Cloud Managed Services Market Report Scope & Overview:

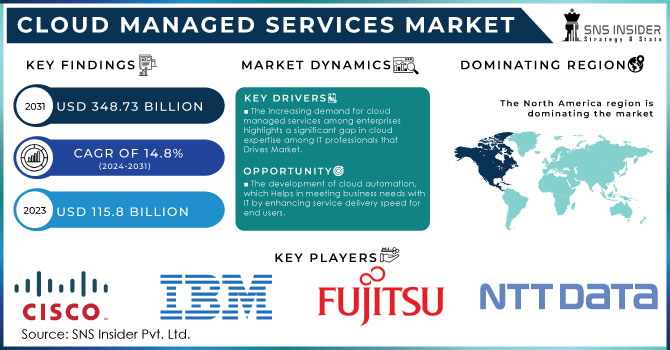

Cloud Managed Services Market was valued at USD 110.67 billion in 2023 and is expected to reach USD 375.51 billion by 2032, growing at a CAGR of 14.58% from 2024-2032. This report includes key insights on adoption rates, cloud deployment trends, cost savings and efficiency metrics, customer satisfaction and retention rates, as well as cybersecurity and compliance statistics. The market is witnessing rapid adoption driven by the increasing reliance on cloud solutions for scalability and operational efficiency. Cloud deployment trends indicate a shift toward hybrid and multi-cloud environments, optimizing cost and security. Enhanced automation and AI integration are improving efficiency, while strong cybersecurity measures and compliance adherence are crucial for sustained customer trust and retention.

Get more information on Cloud Managed Services Market - Request Sample Report

Market Dynamics

Drivers

-

Growing Cyber Threats and Compliance Requirements Are Driving the Adoption of Managed Security Services for Cloud Protection and Risk Mitigation

The rising incidence and depth of cyberattacks have established strong security as a top priority for companies that exist in the cloud environment. Companies are exposed to increased threats from ransomware, data breaches, and advanced persistent threats, which require round-the-clock monitoring and active threat reduction. Also, strict regulatory guidelines and industry compliance regulations, including GDPR, HIPAA, and SOC 2, force companies to fortify their security stance. Having in-house security can be complicated and manpower-intensive, which compels firms to approach professional-managed security services to find real-time threat detection, incident response, and compliance management. With cloud use growing, businesses are placing increased emphasis on managed security solutions for protecting sensitive data, ensuring compliance with regulations, and maintaining business continuity.

Restraints

-

Data Security, Privacy Concerns, and Compliance Risks Are Hindering the Adoption of Cloud Managed Services Across Sensitive Industries

Organizations dealing with sensitive information are concerned about delegating cloud management to third-party vendors because of security risks and compliance issues. Data leaks, unauthorized access, and regulatory non-compliance are issues related to confidentiality and control of sensitive business information. Stringent data protection regulations like GDPR and CCPA place stringent requirements, and companies are therefore hesitant to outsource cloud operations. In addition, sector-specific compliance requirements in healthcare and finance further make adoption difficult. Concerns of vendor lock-in and poor visibility of security practices also keep businesses from adopting managed cloud services completely. Solving these issues necessitates providers to provide open visibility of security practices, strong encryption, and rigid compliance with rules.

Opportunities

-

AI-Driven Automation, Advanced Cloud Security, and Multi-Cloud Strategies Are Creating Growth Opportunities for Cloud Managed Services Providers

The integration of automation and AI into cloud management is transforming service effectiveness, facilitating real-time monitoring, predictive analysis, and self-repair systems. Organizations are finding more ways to use AI-powered solutions to drive performance, strengthen security, and lower operational costs. The increased demand for cutting-edge cloud security, such as Zero Trust architecture and AI-powered threat detection, also represents a tremendous opportunity for managed service providers. As businesses embrace multi-cloud and hybrid models, the need for smooth interoperability, compliance management, and cost optimization solutions keeps rising. Growing 5G networks and edge computing further boost the market potential, necessitating managed services that provide scalability, security, and effective cloud operation.

Challenges

-

Service Outages, Downtime Risks, and Reliability Concerns Are Creating Uncertainty for Businesses Relying on Cloud Managed Service Providers

Businesses that depend on third-party cloud managed service providers are exposed to downtime and service disruption risks, which can significantly affect operations, productivity, and customer confidence. Sudden outages, network crashes, or technical errors in cloud environments can result in major financial losses and data availability problems. As enterprises no longer directly control infrastructure, they have to rely on providers' uptime guarantees, which may not always satisfy critical business needs. Also, service-level agreements usually contain restrictions that might not completely offset prolonged outages. With more organizations migrating mission-critical workloads to the cloud, high availability, strong failover capabilities, and preemptive incident management become essential in order to ensure business continuity and operational resilience.

Segment Analysis

By Cloud Deployment

The public segment led the Cloud Managed Services Market with the largest revenue share of approximately 64% in 2023 as a result of its cost efficiency, scalability, and extensive adoption among enterprises. Enterprises favor public cloud environments because of their agility, lower infrastructure expenses, and managed security options. Moreover, large cloud vendors continuously improve their offerings with AI, automation, and compliance features, which are making public cloud solutions the favored option for businesses looking for efficient cloud management.

The private segment is expected to grow at the fastest CAGR of approximately 16.13% during 2024-2032, led by growing demand for higher security, data privacy, and regulatory compliance. Private cloud solutions are favored by businesses in sectors like banking, healthcare, and government to have more control over sensitive information. Moreover, improvements in hybrid cloud architecture are making it easier to adopt private cloud, further driving its growth in the market.

By Organization Size

The Large Enterprises segment led the Cloud Managed Services Market with the largest revenue share of around 64% in 2023 due to the demand for scalable, secure, and cost-effective cloud solutions. Such companies handle huge volumes of data and need sophisticated managed services for security, compliance, and automation. Large enterprises also spend heavily on hybrid and multi-cloud strategies to ensure smooth functioning, better cybersecurity, and more efficient IT infrastructure management, thereby further cementing their market leadership.

The Small and Medium Enterprises segment will experience the fastest growth CAGR of 15.68% from 2024-2032, driven by expanding adoption of the cloud for cost-effectiveness, scalability, and business flexibility. SMEs want to use managed services to transcend complexities of IT infrastructure while keeping IT costs down at their end. With escalating digital transformation programs and the popularity of cloud-based business applications, SMEs are becoming more inclined toward using managed services to boost efficiency and competitiveness.

By Verticals

The BFSI sector led the Cloud Managed Services Market with the largest revenue share of approximately 26% in 2023 due to the sector's demand for strong security, compliance, and effective data management. Financial institutions depend on managed cloud services for real-time transaction processing, fraud detection, and regulatory compliance. Moreover, growing adoption of AI-based automation, hybrid cloud platforms, and disaster recovery solutions further enhanced the BFSI sector's dependence on cloud management.

The Government vertical is anticipated to grow at the fastest CAGR of approximately 19.26% during the period 2024-2032, driven by growing digital transformation activities and the demand for secure, scalable cloud services. Governments across the globe are embracing managed cloud services to improve the delivery of public services, advance cybersecurity, and meet stringent data protection laws. The growing use of AI, IoT, and big data analytics in government operations further drives the need for managed cloud services.

By Service Type

The Security Services segment led the Cloud Managed Services Market with the largest revenue contribution of nearly 32% in 2023, spurred by the increasing cyber threats and stringent regulatory compliance needs. Companies of all industries give importance to managed security solutions to safeguard sensitive information, avoid cyberattacks, and guarantee business continuity. The increasing use of Zero Trust security architectures, AI-based threat detection, and cloud-native security platforms has further boosted the demand for managed security services.

The Mobility Services segment is expected to grow at the fastest CAGR of around 18.13% during 2024-2032, driven by the growing popularity of remote work, bring-your-own-device policies, and cloud-based enterprise mobility solutions. Companies are investing in managed mobility services to improve workforce productivity, secure mobile endpoints, and simplify IT management. The growth of 5G networks and IoT-based mobile applications further propels the need for cloud-managed mobility solutions.

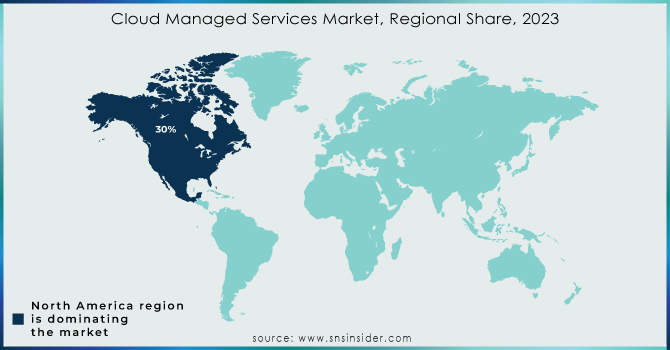

Regional Analysis

North America led the Cloud Managed Services Market with the largest revenue share of around 42% in 2023 due to the prevalence of top cloud service providers, robust cloud uptake rates, and tight cybersecurity legislations. Managed services are relied on more by businesses in industries such as BFSI, healthcare, and IT to maximize cloud infrastructure and increase security. Furthermore, the region's emphasis on digital transformation, AI-powered cloud services, and hybrid cloud adoption also reinforces its market leadership.

Asia Pacific is anticipated to grow at the fastest CAGR of around 16.26% during 2024-2032, driven by high-speed digitalization, rising adoption of cloud services among SMEs, and government initiatives for cloud infrastructure growth. The IT industry's growth in the region, along with the rising demand for cost-efficient and scalable cloud services, is boosting demand for managed services. Furthermore, improvements in 5G, IoT, and AI-driven cloud solutions are driving cloud adoption across industries, leading to strong market growth.

Need any customization research on Cloud Managed Services Market - Enquiry Now

Key Players

-

Accenture (Cloud and Data Center Managed Services, Network Optimization Services)

-

CenturyLink (Cloud Application Manager, Managed Services Anywhere)

-

CHINA HUAXIN (Cloud Computing Solutions, Managed Network Services)

-

Cisco Systems, Inc. (Cisco Cloudlock, Cisco Meraki)

-

Fujitsu (Fujitsu Cloud Service K5, Managed Infrastructure Services)

-

Huawei Technologies Co., Ltd. (Huawei Cloud Stack, Managed Cloud Services)

-

IBM Corporation (IBM Cloud Managed Services, IBM Cloud Pak)

-

NTT DATA Corporation (Cloud Lifecycle Services, Managed Cloud Services)

-

Ericsson (Ericsson Managed Cloud Operations, Ericsson Cloud Container Distribution)

-

Trianz (Cloud Management Services, Cloud Infrastructure Management)

-

Verizon (Verizon Cloud Managed Services, Virtual Network Services)

-

Infosys (Infosys Cobalt, Cloud Infrastructure and Management Services)

-

HPE (HPE GreenLake, HPE Pointnext Services)

-

NEC (NEC Cloud IaaS, NEC Cloud System)

-

Atos (Atos OneCloud, Cloud Managed Services)

-

TCS (TCS Cloud Exponence, TCS Enterprise Cloud)

-

Wipro (Wipro Cloud Studio, Cloud Managed Services)

-

Datacom (Datacom Cloud Services, Managed Cloud)

-

AT&T (AT&T NetBond for Cloud, AT&T Multi-Cloud Connect)

-

HCL Technologies (HCL Cloud Native Services, Cloud Management Services)

-

CDW Corporation (CDW Cloud Managed Services, Cloud Collaboration Solutions)

Recent Developments:

-

In January 2024, Accenture completed the acquisition of Navisite to enhance its cloud and managed services capabilities, adding 1,500 professionals to its team. This move aims to help clients modernize their IT for the AI era.

-

In December 2024, IBM announced a collaboration with AMD to deploy AMD Instinct MI300X accelerators as a service on IBM Cloud, enhancing AI and HPC performance. The service is expected to launch in the first half of 2025.

| Report Attributes | Details |

| Market Size in 2023 | USD 110.67 Billion |

| Market Size by 2032 | USD 375.51 Billion |

| CAGR | CAGR of 14.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Business Services, Network Services, Security Services, Data Center Services, Mobility Services) • By Cloud Deployment (Public, Private) • By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)) • By Verticals (BFSI, Healthcare, Retail & Consumer Goods, IT & Telecom, Manufacturing & Automotive, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, CenturyLink, CHINA HUAXIN, Cisco Systems, Inc., Fujitsu, Huawei Technologies Co., Ltd., IBM Corporation, NTT DATA Corporation, Ericsson, Trianz, Verizon, Infosys, HPE, NEC, Atos, TCS, Wipro, Datacom, AT&T, HCL Technologies, CDW Corporation |