenue share. owing to the penetration of healthcare IT, the large concentration of clinical trials, and the presence of leading software vendors. Favorable regulations, a high rate of EHR adoption, and significant R&D investments by reported companies also contribute to regional dominance, and being a hotbed of innovation in patient recruitment and trial optimization technologies.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Clinical Trials Matching Software Market Insights

The clinical trials matching software market is led by the U.S. on account of, highly developed healthcare IT infrastructure, an increased number of clinical trials, and surging AI adoption. Regulatory leniency and the integration with EHRs foster innovation.

Asia-Pacific Clinical Trials Matching Software Market Insights

Asia-Pacific is expected to witness the fastest growth in the clinical trials matching software market over 2025-2032, with a projected CAGR of 13.94% driven by an acceleration of clinical trials activity, growth in healthcare infrastructure, and government support for digital health. Countries including China, India, South Korea, and Japan are making huge investments in AI-based healthcare products and patient recruitment tools. The region has a multicultural and multiracial patient population, perfect for global studies, so efficient matching tools are needed. Explosive uptake of EHR systems, CROs increasing their presence, and international pharma partners collaborating with local research centers add to the demand.

China Clinical Trials Matching Software Market Insights

China is leading the regional clinical trials matching software market due to its fast-growing healthcare infrastructure and the emerging clinical research market. Government initiatives in favor of digital health, efficient clinical trials, and local development of AI-driven matching platforms are fostering the adoption among hospitals, research institutions, and contract research organizations.

Europe Clinical Trials Matching Software Market Insights

The clinical trials matching software market in Europe is growing at a steady pace owing to the robust healthcare infrastructure, stringent regulations for patient safety and research, and the rise in the use of Decentralized Trials. Increasing attention to precision medicine, AI-driven patient recruitment, and cross-border trials is fueling this demand. Countries such as Germany, France, and the UK are taking the lead, driven by government-led initiatives, Digital Health Investments, along with CROs and hospital collaborations.

Germany Clinical Trials Matching Software Market Insights

Germany, a country with high healthcare standards and a focus on patient safety, is the largest market for Clinical Trials Matching Software in Europe. AI-powered and EHR-centric platforms are being rapidly embraced by hospitals and CROs to accelerate investigational patient recruitment, enhance study efficiency, and maintain regulatory compliance as a better, faster, and cheaper replacement to the traditional manual enrollment methodologies.

Latin America (LATAM) and Middle East & Africa (MEA) Clinical Trials Matching Software Market Insights

The clinical trials matching software market in Latin America and the Middle East & Africa is expanding due to the enhanced healthcare infrastructure, rising clinical research volumes, and government initiatives. Growing usage of digital health instruments and decentralized trials fosters cost-effective patient recruitment, whereas countries such as Brazil, Mexico, Saudi Arabia, and the UAE concentrate on enhancing trial accessibility, enrollment speed, and regulatory compliance.

Clinical Trials Matching Software Market for Competitive Landscape:

IBM Watson Health: Uses artificial intelligence, natural language processing, and real-world data to better match patients with trials. Assists hospitals, sponsors, and CROs with faster patient recruitment, increased trial efficiency, and regulatory compliance. Robust analytics facilitate trial design, patient stratification, and prediction of endpoints for complicated trials globally.

-

In March 2024, Launched Watson for Clinical Trials Enrollment 2.0, enhancing AI-driven patient matching with EHR data, reducing recruitment time by 30% in oncology and cardiology trials.

Antidote Technologies: Working to make the clinical trial experience patient-centric by matching patients with the trials that are right for them through digital means. Utilizes AI-powered algorithms and data analytics to optimize the hiring process, shorten time to hire, and open up capacity for new patients. Specializing in oncology, rare diseases, and chronic conditions, with a focus on decentralized trials and global patient engagement.

-

In July 2024, expanded to Europe and APAC, integrating AI-powered patient engagement tools, boosting decentralized trial enrollment, especially in rare disease and oncology studies.

Deep 6 AI: Offers AI-based software that quickly matches eligible patients from electronic medical records. Improves recruitment effectiveness, decreases the duration of trials, and facilitates precision medicine research. Oncology/Rare Diseases expertise, enabling real-time insights, predictive analytics, and intelligent patient cohorts for life sciences organizations and hospitals.

-

In January 2025, introduced Clinical Insights Suite, enabling real-time cohort identification and predictive analytics from EHRs, improving enrollment efficiency by 25% and accelerating precision medicine trials.

Clinical Trials Matching Software Market Key Players:

Some of the clinical trials matching software market Companies

-

IBM Watson Health

-

Antidote Technologies

-

Deep 6 AI

-

TriNetX

-

Clinerion

-

ConcertAI

-

Emergent Connect

-

Trialspark

-

ClinOne

-

Elligo Health Research

-

Phreesia

-

HealthMatch

-

SubjectWell

-

JPNV

-

TrialJectory

-

Parexel

-

Inato

-

Mendel.ai

-

PatientWing

-

Flatiron Health

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 187.14 million |

| Market Size by 2032 | USD 501.86 million |

| CAGR | CAGR of 13.14% from 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | "• By Mode (Web & Cloud-based, On-premises) • By Component (Software/Platform, Services) • By Application (Patient Recruitment & Matching, Protocol Feasibility & Site Selection, Real-time Patient Monitoring, Data Integration & Interoperability) •By End User (Pharmaceutical & Biotechnology Companies, CROs, Medical Device Firms) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | IBM Watson Health, Antidote Technologies, Deep 6 AI, TriNetX, Clinerion, ConcertAI, Emergent Connect, Trialspark, ClinOne, Elligo Health Research, Phreesia, HealthMatch, SubjectWell, JPNV, TrialJectory, Parexel, Inato, Mendel.ai, PatientWing, Flatiron Health, and other players. |