COMPUTATIONAL PHOTOGRAPHY MARKET KEY INSIGHTS:

The Computational Photography Market Size was valued at USD 15.35 Billion in 2023 and is expected to reach USD 49.87 Billion by 2032 and grow at a CAGR of 14.02% over the forecast period 2024-2032. Rapid advancement in the Computational Photography market is due to the rapidly emerging image processing technologies and AI-based improvements. The emerging domain integrates computer vision, artificial intelligence, and advanced imaging algorithms to make images that go far beyond traditional photography capabilities. One of the major driving factors propelling this growth is the high penetration of smartphones with sophisticated camera technology. This broader availability of such photography features in consumer devices has made them rather democratized to access higher-quality images. In 2023, the estimated penetration rate of mobile phones in the global market was around 69%, or about 6.7 billion subscriptions for smartphones worldwide against a total world population of about 7.4 billion. This does draw attention to the size of the user base subscribing to better computational photography features built into mobile devices.

To Get More Information on Computational Photography Market - Request Sample Report

Beside cellular phones, other technologies that have been heavily advanced include standalone cameras and machine vision applications. The technologies are now significant in the healthcare, automotive, and industrial automation industries. In the healthcare industry, quality enhancement in diagnosis images through machine vision cameras helps achieve a higher quality in images. In the automotive industry, they are used in driver-assistance systems that work in very high accuracy conditions. The advantage of machine vision in industrial fields comes from the fact that the inspection process is automated through computation imaging enhancing accuracy and productivity.

Other impacts include adoption in the AR/VR experiences, augmented reality, and social media channels, which have seen significant contributions to growth. They involve sophisticated image processing for more immersive and realistic user experiences; therefore, an enormous amount of research and investment is indispensable. The demand for superior imaging quality is a never-ending trend as users continue to share content on these social media platforms and use AR-based tools.

MARKET DYNAMICS

KEY DRIVERS

- Higher penetration of smartphones with cameras drives growth.

Smartphones, by virtue of their high camera capacities, are one of the primary drivers in the computational photography space. Mobile photography has become highly pertinent, with features such as HDR, Night Mode, portrait improvements, and real-time image processing. These functionalities depend on intricate computational processes that sequentially filter several frames and then put them together to construct an image better than any one of the filtered frames. Though, across Sub-Saharan Africa, the smartphone penetration is only at 55% up to the end of 2023, in North America, and Europe, the same, rests somewhere around 86% and 82% respectively in a humongous user base.

These high adoption rates are stoking consumer demand for cameras that perform truly exceptional in a wide range of conditions. The growth in social media engagement and immediate sharing of quality photographs and videos further perpetuates this trend. More consumers are using camera specifications as a major consideration in the purchase of their smartphone, leading to investments in research and development to achieve further boundaries of computational photography, make the user experience better, and reinforce growth in market share.

- AI-based imaging will speed up the adoption of computational photography

Computational photography underwent tremendous changes in the use of artificial intelligence, which propagated the spread of AI-based imaging technology. Common features include scene recognition, automatic exposure adjustments, and AI-based image correction, all there to give the photo a high quality with minimal user interference. According to data from the National Institute of Standards and Technology, AI technologies increase productivity by as much as 40% in image-related fields.

With integration, devices can regulate settings automatically according to lighting, object recognition, and user preference, achieving ideal results. For example, in the healthcare sector, the use of AI-enabled machine vision cameras in diagnostic imaging is of significant benefit. Automotive sectors employ it to build driver-assist systems. The ability to produce sharper images with higher resolution depth perception and color accuracy also makes for a plausible reason for consumer as well as industrial applications. This has underlined the role AI plays in driving the growth of computational photography technology across different domains.

RESTRAIN

- High costs associated with technology implementation restrain market growth.

Even as the computational photography market grows, the high costs that are associated with developing and implementing advanced imaging technology remain a critical challenge. High-end hardware and software development call for considerable resources that are mainly accessible to few devices, thereby hindering adoption. Such innovations in the form of AI processors, custom ISPs, and real-time image processing units can highly invest in R&D. Smaller companies and firms in developing regions sometimes cannot implement such technologies into their products due to these funds. For example, according to the data by the European Commission, funding is a barrier to many SMEs in various technology sectors.

The International Finance Corporation estimates that 65 million firms, or 40% of all formal MSMEs in developing countries, lack financing, equivalent to USD 5.2 trillion annually-a cost barrier that goes not only to device manufacturers but also to end-users who may consider such advanced devices to be out of reach at such costs. In addition to that, the exponential growth of technology requires companies that are keen and prepared to invest to continually update their products so as not to miss the competition. This is costly. After subsidizing or joining forces, the above prohibitive cost factors will minimize this constraint and thus expand the extent of participation.

KEY MARKET SEGMENTS

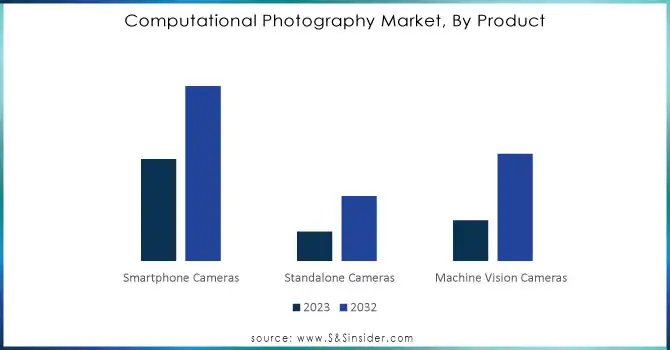

BY PRODUCT

Smartphone Camera captured 51% of the market share in 2023. This aspect of leadership is given through a seamless embedding of cutting-edge technologies, such as multi-frame synthesis, AI-driven upgrades, and optical zoom capabilities, in the smartphone. This makes consumer preferences shift towards devices that offer such professional photography capabilities but in a compact form. For instance, in 2023, the shipments of smart devices from Samsung became approximately 226.5 million around the world. The next is the Apple brand in the list of being the largest smartphone producing company in the world. In 2023, the company shipped more than 232 million iPhones all over the world. The constant developments on mobile camera modules among the tech giants have ensured that camera-equipped smartphones remain a hot product in the market.

The Smartphone Cameras will spearhead the market in terms of growth with the highest CAGR of 14.13% during the forecast period 2024-2032, attributed to continuous innovation through AI, augmented reality capabilities, and computational power.

Standalone cameras are still niche markets due to continued relevance for some users requiring higher resolutions for professional photography or videography applications.

Do You Need any Customization Research on Computational Photography Market - Inquire Now

BY APPLICATION

3D Imaging with 41% of the market share in 2023 depicted its major role in industries as broad as healthcare to entertainment. This segment will continue to grow at a healthy rate, fueled by requirements for enhanced visuals and the requirement for high-definition imaging, especially in professional services that require medical imaging based on 3D models.

Moreover, 3D Imaging is expected to grow at the fastest CAGR of 14.34% during the forecast period of 2024-2032 due to technological development in creating higher depth and resolution. Augmented reality and mixed reality increased its application areas in gaming, education, and retail thereby demanding the high-quality imaging in that market. While VR and MR applications continue to evolve, AR has found a solid footing in consumer electronics to enhance interactive experiences from smartphones to smart glasses.

Each application area leverages capabilities of computational photography, improving visual fidelity that leads to increased interaction and real-world usability. What is creating the future of the computational photography market is the trend towards mixed-use applications, blending AR, VR, and 3D imaging. Continuous innovation and adoption are expected to define the future of the computational photography market. There is significant regional variation in growth and adoption in the computational photography market.

REGIONAL ANALYSIS

North America held a 38% market share in 2023, primarily due to the high concentration of major tech giants and robust R&D capabilities in the region. Advanced imaging technology has penetrated nearly every type of consumer electronics in this region. Within smartphones and standalone cameras, the U.S. saw robust demand for those features installed with computational photography.

The Asia Pacific market is forecasted to grow at a CAGR of 14.97% during the forecast period 2024-2032. Growth is mainly attributed to prominent factors such as smartphone penetration, growing disposable incomes, and developments in the infrastructure for technology in countries such as China, India, and South Korea. Government efforts toward digital innovation and technological advance further accelerate the rapid expansion of the region. The region's competitive manufacturing landscape coupled with significant investments in AI and machine vision technologies are further expected to support the growth of the Asia Pacific market.

KEY PLAYERS

Some of the major players in the Computational Photography Market are

-

Apple Inc. (iPhone Cameras, iPad Cameras)

-

Samsung Electronics Co., Ltd. (Galaxy Cameras, Smart Camera Solutions)

-

Google LLC (Pixel Cameras, ARCore)

-

Huawei Technologies Co., Ltd. (P Series Cameras, Image Processing Software)

-

Sony Corporation (Alpha Cameras, Image Sensors)

-

Canon Inc. (EOS Cameras, Imaging Software)

-

Nikon Corporation (Z Series Cameras, Image Editing Software)

-

Xiaomi Corporation (Redmi Cameras, MIUI Camera Apps)

-

Oppo (Find Series Cameras, Image Enhancement Software)

-

LG Electronics Inc. (V Series Cameras, Optical Solutions)

-

Microsoft Corporation (HoloLens Cameras, AI Imaging Tools)

-

Panasonic Corporation (Lumix Cameras, Machine Vision Cameras)

-

Fujifilm Holdings Corporation (X Series Cameras, Photo Processing Software)

-

Leica Camera AG (M Series Cameras, Optics)

-

Olympus Corporation (OM-D Cameras, Imaging Equipment)

-

Intel Corporation (RealSense Cameras, Vision Processing Units)

-

Qualcomm Technologies, Inc. (Snapdragon Image Signal Processors, AI Solutions)

-

Adobe Systems Incorporated (Lightroom, Photoshop)

-

HTC Corporation (Vive Cameras, AR/VR Solutions)

-

GoPro, Inc. (HERO Cameras, Editing Software)

MAJOR SUPPLIERS (Components, Technologies)

-

Sony Semiconductor Solutions Corporation

-

ON Semiconductor

-

STMicroelectronics

-

Samsung Foundry

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

ASE Group (Advanced Semiconductor Engineering)

-

Texas Instruments

-

LG Chem

-

Corning Inc.

-

Sumitomo Electric Industries

-

AMS AG

-

Murata Manufacturing Co., Ltd.

-

Broadcom Inc.

-

Analog Devices, Inc.

-

Toshiba Corporation

-

Micron Technology

-

NXP Semiconductors

-

Infineon Technologies AG

-

Renesas Electronics Corporation

-

Applied Materials, Inc.

MAJOR CLIENTS

-

Apple Inc.: Telecom carriers, Retail chains

-

Samsung Electronics: Mobile service providers, Consumer electronics stores

-

Google LLC: AR/VR companies, App developers

-

Huawei Technologies: Mobile carriers, E-commerce platforms

-

Sony Corporation: Photography professionals, Media companies

-

Canon Inc.: Photography retailers, Printing services

-

Nikon Corporation: Camera shops, Professional photographers

-

Xiaomi Corporation: Online marketplaces, Retail electronics stores

-

Oppo: Distributors, Telecom operators

-

LG Electronics: AR/VR companies, Consumer electronics outlets

-

Microsoft Corporation: Tech developers, AR/VR startups

-

Panasonic Corporation: Industrial automation companies, Medical imaging providers

-

Fujifilm Holdings Corporation: Photography services, Laboratories

-

Leica Camera AG: Professional photographers, High-end camera shops

-

Olympus Corporation: Medical device manufacturers, Scientific research institutions

-

Intel Corporation: Tech startups, Robotics firms

-

Qualcomm Technologies: Smartphone manufacturers, IoT solution providers

-

Adobe Systems: Creative agencies, Marketing firms

-

HTC Corporation: Gaming companies, VR solution providers

-

GoPro, Inc.: Sports retailers, Travel and adventure companies

RECENT TRENDS

-

November 2023: Insta360 unveiled the Ace and Ace Pro, the two new action cameras co-engineered with Leica, in development, to truly promise users spectacular image quality, backed by the fusion of hardware and computational photography, driven by artificial intelligence. The flagship Ace Pro hosts what Insta360 refers to as an industry-first Type 1/1.3 image sensor, which shoots video at up to 8K at 24 fps and captures 4K at 120 fps, and it is able to capture 48-megapixel photos as well. It also brings in a "vlogging-friendly" 2.4-inch flip touchscreen providing live preview and camera control.

-

November 2023: OPPO and Hasselblad had already announced its three-year partnership was going to bring out the sequel to HyperTone Camera Systems in 2024. The announcement came at Paris Photo 2023 and marked an important step forward in OPPO and Hasselblad's relationship, which began with Find X5 series. Breaking down features into solutions planning and meticulous tuning, OPPO pioneers a groundbreaking system ushering the new era of computational photography.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 15.35 Billion |

| Market Size by 2032 | US$ 49.87 Billion |

| CAGR | CAGR of 14.02 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Camera Module, Software), • By Type (Single- And Dual-Lens Camera, 16- Lens Camera, Others), • By Product (Smartphone Cameras, Standalone Cameras, Machine Vision Cameras), • By Application (3D Imaging, Virtual Reality, Augmented Reality, Mixed Reality) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Samsung Electronics Co., Ltd., Google LLC, Huawei Technologies Co., Ltd., Sony Corporation, Canon Inc., Nikon Corporation, Xiaomi Corporation, Oppo, LG Electronics Inc., Microsoft Corporation, Panasonic Corporation, Fujifilm Holdings Corporation, Leica Camera AG, Olympus Corporation, Intel Corporation, Qualcomm Technologies, Inc., Adobe Systems Incorporated, HTC Corporation, GoPro, Inc. |

| Key Drivers |

|

| Restraints |

|