Cloud Compliance Market Size & Overview:

Get More Information on Cloud Compliance Market - Request Sample Report

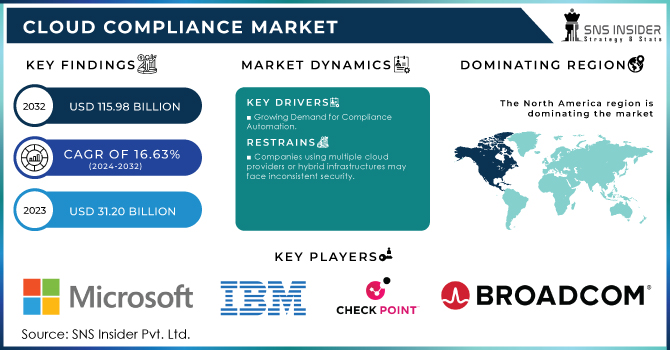

The Gobal Cloud Compliance Market Size, valued at USD 31.20 Billion in 2023, is projected to reach USD 115.98 Billion by 2032, growing at a CAGR of 16.63% during the forecast period.

The growth of the cloud compliance market has been driven by the increasing reliance on cloud services and the increasingly stringent regulatory environment in the cloud compliance market. Governments around the world have been increasingly enacting more stringent data protection policies surrounding data, particularly in the cloud. The US Department of Homeland Security reported that cloud services can now be counted as part of new critical infrastructure pieces in its 2023 cybersecurity update. More importantly, there has been an increase in the total number of compliance mandates and compliances demanded by cloud services in the market. One of these has been the Federal Risk and Authorization Management Program or FedRAMP which demands high levels of cloud security. The European Union has also enforced the General Data Protection Regulation which demands heavy penalties from those who fail to adhere to these requirements, with the EU reporting that compliance fines exceed €1.5 billion in 2023. This rise in stringent policies globally has prompted organizations to invest significantly in cloud compliance solutions, driving market growth as enterprises seek to mitigate legal and financial risks.

Cloud compliance refers to the requirement that systems offered by the cloud comply with both internal and external regulations. Organizations need to comply with a variety of regulations, such as data privacy regulations, security regulations, and financial regulations. Cloud compliance solutions can help organizations assess their compliance risks and implement the necessary controls to ensure that they are compliant with the latest regulations.

Cloud Compliance Market Dynamics

Drivers

-

Stringent data protection laws like GDPR, CCPA, and HIPAA are forcing organizations to adopt cloud compliance solutions to avoid hefty penalties and ensure data security.

-

With more businesses migrating to cloud environments, there is a growing need for automated compliance solutions to manage and streamline regulatory requirements efficiently.

-

Growing Demand for Compliance Automation and increasing awareness of cloud security risks

The increasing government regulations to ensure the security and privacy of the data are one of the prime factors driving the cloud compliance market. Governments around the world are now introducing regulations to ensure that the massive data stored and processed in cloud environments is secure. For example, the General Data Protection Regulation of the European Union is considered a global data protection standard. It requires every organization that processes or even touches the data of EU citizens, regardless of the company’s location, to comply. In the United States, the California Consumer Privacy Act and the Health Insurance Portability and Accountability Act are two of the laws that have forced businesses to remain compliant. HHS reported that by the end of this year, 45% of healthcare providers had some degree of cloud-based services as a measure to comply with HIPAA. The influence of the Dodd-Frank Act and FedRAMP is also increasing in banks and financial institutions. According to the US SEC, fines worth over $12 billion in bank and financial data breaches were reported, as and lack of compliance by organizations. These stringent rules are pushing organizations to adopt cloud compliance solutions to avoid legal repercussions and protect sensitive data effectively.

Restraints

-

The rapidly changing and diverse compliance regulations across regions make it challenging for companies to keep up with and implement the necessary compliance measures.

-

The financial burden of implementing and maintaining cloud compliance software, especially for small and medium-sized enterprises (SMEs), can be prohibitive, limiting market adoption.

-

Companies using multiple cloud providers or hybrid infrastructures may face inconsistent security.

The major restraint in the cloud compliance market is the complexity of compliance requirements. Different legislations such as GDPR, HIPAA, and CCPA vary significantly across regions and industries, making it challenging for businesses to maintain compliance across all applicable laws. This means that different organizations have to handle several compliance frameworks, each with its own set of rules, processes, and sanctions for non-compliance. Moreover, the laws keep changing on a regular basis which means that companies have to constantly monitor current trends and amend their cloud compliance strategies in real time. Multinational companies are faced with an even bigger challenge given that they have to abide by different laws while ensuring that the working habits concerning data remain the same across various regions. The problem with this level of complexity is that it increases the likelihood of not being compliant and hinders process optimization as it guarantees inefficiency. The dynamic nature of regulatory changes makes it hard for businesses to keep up, creating compliance bottlenecks.

Opportunity

- The increasing popularity of hybrid and multi-cloud provision is creating opportunities for cloud compliance solutions.

Cloud Compliance Market Segment analysis

By Component

The cloud compliance market’s software segment held the highest share 58% of revenue in 2023. The rising demand for automation and efficiency in complying with highly complex regulatory mandates is a significant driving factor. Governments are actively promoting the use of cloud compliance software by businesses and public organizations to mitigate their compliance risks and costs. For instance, the U.S. government's National Institute of Standards and Technology (NIST) published statistics showing that over 75% of federal agencies have shifted to cloud-based software to meet evolving compliance mandates. These software solutions include automated risk assessment tools and audit trails as well as continuous monitoring, eliminating human error and tedious manual labor, and lowering operational costs. In addition, the need for flexible and scalable compliance solutions is crucial as businesses deal with rapidly changing regulations like businesses in different industries face rapidly changing regulatory frameworks. An excellent example is California’s Consumer Privacy Act which imposed 30% more in fines in 2023 to address non-compliance data fraud, according to the state’s Attorney General Office.

By Application

In 2023, the audit and compliance management segment held the largest market share of the cloud compliance market. This growth is attributed to the increasing regulatory focus on audit trails, governance, and compliance across industries. For instance, according to the 2023 report published by the European Data Protection Board, organizations were demanded to adhere to higher standards in maintaining audit logs and data governance. Reportedly, over 60% of European enterprises increased their investment in audit and compliance management solutions, with most of these implemented to meet GDPR requirements and avoid fines. The U.S. Federal Trade Commission also published its data in the same year that, of all non-compliance fines, 40% were owed to noncompliance with audits. Audit and compliance management systems help businesses to track, report, and stay compliant in audits by offering solutions for tracking, reporting, and staying compliant in case of regulatory auditing trails. Most of these tools also offer cloud systems to enable businesses to store all their audit data in the cloud. Notably, the popularity of this tool is still increasing, and as a result, this market segment is experiencing unprecedented growth.

By End-User

The BFSI (banking, financial services, and insurance) sector held the largest revenue share 23% of the cloud compliance market. This can be attributed to the growing regulatory pressure and the sensitive nature of financial data. Government statistics show that the global BFSI sector faced over $12 billion in fines in 2023 due to non-compliance with data protection regulations, as reported by the U.S. Securities and Exchange Commission (SEC). This has led to substantial investments in cloud compliance solutions to ensure the security and compliance of financial data in the cloud.

On the other hand, the healthcare industry will grow with the highest CAGR throughout the forecast period. The increased buying behavior of cloud remedies and regulatory frameworks adoption, such as HIPAA, have spurred growth in the healthcare sector. The U.S. Department of Human and Health Services disclosed that by the end of 2023, 45% of healthcare providers in the U.S. will conclude their analysis and upgrade to cloud remedial services. To address the rising demand, investors are asked to concentrate on ventures that will deliver adequate compliance mechanisms to ensure patient data security and regulatory compliance.

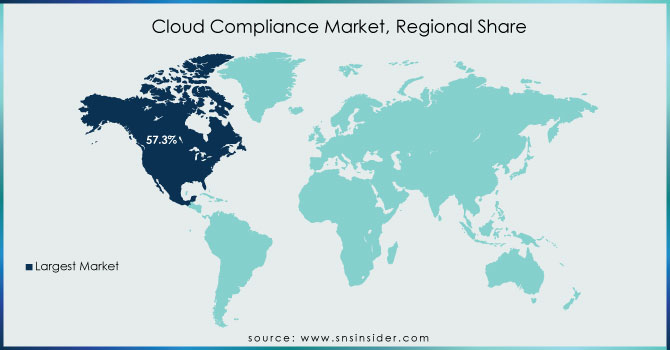

Regional Analysis

North America led the cloud compliance market in 2023, with over 38% of the global share. This dominance emerged due to the region’s strict regulatory environment and the high pace of cloud technology adoption. In the United States, the federal government laid down strict cloud compliance standards for the public and private sectors using the FedRAMP framework. The U.S. Federal Communications Commission reported that the number of businesses adopting cloud services increased by 20% in 2023. Moreover, Canada’s Personal Information Protection and Electronic Documents Act also dictated strict data governance and compliance requirements, fostering high investments in cloud compliance technologies. Cloud computing is growing exponentially and attracting high government interest, making cloud compliance solutions an essential priority for businesses to conform to the law and avoid penalties. As such, it processes as the largest market base for cloud compliance solutions and causes the generation of the most significant revenue across all regions. The United States leads the cloud compliance market in North America, accounting for a significant market share in 2023. Canada is the second-largest market in NA. The increasing adoption of cloud computing by businesses in these regions. As businesses move their data and applications to the cloud, they need to ensure that their data is secure and compliant with regulations.

The Asia Pacific is expected to grow with the highest compound annual growth rate due to high cloud technology adoption across industries, driven by digital transformation, increased internet use, and rising demand for scalable IT infrastructure. Many countries in this region are embracing digital transformation, leading to increased demand for cloud services and compliance measures. China is the largest market for cloud compliance in the Asia Pacific and accounted for a significant market share in 2023. In the Asia Pacific, cloud security and compliance remain major concerns for businesses. Enterprises are actively seeking robust solutions to protect sensitive data and meet regulatory obligations.

Do You Need any Customization Research on Cloud Compliance Market - Enquire Now

Key Players

-

Amazon Web Services (AWS) (AWS Compliance Center, AWS Audit Manager)

-

Microsoft Azure (Azure Policy, Microsoft Compliance Manager)

-

Google Cloud (Google Cloud Compliance Manager, Security Command Center)

-

IBM (IBM Cloud Compliance Center, IBM Guardium)

-

Oracle (Oracle Cloud Compliance, Oracle Cloud Guard)

-

VMware (VMware CloudHealth, VMware Secure State)

-

Cisco (Cisco Cloudlock, Cisco Umbrella)

-

Palo Alto Networks (Prisma Cloud, Aperture)

-

McAfee (MVISION Cloud, McAfee Total Protection for Data Loss Prevention)

-

Symantec (Symantec CloudSOC, Symantec DLP Cloud)

-

Check Point Software Technologies (CloudGuard, Dome9)

-

Tenable (Tenable.io, Tenable.sc)

-

Fortinet (FortiGate Cloud, FortiAnalyzer)

-

Trend Micro (Trend Micro Cloud One, Deep Security)

-

Splunk (Splunk Cloud, Splunk Enterprise Security)

-

Qualys (Qualys Cloud Platform, Qualys Web Application Scanning)

-

Proofpoint (Proofpoint Cloud App Security Broker, Proofpoint Threat Protection)

-

Thales Group (CipherTrust Cloud Key Manager, SafeNet Trusted Access)

-

ServiceNow (ServiceNow GRC, ServiceNow Cloud Management)

-

Zscaler (Zscaler Cloud Security, Zscaler Internet Access) and others.

Recent development

-

U.S. Federal Risk and Authorization Management Program: In March 2024, the U.S. government released a new security control baseline for FedRAMP certification, broadening the requirement for cloud service providers. The update requires additional continuous monitoring capabilities to comply with the requirement.

-

In October 2023, Amazon Web Services launched AWS Deadline Cloud. It is a managed service that accelerates the rendering process, enabling the setting up, deployment, and scaling of rendering projects without burdening users with infrastructure management. The service enhances efficiency for computer graphics, VFX work, and AI-generated visuals.

-

In September 2023, IBM introduced new cloud security and compliance solutions and expanded the IBM Compliance Center and Cloud Security. The services aim to assist enterprises in avoiding risks and protecting their data in multi-cloud and hybrid environments.

| Report Attributes | Details |

| Market Size in 2023 | US$ 31.20 Billion |

| Market Size by 2032 | US$ 115.98 Billion |

| CAGR | CAGR of 16.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Services, Software) • By Application (Audit and Compliance Management, Threat Detection and Remediation, Activity Monitoring and Analytics, Visibility and Risk Assessment) • By Cloud Model (Infrastructure as a Service, Platform as a Service, Software as a Service) • By Organization Size (Large Enterprises. Small and Medium Enterprises (SMEs)) • By End-user (BFSI, IT and Telecom, Healthcare, Manufacturing, Retail and e-Commerce, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM, Oracle, VMware, Cisco, Palo Alto Networks, McAfee, Symantec, Check Point Software Technologies, Tenable, Fortinet, Trend Micro, Splunk, Thales Group |

| Key Drivers | •Stringent data protection laws like GDPR, CCPA, and HIPAA are forcing organizations to adopt cloud compliance solutions to avoid hefty penalties and ensure data security. •With more businesses migrating to cloud environments, there is a growing need for automated compliance solutions to manage and streamline regulatory requirements efficiently •Growing Demand for Compliance Automation and increasing awareness of cloud security risks |

| Market Restraints | •The rapidly changing and diverse compliance regulations across regions make it challenging for companies to keep up with and implement the necessary compliance measures. •The financial burden of implementing and maintaining cloud compliance software, especially for small and medium-sized •enterprises (SMEs), can be prohibitive, limiting market adoption Companies using multiple cloud providers or hybrid infrastructures may face inconsistent security |